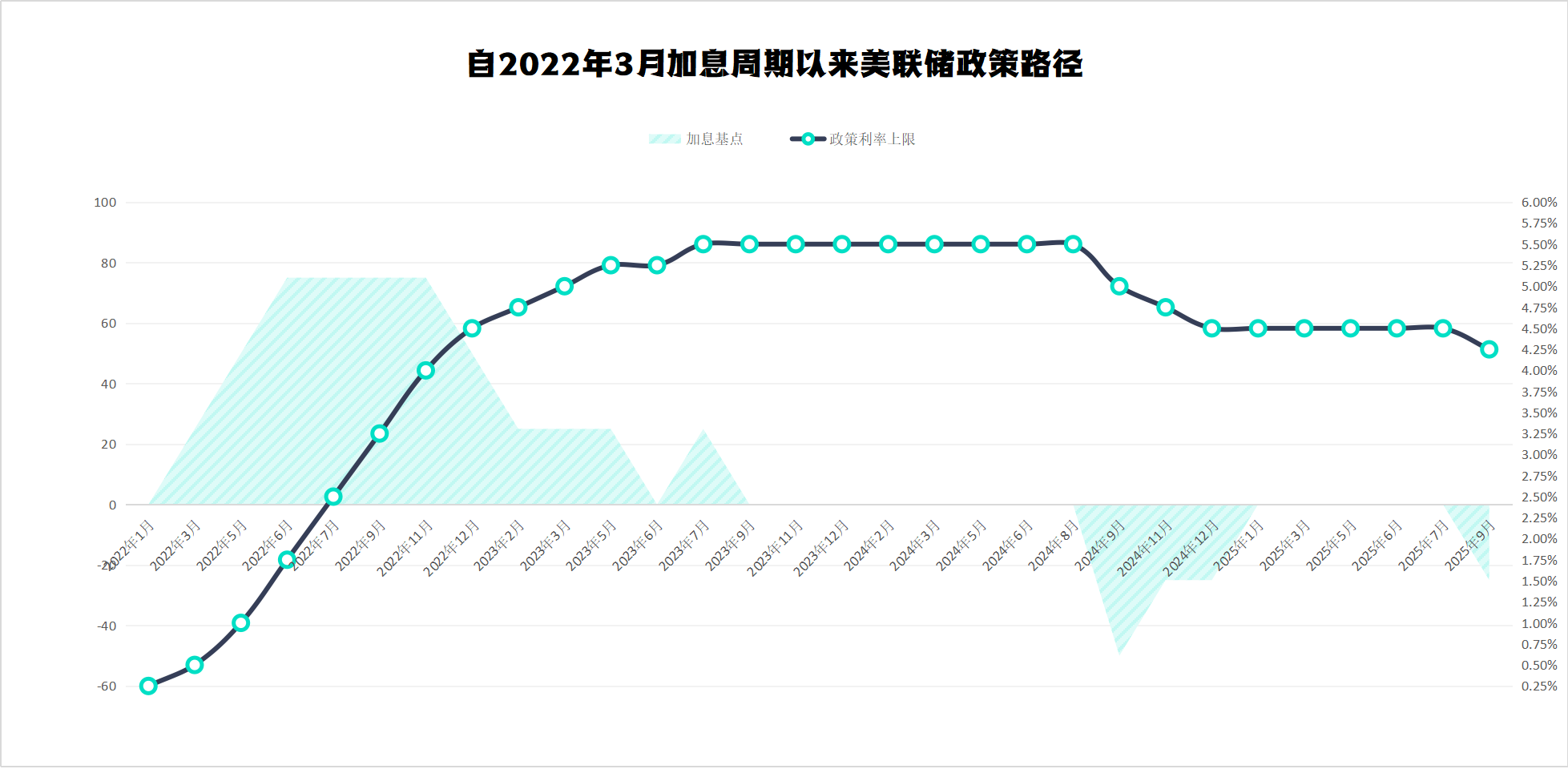

Federal Reserve's FOMC interest rate meeting agenda, latest interest rates, policy path, meeting review, inflation trend (2025)

What is the path for the Federal Reserve to cut interest rates in 2025? How much will the Federal Reserve cut interest rates in 2025? What should investors pay attention to after interest rate cuts? What did the Fed's policy meeting reveal?

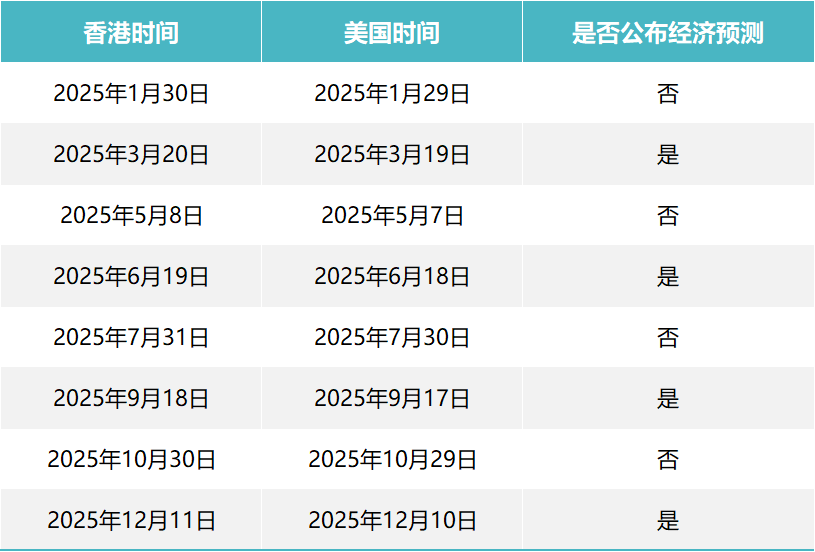

2025FOMC regular meeting schedule:

