Markets may fluctuate during short-term policy transitions, but medium-term trends tend to reflect valuation repairs and improved liquidity in an easing environment.

After the Federal Reserve kept interest rates unchanged for nine consecutive months, market expectations for it to resume interest rate cuts in September quickly rose.

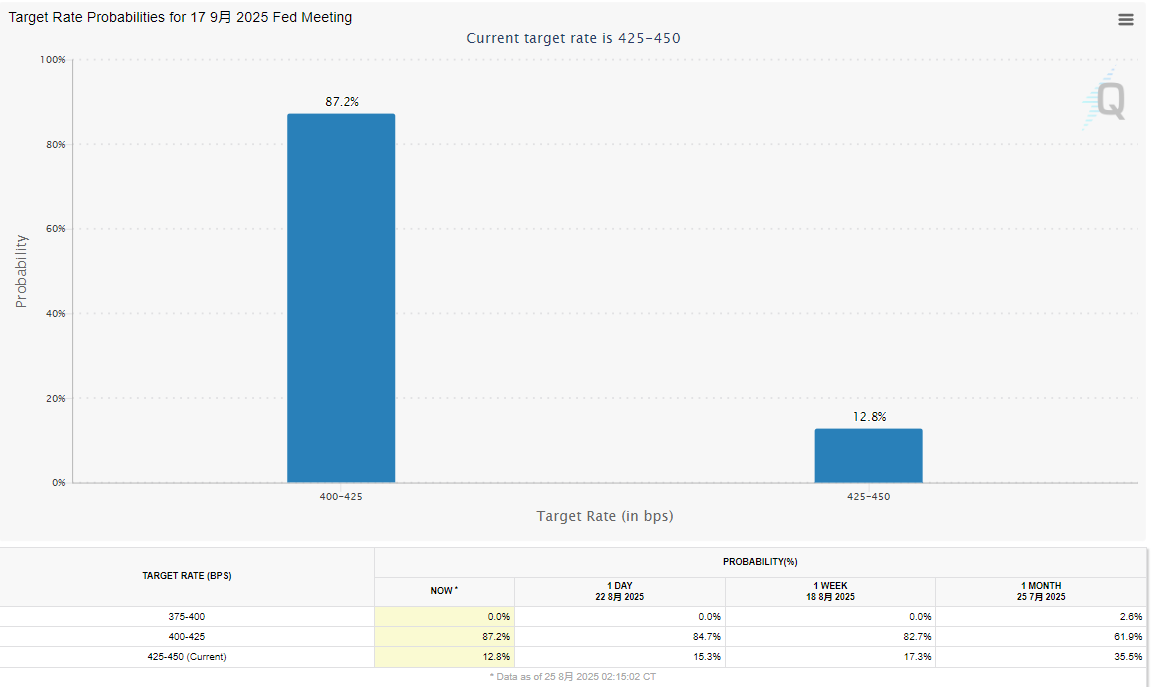

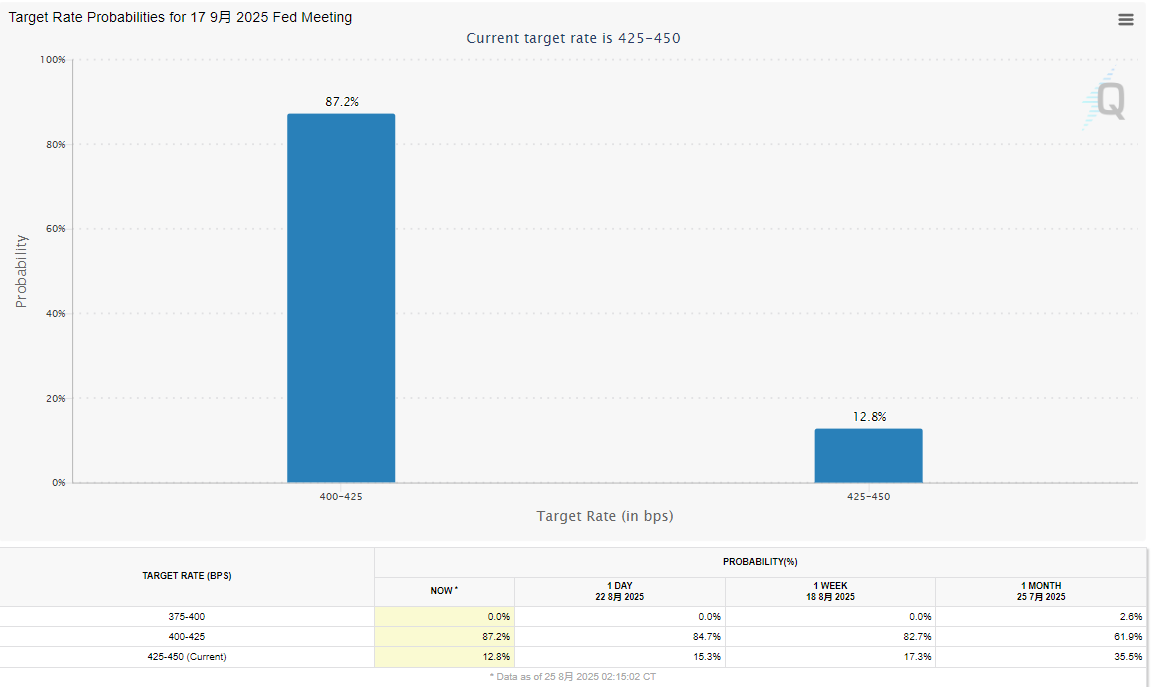

The market is betting that the probability of interest rate cuts in September will increase significantly

On August 23, Federal Reserve Chairman Powell's statement at the Central Bank's Annual Meeting in Jackson Hole was interpreted by the market as an obvious turnaround.Although he reiterated his "data-dependent" decision-making path, concerns about a weak labor market were seen as a signal that