August CPI Preview: 25 or 50bps Cut Next?

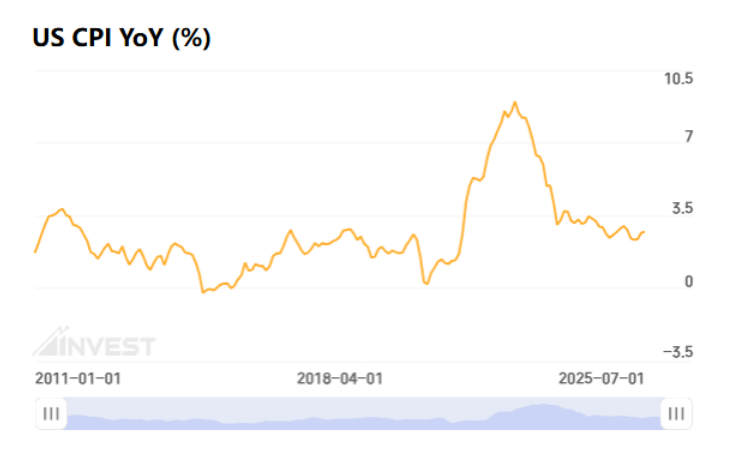

The U.S. August CPI will be released, marking the final critical economic data before the Fed’s September policy meeting.Markets expect August CPI to rise 2.9% YoY and 0.3% MoM, both faster than July.

The U.S. August CPI will be released, marking the final critical economic data before the Fed’s September policy meeting.