Data source: Federal Reserve official website

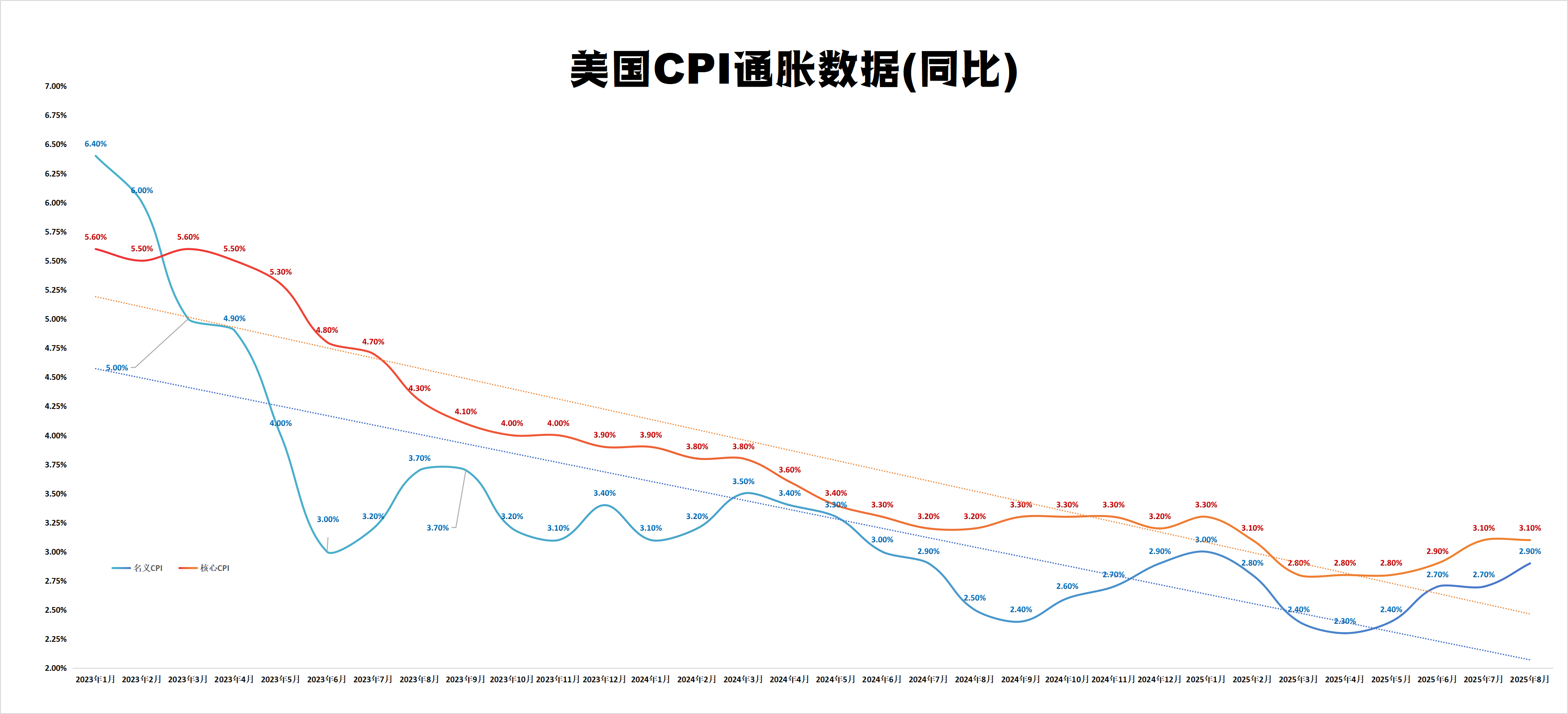

U.S. CPI inflation data (year-on-year):

Data source: U.S. Bureau of Labor Statistics

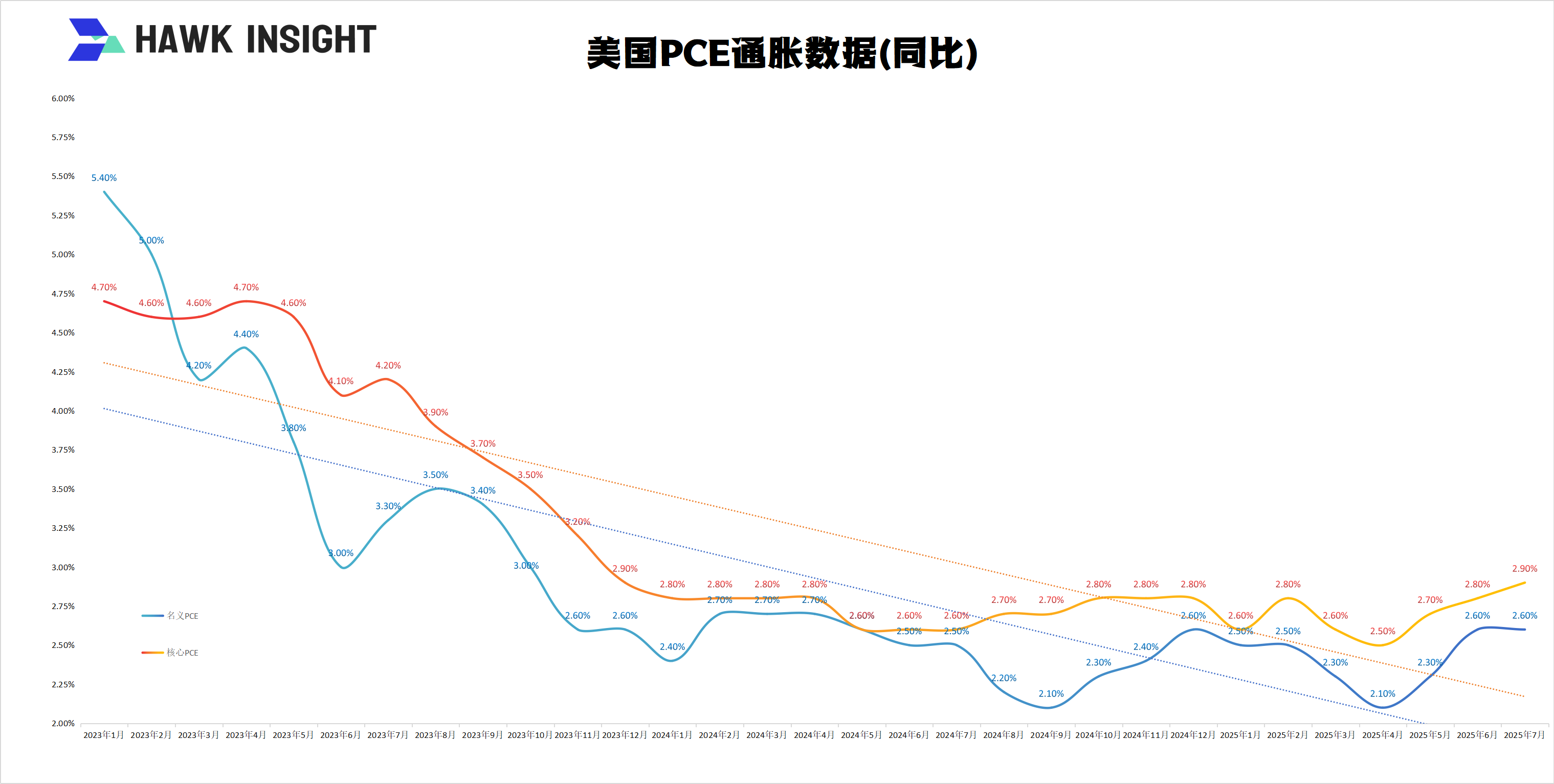

U.S. PCE inflation data (year-on-year):

