Doo Financial Comprehensive Review: Is It Good? Account Opening Guide and Practical Tips

Doo Financial Complete Account Opening Guide: Includes the full process via Doo Financial HK, required documents (ID card /address proof, etc.), 3 verification methods (online transfer /in-person verification), and review steps. A step-by-step guide to help you complete account opening—check out the detailed guide now!

Introduction: Hong Kong Licensed Broker with Zero Threshold Serving Mainland Investors

Still wondering "Is Doo Financial reliable? Is it safe?" As a licensed corporation regulated by the Hong Kong Securities and Futures Commission (Central Entity Number: BSM562), Doo Financial (Doo Financial Hong Kong Limited) offers a 4-in-1 account covering Hong Kong stocks, US stocks, A-share Connect, and China Connect. Mainland residents can open an account online with just an ID card and a Hong Kong bank card, no overseas work certificate required! This article provides an in-depth review of its safety, fees, and exclusive account opening benefits, including July limited-time rewards and a guide to claiming them with the invitation code RKM01.

I. Introduction to Doo Financial

Doo Financial is a well-known financial services provider in Hong Kong, focusing on the securities trading market. The company's services cover trading in markets such as Hong Kong stocks, US stocks, and A-shares, providing a broad investment platform for investors. Both novice and experienced investors can find suitable investment opportunities here.

II. Why Choose Doo Financial?

Strong Regulatory Endorsement

- Licensed by the Hong Kong Securities and Futures Commission (Type 1/4/9 regulated activities), with client funds segregated and custodied in top banks such as HSBC/Standard Chartered.

- Licensing information is available on the official website (HK SFC BSM562), avoiding risks associated with unlicensed brokers.

Core Account Advantages

| Feature | Traditional Brokers | Doo Financial |

|---|---|---|

| Supported Markets | Hong Kong/US stocks | ✅ Hong Kong stocks + US stocks + A-share Connect + China Connect |

| Account Opening for Mainland Residents | Requires overseas address/work certificate | ✅ Only requires ID card + Hong Kong bank card |

| Platform Fee | Generally charged | ✅ 0 platform fee during the promotion period |

High Fee Transparency

- Hong Kong stock trading: 0.03% commission (minimum HK$3), much lower than the industry average of 0.1%;

- US stock trading: $0.004 per share (minimum $1), no platform usage fee.

Convenient Account Opening Threshold

- No need for overseas work certificates or existing asset certificates; mainland residents can apply online with only basic materials such as ID cards and Hong Kong bank account certificates;

- Supports account opening for various identity types, including mainland Chinese residents, Hong Kong permanent residents, and residents of Taiwan and other regions, catering to different user needs.

III. Doo Financial Account Opening Guide

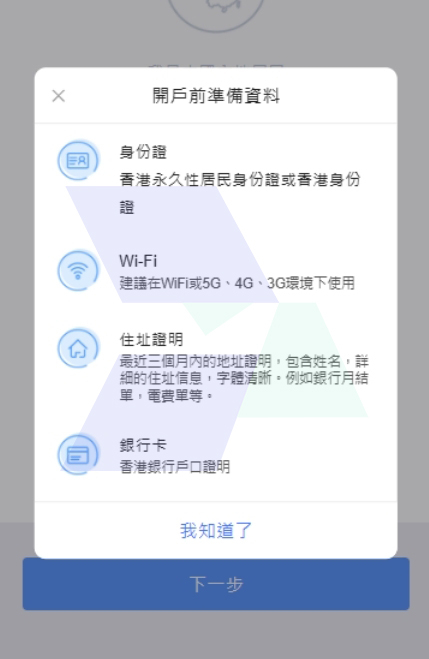

Documents to Prepare

- Mainland Chinese residents: personal ID, personal Hong Kong (or overseas) bank card, Hong Kong bank card statement within 3 months;

- Hong Kong residents: ID card, address proof, bank account proof, etc.

Account Opening Process

Step 1: Download the APP and Register/Login

Download "Doo Financial HK" through official channels, click "Register", enter your mobile phone number (e.g., starting with +852), obtain and fill in the verification code to complete login.