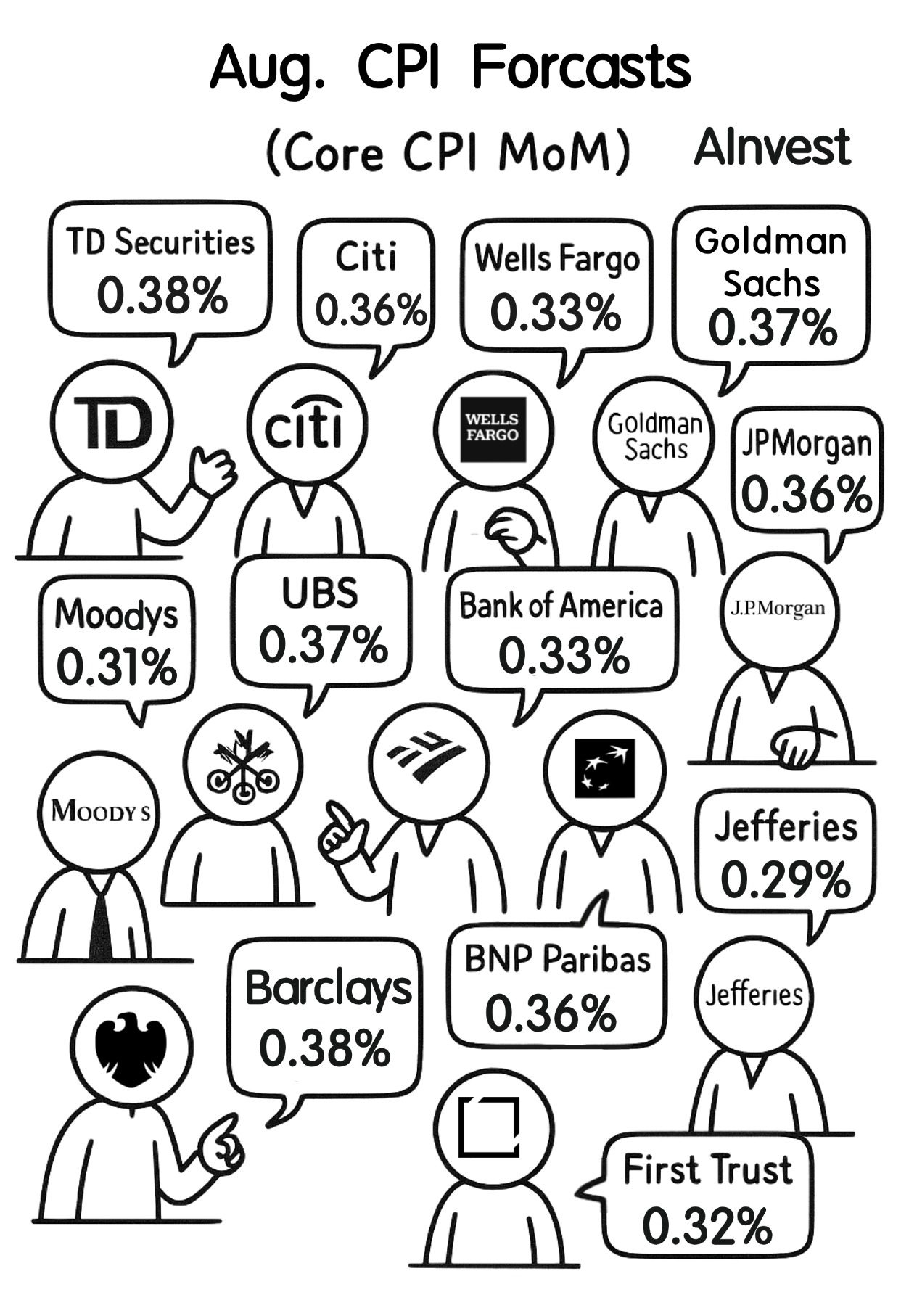

Markets expect August CPI to rise 2.9% YoY and 0.3% MoM, both faster than July. Core CPI, excluding food and energy, is expected to remain unchanged from July’s pace.

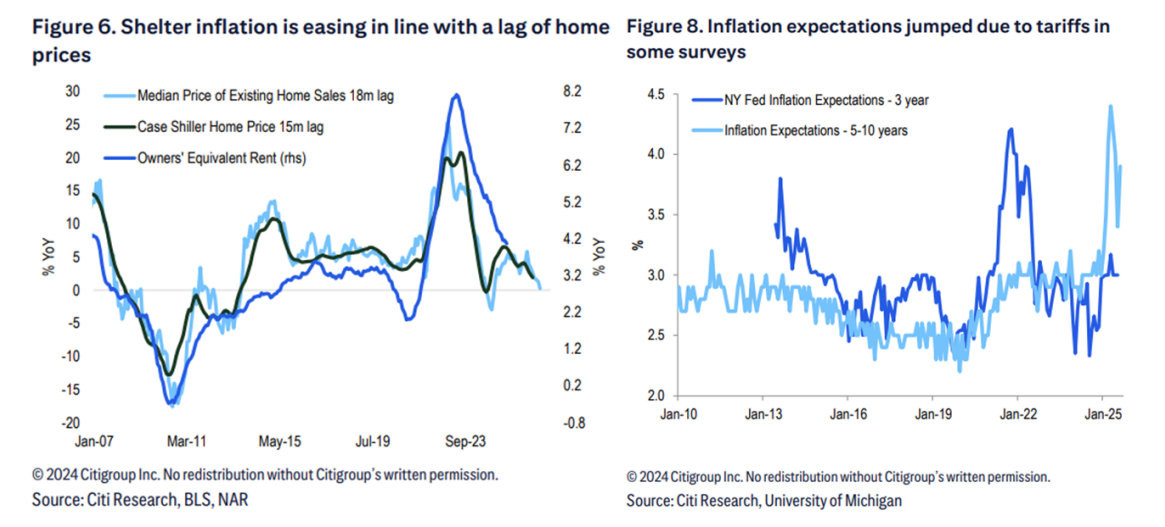

Overall, retailers have depleted inventories stockpiled before tariffs and will gradually raise prices to offset tariff costs, making goods inflation a key driver. In services, housing inflation is expected to cool, while non-housing services remain resilient. Airfares and hotels, supported by summer travel demand, will add short-term upward pressure.

