Doo Financial observed that this time Oaks 'pursuit of Hong Kong stocks coincides with a historical window of changes in the emerging market landscape.

On August 4, multiple market news confirmed that Oaks Electric, the world's fifth largest air conditioner provider, plans to land on the main board of the Hong Kong Stock Exchange as early as September this year. The scale of funds raised is expected to be in the range of US$600 million to US$800 million (approximately US$4.7 billion to US$6.3 billion), with CICC serving as the exclusive sponsor of this IPO.The Ningbo-based air conditioner manufacturer obtained an overseas listing filing notice from the China Securities Regulatory Commission in July, and completed an intensive second round of non-traded roadshow (NDR) at the end of July, marking that its listing process has entered the final sprint stage.

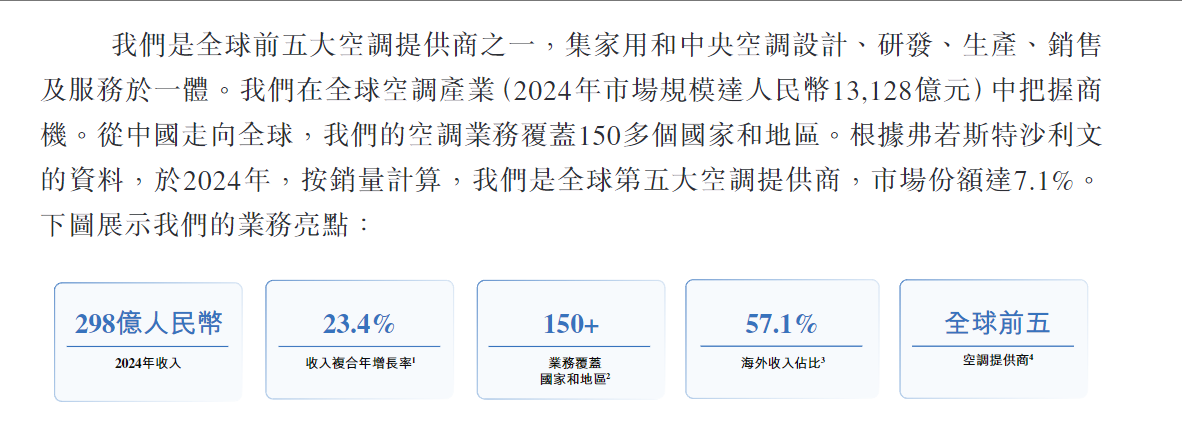

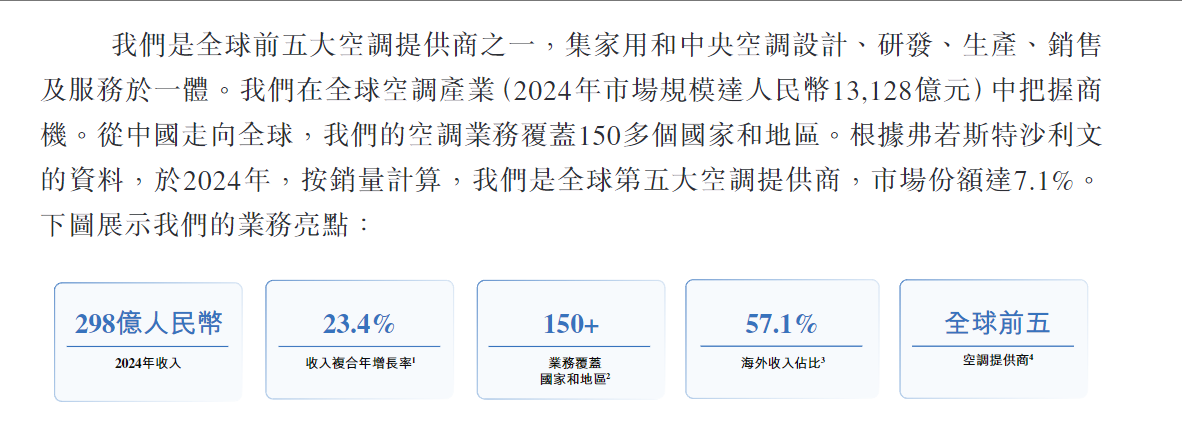

Oaks Electric is well-known in the global home appliance industry. According to Frost and Sullivan's data, Oaks will rank among the world's fifth largest air-conditioning provider in 2024 with a global market share of 7.1%.The company's business reach extends to more than 150 countries and regions, forming a truly global layout.In the first quarter of 2025, Oaks Electric's overseas revenue accounted for 57.1%, far exceeding the industry average.From 2022 to 2024, the compound annual growth rate of the company's sales volume is as high as 30.0%, which is rare in the mature home appliance industry.