Data source: US Department of Commerce

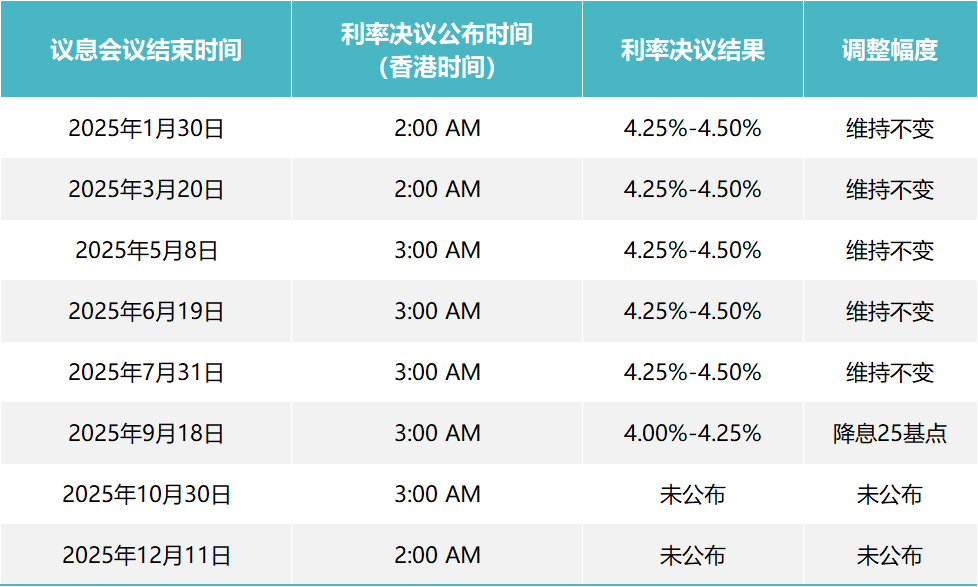

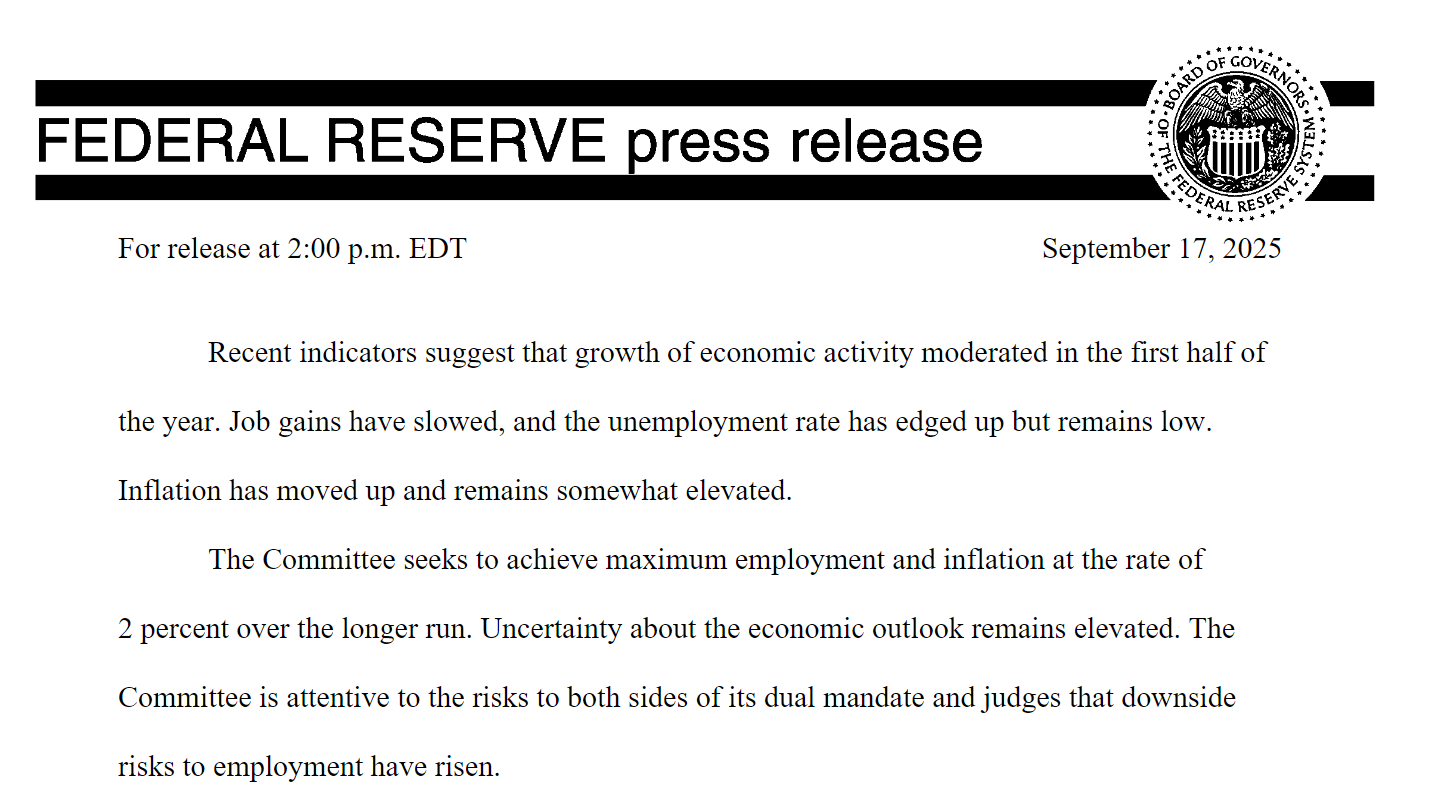

Review of the statement of the Federal Reserve's September 2025 interest-rate meeting

·Interest rate cuts for the first time in the year, with a decrease of 25 basis points

--"The Federal Reserve announced after the FOMC meeting of the Monetary Policy Committee that the target range of the federal funds rate has dropped from 4.25% to 4.5% to 4.00% to 4.25%, a decrease of 25 basis points.”

--"This is the first time the Federal Reserve has cut interest rates since December last year, marking the first policy shift this year.”

--"The Federal Reserve has cut interest rates at three consecutive meetings since September last year, with a total decrease of 100 basis points. It has been suspended this year, and it has acted again at this time, making the market's general expectations fulfilled.”

Federal Reserve's worries about the job market escalate

--"This resolution statement adds that employment growth in the United States has slowed down, the unemployment rate has risen slightly, and downside risks to employment have increased.”

--"The statement deleted the expression 'the labor market remains stable' and instead emphasized that 'the committee judges that downside risks to employment have increased.'”

--"Powell said at a press conference: 'We are now more concerned about signs of weak employment, especially in the service industry and temporary job recruitment.'”

·Differences within the Federal Reserve still exist, Milan advocates aggressive interest rate cuts

--"The voting results showed that 11 of the 12 committee members supported a 25 basis point interest rate cut. Only Milan, the new director appointed by Trump, opposed and advocated a one-time interest rate cut of 50 basis points.”

--"Milan was just confirmed by the Senate to join the FOMC voting committee earlier this week, becoming one of the fastest Fed officials to take office.”

--"Some analysts said that Milan, who voted against this time, is likely to be the one in the 'dot matrix' who predicts five interest rates during the year, totaling 150 basis points.”

·There are still two interest rate cuts expected during the year, but differences have widened

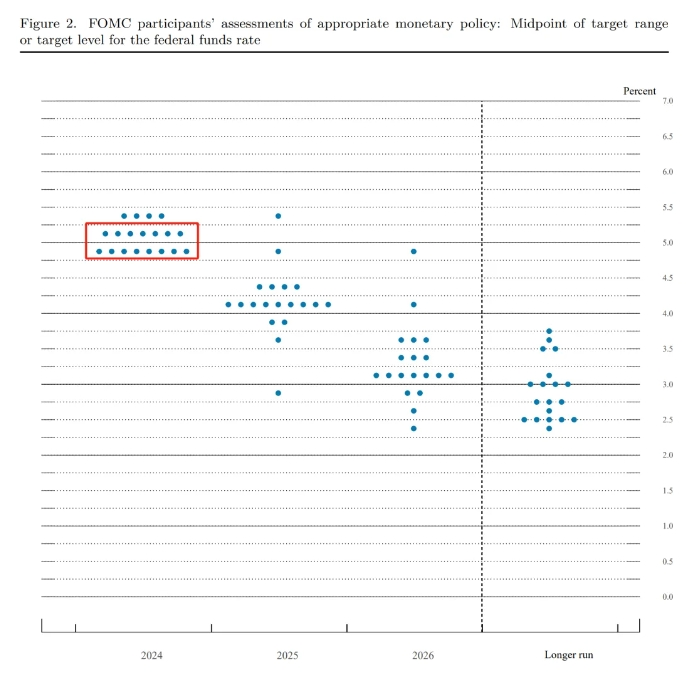

--"The dot chart shows that 9 of the 19 officials expect to cut interest rates twice this year, accounting for less than half;6 are not expected to cut interest rates again, and 1 is expected to raise interest rates.”

