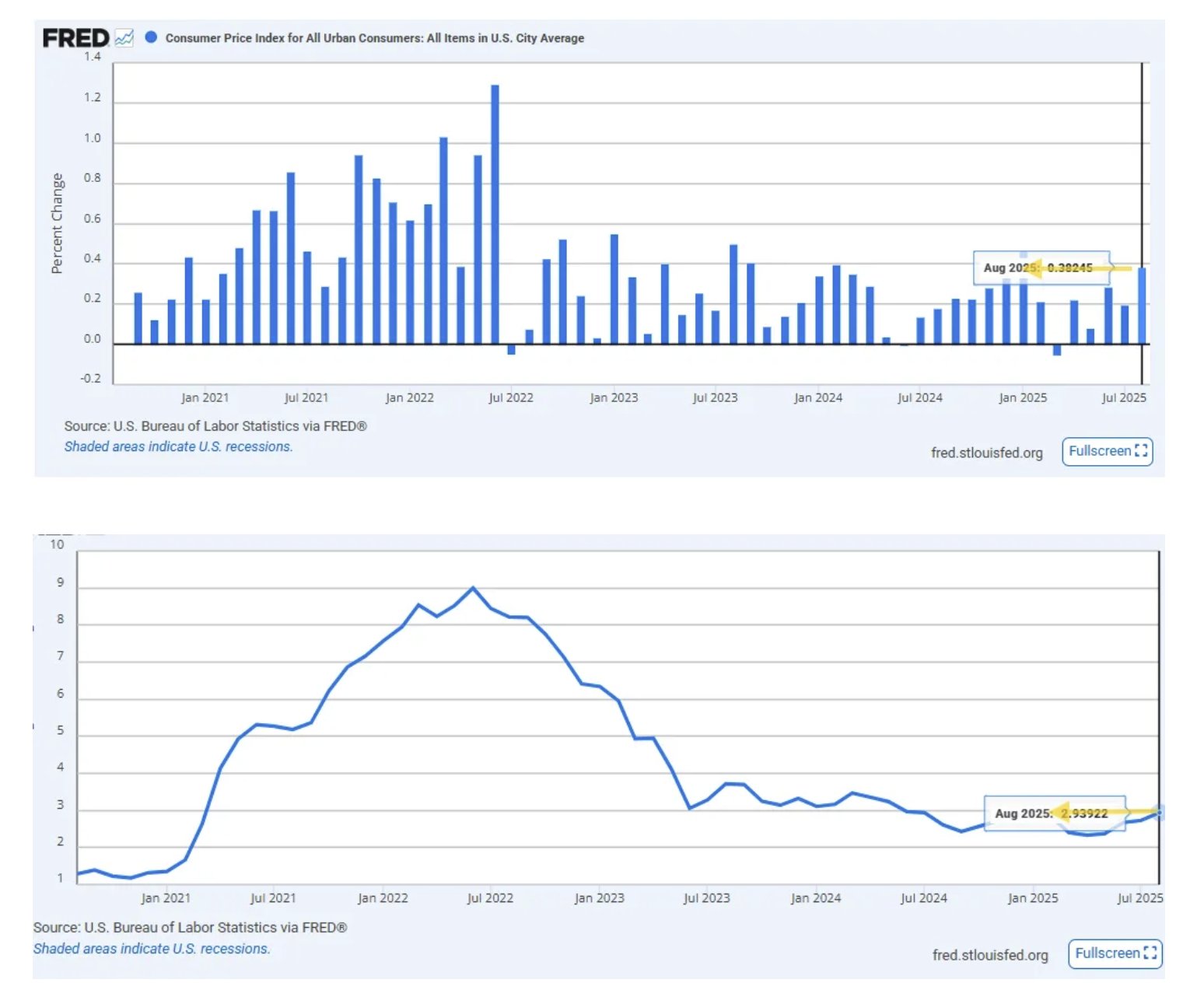

U.S. August CPI Rises 2.9%, Matching Expectations

The U.S Consumer Price Index (CPI) rose 2.9% year-on-year in August, in line with expectations. On a month-on-month basis, CPI increased by 0.4%, slightly above the forecast of 0.3%.Excluding energy a

The U.S Consumer Price Index (CPI) rose 2.9% year-on-year in August, in line with expectations. On a month-on-month basis, CPI increased by 0.4%, slightly above the forecast of 0.3%.

