CATL's suspended lithium mine to resume production soon, report says

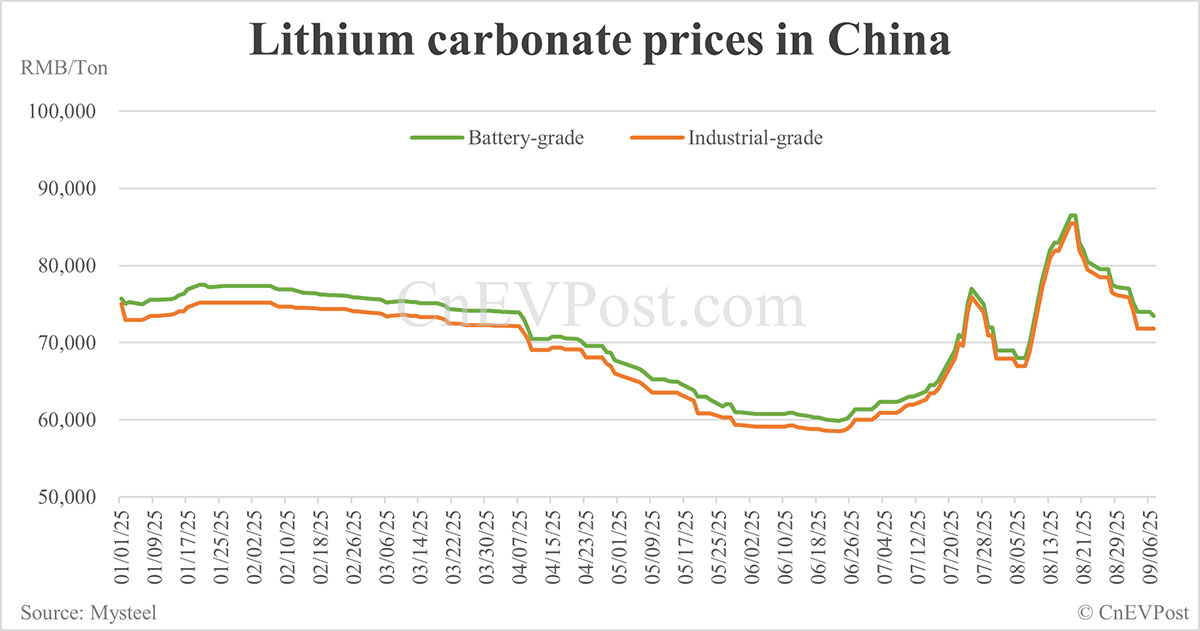

Following the production halt at the CATL lithium mine on August 10, China's lithium carbonate prices surged by 24 percent at one point.

- Following the production halt at the CATL lithium mine on August 10, China's lithium carbonate prices surged by 24 percent at one point.

- The mine is resuming operations faster than the market's most optimistic expectations, a source said.

A major lithium mine operated by CATL (SHE: 300750) that had suspended production is reportedly set to resume operations soon, following a month-long shutdown that triggered a surge in lithium prices.

A CATL subsidiary in Yichun, Jiangxi province, convened a special meeting this morning regarding the restart of the Jianxiawo lithium mine, according to an official Securities Times report today.

The company is making steady progress in applying for mining rights certificates and permits for the mine, with operations expected to resume soon, the report cited a source as saying.

"This is faster than even the most optimistic market expectations," the source said.

The mine halted production on August 10 after its mining permit expired on August 9. CATL had previously indicated it was actively processing the permit renewal application.

Following the mine's suspension, lithium carbonate prices in China surged. Battery-grade lithium carbonate jumped 24 percent from around RMB 70,000 ($9,830) per ton on August 8 to RMB 86,500 per ton on August 18, according to data compiled by CnEVPost..

Lithium is a key raw material for batteries, which typically account for a significant portion of an electric vehicle (EV) model's cost. Lithium carbonate and iron phosphate are the primary raw materials for lithium iron phosphate (LFP).

The shutdown of CATL's lithium mine coincides with the Chinese government's crackdown on overcapacity across multiple industries and intensified scrutiny of mining operations.

In 2022, lithium prices surged dramatically in China, with battery-grade carbonate reaching RMB 590,000 per ton in November -- a roughly 14-fold increase from RMB 41,000 per ton in June 2020.

However, lithium carbonate prices have since experienced a prolonged decline, with battery-grade carbonate currently trading around RMB 75,000 per ton in China.

($1 = RMB 7.1215)

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.