--"The median value of the Federal Reserve's interest rate forecast shows that officials expect to cut interest rates three times this year and again next year.”

--"Compared with June, the number of officials supporting the three interest rate cuts has increased significantly, but it is still not enough to form a consensus, reflecting the uncertainty within the Fed.”

·Continue to reduce national debt and maintain a stable pace of shrinking the balance sheet

--"The Federal Reserve will continue to reduce its holdings of U.S. Treasuries, agency bonds and agency mortgage-backed securities (MBS).”

--"Lower the monthly redemption limit for U.S. Treasuries from $25 billion to $5 billion, while leaving the monthly redemption limit for agency debt and MBS unchanged at $35 billion.”

--"This is the fourth consecutive meeting that has maintained this pace of shrinking the balance sheet, indicating that the Federal Reserve will not consider fully stopping shrinking the balance sheet in the short term.”

·Waller's attitude changes and is regarded as a policy vane

--"Federal Reserve Governor Waller had previously been hawkish, but this month supported interest rates. He once said: 'I am worried that high interest rates may harm an economy lacking inflationary pressure'.”

--"Nick Timiraos, who calls himself the 'New Federal Reserve News Agency', said that Waller's statement may be related to Trump's view as the next Fed chairman.”

--"Waller's July speech emphasized that the essence of quantitative easing is to lower long-term interest rates. Although its effect is limited, it is still an important part of the Fed's toolbox.”

·Federal Reserve raises economic growth forecast and cuts unemployment rate

--"GDP growth is expected to be 1.6% in 2025, which is upward from the previous forecast of 1.4%; the growth rates in 2026 and 2027 will be 1.8% and 1.9% respectively.”

--"The unemployment rate is expected to be slightly lowered in the next two years, from 4.4% in 2026 to 4.2% in 2028.”

--"Fed officials expect inflation to fall back to its 2% target in 2028, the first time in seven years.”

For a complete analysis of this meeting, please refer to: Federal Reserve's September interest rate decision: cut interest rates by 25 basis points as scheduled, or cut interest rates twice more during the year

Review of the press conference of the Federal Reserve's September 2025 interest-rate meeting

Powell emphasizes that "employment risks" have become a policy focus

--"We are seeing signs of weakness in the labor market, especially against the backdrop of slowing hiring activity and a slight rise in unemployment.”

--"The risk of downward employment has become an important consideration in the policy formulation process, and we must respond to this.”

--"Our judgment on inflation is that it is still slightly above the target, but it is not the main resistance at present.”

Powell responded positively to the "Third Mission" issue for the first time

--"The third mission does exist, but in our view it is a derivative of two more well-known goals stipulated in the law.”

--"We believe that moderate long-term interest rates will be the natural result of stabilizing inflation and maximizing employment.”

--"We don't believe this is a separate goal that requires us to independently set policies to achieve.”

·Reaffirm that monetary policy has limited impact on long-term interest rates

--"The Federal Reserve's tools mainly work on short-term interest rates, and their impact on long-term interest rates is more indirect and limited.”

--"Long-term interest rates are influenced by a variety of factors, including the global savings and investment balance, market risk sentiment and the fiscal outlook.”

--"We will not set targets for long-term interest rates.”

·Reflection and clarification on the effects of quantitative easing (QE)

--"In extraordinary times in the past, we used quantitative easing to ensure that markets were functioning properly and to provide additional stimulus when interest rates were close to zero.”

--"But we have never used quantitative easing as a direct tool to achieve our third mission.”

--"We know it may reduce long-term borrowing costs, but the effect is difficult to quantify accurately.”

·Maintain "data-based" flexibility in future policy paths

--"We don't pre-set interest rate paths, but pay close attention to every piece of data.”

--"If future data shows a rebound in inflation or a return to employment stabilization, we are prepared to adjust our policy stance.”

--"We still maintain a meeting-by-meeting approach and proceed cautiously.”

·Respond to market pricing expectations for interest rates to "turn cycles"

--"We are aware that the market expects us to continue to cut interest rates, and we understand the logic behind this view.”

--"But we will not be guided by market expectations, we will make judgments based on data.”

--"Adjusting interest rates too fast or too slowly brings risks, and we will maintain balance.”

·Responding to questions about "political interference"(indirectly responding to Trump)

--"Our decisions are based entirely on economic data, not political considerations.”

--"I emphasize that the Federal Reserve is an independent institution and our mission is to serve the public, not any government.”

--"Directors have different backgrounds and perspectives, but we work together to achieve long-term economic stability.”

·Clarify and appease internal differences in the Fed

--"Although there are different opinions among members on the pace of interest rate cuts, everyone agrees with the overall economic direction.”

--"We welcome the diversity of policy perspectives, which allows us to have a more comprehensive understanding of the economy.”

--"At present, the Federal Reserve Board remains highly united in our dual mission.”

For a complete analysis of this meeting, please refer to: Federal Reserve's September interest rate decision: cut interest rates by 25 basis points as scheduled, or cut interest rates twice more during the year

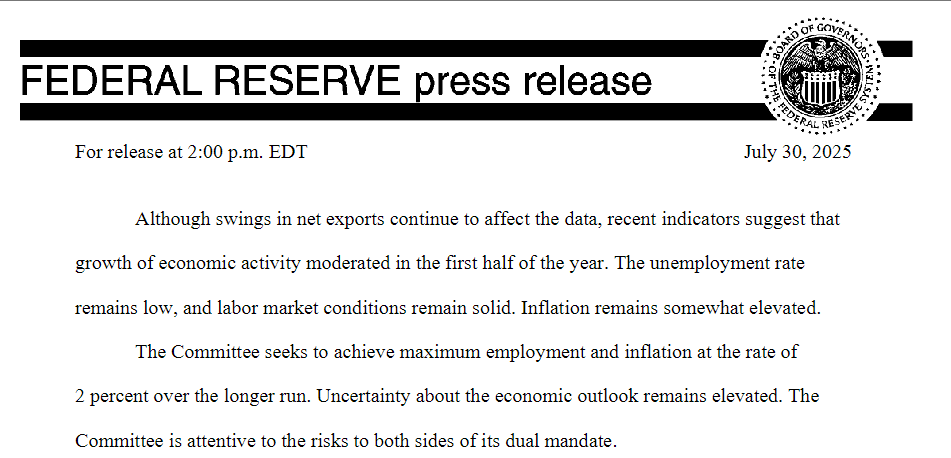

Review of the statement of the Federal Reserve's July 2025 interest-rate meeting

·The Federal Reserve keeps interest rates unchanged, with a rare double negative vote

- -The FOMC meeting on July 30 decided to continue to maintain the federal funds rate at 4.25%-4.5%, in line with market expectations.

--At this meeting, Bowman and Waller voted against it, advocating an immediate interest rate cut. This was the first time since 1993 that two dissenting votes appeared.

--The text of the statement only makes minor revisions to the impact on net exports, deletes the previous statement about "declining economic uncertainty", and is generally neutral.

·The market interprets Powell's statement as a "biased eagle"

--Although the Federal Reserve maintained its policy unchanged and the market had expected a loose signal, Powell's continued cautious stance disappointed the market.