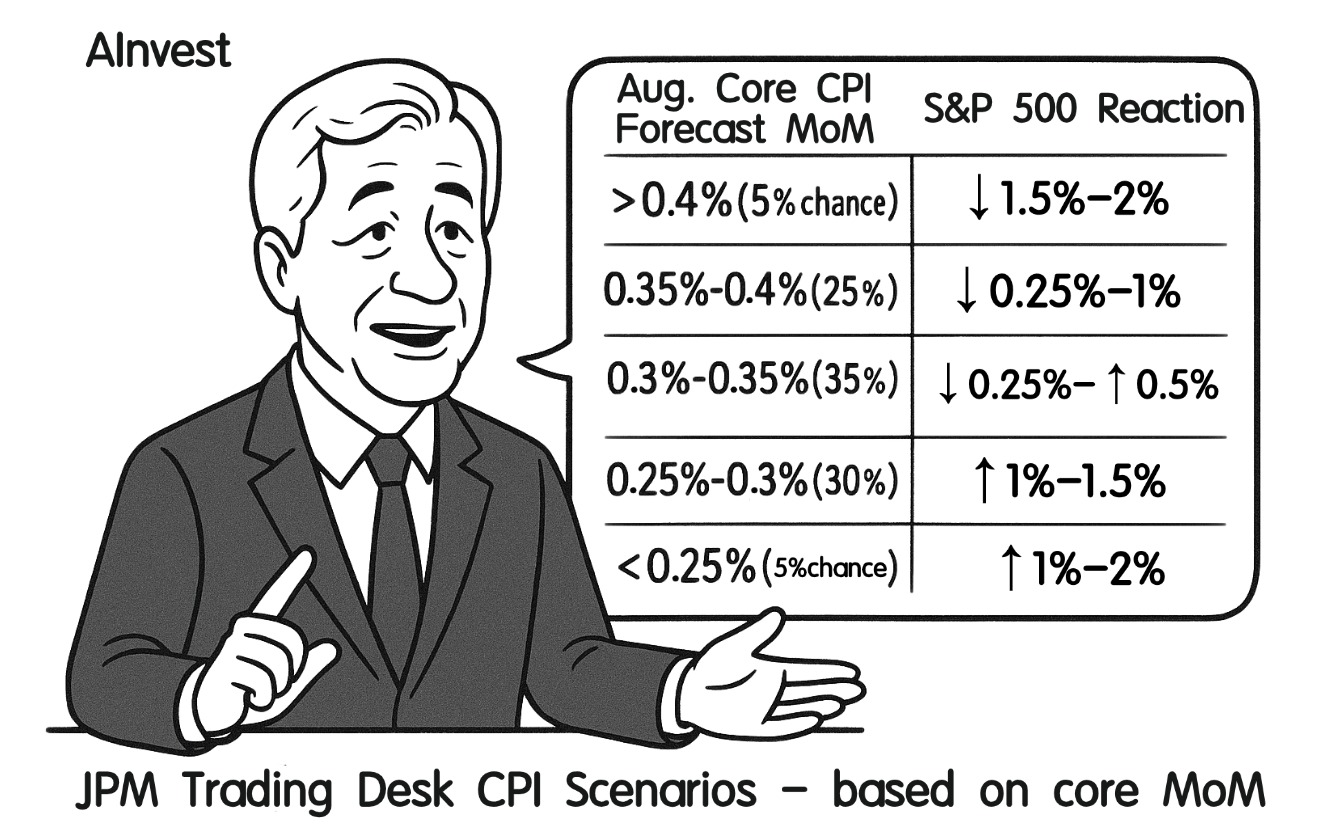

The JPM trading desk mapped out potential S&P 500 reactions to the CPI print.

Given the sharp downward revisions to U.S. nonfarm payrolls over the past year, and the weak August jobs report, this CPI print is unlikely to affect the Fed’s September decision. The key question: will the cut be 25bps or 50bps?

At the Jackson Hole symposium, Powell said tariff-related inflation might be “one-off” and stressed the Fed’s greater focus on labor market weakness. This suggests the market’s top concern has shifted from CPI to jobs.

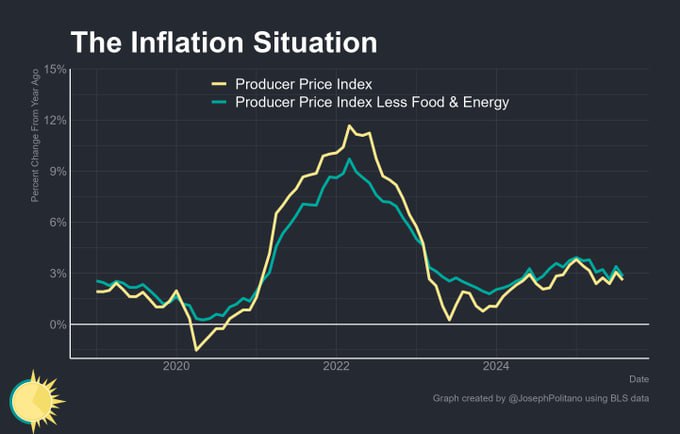

PPI Falls Sharply — But Inflation Still Sticky?