Step 2: Select Identity Type

On the "Please select identity type" page, check the corresponding option according to your situation (e.g., "Mainland Chinese Resident"), and click "Next".

|

|

|

Step 3: Select Account Type and Services

- Account nature: default "Securities Cash";

- Products and services: check the markets you need to open (e.g., Hong Kong stocks, US stocks, Shenzhen A-shares, etc.);

- Read and agree to all agreement statements, click "Next".

|

|

|

Step 4: Upload Documents and Complete Information

- Upload ID card: take or upload a photo of your ID card as prompted, ensuring it is not blurry, has no glare, and the borders are complete;

- Fill in personal information: including name (Chinese and English), ID number, date of birth, nationality, place of birth, etc., and submit after confirmation.

|

|

|

|

Step 5: Fill in Contact Information and Residential Address

- Email address: needs to be verified (the system will send a verification code);

- Residential address: need to fill in details such as country, region, street, and house number, which must be consistent with the address proof;

- Mobile phone: fill in a valid number (e.g., Hong Kong numbers start with 852).

|

|

|

Step 6: Submit Bank Information

- Fill in the name of the Hong Kong bank account holder, currency (e.g., Hong Kong dollars), bank name, and account number;

- Upload bank proof documents (e.g., statements from the past 3 months), click "Next".

