Expectations for interest rate cuts heat up, and gold approaches US$3800, hitting a record high

Gold stocks surged.

Where are the limits of gold?

On September 22, the spot gold price exceeded US$3785/ounce, setting a new record again, with an intraday increase of more than 1%.Boosted by the price of gold, many gold concept stocks were active, especially companies such as Datang Gold, Wanguo Gold Group, Chifeng Gold, Shandong Gold, and China Gold International in the Hong Kong stock market generally rose. Among them, Datang Gold's single-day increase was as high as 28%, attracting market attention.

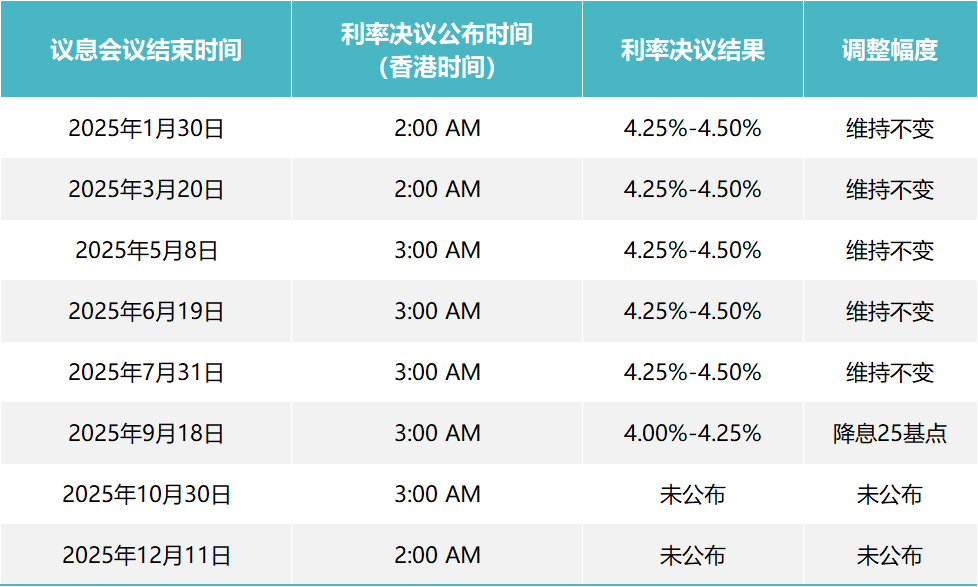

The key factor contributing to the surge in gold prices lies in the deep changes in the global macro environment.First of all, the US dollar interest rate policy is quietly turning in the channel of falling back from its high point.At the latest Federal Reserve meeting, the market expected the Federal Reserve to cut interest rates by a total of 150 basis points in 2025.Driving these expectations are not only the fall in inflation data and the relatively strong performance of retail sales, but more importantly, the marginal weakening of the labor market and growing concerns about the sustainability of fiscal deficits and debt.Especially in the context of Trump's frequent voices on monetary policy and public calls for radical interest rate cuts, the "independence" of the Federal Reserve is being re-discussed, which undoubtedly exacerbates the market's uncertainty about the future policy path and indirectly promotes investors to further allocate "no credit risk" assets such as gold.

From within the Fed, differences have emerged.According to reports, Milan, the new Fed governor appointed by Trump, proposed at this meeting that interest rates should be cut immediately by 50 basis points and expected continued substantial easing in the coming year.Although his views have not been accepted by the mainstream, the market has clearly given its own interpretation of this eagle-dove split: since the policy consensus is no longer solid, possible "unexpected easing" in the future will greatly increase the price elasticity of gold.This uncertainty itself has become an important fuel for the upward trend of gold prices.

At the same time, global capital's attitude towards the allocation of gold assets has also shifted significantly.According to the latest data from the World Gold Council, as of mid-September, global gold ETF positions have rebounded for four consecutive weeks, and the increase in holdings hit a new high in the second half of the year.In particular, ETFs in North America and Asian markets are the most enthusiastic about increasing positions.Demand for physical gold from China, India and the Middle East remains firm, while the trend of global central banks increasing their holdings of gold reserves has not stopped. In the first half of the year alone, China's central bank increased its holdings by more than 120 tons, ranking first among the global central banks in increasing their holdings.This structural buying, coupled with concerns about geopolitical conflicts and credit risk, provides solid long-term support for gold.

As a direct beneficiary of the rise in gold prices, the high correlation between the stock price performance of gold stocks and the spot price of gold was once again confirmed in this market.Take Datang Gold as an example. As a highly elastic target with small and medium-sized market capitalization, it is extremely sensitive to marginal changes in gold prices. Therefore, it has rapidly increased in volume during this round of gold price breakthroughs.Leading mining companies such as Shandong Gold and China Gold International are more suitable for institutional investors for medium-and long-term allocation due to their stable resource reserves and sufficient cash flow.Data shows that although the growth rate of such leading stocks is relatively moderate, their stock price volatility is small and there is still much room for valuation repair. Especially in the context of the overall undervaluation of the Hong Kong stock market, it has the basis for further strength.

From a valuation perspective, the current average P/E ratio of Hong Kong stocks and gold stocks is still significantly lower than that of similar gold mining companies in the United States.For example, North American mining giants such as Barrick Gold and Newmont Corporation currently have a valuation center of more than 15 times, while Hong Kong stocks such as Shandong Gold and Zhaojin Mining are generally less than 12 times PE. Under the circumstances of homogeneous resources and similar asset quality, Hong Kong stocks have gold There is some room for valuation repair.At the same time, the price-to-book ratio of some companies is even less than double, reflecting that the market may lag behind in its perception of the continuity of the golden cycle.

In addition to the fundamentals of the Federal Reserve's policies and gold supply and demand, technical aspects also provide support for the rise in gold prices.Analysts said that from the technical figures, the price of gold has broken through the strong resistance level near US$3750 in the previous period and is firmly in the upward channel.If it can maintain operating above US$3700 in the next two weeks, a new uptrend channel may be formed, further pointing to the target price of US$3800 or higher.Morgan Stanley pointed out in its latest strategy report that if the Federal Reserve sends a signal to cut interest rates before the end of the year, the price of gold may hit US$4000 during the year, and recommends that investors appropriately add gold-related assets.

In general, gold, as an important asset for medium-and long-term allocation in the global capital market, has regained market favor in the current multiple environments of easing inflation expectations, widening policy differences, and intensifying debt concerns.As a leverage amplifier for gold price fluctuations, gold stocks will still deserve high attention in the future.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.