policy could be loosened.Interest rates are currently in a restricted range. If the economy continues to perform weakly, the possibility of monetary policy adjustments is increasing.

According to CME FedWatch tool, the market expects the probability that the Federal Reserve will cut the federal funds rate by 25 basis points in September to be 87.2%, a significant increase from 75% a week ago.Traders also expected an 83.9% probability that the Fed may implement at least two interest rate cuts this year.This means that the market has generally counted at least one easing policy operation.

Historical experience supports bullish views in the medium and long term

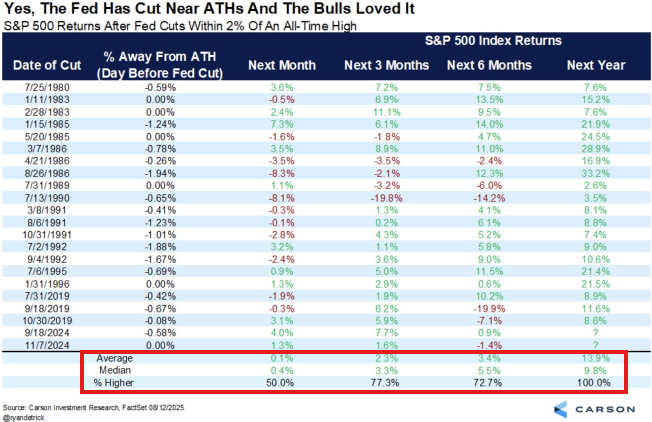

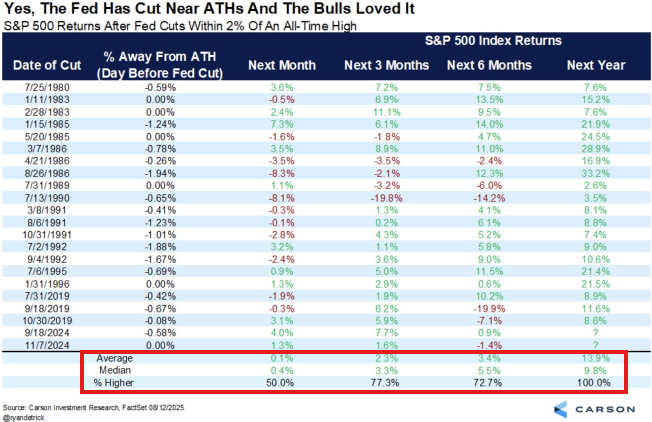

Historical data supports the optimism behind this expectation.