--U.S. bond yields rose rapidly, with the 10-year yield rising from 4.12% to 4.24%; the U.S. dollar index strengthened simultaneously.

--U.S. stocks and gold prices experienced short-term downturns as the market reassessed the possibility of a rate cut in September.

·Market cuts expectations for September interest rate cuts

--Before the meeting, the market expected the probability of starting interest rate cuts in September to be nearly 50%, and dropped to less than 30% after the meeting.

--Institutional analysis said that the Fed is obviously not ready to "act quickly" and will wait for more data confirmation before taking measures.

--This change prompted investors to readjust their pricing of policy paths before the end of the year, and risk aversion increased.

Review of the press conference of the Federal Reserve's July 2025 interest-rate meeting

· Avoid talking about September policy

· Fed interest rate decision not affected by Trump policies

--"We believe that the current monetary policy stance allows us to respond in a timely manner to potential changes in the economic situation.The Fed needs to confirm that President Trump's tariff policies will not turn into a major inducement to higher inflation.”

--"Whether to cut the current overnight interest rate of 4.25%-4.5% will depend entirely on the performance of the data.”

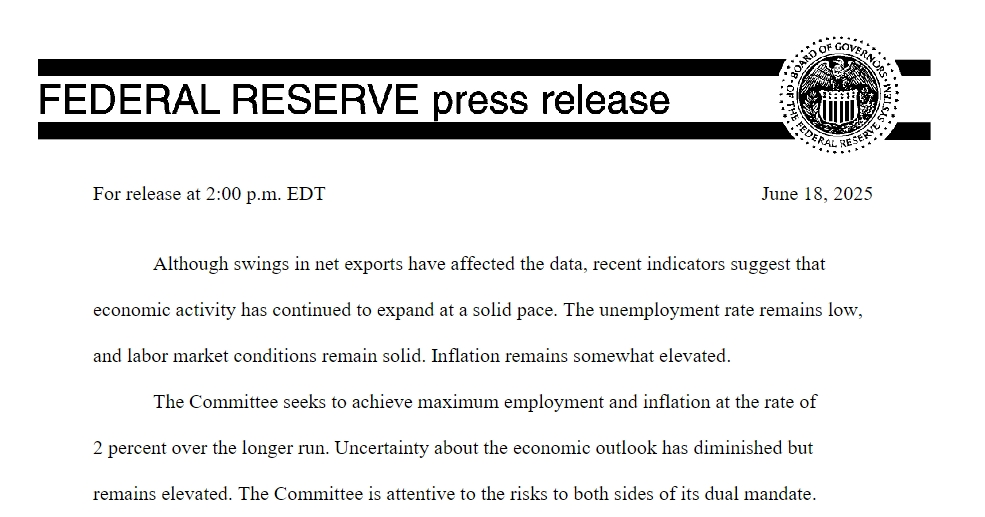

Review of the statement of the Federal Reserve's June 2025 interest-rate meeting

· keep interest rates unchanged

--"This decision to suspend interest rate cuts has the unanimous support of all voting members of the Federal Open Market Committee (FOMC).”

· on macroeconomic

--"Uncertainty related to the U.S. economic outlook has subsided, but remains high.”

· Continue to cut national debt

--"Will continue to reduce its holdings of U.S. Treasuries, agency bonds and agency mortgage-backed securities.The committee is firmly committed to supporting the goal of maximizing employment and returning inflation to 2%.”

· Interest rate cuts open in the second half of the year

--Nick Timiraos, who is known as the "sounding board of the Federal Reserve", issued a document after the Federal Reserve meeting and pointed out that the Federal Reserve is open to interest rates in the second half of this year.Fed officials are waiting to see whether companies will respond to rising costs from tariffs by cutting profits or raising prices.”

--Timiraos believes that to restart interest rate cuts, Fed officials may need to see a weak labor market or stronger evidence that price increases caused by tariffs will be relatively mild.

For a complete analysis of this meeting, please refer to: Federal Reserve's June Interest Rate Decision: The Future is Full of Changes

Review of the press conference of the Federal Reserve's June 2025 interest-rate meeting

· Not in a hurry to adjust policy interest rates

--"There is no rush to make policy adjustments. In the current economic situation, the Federal Reserve" is fully qualified to wait and further understand the possible direction of the economy."”

· Inflation becomes more obvious in the summer, and the impact of tariffs remains to be observed

--"We have seen a slight increase in commodity inflation and do expect it to become more pronounced this summer."”

--"It will take some time to see the impact of tariff policies across the distribution chain of goods, and many of the products currently sold by retailers were imported months before the tariffs were imposed.Some impacts are already beginning to be seen, and more are expected to be seen in the coming months.”

--"Currently assessing the transmission path of tariff inflation is" very difficult to predict "

· The U.S. labor market is "low in hiring, low in firing" --"There is now a phenomenon in the U.S. labor market called" low hiring, low firing."”

--"If you lose your job, it's really difficult to find a job, but very few people are being laid off right now.This is a balance that we are watching very closely.”

--Real wages are still rising, and Powell called their growth a "healthy" rate."The labor market is not calling for interest rate cuts.

· Will you continue to serve as a Fed governor after the end of your term?

--"I'm not thinking about it, I'm focusing on my current job.”

For a complete analysis of this meeting, please refer to: Federal Reserve's June Interest Rate Decision: The Future is Full of Changes

Review of the statement of the Federal Reserve's May 2025 interest-rate meeting

· About economic activities

--"Uncertainty about the economic outlook has further increased, and the committee is concerned about the risks to both parties posed by its dual mandate and judges that the risks of higher unemployment and higher inflation have increased.”

· with respect to inflation

· Keep policy interest rates unchanged

--"To support its goal, the committee decided to maintain the target range for the federal funds rate at 4.25%-4.5%.”

--"When considering the extent and timing of further adjustments to the federal funds rate target range, the committee will carefully evaluate the data it receives, the changing outlook and the balance of risks."”

· Continue to monitor the impact of economic activity

--"In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the impact of upcoming information on the economic outlook."”

--"Should risks arise that may hinder the achievement of the Committee's goals, the Committee will be prepared to adjust its monetary policy stance appropriately."The committee's assessment will consider a wide range of information, including information on labor market conditions, inflationary pressures and inflation expectations, as well as financial and international developments.”

For a complete analysis of this meeting, please refer to: Federal Reserve's May interest-rate decision: Recession risks have been noted but have not yet been reflected in the economy

Review of the press conference of the Federal Reserve's May 2025 interest-rate meeting

· Not in a hurry to adjust policy interest rates

--"The Fed does not need to rush to adjust interest rates, and the policy is moderately restrictive; the current uncertainty requires the Fed to continue to wait; Trump's request for a rate cut will not affect the Fed's work.”

· Risk of stagflation rises but is not reflected in economic data

--"If the significant tariff increases as announced continue, higher inflation will emerge.The Fed has an obligation to stabilize inflation expectations.The risks of rising unemployment and rising inflation have increased, but are not yet in the data.”

--"There are no signs of slowing economic growth in the actual economic data. The economy is in a stable state, but the uncertainty is very high and the economic downside risks have increased.”

· Wage growth slows and labor market is saturated

--"Wage growth continues to slow and the labor market has reached or is close to the highest employment level; if there is a contradiction between the dual goals, consider the distance from the goals and the time to close the gap."”

· U.S. debt unsustainable

- Not wanting to tighten financial conditions sharply at a time of economic weakness, U.S. debt is on an unsustainable path.”