Several leading indicators shed light on CPI risks. August PPI rose 2.6% YoY, far below expectations of 3.3%; MoM, PPI fell 0.1% versus expectations of +0.3%. July PPI was also revised lower. This decline could foreshadow softer CPI.

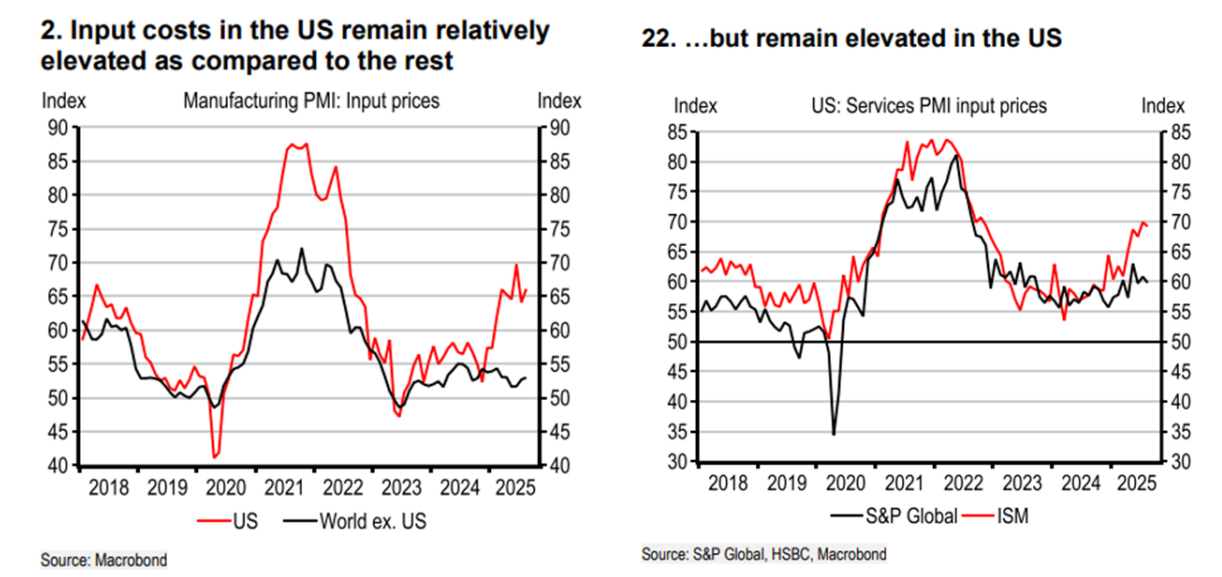

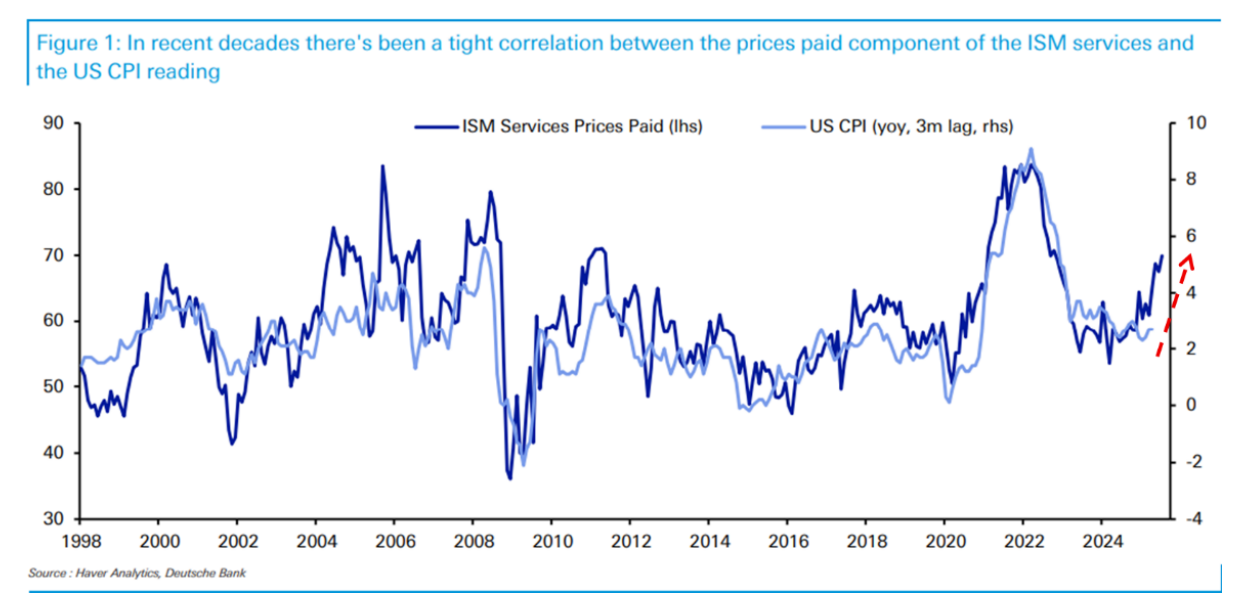

However, PPI is just one indicator. Others suggest inflation remains sticky. First, PMI: both U.S. manufacturing and services PMIs stand significantly higher than global peers.

