End of U.S Dominance? Europe Stock Reclaims the Spotlight

For more than a decade, U.S. stocks have vastly outperformed global peers, leaving developed markets like Europe behind and largely forgotten by investors. But EU —— the world’s largest economic bloc—

For more than a decade, U.S. stocks have vastly outperformed global peers, leaving developed markets like Europe behind and largely forgotten by investors.

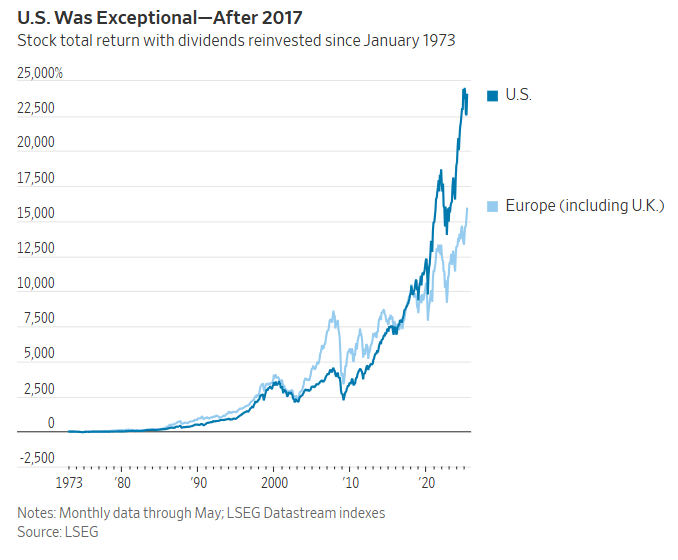

But EU —— the world’s largest economic bloc—really such an underperformer? That’s a major misconception. Prior to the eurozone crisis and the rise of America’s tech giants, European equity returns had kept pace with the U.S. As the chart shows, the U.S. only began to meaningfully outperform after 2017. Between 1995 and 2010, the S&P 500 rose 130%, while European equities gained 220%.

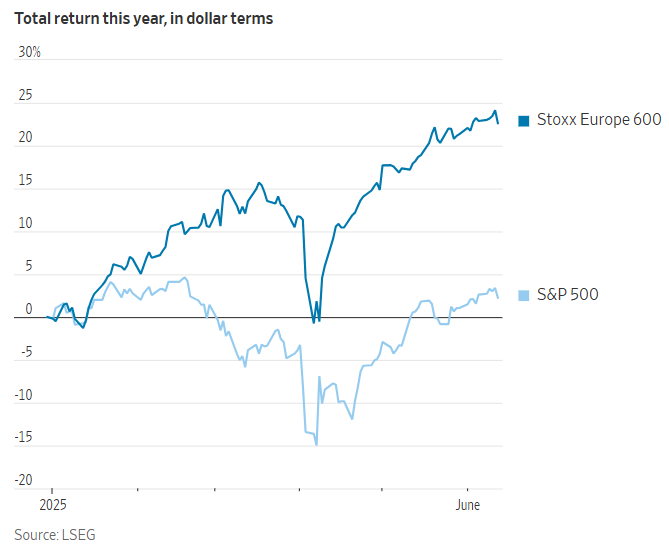

Now, in 2024, the “America Exception” is fading. Europe’s Stoxx 600 index is up 20% year-to-date, compared to just a 2% gain for U.S. stocks. As U.S. outperformance loses steam, Europe is coming back into focus for global investors.

So what really fueled America’s dominance? It wasn’t an “American exception,” but rather a “Mag 7” exception.

The most straightforward explanation is the meteoric rise of the Magnificent 7 tech giants, which showcased America’s global leadership in emerging technologies. These firms have poured vast sums into R&D, giving them a competitive edge in highly profitable sectors.

R&D spending is a strong predictor of future profitability. In 2024, the total R&D expenditure of the Mag 7 (now including Broadcom instead of Tesla) has already surpassed that of all publicly listed European companies combined. Since 2007, U.S. firms’ R&D investment has grown from 1.3x that of Europe to nearly 3x today.

This should serve as a wake-up call for Europe. There is ample evidence that R&D investment builds competitive moats and underpins long-term returns and growth. Europe’s lag in emerging tech has led to significantly lower profit margins for its large firms compared to American counterparts.

But again, this is not about “America” versus “Europe” overall—it’s about “Mag 7” versus the rest. Among small and mid-sized enterprises, profit margins between U.S. and European companies are not significantly different. In fact, using an equally weighted S&P 500 index instead of a market cap-weighted one, returns from late 2021 to the 2024 U.S. election cycle were almost identical between the U.S. and Europe.

What’s Still Holding Europe Back?

However, the performance gap isn’t only about tech dominance. Since the 2010 eurozone debt crisis, Europe’s economy has underperformed, burdened by rigid labor laws and generous welfare systems. These factors have slowed corporate restructuring and led to lower capacity utilization compared to the U.S.

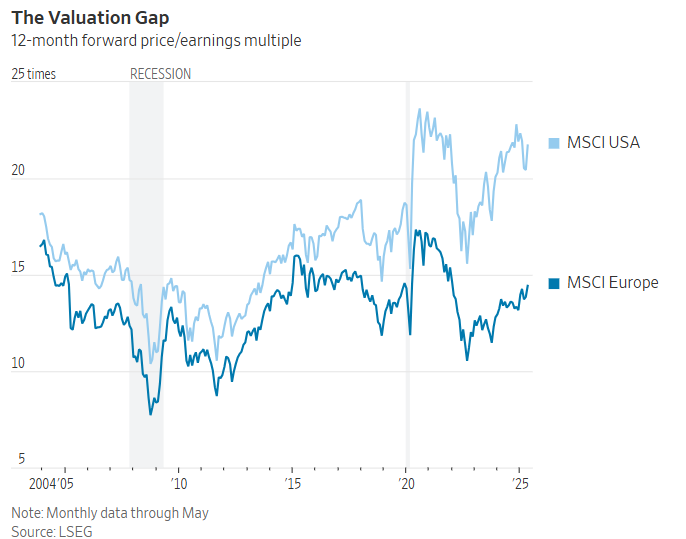

Starting in 2017, U.S. equity valuations surged while Europe’s remained stagnant. But the revaluation was driven mainly by big tech. While U.S. small- and mid-cap stocks still trade at higher multiples than their European peers, the gap hasn’t widened meaningfully in recent years.

Are Europe’s Structural Challenges Being Addressed?

On the innovation front, European governments have recognized the problem, though meaningful action remains limited.

Economically, major EU countries are ramping up fiscal spending. Germany, in particular, is leading with significant investments in defense and infrastructure—moves that should stimulate growth, improve capacity utilization, and support corporate profitability.

Meanwhile, the European Central Bank has begun cutting rates. That said, energy cost volatility, especially after Israel’s strikes on Iran, may make the ECB more cautious going forward.

A Rotation in the Making?

Morgan Stanley believes a rotation from U.S. to European equities is underway. Europe now enjoys monetary easing, fiscal expansion, and the tailwind of a weaker euro.

The investor dilemma is this: U.S. mega-cap stocks remain more innovative and profitable, but they also command premium valuations. European companies may seem less exciting, but they are cheaper and backed by policy support—making them increasingly attractive for those seeking diversification from U.S.-centric portfolios. If European corporates can even slightly narrow the gap with U.S. peers, the region may once again become a compelling investment destination.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.