Domestic new energy August battle report: Xiaopeng's monthly delivery is approaching 40,000 kilometers, and a zero-running explosion occurs

Xiaopeng Automobile is undoubtedly the most watched brand this month.

In August, the new energy vehicle market ushered in a concentrated outbreak.New forces such as Xiaopeng, Nilai, Zero Run, Ideal, and Xiaomi have all set new highs, and some brands have even set new records with triple-digit year-on-year growth rates.At the same time, although traditional leaders BYD and Geely have not shown extreme growth rates, they still remain firmly at the core of the industry.

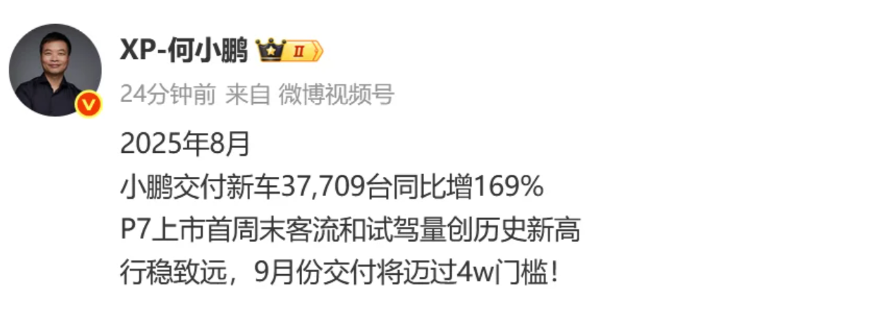

Xiaopeng: Explosive growth and new P7 boost

Xiaopeng Automobile is undoubtedly the most watched brand this month.

37,709 vehicles were delivered in August, a year-on-year increase of 169%, and a month-on-month increase of 3%, once again setting a new monthly delivery record.This is the tenth consecutive month that it has delivered more than 30,000 vehicles, and it has hit a new high for the second consecutive month.More importantly, judging from the cumulative data from January to August, Xiaopeng has delivered 271,615 vehicles, a year-on-year increase of 252%.This achievement not only ranks at the forefront of new forces, but also puts pressure on traditional manufacturers.

Behind the promotion of Xiaopeng's rapid growth is the effective combination of its product iteration and market strategy.At the end of August, the new P7 was launched, and within 7 minutes, it was set to exceed 10,000 units, becoming the fastest model to exceed 10,000 in the company's history.Its AI luxury coupe positioning and the full product matrix from long battery life to four-wheel drive Peng Wing Ultra directly hit the needs of young consumers and technology enthusiasts.At the same time, Xiaopeng's investment in the field of intelligent driving continues to release value, and technologies such as urban NGP and AI driving assistants have gradually transformed into differentiated competitive advantages.

NIO: Multi-brand strategy unleashes potential

Wei Lai's performance was equally outstanding.

31,305 vehicles were delivered in August, a year-on-year increase of 55.2%, setting a record high.What is more noteworthy is the change in the brand structure: ONVO delivered 16,434 vehicles, a year-on-year surge of 175%, Firefly delivered 4,346 vehicles, a year-on-year increase of 84%, while the traditional NIO brand only delivered 10,525 vehicles, a significant decline. This pattern of "losing each other and growing each other" shows that NIO is actively adjusting its strategy, gradually shifting from a single high-end brand to multiple brands in parallel.

ONVO targets the mid-end household market, and its price band is closer to public consumption power. It is the core driving force for the explosion of sales.Firefly focuses on young and entry-level groups to further expand market coverage.In particular, the ONVO L90 model exceeded 10,000 units delivered in just two months after its launch, setting a new record for NIO delivery speed.This transformation model allows Weilai to find a new growth engine in the fierce competition.

Zero running: High growth rate and internationalization parallel

Zero-running vehicles delivered 57,066 vehicles in August, a year-on-year increase of 88%, setting a new record.

A total of 328,900 vehicles were delivered from January to August, a year-on-year increase of 136%, and they have been the sales champion of new forces for several consecutive months.This not only reflects the acceptance of its products in the domestic market, but also reflects the maturity of its manufacturing and supply chain capabilities. It is worth noting that zero-running has achieved profits in the first half of the year, becoming the second new force to achieve annual profits after ideals.

This achievement is particularly rare for a company that has been established for a relatively short time.What is more strategic is that zero-running is accelerating the international layout.In August, in cooperation with the European ro-ro ship giant, the B10 model set sail in Europe and will be officially unveiled at the Munich Motor Show.In the future, whether zero-run can open up the European market with the help of its mid-to-low-end product matrix will become a new variable in its valuation logic.

Ideal: Consolidate high-end MPV and transform into pure electricity

Ideal cars delivered 28,529 units in August, and the cumulative delivery has reached 1.397 million units.Although the year-on-year growth rate has slowed down, the delivery of the ideal MEGA vehicle series exceeded 3,000 units in a single month, ranking first in the high-end MPV and pure electric markets of more than 500,000 yuan for two consecutive months.

Currently, Ideal is accelerating the transformation of pure electricity.CEO Li Xiang clearly stated that "2025 is the first year of the ideal all-electric SUV" and set goals: stabilize 6,000 i6 vehicles in August and stabilize 9,000 - 10,000 i6 vehicles, and cooperate with MEGA to achieve an overall delivery of 18,000 - 20,000 vehicles per month.Compared with previous models that relied on extended program products, Ideals now have greater ambitions in the pure electricity field.The success of its strategy will directly affect the ideal competitiveness in the next 3 - 5 years.

Xiaomi: Continue delivery momentum but faces production capacity test

Xiaomi Motors continued its previous popularity, delivering more than 30,000 vehicles in August, breaking the 30,000 vehicle threshold for the second consecutive month.

Models such as SU7 and YU7 still maintain high popularity in the market, and orders continue to be stable. However, the growth in sales is also accompanied by concerns about its production capacity.As the supply chain and production line are still in the climbing stage, whether Xiaomi can maintain stable delivery in the next six months has become the focus of the market.If production capacity expansion falls short of expectations, it may affect its long-term scale strategy.However, Xiaomi's strong brand effect and ecological chain advantages are still its unique moat in the field of new energy vehicles.

BYD and Geely: Progress while maintaining stability, efforts overseas

Compared with the fierce competition between new forces, BYD and Geely performed more steadily.

BYD's overall sales were flat, but pure electricity sales increased year-on-year, indicating that its fundamentals in electrification transformation are still solid.Geely achieved sales of 250,000 vehicles in August, a year-on-year increase of 38%. Among them, pure electricity increased by 98% year-on-year, and plug-in increased by 90%. It also maintained rapid expansion.

For these two traditional car companies, intensified competition in the domestic market means that profit margins are compressed.As a result, overseas markets have become new growth breakthroughs.BYD's expansion in European and Southeast Asian markets is accelerating, and Geely is also accelerating its internationalization through its brands such as Krypton and Geometry.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.