For a complete analysis of this meeting, please refer to: Federal Reserve's May interest-rate decision: Recession risks have been noted but have not yet been reflected in the economy

Review of the statement of the Federal Reserve's March 2025 interest-rate meeting

· Continue to suspend interest rate cuts and slow down the pace of shrinking the balance sheet

--"Starting in April, the Federal Reserve will begin to slow down the pace of shrinking its balance sheet, slowing the monthly ceiling on US debt reduction from US$25 billion to US$5 billion.”

--"Add the expression" increasing uncertainty in the economic outlook "and delete" employment and inflation are roughly balanced."”

· Employment is stable, inflation may rebound temporarily

--"The committee maintained the statement that" inflation remains somewhat elevated."”

--"The Federal Reserve raised its unemployment forecast for 2025 from 4.3% to 4.4%, and its expectations for inflation increased, raising PCE's inflation forecast to 2.7%.”

· Keep policy interest rates unchanged

--"During this interest-rate meeting, the Federal Reserve decided to maintain the benchmark interest rate within the target range of 4.25%-4.5%, and continue to implement the reduction of the balance sheet at the original pace.”

· Interest rate cuts during the year may be greater

--"The market expects the probability of keeping interest rates unchanged in May to rise to 80.5%.”

--"Markets tend to underestimate interest rate cuts, and the Federal Reserve may implement greater easing.”

For a complete analysis of this meeting, please refer to: The Federal Reserve's March interest rate decision: Stay put, but slow down the balance sheet

Review of the press conference of the Federal Reserve's March 2025 interest-rate meeting

· Talk about future monetary policy actions

--"Recent surveys have shown that economic uncertainty has intensified, but it remains to be seen how uncertainty will affect the economic outlook.”

--"The Fed does not need to rush to adjust its policy stance. The cost of waiting is very low. It is not in a hurry to cut interest rates in May.”

--"We have seen some signs of intensifying tightening in the money market, which means that the Federal Reserve will shrink its balance sheet at a slower rate and over a longer period of time.”

--"There are currently no plans to slow down the reduction of MBS because there is a strong desire for MBS to exit the Federal Reserve's balance sheet.”

· Although inflation has made progress, it is still high and the labor market is solid

--"Tariff policy is clearly part of the factor driving inflation, but in the Fed's baseline forecast, inflation will be temporary, while long-term inflation expectations will be flat or slightly lower, in line with the 2% target.”

--"Further progress in inflation this year may be delayed. If commodity inflation in the past two months continues, it will definitely be related to tariffs.”

--"Currently, the hiring rate and layoffs rate in the United States are at low levels. A significant increase in layoffs may quickly translate into unemployment. Layoffs are important to individuals, but they are not significant at the national level."

· Dot chart: Although the median forecast remains unchanged, officials 'expectations for interest rate cuts in 2025 have generally weakened.

--"For 2025, among the 19 officials, 4 are not expected to cut interest rates (an increase of 3 from the previous time), 4 are expected to cut interest rates only once (an increase of 1), and 9 are expected to cut interest rates twice (a decrease of 1), only 2 are expected to cut interest rates three or more times (a decrease of 3)"

--"The median policy interest rate forecast in 2025 remains at 3.9%(interest rate cuts twice during the year), the median policy interest rate forecast in 2026 remains at medium 3.4%, and the long-term policy interest rate forecast remains at 3.0%.”

--"The median inflation forecast for PCE and core PCE in 2025 will be revised upwards by 0.2 and 0.3 percentage points respectively to 2.7% and 2.8%: both indicators will be 2.2% in 2026 and 2.0% in 2027. Long-term inflation forecasts are both 2.0%.”

· Financial market conditions (including stock markets) are important to the Fed

--"The Federal Reserve will not express opinions on the reasonable level of any market, but will focus on changes in economic data from a macro perspective.”

--"Changes in financial markets will have an impact on economic activity, but this impact needs to be substantial, sustained, and last long enough to attract the attention of the Federal Reserve.”

--"Market sentiment data, such as consumer confidence surveys, show concerns and downside risks, but these have not yet translated into significant weakness in actual economic activity."”

For a complete analysis of this meeting, please refer to: The Federal Reserve's March interest rate decision: Stay put, but slow down the balance sheet

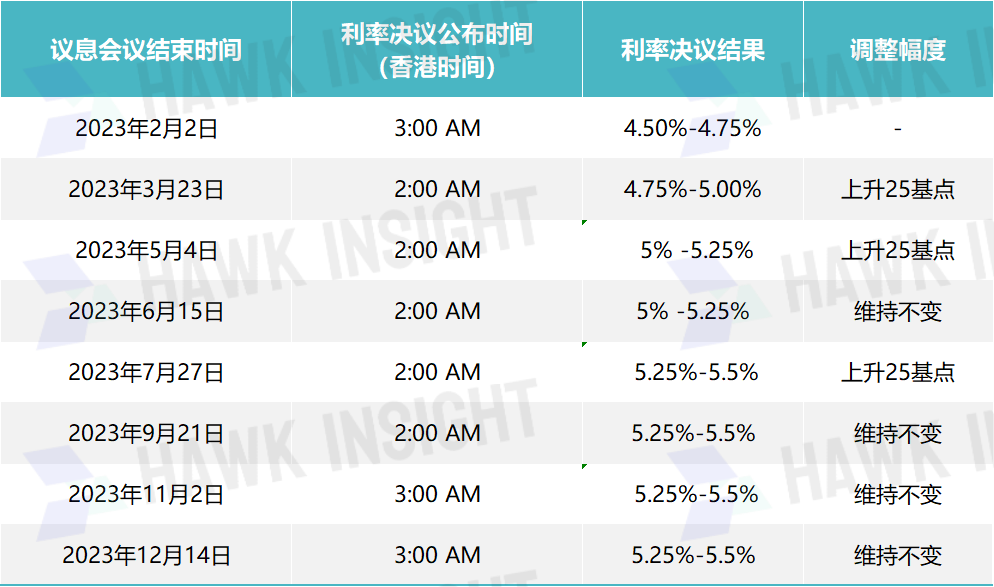

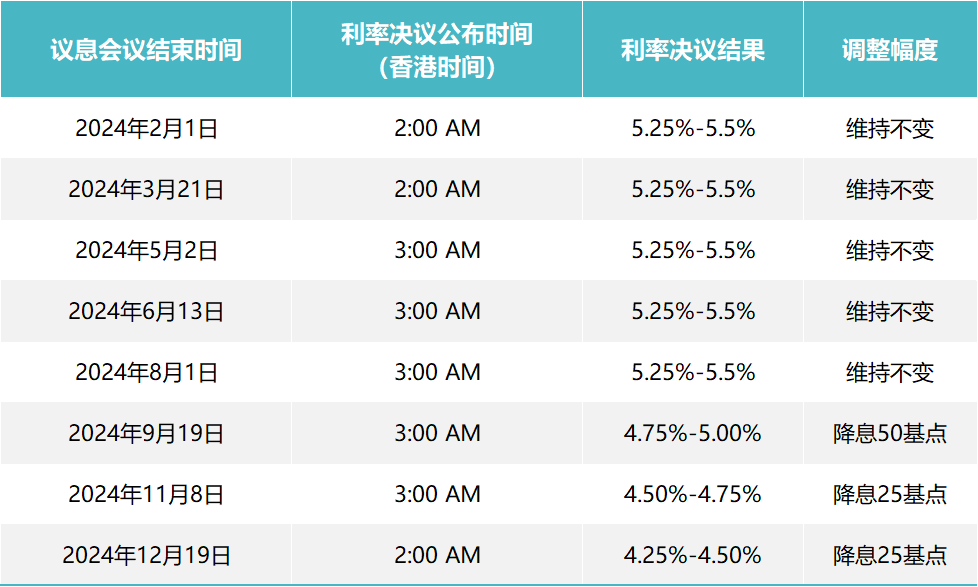

Review of the statement of the Federal Reserve's December 2024 interest-rate meeting

· The US economy continues to expand steadily

--"Since earlier this year, the labor market situation has generally eased, and the unemployment rate has increased, but it is still at a low level.”

