The meat of this meal may be a little more than you think.

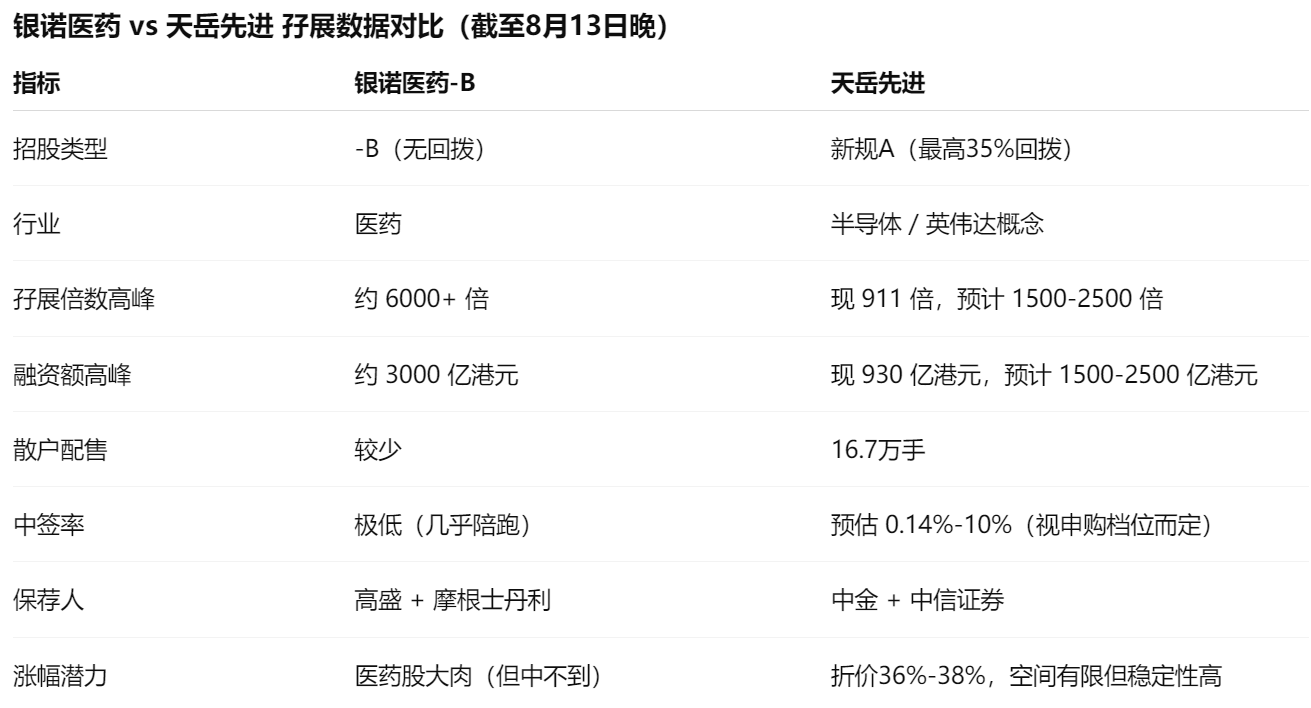

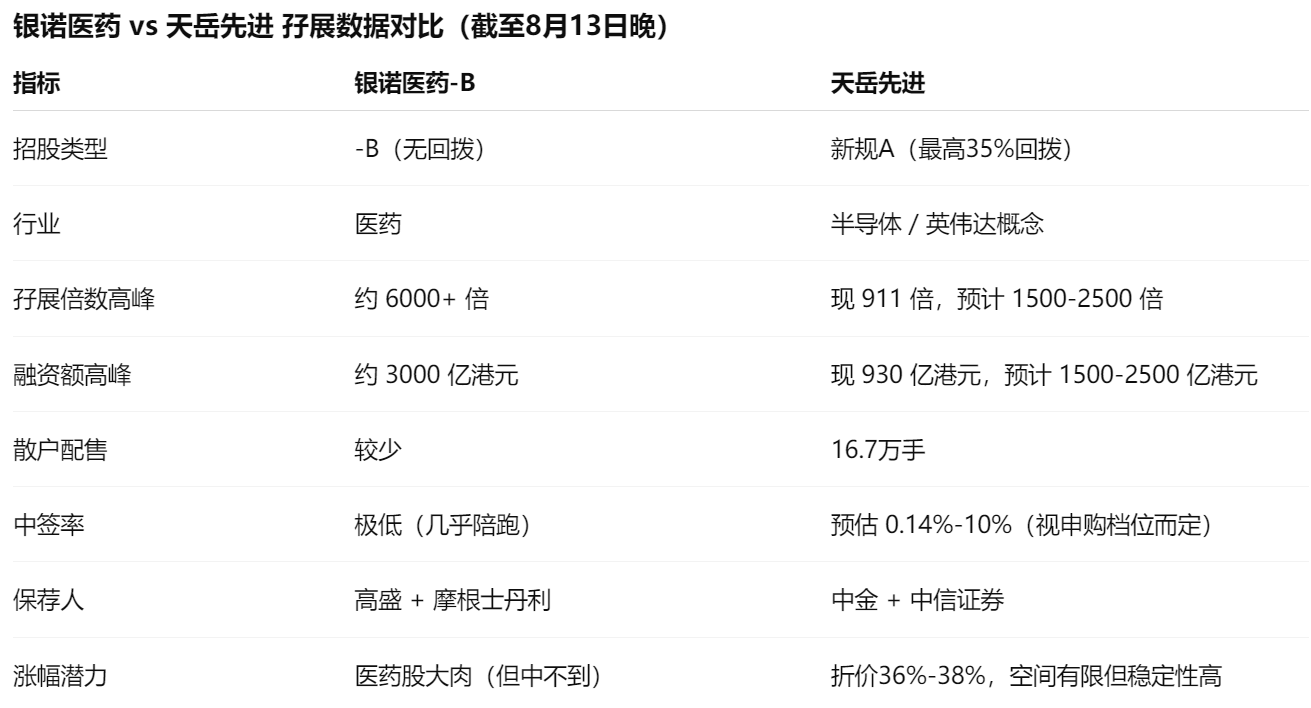

Hong Kong stocks are playing new markets, and the recent pace is getting stronger and stronger.Yinnuo Medicine had not finished yet, Tianyue Advanced had already rushed forward.As a semiconductor company listed in A+H, its IPO popularity is not like a secondary listing of "chicken rib stocks". Instead, it has the shadow of a "abnormal margin" like medicine.

