Apple, Alphabet, JPMorgan Chase, Bank of America, Morgan Stanley and other giants are the most prominent participants.

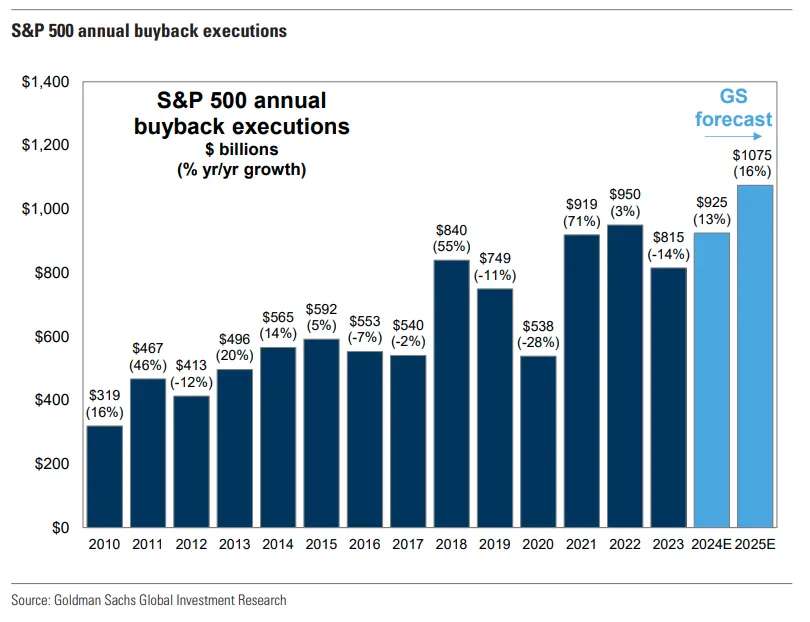

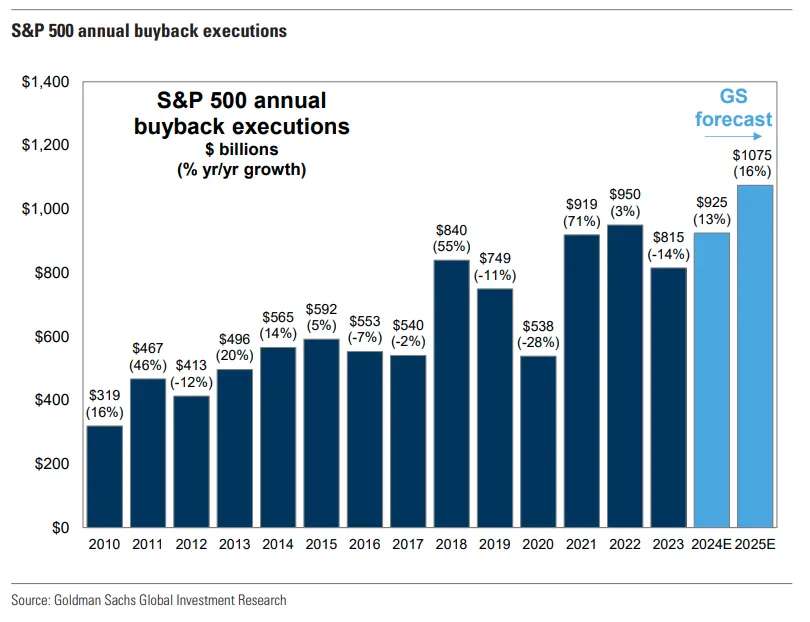

In 2025, U.S. listed companies are accelerating stock buybacks with unprecedented efforts. This not only sets a new historical record, but also becomes an important driving force for U.S. stocks to hit record highs.

According to Birinyi Associates, as of now, U.S. companies have announced repurchase plans of up to $983.6 billion, the highest level for the same period since records began in 1982, and the full-year total is expected to exceed $1.1 trillion.Compared with previous repurchase cycles, this round of actions is more concentrated and larger in scale, especially in the technology and finance sectors, demonstrating the company's confidence in the capital market and strategic adjustments in cash flow management.

In this repurchase boom, giants such as Apple, Alphabet, JPMorgan Chase, Bank of America, and Morgan Stanley are undoubtedly the most prominent participants.

Apple committed to investing US$100 billion in repurchase in May and disclosed in its July earnings report that it held US$36.3 billion in cash and equivalents;Alphabet's US$70 billion repurchase plan is equally eye-catching, with cash reserves of approximately US$21 billion.JPMorgan Chase announced $50 billion, Bank of America $40 billion, and Morgan Stanley reauthorized a $20 billion repurchase line.This strategy of returning large-scale funds to shareholders has benefited from the continued strengthening of profitability and the expansion of balance sheets in recent years, while the AI boom has further pushed up the market value and repurchase capabilities of technology giants.