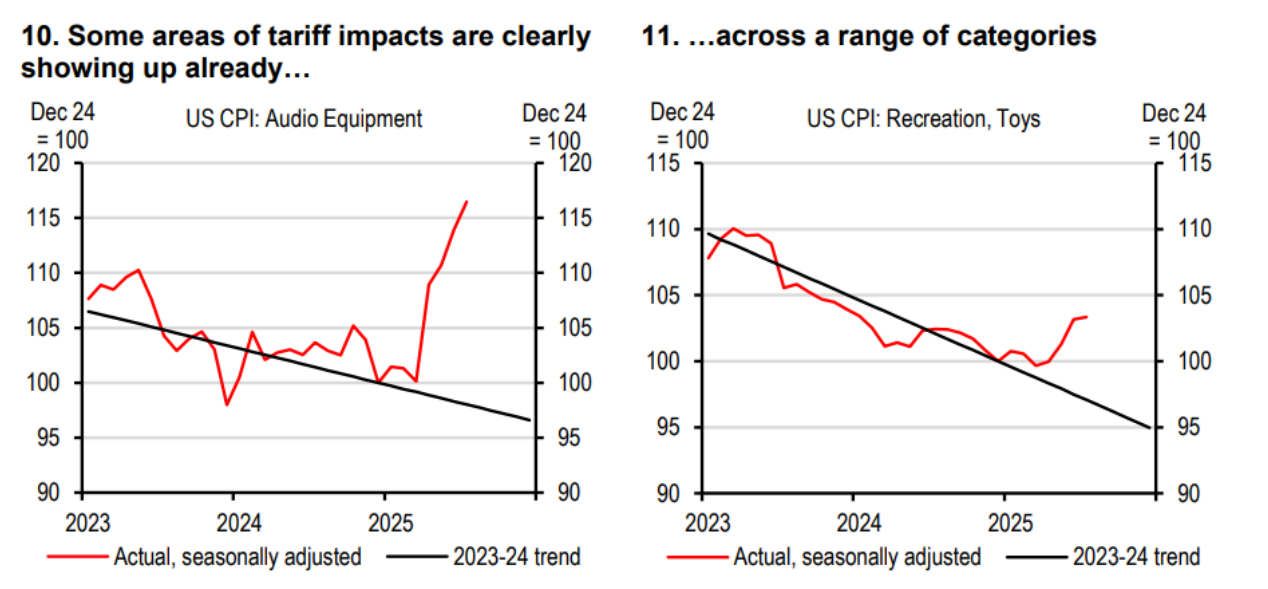

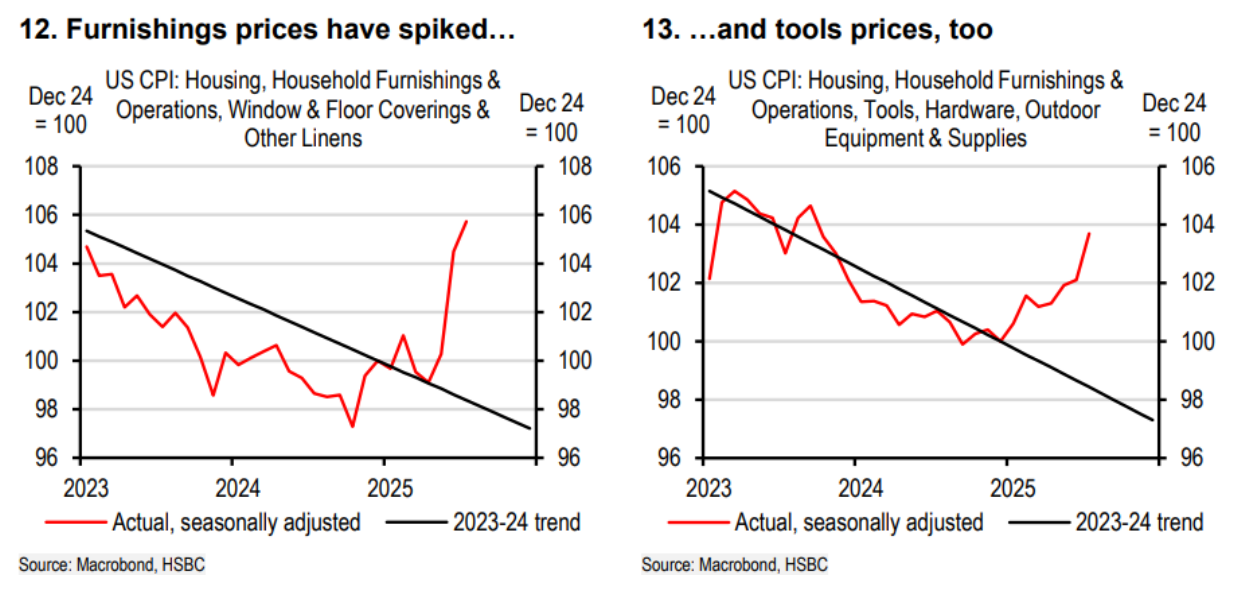

Second, tariff pass-through. Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, noted wholesalers and retailers now hold just 1.3 months of inventory. With new imports carrying tariff costs, these costs will increasingly pass to consumers.

Charts show rising price pressures in furniture, audio equipment, and toys.

