Polymarket Tracker: U.S.-China Talks Loom, No Tariff Cut in Sight

As anticipation builds for the upcoming U.S.-China trade talks in Geneva, President Donald Trump on Wednesday firmly dismissed the possibility of lowering tariffs on Chinese goods, despite appeals fro

As anticipation builds for the upcoming U.S.-China trade talks in Geneva, President Donald Trump on Wednesday firmly dismissed the possibility of lowering tariffs on Chinese goods, despite appeals from Beijing.

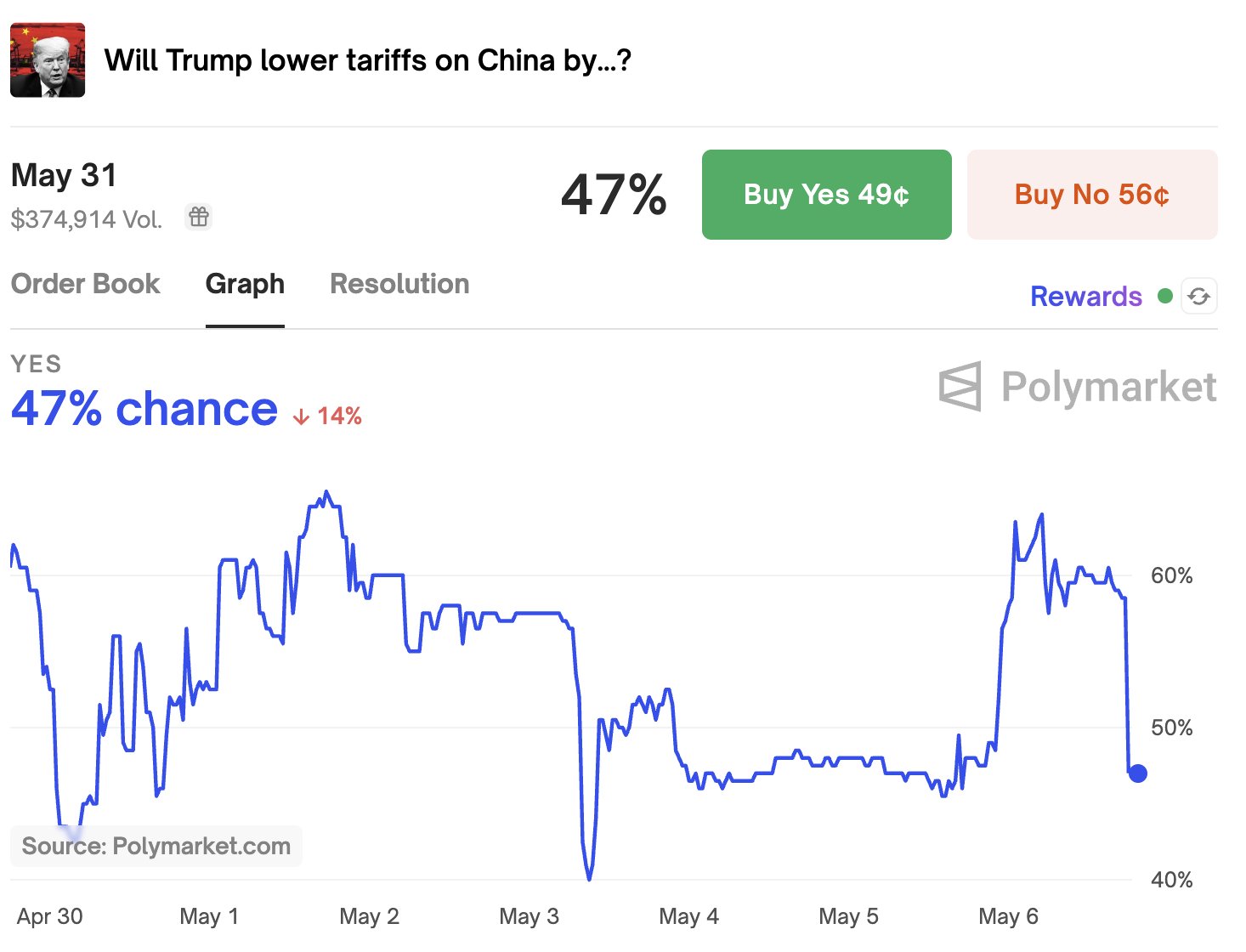

When asked in the Oval Office whether he would reduce tariffs—which currently stand at a minimum of 145%—to help initiate negotiations, Trump replied bluntly: “No.” His response immediately shifted expectations on prediction markets. On Polymarket, the probability of Trump lowering tariffs by May 31 dropped 14%, from 61% to 47%.

Trump also contradicted China’s assertion that the meeting was arranged at Washington’s request. “I think they should go back and check their records,” he said, implying it was in fact Beijing that sought the dialogue—a claim that underscores the political sensitivity surrounding who appears to be yielding.

Senior U.S. officials are still scheduled to meet with their Chinese counterparts this weekend. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamison Greer will hold talks in Geneva on Saturday and Sunday to discuss economic issues. While both economies are suffering under the weight of the ongoing trade war, neither side wants to be seen as the first to blink.

Chinese officials confirmed that He Lifeng, the country’s top trade negotiator, will attend the talks. Beijing has attempted to position itself as the more responsible party while maintaining a firm tone: “You better perform well in these talks,” one official reportedly said.

Still, observers note that the very fact that talks are happening reflects a slight softening in China's stance, particularly as economic data begins to show the toll of prolonged tensions.

Chinese factory output has slowed to its weakest pace in over a year, and exports to the U.S. have declined significantly. American retailers are warning of inventory shortages. On the other side, the U.S. economy contracted in Q1, and corporations are now revising down their growth expectations.

In a Fox News interview Tuesday night, Secretary Bessent emphasized that de-escalation would be the priority in Geneva: “We need to de-escalate first before we can move forward,” he said.

Experts remain skeptical about any major breakthroughs.

Associate Professor Foo Fangjian of Singapore Management University told Lianhe Zaobao that the choice of Switzerland as the meeting location signals a low level of trust between both sides and a desire not to lose face.

Stephen Olson, visiting fellow at the ISEAS–Yusof Ishak Institute, added that the U.S. and China face deep structural tensions, making any quick resolution unlikely. He predicted the talks might end with a generic statement about “open dialogue and willingness to continue negotiations.”

Meanwhile, Polymarket participants continue to weigh the odds. As of now, the market reflects only a 47% chance that Trump will ease tariffs by May 31, with prices shifting sharply after his blunt rejection.As anticipation builds for the upcoming U.S.-China trade talks in Geneva, President Donald Trump on Wednesday firmly dismissed the possibility of lowering tariffs on Chinese goods, despite appeals from Beijing.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.