Excluding energy and food, core CPI rose 3.1% year-on-year and 0.3% month-on-month, both matching expectations.

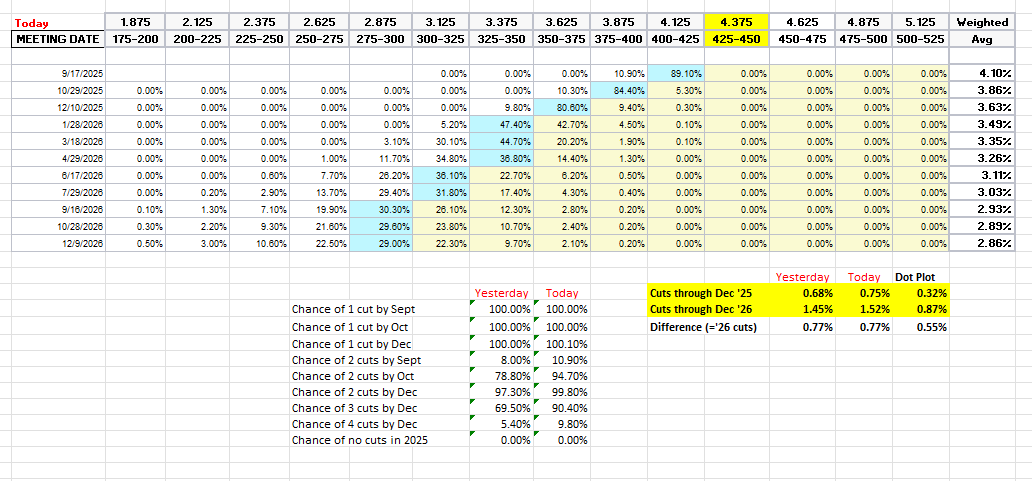

After the data release, markets priced in three consecutive 25 basis point rate cuts by the Federal Reserve at its September, October, and December meetings.

The probability of a 50 basis point cut in September stands at 11%, while the odds of another cut in January exceed 50%.

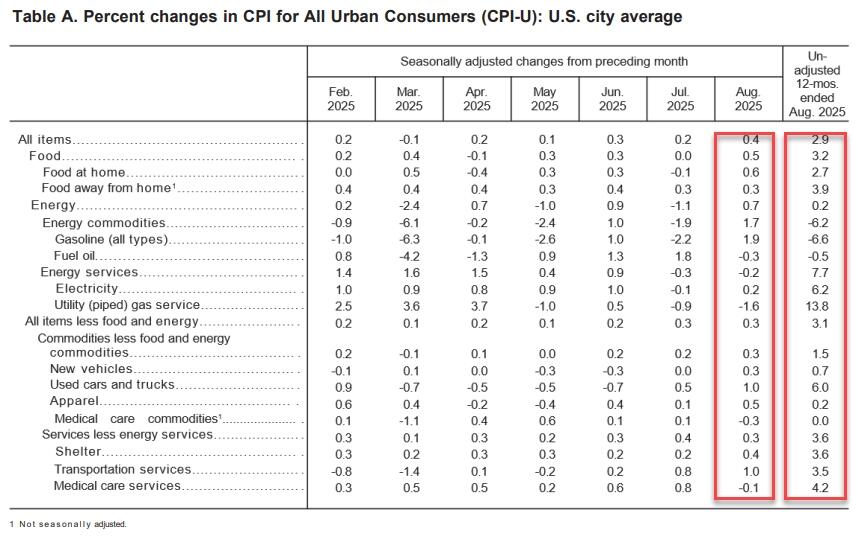

Category Breakdown: Import Tariff-Linked Goods

Household goods rose 0.1% in August, the smallest increase since March, while household appliances rose 0.4%, the largest since June.