The underlying reason for promoting enterprises to actively repurchase lies in the superposition of macro and micro factors.On the one hand, the U.S. economy has shown resilience in a high interest rate environment, with consumer spending remaining stable, pushing banking profits to remain strong; on the other hand, trade policy uncertainty, geopolitical risks and changes in global demand structure have caused some companies to postpone capital expenditure plans, making using cash for repurchase to increase earnings per share (EPS) a more attractive option.FactSet data shows that 82% of companies in the S & P 500 that have reported second-quarter earnings have exceeded market expectations, providing a solid performance basis for the repurchase wave.

It is worth noting that companies have not slowed down the pace of repurchase during the market downturn.In the first quarter of this year, S & P 500 companies bought back US$293.5 billion worth of shares when the market was relatively weak, setting a quarterly record and a 21% increase from the end of 2024.This shows that repo is not only a tool to fuel the bull market, but is also used as a strategic operation to stabilize stock prices and send signals.

However, with the upsurge comes controversy and worry.Critics point out that U.S. stock valuations are already at high levels and that large-scale buybacks may conceal potential fundamental risks.Historical experience shows that enterprises tend to increase repurchase efforts when stock prices rise, rather than sell at the undervaluation stage, which has problems in resource allocation efficiency.At the same time, relying too much on buybacks rather than long-term capital investment may mean companies lack confidence in future growth.Especially in the context of global economic slowdown and supply chain restructuring, this trend may weaken future competitiveness.

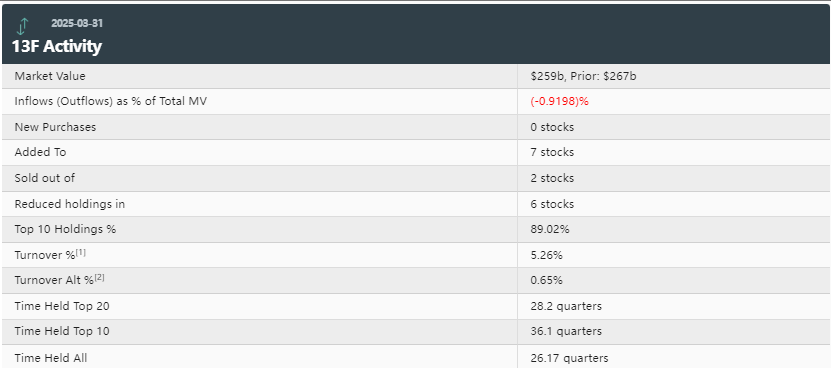

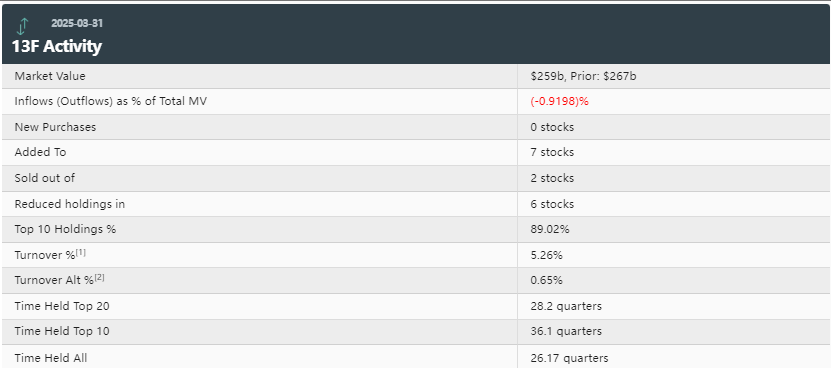

Warren Buffett's attitude is particularly typical.Berkshire Hathaway did not conduct any share repurchases from April to June this year. This is the fourth consecutive quarter that it has suspended repurchases, and the company's cash reserves have climbed to a record high of US$344 billion.Buffett has long insisted on buying back stocks when they are undervalued. This counter-cyclical strategy is in sharp contrast to the current market enthusiasm.BlackRock CEO Larry Fink also emphasized in his annual letter to the CEO that share buybacks should be balanced with long-term growth investments and avoid sacrificing future competitive advantages for short-term shareholder returns.

What is worth observing from an international perspective is that the US repurchase wave far exceeds that of the European and Japanese markets in terms of scale and concentration.The repurchase activities of European companies are more subject to regulation and shareholder structure. Although Japan has increased significantly in recent years driven by corporate governance reforms, the scale is still much lower than that of U.S. stocks.At the same time, the funding source for U.S. stock buybacks not only relies on profits, but also includes cheap debt accumulated during historically low interest rates, which is also a condition that is difficult for other markets to fully replicate.The ultra-large-scale repurchase in this context not only reflects the company's capital operation capabilities, but also reflects the uniqueness of the U.S. capital market system and investment culture.

Overall, analysts expect the buyback boom to boost stocks that are already boosted by solid corporate earnings.Fitzpatrick, managing director at Logan Capital Management, said: "This bodes well for the overall market.”