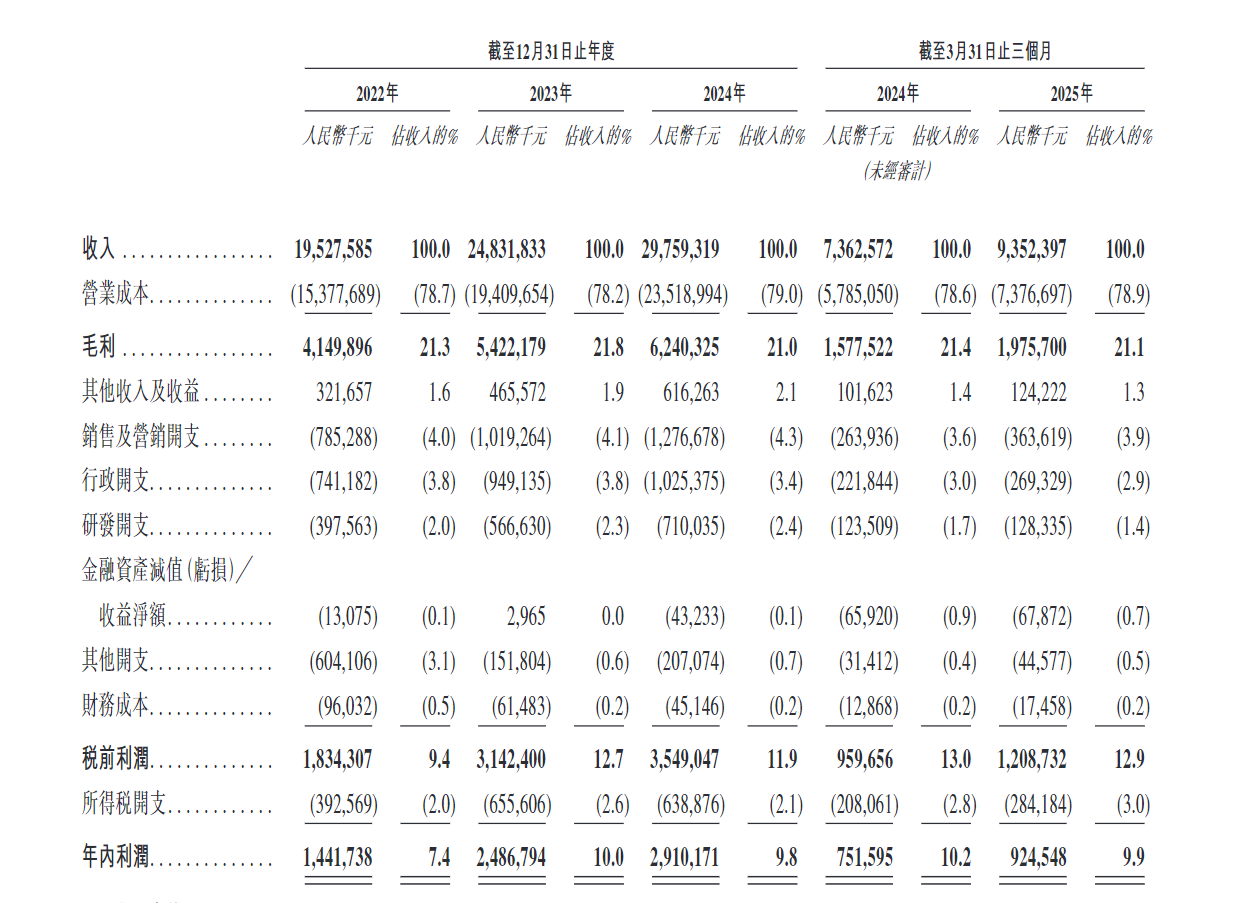

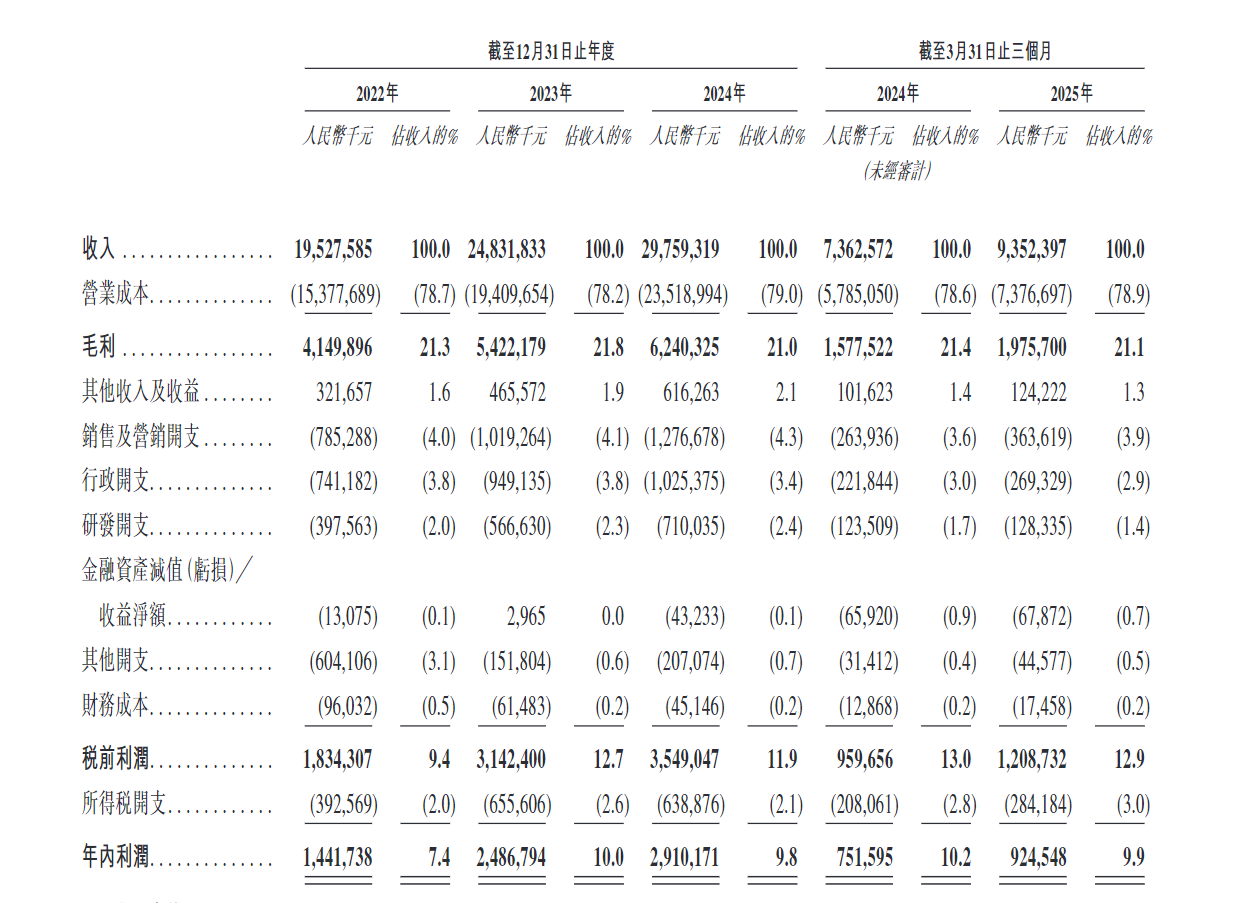

In terms of finance, according to Metropolitan Trading Data, Oaks has shown a steady trend of both revenue and profit growth in the past three years.The company's revenue has steadily climbed from 19.528 billion yuan in 2022 to 29.759 billion yuan in 2024, with a compound annual growth rate of 23.4%; net profit has jumped from 1.442 billion yuan in 2022 to 2.910 billion yuan in 2024, more than doubling.The first quarter of 2025 continued this upward trend, achieving revenue of 9.352 billion yuan, a year-on-year increase of 27.0%; and net profit of 925 million yuan, a year-on-year increase of 23.0%.In terms of profit indicators, the company's gross profit margin has stabilized at around 21%, and the net profit margin has increased from 7.4% in 2022 to the recent range of 9.9%-10.2%. This is due to the emergence of corporate scale effects and the improvement of operational efficiency.

Aux's product strategy shows the dual-track characteristics of "outstanding main business and diversified exploration".As a core business, household air conditioners account for more than 85% of total revenue for a long time.The company covers different market levels through multi-brand strategies: anchoring the mass market with the main brand of "Aux AUX", incubating sub-brands such as "Huasuan" and "AUFIT" to expand segments, and launching "ShinFlow" high-end brand to impact the premium market.It is worth noting that the average selling price of its household air conditioners has shown a downward trend-from 1698 yuan in 2022 to 1517 yuan in 2024.There are two main reasons for this change. One is that the company