Stocks Open Higher as Airline and Food Beats Spark Risk-On Tone

U.S. stocks opened slightly higher on Thursday, October 9, 2025, driven by a pair of solid earnings reports from Delta Air Lines and PepsiCo that injected a note of optimism into sectors grappling wit

U.S. stocks opened slightly higher on Thursday, October 9, 2025, driven by a pair of solid earnings reports from Delta Air Lines and PepsiCo that injected a note of optimism into sectors grappling with costs and demand volatility.

The Dow Jones Industrial Average rose 49.06 points, or +0.11%, while the S&P 500 gained 0.31 points, up +0.12%. The Nasdaq Composite saw a nominal rise of 0.06 points, ticking up +0.00%. The small-cap Russell 2000 ETF, however, lagged the majors, falling 0.57 points, or −0.23%.

The session’s modest gains come as attention focuses on corporate results and persistent inflation concerns. The price of Gold futures for December 2025 (GC=F) fell −3.70, or −0.09%, to 4,066.80 as of 8:48:20 AM EDT. Crude Oil futures for November 2025 (CL=F) also saw a slight dip of −0.05, or −0.08%, to 62.50 as of 8:48:38 AM EDT.

Earnings Provide Lift

Delta Air Lines (DAL) delivered a quality beat with credible guidance that set a positive tone for the airline sector. The company reported third-quarter adjusted earnings per share of $1.71 on adjusted revenue of $15.2 billion, exceeding consensus estimates of $1.53 EPS and ∼$15.1 billion in revenue, according to Alnvest. Shares surged about 7% in pre-market trading, testing the $60 resistance area.

The strength was driven by high-demand travelers, with premium, loyalty, and corporate revenue each growing 9% year-over-year. CEO Ed Bastion noted that "sales momentum has accelerated across geographies over the past six weeks, corporate demand is improving, and holiday travel looks strong". Management tightened the full-year EPS guidance to roughly $6.00, ahead of the Street’s ∼$5.80.

In the consumer staples sector, PepsiCo (PEP) provided a modest but reassuring start to earnings season. The food and beverage giant's third-quarter adjusted EPS of $2.29 and revenue of $23.94 billion both topped consensus estimates of $2.26 and $23.83 billion, respectively. Organic revenue rose 1.3%.

PepsiCo's results showed resilience despite cost pressures. Management reported that tariff-related supply chain costs acted as a 3-percentage-point headwind to EPS. However, management stressed a clear plan to offset these pressures and expects to "mitigate the impact of higher supply chain costs moving forward". The company reaffirmed its 2025 financial guidance and named Steve Schmitt, formerly CFO of Walmart U.S., as its incoming finance chief. Shares of PepsiCo gained 1.4% premarket.

Passive Investing Debate

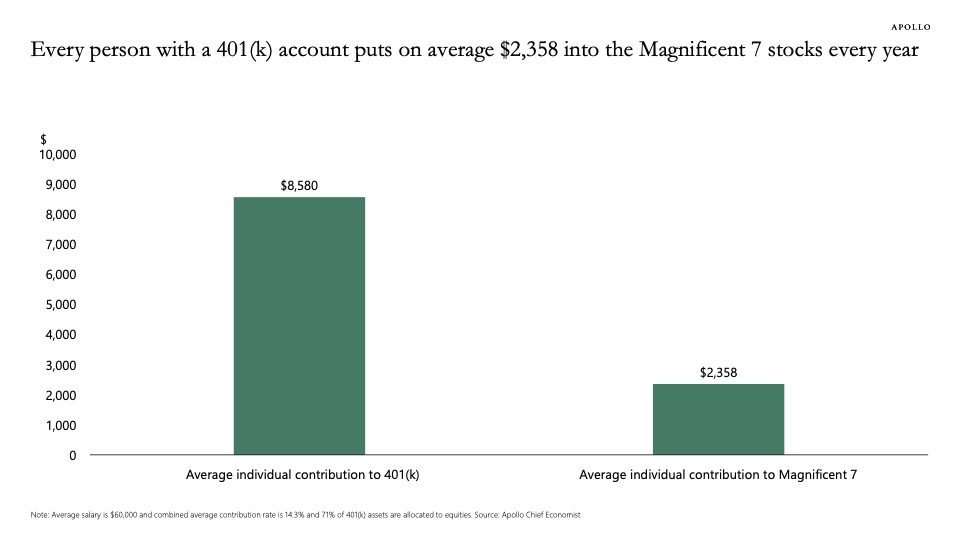

Meanwhile, a note from Apollo Global Management's Chief Economist, Torsten Slok, highlighted the ongoing structural risk posed by passive investing. Mr. Slok noted that the "Magnificent Seven" stocks hold a weight of almost 40% in the S&P 500. Based on average worker contributions to 401(k) accounts, he estimates that each U.S. worker puts an estimated $2,300 into the Magnificent Seven stocks every year, regardless of the stocks' outlook.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.