Clothing prices increased 0.5%, the biggest gain since February.

Video and audio products rose 0.5%, the smallest since May.

New car prices advanced 0.3%, while used cars and trucks surged 1.0%. Vehicle maintenance costs rose 2.4% year-on-year, motor fuel increased 1.8%, and auto insurance costs were flat from a year earlier.

Food Prices

Overall food inflation rose 0.5% in August. Meat prices jumped 2.7%, the highest in nearly four years, mainly driven by beef.

Fresh vegetables surged 3%, the biggest increase since January 2020, partly due to tariffs on Mexican tomatoes (which account for 90% of U.S. supply).

Notably, companies such as Hormel Foods, J.M. Smucker, and Ace Hardware have raised prices due to higher meat costs and tariffs. Retail giants like Walmart, Target, and Best Buy have also begun implementing tariff-related price hikes, with more to come. This underscores the sticky nature of U.S. inflation.

Other Categories

Airfares spiked 5.9% in August due to peak summer travel demand. Tobacco prices rose 1.0%.

Overall, tariff-linked goods did not show clear signs of accelerating inflation.

Services Sector

Housing costs remain the most persistent driver of inflation. Rents and hotel prices rose significantly in August, pushing the housing component up by 0.4%.

Dental fees, however, fell 0.7% in August.

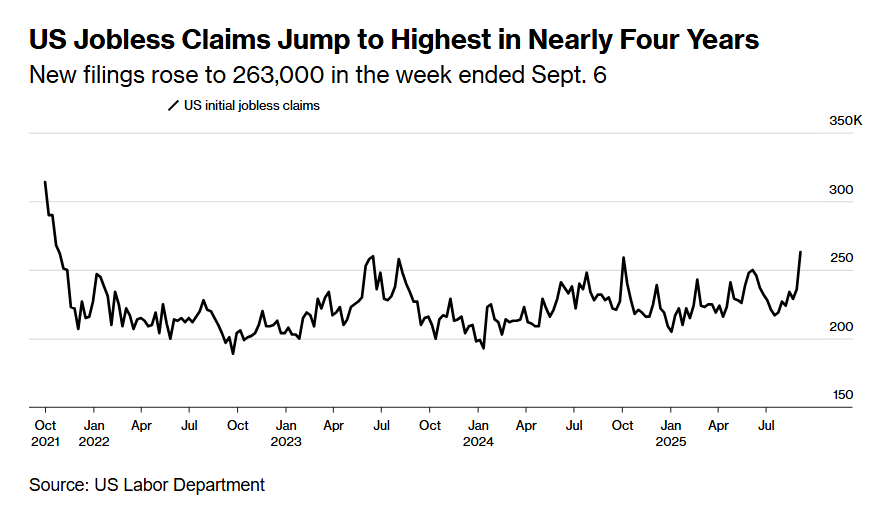

Alongside CPI, weekly jobless claims were released. With the labor market increasingly under scrutiny, the importance of claims data has grown. Initial claims surged, suggesting layoffs may be rising as hiring slows sharply.

Bloomberg economist Eliza Winger said:

“With labor market weakness deepening, any signs of further deterioration warrant close attention. A broader rise in jobless claims would be especially concerning.”

Market Implications

CPI data met expectations, while the labor market continues to weaken. This raises the possibility of a wave of consecutive Fed rate cuts.

Bloomberg’s chief U.S. rate strategist Ira Jersey believes a 25 basis point cut in September is certain, with further cuts possible in October and December.

Fitch chief economist Brian Coulton noted that while tariffs are clearly feeding into consumer prices, easing service inflation and stable core inflation will reassure the Fed that cutting rates in September does not undermine its price stability mandate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.