Doo Financial Observation| Observe the "stock god"'s thinking of reducing holdings from Buffett's clearance of BYD

From Apple to BYD, what is the logic behind Buffett's reduction of holdings?

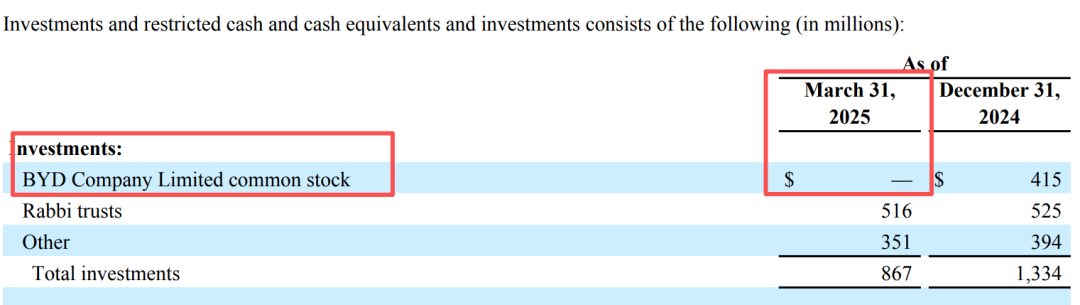

On September 21, according to Berkshire Hathaway's first-quarter financial documents, the agency had completely cleared BYD's shares.Later, a Berkshire spokesperson confirmed that BYD's entire position had indeed been sold.

BYD's liquidation also marks the temporary end of Berkshire's 17-year investment journey in BYD.

Munger strongly recommended BYD not to let Buffett down

In September 2008, while the haze of the financial crisis had not yet dissipated, BYD's potential in the fields of new energy batteries and electric vehicles had begun to emerge.At that time, Charlie Munger keenly captured the technical strength of this China company and the execution power of founder Wang Chuanfu, and firmly recommended it to Buffett.In the end, Buffett subscribed for 225 million BYD H shares through Berkshire's Sino-American Energy Company at a price of HK$8 per share, accounting for approximately 10% of the total share capital after the placement at that time, and the transaction amount was approximately HK$1.8 billion.

At the 2009 annual shareholders meeting, Charlie Munger told shareholders that although it seemed "Buffett and I were crazy," he thought the company and its CEO Wang Chuanfu were a "remarkable miracle."During Berkshire's holding period, BYD's share price rose by approximately 3890%.

The turning point will occur in 2022.In August of that year, the Hong Kong Stock Exchange disclosed that Berkshire reduced its holdings of BYD for the first time, selling approximately 1.33 million shares and cashing in HK$369 million.Although the scale of the reduction is limited, it breaks the persistence of long-term holding.Subsequently, Berkshire began a two-year phase-out process, selling BYD shares in batches at different stages.

As of September 21, 2025, some investors noticed that Berkshire Energy subsidiary, which holds BYD shares, listed the book value of the investment as zero in its first-quarter financial documents, which means Buffett completely liquidates BYD.

Buffett's Reduction Thinking: The Marginal Efficiency of Capital

According to BYD's 2025 mid-year report, the company's revenue in the second quarter reached 200.92 billion yuan, a year-on-year increase of 14% and a month-on-month increase of 17.9%; however, net profit was only 6.36 billion yuan, a year-on-year decrease of 29.9% and a month-on-month decrease of 30.6%. This is the first time since 2022 BYD has experienced a quarterly profit decline, significantly lower than market expectations.

For example, he has gradually increased his investment in energy and infrastructure areas in the past few years, such as investing heavily in Occidental Petroleum, a U.S. oil and gas company, and increased capital investment in natural gas and renewable energy projects, because although these industries are growing at a slower rate than new Energy vehicles are dazzling, but they provide more stable and predictable cash flow.At the same time, Berkshire also continues to expand its allocation in traditional sectors such as insurance and railways, emphasizing defensive and long-term compound interest effects.Compared with these directions, the opportunity cost of continuing to hold BYD, which has high valuation, slowing profit growth and fierce competition, is obviously rising.

The same is true for Buffett's reduction in Apple.

Buffett's investment in Apple began between 2016 and 2018, when Berkshire bought Apple shares in batches at a total cost of approximately US$35 billion.As Apple's product ecosystem, service business and brand loyalty increase, and the company's cash flow continues to improve, this investment will bring huge value-added in the next few years.By the end of 2023, the book value of the investment had grown to approximately $173 billion, making Apple one of the largest positions in Berkshire's stock portfolio.Buffett has repeatedly publicly stated that Apple has an "economic moat" and believes that consumers have low price elasticity for core products such as the iPhone, and that the company continues to buy back shares and pay dividends, making its shareholder earnings more stable.

However, in 2024, Berkshire will gradually reduce its holdings of Apple.This reduction is not achieved overnight, but is carried out in stages.In the first and second quarters, Berkshire significantly reduced its shareholding in Apple, and by mid-2024 it has been reported that it had reduced nearly half of its Apple position in the second quarter.In the third quarter, the reduction continued. As of the end of the year, its holdings in Apple were about two-thirds lower than a year ago.In the process, Berkshire's gains are very substantial.At the same time, the valuation of Apple shares has also risen sharply from the multiple of the price at the time of entry.Buffett has mentioned in public that many assets in the current market are highly valued, and some alternative opportunities now seem to have better marginal returns, so he sold some apples to free up cash.

Buffett's case of reducing his holdings of Apple is very similar to BYD. Both of them focused on the company's growth and moat in the early stage, and benefited a lot from long-term holding. However, at a certain stage, the valuation has become much higher than when buying, and future growth Although there is still, the asymmetry between growth rate and risk has increased, and changes in competition and the external environment have also become one of the considerations.In Apple's case, Berkshire's reduction is to prevent a certain target in the portfolio from accounting for too large a proportion, while locking in profits and increasing liquidity for better allocation opportunities in the future; similarly, BYD's liquidation may also be because between its valuation and growth, marginal returns have declined or are not as attractive as other alternative investment opportunities.

_1853586813_214.png)

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.