Ryan Detrick, chief market strategist at Carson Group, statistics that since 1970, the Federal Reserve has experienced 11 cases of "suspending interest rates again after 5 to 12 months."In such scenarios, although the S & P 500 averaged weak performance in the one to three months after the rate cut (down 0.9% and 1.3% respectively), its performance strengthened significantly a year later-with 10 gains, with an average increase of 12.9%.

This suggests that the market may fluctuate during short-term policy turns, but the medium-term trend tends to reflect valuation repairs and liquidity improvements in an easing environment.The S & P 500 index is currently close to historical highs, and the Dow has set a closing record, indicating that the market is responding positively to future monetary easing.

Small-cap stocks led the gains, with valuation sensitivity highlighted

The impact on the asset structure is also gradually emerging.

Although large technology stocks are the main beneficiaries of the interest-rate interest-rate environment, their upside is limited in the context of high valuations.

In contrast, the recent performance of small-cap stocks has improved significantly.

The Russell 2000 index rose 3.9% in a single day on August 23, surpassing the S & P 500's 1.5%.The reason is that small and medium-sized enterprises hold more floating rate debt and are more sensitive to changes in financing costs.Once the interest rate cut is implemented, it will directly relieve the pressure on interest expenses and improve profit expectations.

At the same time, the overall performance of risk assets was active.

Against the backdrop of falling U.S. bond yields and a weakening U.S. dollar, gold and industrial metal prices rebounded and funds were redistributed to high-risk sectors.Steve Sosnick, strategist at Interactive Brokers, pointed out that the current market risk appetite has increased significantly, and investors are more willing to allocate assets far beyond the risk curve driven by expectations of interest rate cuts.

Policy differences and inflation variables still exist

Despite this, opinions within the Fed are not entirely consistent.

Cleveland Fed President Mark Hammack said recently that based on current data, she is not inclined to support a September rate cut.This means that despite the consensus in the market, there is still a cautious voice among policymakers.At present, core inflation has not dropped significantly, and the price of the service industry is highly sticky. If inflation unexpectedly rebounds, it will have a direct impact on expectations of interest rate cuts.

Data in the next few weeks will become a key variable in determining the direction of the Fed's policy.

The market will focus on the upcoming July PCE inflation data, August non-farm payrolls report, and CPI and PPI released before September.These data will directly affect the Fed's policy judgment at the FOMC meeting from September 17 to 18.The market's expected pace of interest rate cuts needs to be based on data support, otherwise it will easily create the risk of price correction after the policy fails.

Structural market may continue

Wall Street said that if the Fed enters an actual interest-rate cut cycle, asset performance will be re-differentiated.

Sectors that are more sensitive to interest rates such as small-cap stocks, finance, industry, and real estate will benefit, while growth stocks with already high valuations need to rely on improved earnings to maintain stable valuations.In addition, bond markets will also benefit, especially as short-and medium-term credit bonds may perform better than long-term government bonds.

From a global perspective, the Federal Reserve's interest rate cut will lead to a fall in the US dollar, which will have indirect benefits for capital flows in emerging markets.

Currencies in markets including Mexico, India and Indonesia have rebounded recently, attracting short-term capital inflows.In addition, the correction in the US dollar also supported the performance of international commodity prices. The prices of industrial metals such as copper and aluminum rebounded in stages, which is good for resource countries.

However, the risks cannot be ignored.There has always been a mismatch between market expectations and the Fed's statement.

Once subsequent data does not support interest rate cuts or inflation rises again, the revision of policy expectations will bring about severe asset price fluctuations.Several rounds of sharp corrections since 2022 are all due to deviations between the market's excessively forward-looking expectations and the Fed's actual actions.