Nio extends losses to 12% in Hong Kong amid concerns over GIC lawsuit

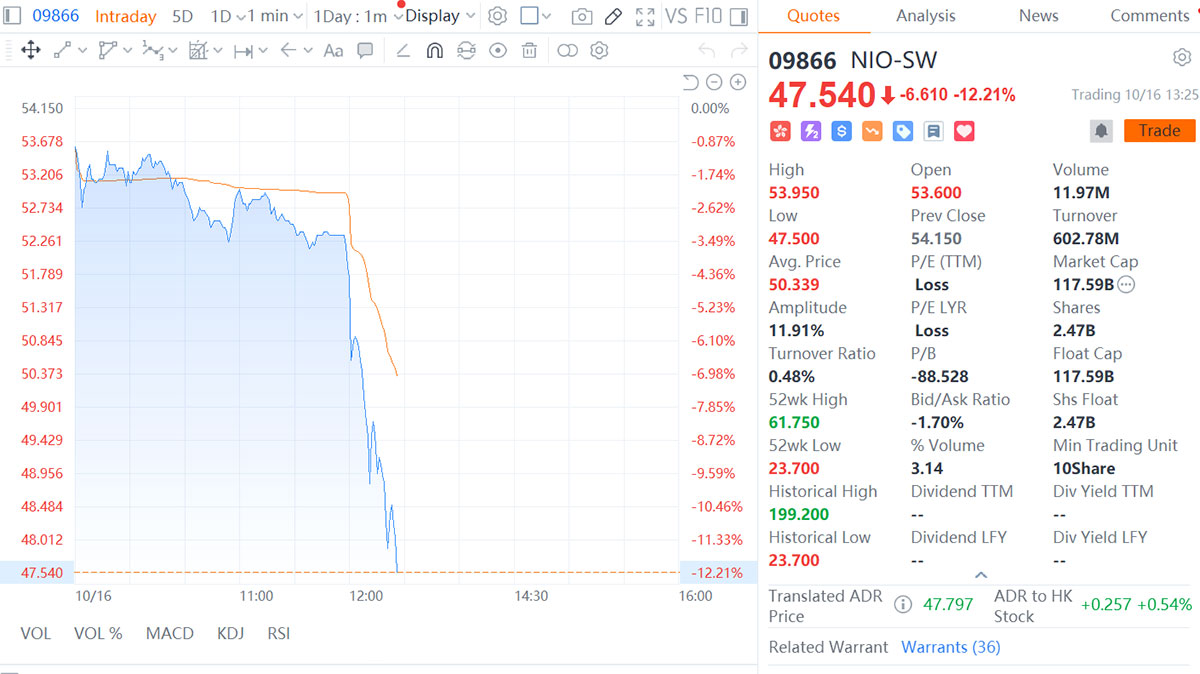

As of press time, Nio had fallen 12.21 percent to HK$47.54 per share, poised for its biggest single-day drop since April 7.

- As of press time, Nio had fallen 12.21 percent to HK$47.54 per share, poised for its biggest single-day drop since April 7.

- Singapore's sovereign wealth fund GIC has filed a lawsuit against Nio over disputes regarding its revenue recognition practices.

Nio Inc (NYSE: NIO) shares traded in Hong Kong plunged sharply in afternoon trading on Thursday as investors worried about the potential impact of a lawsuit filed by Singapore's sovereign wealth fund GIC Private Limited.

As of press time, Nio had fallen 12.21 percent to HK$47.54 per share, poised for its biggest single-day drop since April 7.

GIC has sued Nio over disputes regarding the Chinese electric vehicle (EV) maker's revenue recognition practices.

Chinese media outlet Caixin first reported the lawsuit yesterday. The case was stayed in a US court earlier this month to await the outcome of a prior class lawsuit.

The trigger for GIC's lawsuit against Nio was a short-selling report released in June 2022 by US short-seller Grizzly Research, as noted by Caixin's report.

In its June 28, 2022 report, Grizzly claimed it believed Nio was playing an accounting game similar to Valeant's to inflate revenue and boost profit margins.

The short seller suspected Nio likely used an unconsolidated affiliate, Mirattery, or Wuhan Weineng, to inflate revenue and profitability, drawing parallels to the Philidor-Valeant relationship.

Similarly, GIC's dispute centers on Nio's relationship with its battery asset operator Mirattery and the company's revenue recognition practices.

GIC alleges Nio misled investors by allegedly helping inflate revenue through Mirattery -- established with partners including CATL (HKG: 3750) -- resulting in GIC's losses.

GIC's allegations echo Grizzly's claims, arguing Nio cannot recognize full battery sales revenue upfront when selling batteries to Mirattery under its BaaS (battery as a service) business.

Following Grizzly's June 2022 report, Nio conducted an internal review concluding these allegations were unfounded.

Multiple Wall Street analysts also refuted Grizzly's claims in their research notes at the time.

Nio has yet to respond to GIC's allegations. CnEVPost has leant that the company's legal department is handling the lawsuit.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.