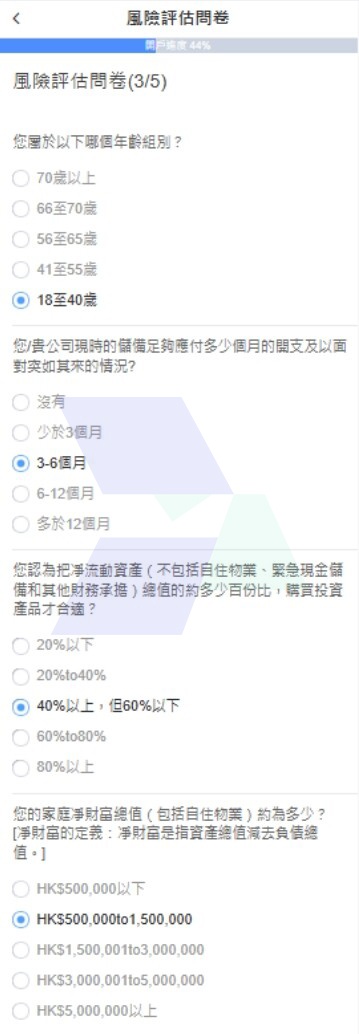

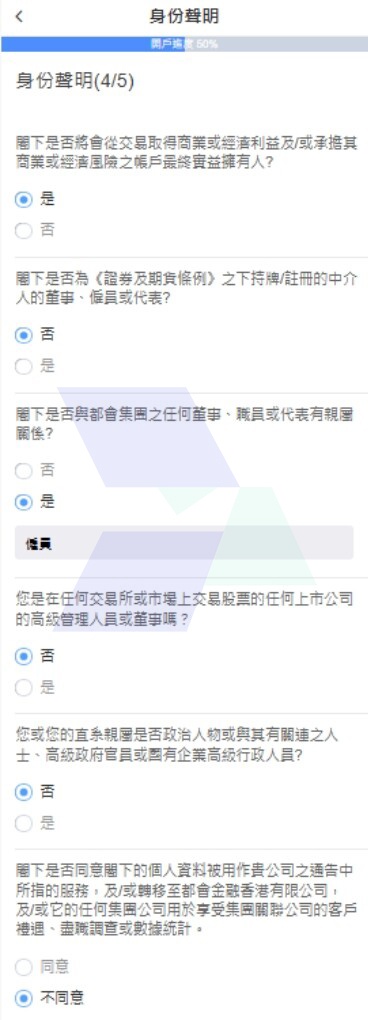

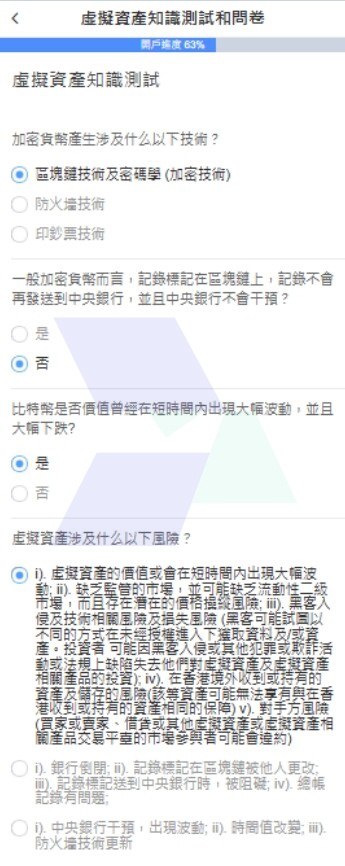

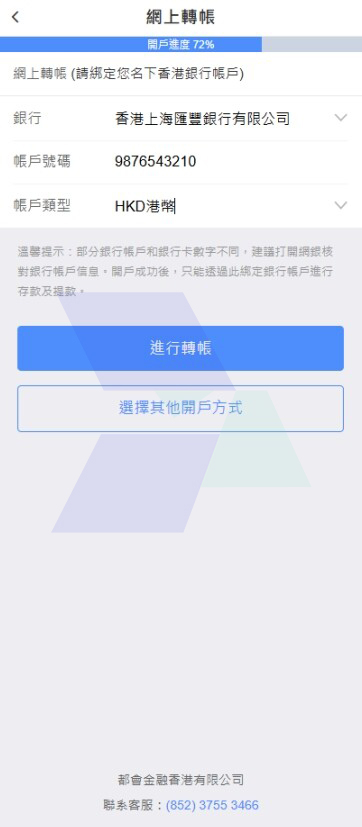

Step 7: Complete Risk Assessment and Questionnaires

- Fill in investment experience (e.g., "no experience", "1-3 years", etc.), investment objectives (e.g., capital appreciation, dividend returns, etc.);

- Answer questions related to risk tolerance (e.g., acceptable proportion of principal loss, investment period, etc.);

- Complete personal tax self-certification, employment status, and other information.

|

|

|

|

|

|

|

|

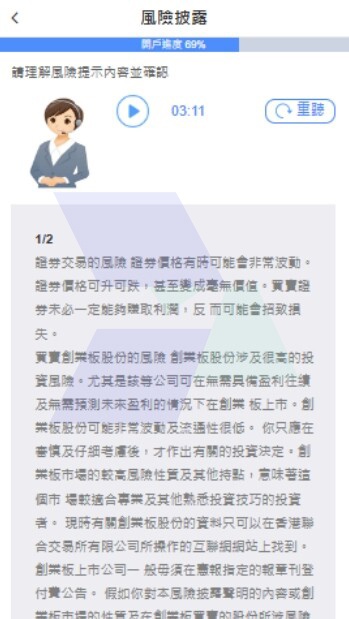

Step 8: Identity Verification (Choose One of Three)

- Online transfer verification: transfer at least HK$10,000 from your personal Hong Kong bank account to Doo Financial's designated account, and upload the transfer receipt;

- In-person verification: go to a licensed person to sign account opening documents and copy identity materials;

- Mail a check: mail a check issued from your Hong Kong bank account to Doo Financial's headquarters to assist in identity verification.

