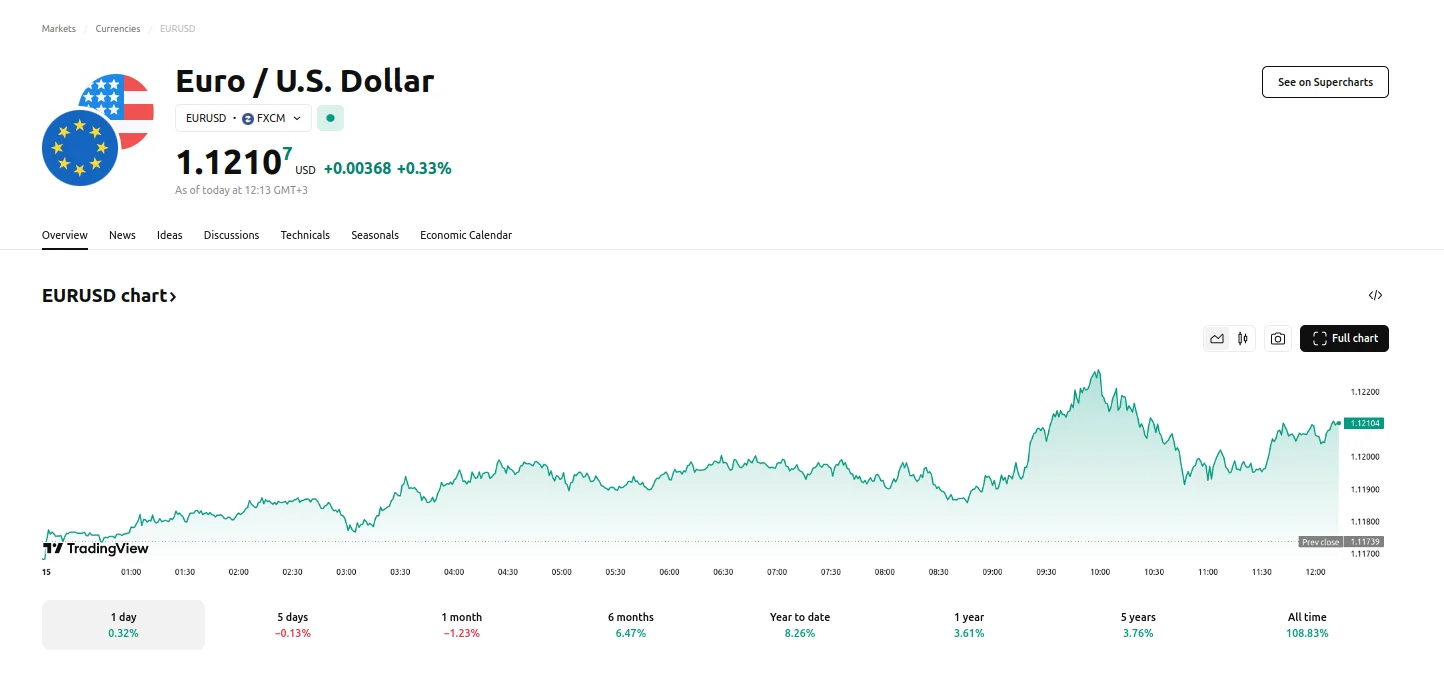

Eurozone Annual Growth Hits 1.2%, EUR/USD Advances 0.33% as Q1 GDP Reaches 0.3% Eurozone Annual Growth Hits 1.2%, EUR/USD Advances 0.33% as Q1 GDP Reaches 0.3%

Key Moments:The Eurozone’s annual GDP jumped 1.2%. Growth was also recorded in Q1 2025, but the 0.3% figure fell below the initial 0.4% estimate.The EUR/USD pair rose to 1.1210.Traders remained cautio

Key Moments:

- The Eurozone’s annual GDP jumped 1.2%. Growth was also recorded in Q1 2025, but the 0.3% figure fell below the initial 0.4% estimate.

- The EUR/USD pair rose to 1.1210.

- Traders remained cautious ahead of key US data reports.

Eurozone Economic Updates Emerge

Europe’s economy registered a 0.3% quarterly expansion in the first quarter of 2025, according to Eurostat’s second estimate released on Thursday. The revised figure falls short of the earlier estimation of 0.4%. However, on an annual basis, the eurozone’s GDP grew 1.2%, in line with both the preliminary report and market expectations. Employment levels within the bloc also inched higher, with the Eurozone Employment Change posting a 0.3% quarterly climb, along with a 0.8% YOY increase in Q1.

Euro Continues to Appreciate Against the Dollar

The EUR/USD pair hovered around $1.1210 on Thursday, marking a modest increase of 0.33% as traders reacted to the mixed economic data from Europe. In Germany, the Wholesale Price Index dropped by 0.1%, slightly better than the projected 0.2% decline. France’s Final Consumer Price Index came in at 0.6%, surpassing the 0.5% forecast. In addition, the eurozone’s industrial production achieved a 2.6% monthly climb in March, up from the 1.1% reported in February.

Spotlight on Upcoming US Macro Data

Trader focus has shifted to a packed US data calendar, with several key prints set to influence the near-term outlook for the greenback. According to current projections, April’s Core Producer Price Index (PPI) will rise to 0.3%, 0.2% higher than last month. Meanwhile, Core Retail Sales may match the PPI’s pace should current estimates prove accurate, while Headline Retail Sales are projected to stall. Traders will also focus on Initial Unemployment Claims, which are expected at 229,000, along with any potential commentary by Federal Reserve Chair Jerome Powell.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.