Nio reports narrowed net loss in Q2 as expenses decline

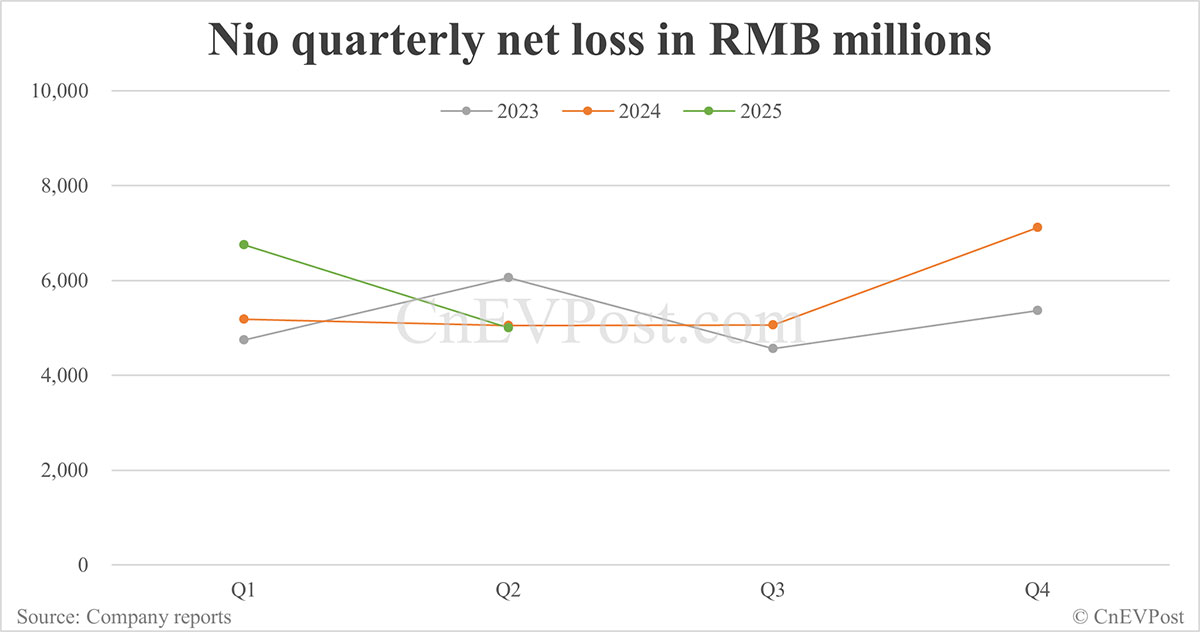

Nio posted a net loss of RMB 4.99 billion ($697 million) in the second quarter, its smallest since the fourth quarter of 2023.

- Nio recorded a net loss of RMB 4.99 billion ($697 million) in the second quarter, its lowest since the fourth quarter of 2023.

- Its third-quarter delivery guidance implies September deliveries are expected to reach a record high range of 38,678 to 34,678 vehicles.

Nio Inc (NYSE: NIO) reported a reduced net loss as it began controlling expenses, preparing for its first profitable quarter in the fourth quarter.

The Chinese electric vehicle (EV) maker recorded a net loss of RMB 4.99 billion ($697 million) in the second quarter, its smallest since the fourth quarter of 2023, according to unaudited financial results released today.

The net loss decreased by 1.0 percent compared to the second quarter 2024 and by 26.0 percent compared to the first quarter of 2025.

Cost control measures are taking effect, with adjusted operating losses narrowing by one-third, said Zavier Wong, market analyst at global trading platform eToro.

Nio's research and development expenses in the second quarter totaled RMB 3.01 billion, down 6.6 percent from the second quarter of 2024 and down 5.5 percent from the firstr quarter of 2025.

The decline in R&D expenses was primarily due to reduced design and development costs resulting from differing stages of new product and technology development, as well as decreased depreciation and amortization expenses, the company stated.

Second-quarter 2025 selling, general, and administrative (SG&A) expenses totaled RMB 3.96 billion, up 5.5 percent from the second quarter of 2024 but down 9.9 percent from the first quarter of 2025.

These developments could position Nio to further narrow its losses in the third quarter and pave the way for profitability in the fourth quarter.

The company's management has repeatedly said this year that the goal is to achieve its first quarterly profit in the fourth quarter.

At the end of last month, Nio founder, chairman, and CEO William Li told employees in an internal speech that with just over a month left in the fourth quarter, achieving profitability remains challenging but achievable.

He noted that while many potential customers recognize Nio's vehicles, services, and technology, at least 30-40 percent of their hesitation to purchase stems from concerns about Nio's financial stability.

"If we achieve profitability, these rumors will be dispelled. User confidence will strengthen, and many issues will resolve themselves," Li said.

Nio delivered 72,056 vehicles in the second quarter, within its guidance range of 72,000 to 75,000 units. Deliveries grew 25.59 percent year-on-year and up 71.18 percent quarter-on-quarter.

These vehicle deliveries translated to second-quarter revenue of RMB 19.01 billion, up 9.0 percent from the second quarter of 2024 and up 57.9 percent from the first quarter of 2025.

Vehicle sales revenue reached RMB 16.14 billion in the second quarter, increasing 2.9 percent year-on-year and up 62.3 percent quarter-on-quarter.

The growth in vehicle sales was primarily driven by increased deliveries, partially offset by a decline in average selling price due to product mix changes, the company stated.

Gross margin for the second quarter was 10.0 percent, compared to 9.7 percent in the second quarter of 2024 and 7.6 percent in the first quarter of 2025.

Vehicle margin for the second quarter was 10.3 percent, compared to 12.2 percent in the second quarter of 2024 and 10.2 percent in the first quarter of 2025.

The decline in vehicle margin compared to a year ago might look like a red flag, but it also the price of chasing growth in new segments through Onvo and Firefly, said Wong of eToro.

Wong stated that the refreshed ES8 will launch at the end of September, adding momentum to third-quarter growth.

As of June 30, Nio's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB 27.2 billion.

During the second quarter, the company experienced an operating cash outflow, with current liabilities exceeding current assets, resulting in negative shareholders' equity as of June 30. Nio said, reiterating risks disclosed in its previous financial reports.

The company's financial resources will be sufficient to support its ongoing normal operations for the next twelve months, Nio said.

Nio guided third-quarter vehicle deliveries to range between 87,000 and 91,000 units, representing a year-on-year increase of about 40.7 percent to 47.1 percent.

This implies September deliveries are expected to reach a record 34,678 to 38,678 units, considering July and August deliveries of 21,017 and 31,305 vehicles respectively.

Nio guided second-quarter revenue between RMB 21.81 billion and RMB 22.88 billion, representing a year-on-year increase of about 16.8 percent to 22.5 percent.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.