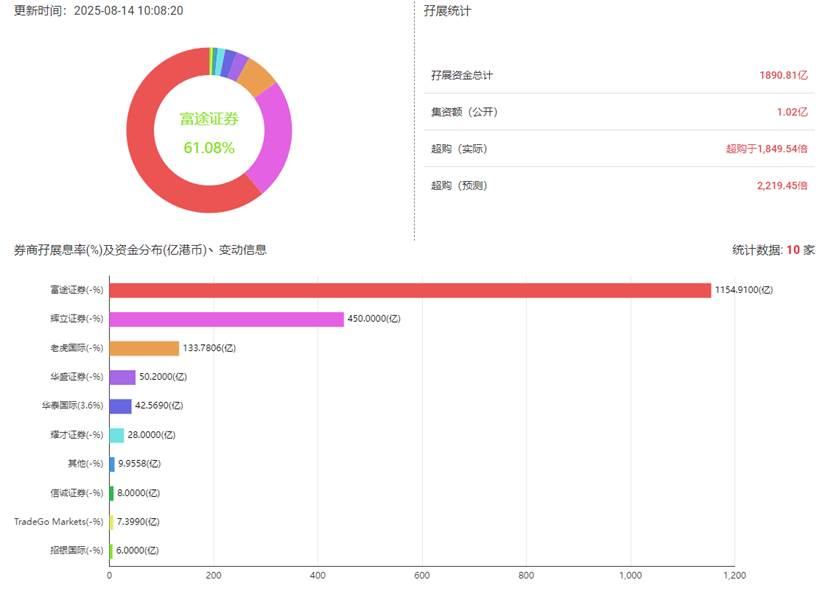

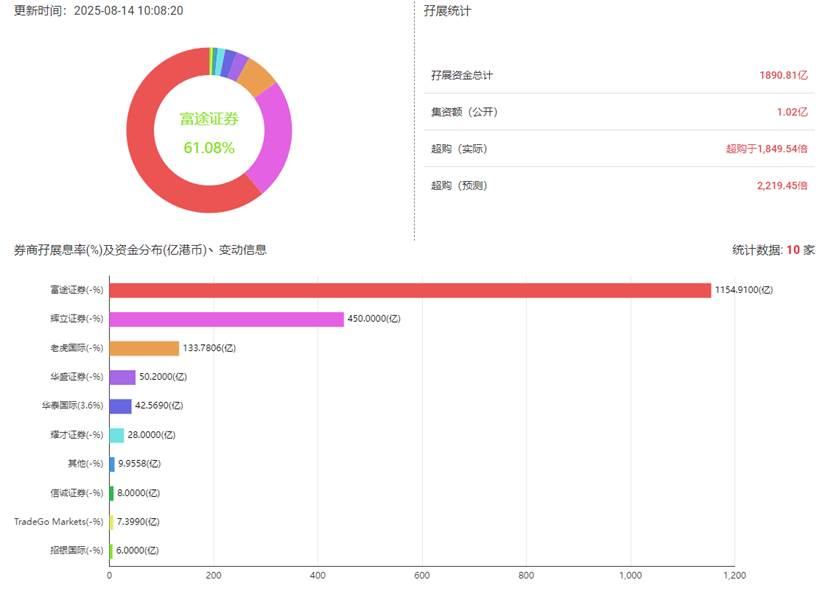

As of 10:08 a.m. on August 14, Tianyue Advanced's margin ratio has soared to 1849 times, with a financing amount of 189.1 billion Hong Kong dollars.This is definitely a high temperature in AH shares, especially considering that Yinnuo Pharmaceutical's new funds have not yet been fully recovered, and there may be a wave of capital backflow on the last day.

According to past experience, if the trend is as I predicted, the final breakthrough of 2000 times is almost certain, and there is even a chance to rush to 2500 times.

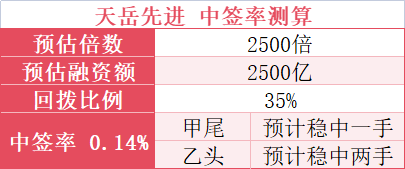

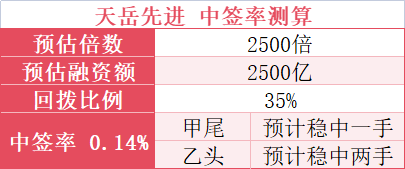

If margin financing really reaches 2500 times, the rough financing amount will reach 250 billion yuan, and the number of participants may be around 200,000.Under the 35% callback mechanism, Group A and Group B each have approximately 8.35 million shares.Based on this estimation, the winning rate is about 0.14%(1÷2500×3.5), the value of tail A is about HK$6048 (0.14%×432), and the value of tail B is about HK$12096 (0.14%×864).

In other words, the first hand is basically stable, and the second hand is drawn; the second hand is highly likely to win the second hand, and the third hand will try luck again.If you play 700 hands (A-29), you can almost win one hand.Of course, this is only a rough calculation. The different allocation methods of Group A and B may lead to significant differences in the winning rate. If the margin is less than 2500 times, there will be more wins, and vice versa.

If the multiple really reaches 2500 times, Tianyue Advanced has almost no reason to hesitate-one word,"rush".