wants to expand its mid-to-low-end market share through brands such as "Huasuan", and the other is that the company faces fierce price competition during the expansion of overseas business.In addition to household air conditioners, the company continues to increase its number in the field of central air conditioning. Its product line covers multiple connections, unit units, heat pumps and other categories. The application scenarios extend from residential buildings to commercial buildings, hospitals and industrial parks, opening up a second curve for future growth.

Looking at the competitive ecology in which Oaks is located, the Red Sea characteristics of the air-conditioning industry have become increasingly obvious.In the domestic market, the two giants of Gree and Midea have built an unshakable leading position-Gree's revenue in 2024 will be 190 billion yuan and net profit will be 32.2 billion yuan; Midea's revenue for the same period will reach 409.1 billion yuan and net profit will be 38.5 billion yuan. Its scale is several times larger than Oaks and it is difficult to catch up in the short term.In addition, there is also cross-border impact from players of new forces: Xiaomi's air conditioner shipments have increased significantly recently, calling for the goal of "third in China"; pursuit technology focusing on cleaning electrical appliances has also extended to the entire house smart ecosystem.Faced with this squeeze, the "price killer" strategy that Oaks relied on to rise in his early years is experiencing diminishing marginal effects and erosion of market share.Oaks has also been at odds with industry leader Gree for a long time. The lawsuits between the two parties over patent infringement and trade secrets have not yet been fully settled, posing potential legal risks.

In this context, Oaks has raised funds in Hong Kong stocks, and the use of funds is particularly critical.The prospectus disclosed that the funds raised will focus on four directions: building a global R & D system; upgrading intelligent manufacturing and supply chain; strengthening sales channels; and replenishing working capital.The company continues to aim to go to sea and is preparing to set up R & D centers in Europe and America to be close to overseas market needs.In terms of production capacity, the first phase of the company's factory in Wuhu has achieved mass production of compressors this year, and plans to build a new factory in Ningbo to expand offshore production capacity and create a dual-track international model of "R & D + manufacturing".

Doo Financial observed that this time Oaks 'pursuit of a Hong Kong stock IPO coincides with a historical window of changes in emerging markets-in Malaysia and other ASEAN countries, the home appliance market long dominated by Japanese and Korean brands is experiencing structural loosening.Taking Haier as an example, the company has successfully opened up the situation locally through in-depth localization (such as research on milde-proof air conditioners developed for tropical climates and energy-saving freezers designed for supermarket scenarios).Even cutting-edge companies in the air conditioning industry such as Liuzhou Zhige Air Conditioning achieved an output value of over 100 million in just one year with 85% of overseas orders.These successful models all provide Oaks with a sea route that can be used for reference.