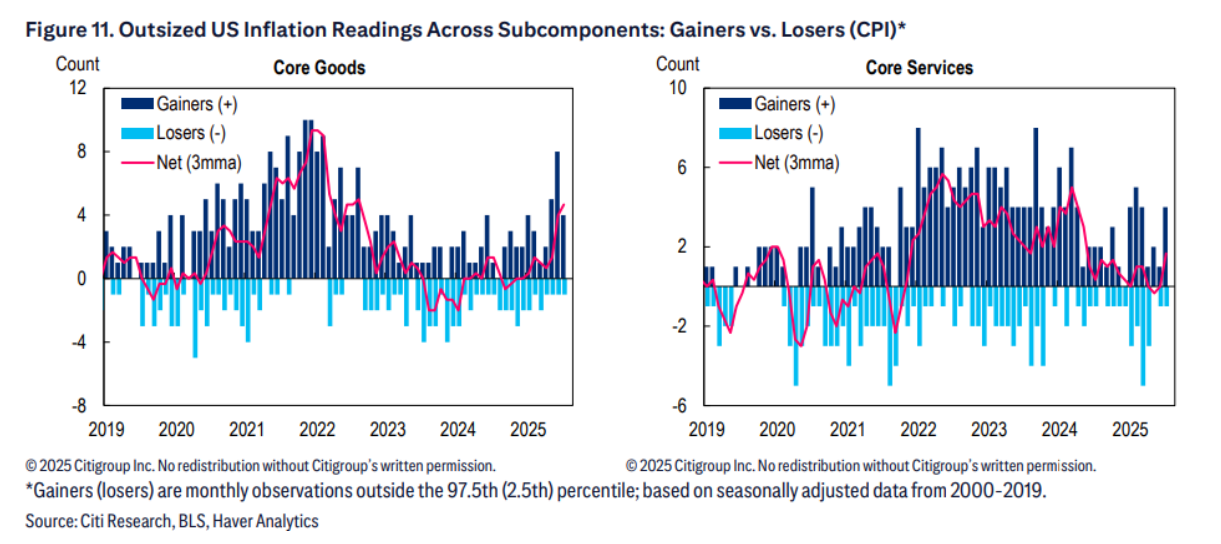

Core goods and services prices have shown renewed acceleration.

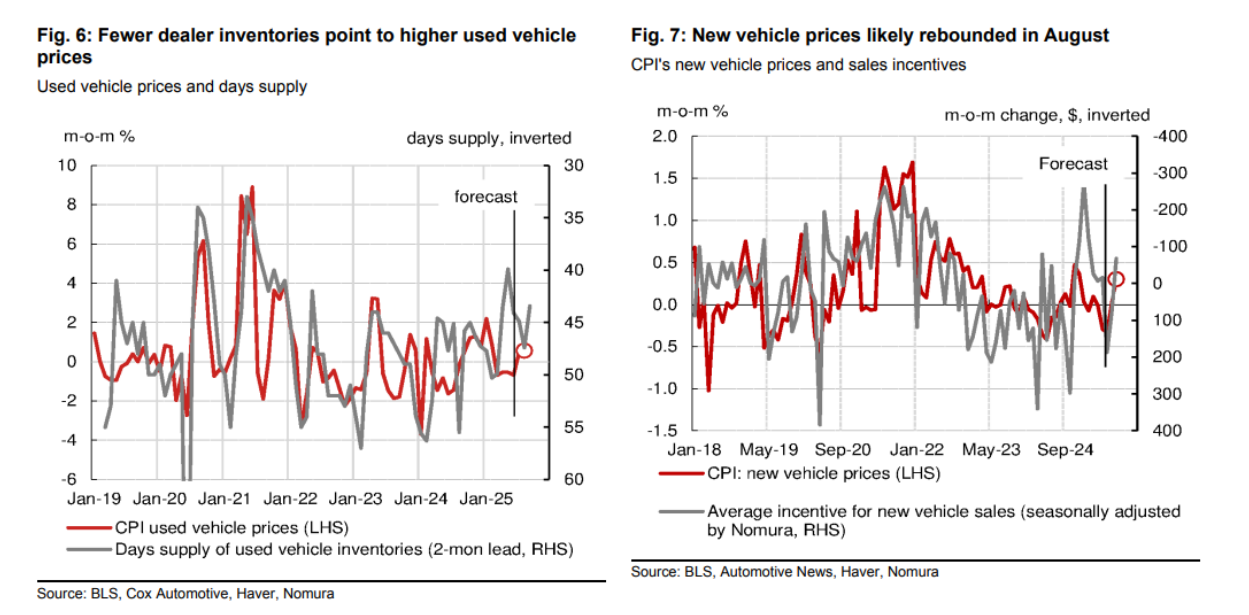

Autos, the largest core goods component, have faced tariffs since April. While retail prices haven’t jumped yet, August auto prices are set to contribute to inflation as sales incentives decline and new model rollouts allow cost pass-through.

The Trump administration formally imposed retaliatory tariffs in early August. With August and September marking the import window for the holiday season, imports of toys, electronics, and clothing surged. Entering autumn, companies also release new seasonal products (like fall/winter apparel), using it as an opportunity to raise prices.

Thus, CPI over August and the coming months will be a critical gauge of tariff pass-through to consumers.

Services Inflation to Cool in August

Turning to services: housing, the largest component, is expected to ease.

High interest rates have slowed U.S. housing markets, with prices consolidating and falling slightly. In rentals, primary rent and owners’ equivalent rent (OER) are trending lower. Zillow’s single-family rent index also shows notable cooling.

Medical prices, typically lagging due to contract adjustments, usually follow overall inflation trends slowly. After sharp rises in June and July, August medical costs are expected to moderate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.