Although it is already listed on the Science and Technology Innovation Board and lacks the room for skyrocketing as pharmaceutical stocks, the recent winning rate of new pharmaceutical stocks is basically "accompanying". In contrast, this kind of semiconductor "chicken ribs" are more practical value.

In particular, the discount on this ticket is currently between 36% and 38%, which is not low. Coupled with the Nvidia concept, the outlet of the semiconductor track, and the recent steady rise of A-share Tianyue Advanced, the fundamentals are not unreasonable.The sponsor is CICC + CITIC, and the combination is quite reliable.

This time, Mechanism A after the new regulations is adopted, with a maximum callback ratio of 35%, and retail investors can receive 167,000 lots, which is much friendlier than recent B-shares.

If you can't get the big meat in medicine, you can change your mind to focus on certainty.Although Tianyue Advanced is not the kind of doubling myth, it is still worth getting on the bus when the funds are full, the callback mechanism is friendly, and the industry theme is tough enough.Especially on the last day when funds return, there is likely to be a small climax-you can regard it as a new "last meal of chicken ribs", but this meal of chicken ribs may have more meat than you think.

Ps: Markets are short-term, and opportunities are also short-term. If you want to keep up with the pace, remember to come here often.Cris will continue to keep an eye on all kinds of news to help everyone walk less and eat more meat.

It's not easy to be original. I hope everyone likes and forwards it more. Cris thanks first!

Friends who are considering launching a new Hong Kong and US stock market but have not prepared a Hong Kong and US stock account, or friends who want to exchange experiences, can add WeChat for exchange