· Inflation "still slightly above target"

--"The risks of achieving employment and inflation targets are roughly balanced.There is uncertainty about the economic outlook.”

· Reduce the policy interest rate by 25 basis points

· Continue to reduce holdings of national debt

--"The committee will continue to reduce the size of its holdings of U.S. Treasurys, agency debt and agency mortgage-backed securities.”

--"The committee is firmly committed to supporting the goal of maximizing employment and restoring inflation to 2%.”

· Continue camera decision making

--"In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the impact of the latest information on the economic outlook.”

--"Should risks arise that may hinder the achievement of the Committee's goals, the Committee will be prepared to adjust its monetary policy stance as appropriate."”

· bitmap

--"Raise the economic forecast for 24/25 years, lower the unemployment rate forecast, and raise the inflation forecast. The inflation forecast for 25 years will be raised by a large margin.”

--"The dot chart only guides interest rates twice throughout next year, showing a strong hawkish tendency.”

For a complete analysis of this meeting, please refer to: Federal Reserve's December Resolution: On the hawkish attitude after cutting interest rates by 25 basis points

Review of the press conference of the Federal Reserve's December 2024 interest-rate meeting

· Talk about future monetary policy actions

--"After this interest rate cut, the Federal Reserve has lowered its policy rate by a full 100 basis points from its peak. Now that the monetary policy stance is significantly less restrictive than before, policymakers can be more cautious when considering more interest rate adjustments.”

--"Any Fed decision to cut interest rates in 2025 will be based on upcoming data, not current economic conditions."”

--"As the Federal Reserve strives to keep the labor market strong while keeping inflation down to 2%, a rate hike next year seems unlikely.”

· Affirming the performance of the US economy

--"The overall economy is performing strongly; economic growth is faster than expected in the second half of 2024; there is no reason to believe that an economic downturn is more likely than usual; it is clear that the United States has avoided a recession: Very optimistic about the economy.”

--"Policymakers generally expect GDP growth to remain strong.”

· Talking about inflation and the job market

--"Given that year-on-year inflation data is still sticky, we will continue to pay attention to the progress of inflation improvement in 2025.”

--"When considering further interest rate cuts, we will focus on improving inflation, and we have made little significant progress on the 12-month inflation data.”

--"Consumers feel more the impact of high prices than the direct effect of high inflation.”

· Some officials have begun to assess the potential impact of Trump's policies

--"Some members of the Federal Open Market Committee (FOMC) have begun a preliminary assessment of the possible impact of Trump's policies.”

--"As for Trump's tariff plan, it is too early to draw conclusions on how it will affect inflation.”

· The Federal Reserve has no intention of holding Bitcoin

--"The Federal Reserve does not intend to add Bitcoin to its balance sheet,"

--"We cannot hold Bitcoin.The Federal Reserve Act sets out what we can have, and we have no intention of seeking to change the law.This is something Congress has to consider, but we are not seeking change at the Fed.”

For a complete analysis of this meeting, please refer to: Federal Reserve's December Resolution: On the hawkish attitude after cutting interest rates by 25 basis points

Review of the statement of the Federal Reserve's November 2024 interest-rate meeting

· The US economy continues to expand steadily

--"The U.S. economic outlook is uncertain, and the Fed will continue to focus on the risks it faces in achieving its goals (employment & inflation).”

· Inflation "still a little high"

· Reduce the policy interest rate by 25 basis points

· Continue to reduce holdings of national debt

Review of the press conference of the Federal Reserve's November 2024 interest-rate meeting

· On the impact of the US election on the Federal Reserve's policy path

· About the rise in bond yields

--"These changes seem to be mainly due to rising inflation expectations, but rather to a perception that growth is stronger and that downside risks are likely to be smaller."”

· What circumstances might lead to a pause in interest rate cuts?

--"As we approach neutral or near neutral levels, it may be appropriate to slow down our pace of reducing restrictions."”

· US finances are unsustainable

--"That is, U.S. finances--the federal government's fiscal policy is on an unsustainable path.Our debt levels are not unsustainable relative to the economy.”

For a complete analysis of this meeting, please refer to:

Review of the statement of the Federal Reserve's September 2024 interest-rate meeting

· Observed a slowdown in employment growth

· Inflation is moving towards set target

· Reduce the policy interest rate by 50 basis points

· Reduce the policy interest rate by 50 basis points

--"Given the progress in inflation and the balance of risks, the committee decided to lower the target range for the federal funds rate by 0.5% to 4.75% to 5%.”

"The Committee will carefully evaluate future data, changing prospects and risk balances as it considers further adjustments to the federal funds rate target range."”

--Delete "The Committee predicts that it is not appropriate to reduce the target range until it is more confident that inflation continues to move towards 2%."

· Add "Support Employment"

--"The committee is firmly committed to supporting full employment and returning inflation to its target of 2%.”

· FOMC voting committee changes

--"Delete" Chicago Fed President Austan D.Goolsbee voted as an alternate member at this meeting.”

--Yes vote: Add Cleveland Fed President Beth M.Hammack

--Voted against a 50 basis point rate cut was Michelle W.Bowman, who preferred to cut the target range of the federal funds rate by just 25 basis points at this meeting

For a complete analysis of this meeting, please refer to: The Federal Reserve's September interest rate decision: The policy of exceeding expectations has seen a major turning point

Review of the Press Conference of the Federal Reserve's September 2024 Interest Rate Negotiation Meeting

--Economic activity continues to expand at a "steady rate" and growth in the second half of this year is expected to be similar to that in the first half."The U.S. economy is in good shape, and our decision today is aimed at keeping it that way.”

--"The U.S. economy currently shows no signs of recession, nor does it believe that a recession is imminent.”

--He did not announce that the Fed had defeated inflation, but expressed his belief that inflation would fall to its target level of 2%.He added: "While people may no longer think about inflation as frequently as before, they may indeed notice higher prices, which is painful.”

· There is no fixed interest rate path in the future, and decisions need to be made based on data cameras.

--Taking into account risk balance, the interest rate will be lowered by 50 basis points today, but no fixed interest rate path has been set, and meetings will be held one by one to make decisions.As usual, Powell reiterated that the next step depends on economic data.

--Powell emphasized that no one should think that a 50 basis point interest rate cut is a new trend, and should not draw such a conclusion based solely on this interest rate cut.In other words, don't bet on a next 50 basis point rate cut.

· Labor market conditions are good

--"The labor market is in good shape, and I hope it can maintain this state; but if the labor market unexpectedly slows down, then the Federal Reserve will accelerate the pace of interest rate cuts."Powell believes that the current unemployment rate of 4.2% is very healthy. The rise in the unemployment rate is partly due to the influx of immigrants. The rise in the unemployment rate is also due to the slowdown in recruitment.

