However, after this market call, U.S. stocks did not skyrocket. On the contrary, the three major indices quickly narrowed their gains.

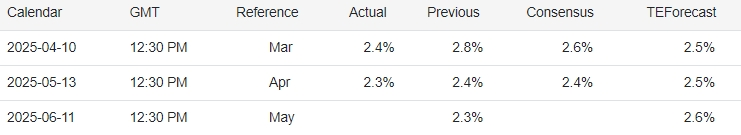

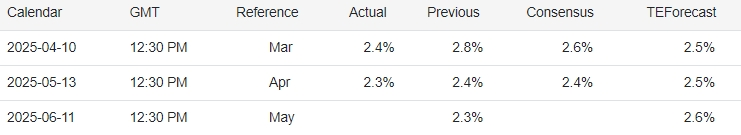

On May 13, the U.S. CPI in April was unexpectedly lower than expected-the year-on-year CPI growth rate of 2.3% not only hit a new low since February 2021, but also formed a subtle deviation from the market expectation of 2.4%.

US inflation fell below expectations in April, Trump cries again

Data showed that CPI increased by 2.3% year-on-year, expected to be 2.4%, and the previous value was 2.4%;CPI increased by 0.2% month-on-month, expected to be 0.3%, and the previous value was-0.4%; core CPI increased by 2.8% year-on-year, the lowest rate since the outbreak of inflation in the spring of 2021; expected to be 2.8%, and the previous value was 2.8%; core CPI rose 0.2% month-on-month, expected to be 0.3%, and the previous value was 0.1%.

It is worth noting that the so-called "super core CPI"(services excluding housing) fell to 3.01% year-on-year, the lowest level since December 2021.

After the data was released, U.S. stocks rose again in early trading and the S & P 500 regained its losses during the year.U.S. President Trump said at the U.S. -Saudi Investment Forum in Riyadh: The market rise is really wonderful.It will continue to rise, much higher.

In addition, Trump also cited the weaker-than-expected inflation report released earlier in the day and once again pressured Federal Reserve Chairman Powell to cut interest rates. Trump wrote on social media: The Federal Reserve must cut interest rates like Europe did.What about Powell's "too late"?

--This statement continues his policy logic in recent years: using the triple leverage of tariffs, taxation and monetary policy to create short-term market momentum, while deeply binding the economic narrative to the political agenda.

Trump has twice previously called on investors to buy the market while the trade war is in full swing.For the first time, a few hours after Trump said on April 9 that "now is a good time to buy", he announced the suspension of some tariffs, and U.S. stocks rebounded sharply by more than 16% that month; the second time, on May 8, Trump shouted again before the announcement of the Sino-US trade agreement,"You'd better go out and buy stocks now.Since then, U.S. stocks have surged across the board on Monday, with the S & P 500 index rising 3.3%, and the Nasdaq 100 index rising 4%.

However, after this market call, U.S. stocks did not skyrocket.On the contrary, the three major indices quickly narrowed their gains.

Trump-style game enters a new stage

In Trump's policy toolbox, tariffs have always been a double-edged sword.

In April 2025, he pushed the S & P 500 index to rebound by more than 16% in just one month by suspending the "anticipatory management" of some tariffs.This operation is in sharp contrast to the market turmoil triggered by its imposition of additional tariffs on China in 2018-when American consumers bore about 8% of the tariff cost transfer, while China exporters maintained a 75% market share through price adjustments.

Today, the market's sensitivity to tariff policies has undergone a qualitative change: investors have begun to view tariffs as a predictable "policy variable" rather than a black swan, and even after the tariff threat caused the stock index to plummet 19% in early April, they were still able to quickly recover lost ground due to policy easing.Behind this adaptability lies institutional investors 'dependence on Trump's "art of trading"-Goldman Sachs data shows that asset management companies' exposure to stock futures has jumped from less than 10% in 2017 to more than 40%. Liquidity games have replaced value judgment as the dominant logic.

In the field of monetary policy, the game between Trump and the Federal Reserve has entered a new stage.In September 2024, the Federal Reserve will start a interest-rate cut cycle and cut interest rates by 50 basis points from 5.25%-5.5%.The current year-on-year growth rate of the core PCE price index has dropped back to 2.3%, providing data support for continued interest rate cuts. However, Powell's emphasis on the principle of "data dependence" has created tension with the aggressive easing demanded by Trump.

This tension is reflected in a dual effect in asset pricing-expectations of interest rate cuts push up the valuation of risky assets, but policy uncertainty suppresses risk appetite.JPMorgan estimates show that if the effective tariff rate increases by 5 percentage points, the earnings of the S & P 500 index may shrink by 1%-2%, and the liquidity expansion caused by interest rate cuts needs to cover this gap to maintain the valuation.

Market structural contradictions are particularly prominent in the field of technology stocks.

The market value of the technology leader, once known as the "Big Seven", evaporated by US$2.5 trillion during the year, and its profit growth rate is expected to plummet from 37% in 2024 to 16%. The impact of tariffs on the supply chain has combined with regulatory risks, making technology stocks The market engine has become a drag factor.

However, this deterioration in fundamentals is not fully reflected in stock prices-the rebound since April stems more from a correction in sentiment than an upward revision in earnings expectations.Company executives such as Tesla bluntly said that rising supply chain costs caused by tariffs are eroding profit margins, but investors are still betting on the possibility of a policy reversal.