|

|

|

|

|

|

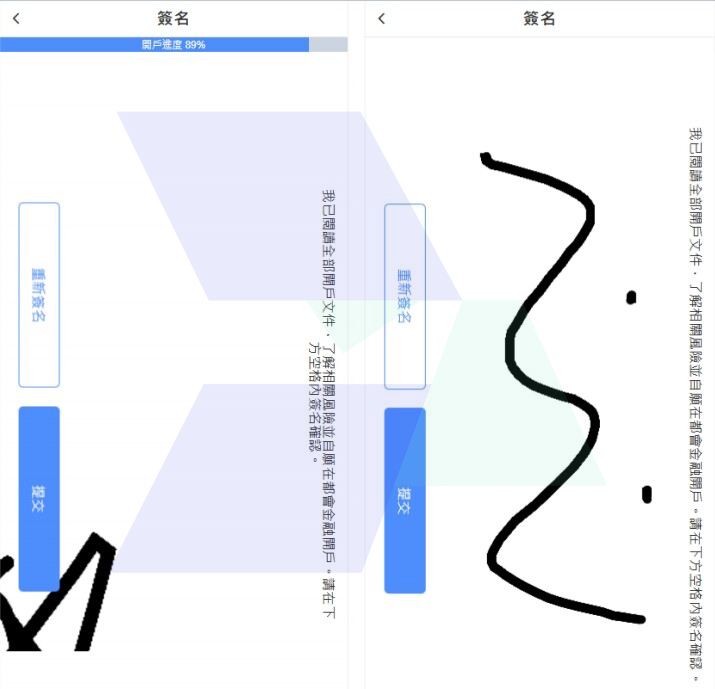

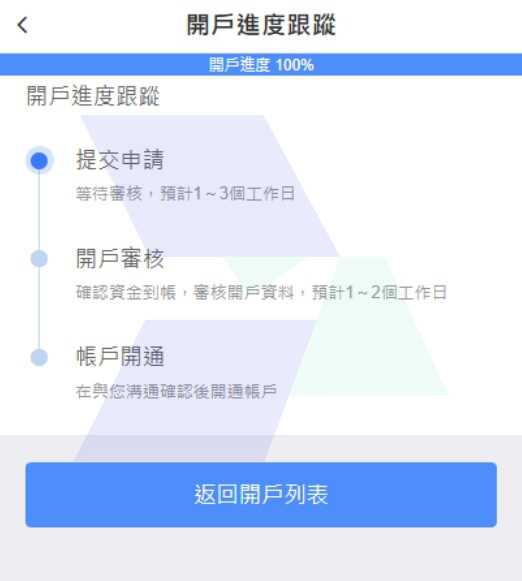

Step 9: Signature Confirmation and Review

- Electronic signature: complete the signature in the designated area, confirming that you have read and agreed to all account opening form contents;

- Submit for review: review is expected to be completed within 1-3 working days. After approval, you will receive the account number, login password, and transaction password.

|

|

|

IV. Exclusive July Reward: Up to HK$888 ETF Gift!

Target keyword: Doo Financial account opening reward. Activity rules: Must enter the invitation code RKM01 when opening an account + meet the first deposit requirement (valid until July 31).

| Deposit Amount | Reward Content |

|---|---|

| ≥HK$10,000 | ✅ 0 platform fee for Hong Kong/US stocks + 30 commission-free trades per month |

| ≥HK$80,000 | ✅ Unlimited commission-free trades (entire activity period) |

| ≥HK$200,000 | ✅ 100 units of Tracker Fund (valued at approximately HK$888) |

| ⚠️ Note: Rewards require deposit from a同名账户 (same-name account)! No fee for withdrawal, which will arrive within 3 working days. | |

V. FAQ Common Questions

Q1: Which regulatory bodies oversee Doo Financial?

A: The operating entity is Doo Financial Hong Kong Limited, regulated by relevant financial regulatory authorities in Hong Kong. Specific qualification information can be found through official channels, and the customer service hotline (852) 37553466 can provide further explanations.

Q2: Can mainland residents open an account without a Hong Kong bank account?

A: No, opening an account requires Hong Kong bank account proof (such as a bank card or statement), and deposits must be made through a Hong Kong bank account.

Q3: What are the specific requirements for address proof?

A: It must be a document from the past 3 months, containing the name, detailed address, and clear handwriting, such as bank statements, electricity bills, gas bills, etc.

Q4: How soon can I start trading after depositing funds?

A: You can log in to your account to trade after the funds arrive and the review is completed (approximately 1-2 working days).

Q5: Are there fees for deposits and withdrawals?

A: The platform does not charge additional fees, but banks may charge transfer fees. The specific amount is subject to the bank's regulations.

Q6: What are the common reasons for account opening review failure?

① Blurred ID photos or incomplete information;

② Address proof inconsistent with the filled address;

③ Transfer amount not meeting the minimum requirement;

④ Risk assessment questionnaire filled out inconsistent with product requirements. You can contact customer service to inquire about specific reasons.

Conclusion: Is Doo Financial Worth Choosing?

Doo Financial, as a Hong Kong licensed financial institution, has guaranteed compliance, simplified account opening procedures, and supports multi-market trading, making it suitable for mainland and Hong Kong investors who wish to invest in Hong Kong stocks, US stocks, and other markets. Its online account opening and deposit/withdrawal functions are convenient, and with detailed guidelines, even beginners can get started quickly.

If you are looking for a one-stop global market trading platform, Doo Financial can be a priority option. It is recommended to prepare relevant materials before opening an account and follow the procedures to improve review efficiency. If you have any questions, you can contact Hawk Insight customer service for consultation.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.