· Neutral interest rates are much higher than before the epidemic; there is no plan to stop shrinking the balance sheet in the near future

--Regarding the neutral interest rate, Powell said he did not know where the specific level was, but it should be much higher than in the past (before the epidemic).When asked about the balance sheet, he said that the reserves are stable and sufficient and are expected to remain for some time, and there is no plan to stop shrinking the balance sheet in the near future.

For a complete analysis of this meeting, please refer to: The Federal Reserve's September interest rate decision: The policy of exceeding expectations has seen a major turning point

Review of the statement of the Federal Reserve's July 2024 interest-rate meeting

· Stay put as scheduled, but interest rate cuts may be discussed at the September meeting

Review of the press conference of the Federal Reserve's July 2024 interest-rate meeting

--"The job market is gradually normalized, and that's what we want to see.“

--"If employment data cools faster than expected, we will respond.“

· on economic

--Powell clearly described the economic situation in his opening remarks as "strong but not overheated".

For a complete analysis of this meeting, please refer to: Federal Reserve's July interest rate decision: interest rates remain unchanged, September interest rate cuts are put on the agenda

Review of the statement of the Federal Reserve's June 2024 interest-rate meeting

· Continue to keep policy interest rates unchanged and progress is made in inflation governance

--"In recent months, moderate further progress has been made towards achieving the committee's 2 percent inflation target.”

· Interest rate dot chart cashes upside risks, and differences in the number of interest rate cuts

--"With a slight increase in inflation forecasts, interest rate forecasts have also been raised.After the increase in long-term interest rate forecast in March, this meeting will continue to increase the level of 0.2%.”

--One interest rate cut during the year (7th place) vs two interest rates (8th place)

Review of the press conference of the Federal Reserve's June 2024 interest-rate meeting

· Long-term interest rates may be higher

--"Many officials do believe that interest rates will not return to pre-epidemic levels.“

· Service industry inflation deserves vigilance, American wages are high

For a complete analysis of this meeting, please refer to: Federal Reserve's June 2024 Interest Rate Decision: Even if others cut interest rates, I will remain firm

· Continue to keep policy interest rates unchanged, official announcements slow down and shrink the balance sheet

--"There has been a lack of further progress in meeting the Committee's 2% inflation target in recent months" and "The risks of achieving employment and inflation targets over the past year have become better balanced."”

--"Starting from June, the monthly pace of reducing national debt will be slowed down.In his speech, Powell said that slowing down the balance sheet reduction is not lenient, nor does it mean that the total reduction in the balance sheet will be smaller than expected, but is to ensure a smooth transition more gradually.”

For a complete analysis of this meeting, please refer to: The Federal Reserve's May Interest Rate Decision: Six consecutive times to slow down the pace of shrinking the balance sheet since June

Review of the press conference of the Federal Reserve's May 2024 interest-rate meeting

· It takes longer to gain confidence in inflation

· The labor market remains relatively strong, denying stagflation.

- -"The United States is still at a very healthy level of growth and has not seen stagnation.”

· Without considering further interest rate hikes, postponing interest rate cuts is appropriate

· Two paths would allow the Fed to consider cutting interest rates

For a complete analysis of this meeting, please refer to: The Federal Reserve's May Interest Rate Decision: Six consecutive times to slow down the pace of shrinking the balance sheet since June

· Don't consider cutting interest rates until you have "greater confidence" in lower inflation

--"The committee believes that lowering the target range is inappropriate until there is greater confidence that inflation continues to move towards 2%.”

· It is not far off to slow down the scale

· Continue to make discretionary decisions and adjust monetary policy as appropriate based on data

For a complete analysis of this meeting, please refer to: Federal Reserve's March 2024 interest-rate resolution: Keep interest rates unchanged, slow down the balance sheet, shrink the balance sheet soon, or cut interest rates three times this year

Review of the press conference of the Federal Reserve's March 2024 interest-rate meeting

· Interest rate cuts in 2024 are appropriate

--"The first interest rate cut has a significant impact.We can approach this issue carefully and let the data speak.”

--"If there is significant weakness in the labor market, that will be a reason to cut interest rates."”

· Inflation has not changed the overall picture

--"Although recent data has changed, the inflation data has not really changed the overall situation, that is, inflation is gradually declining and the road is a bit bumpy.”

· Unemployment is expected to rise

· Slow down and shrink the watch in sight

For a complete analysis of this meeting, please refer to: Federal Reserve's March 2024 interest-rate resolution: Keep interest rates unchanged, slow down the balance sheet, shrink the balance sheet soon, or cut interest rates three times this year

· Don't consider cutting interest rates until it is determined that inflation is lower

--"When considering any adjustment to the federal funds rate target range, the committee will carefully evaluate future data, changing prospects and risk balances."The committee believes that lowering the target range is inappropriate until confidence that inflation continues to move closer to 2%.”

· Economic activity has been expanding steadily

· The Fed's two major goals-promoting employment and controlling inflation-are moving towards balance

· Inflation remains high (consistent with last meeting)

Review of the press conference of the Federal Reserve's January 2024 interest-rate meeting

· Interest rates may have peaked, but March rate cut is not a benchmark scenario

--"The March interest rate cut is not a benchmark scenario.”

--"The balance sheet issue will be discussed in depth at the next meeting. Whether ON RRP is zero will not affect the process of shrinking the balance sheet.”

· Inflation may still rebound

--"There is a risk that inflation will accelerate again.”

· Economic growth will moderate

For a complete analysis of this meeting, please refer to: Federal Reserve's January 2024 Interest Rate Decision: Four consecutive times, interest rate cuts in March are expected to cool down

For a complete analysis of this meeting, please refer to: The Federal Reserve's December Interest Rate Decision: Still not moving on and interest rate cuts have begun to come into view

Review of the press conference of the Federal Reserve's December 2023 interest-rate meeting

· interest rate remains unchanged

· Inflation remains high

· Employment remains strong

· Continue to reduce financial assets

· Continue to monitor financial indicators

Review of the press conference of the Federal Reserve's November 2023 interest-rate meeting

"My colleagues and I remain focused on our dual mission of promoting maximum jobs and stable prices for the American people.We understand the difficulties caused by high inflation, and we remain firmly committed to the goal of reducing inflation to 2%.“

· Powell expressed satisfaction with current economic activity but felt the impact of higher interest rates

--"Recent economic data suggests that economic activity has been growing strongly, well above earlier expectations.Driven by a surge in consumer spending, real GDP grew by 4.9% year-on-year in the third quarter.”

--"After a rebound in the summer, activity in the real estate industry has leveled off and is still well below levels of a year ago, mainly due to rising mortgage rates.Higher interest rates also appear to be putting pressure on corporate fixed asset investment.”

--"In the past three months, an average of 266,000 jobs have been added per month, a strong growth rate that is still lower than earlier this year.

--"Nominal wage growth has shown some signs of easing, and job vacancies have fallen so far this year.Although the gap between employment and workers has narrowed, labor demand still exceeds the supply of available workers.”

--"In the 12 months to September, the overall PCE price index rose 3.4%.Excluding volatile food and energy categories, the core PCE price index rose 3.7%.”

--"Inflation has slowed since the middle of last year, and summer values have been quite favorable.But months of good data are just the beginning of building confidence that inflation is continuing to fall towards our goal.There is still a long way to go to keep inflation down to 2%.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.