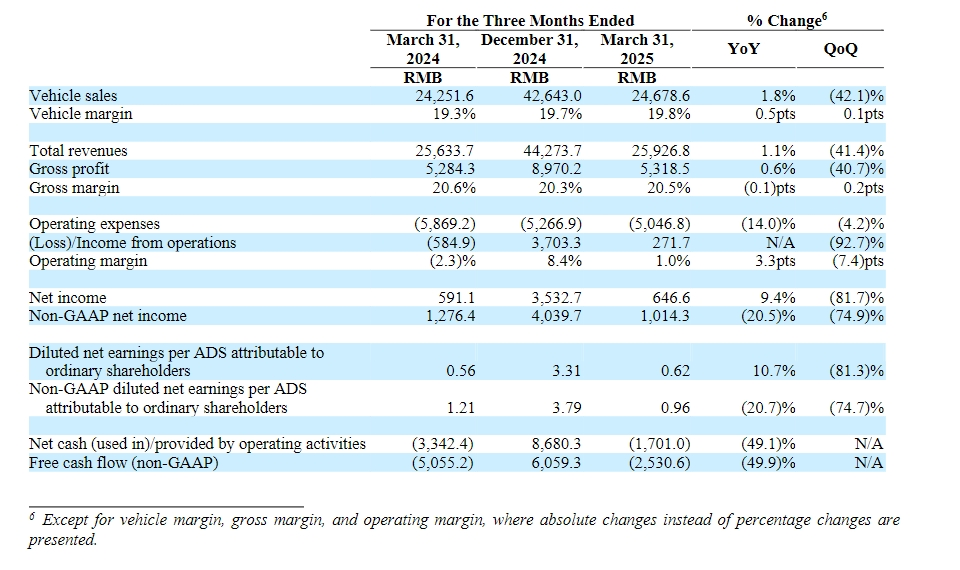

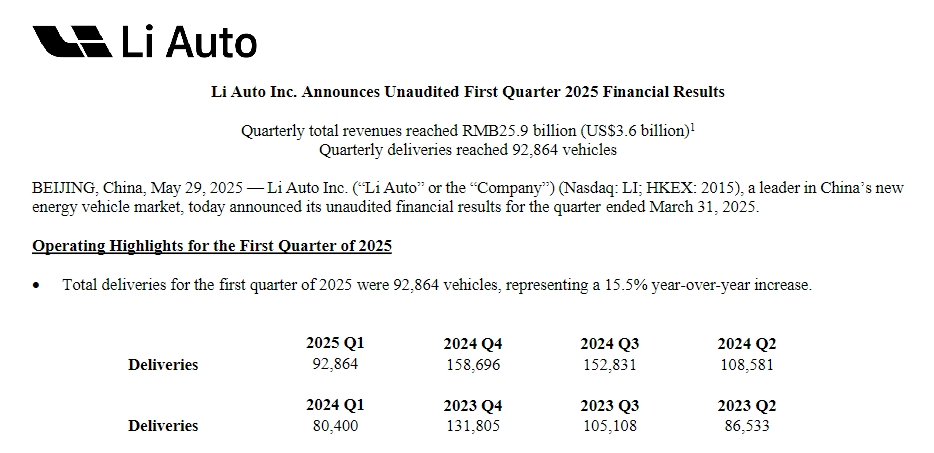

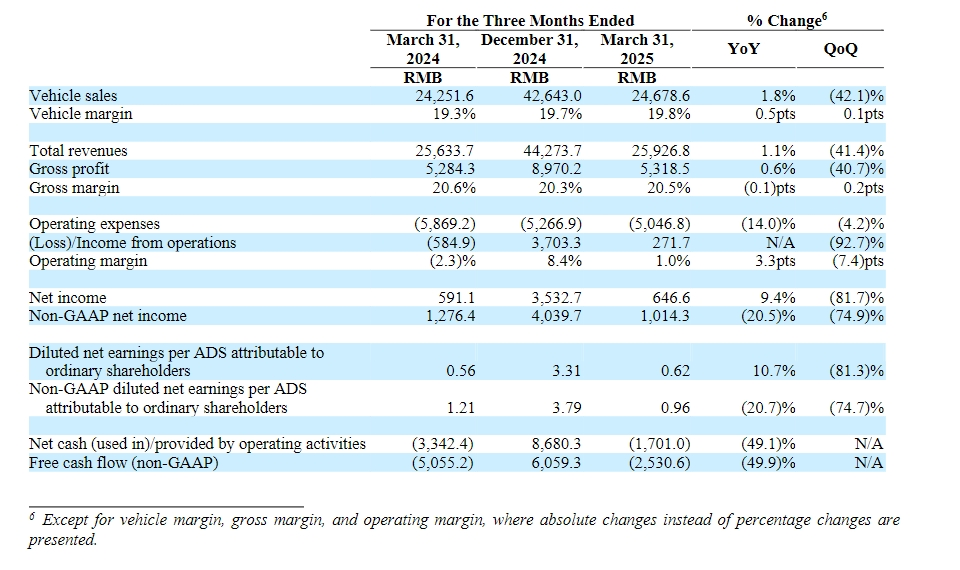

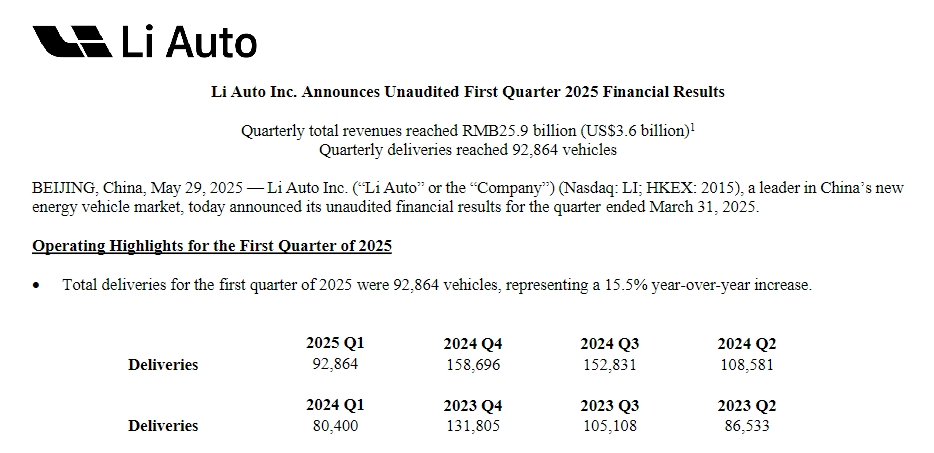

On May 29, Ideal Automobile announced its first-quarter 2025 financial report.Data showed that Ideal's total revenue in the first quarter reached 25.9 billion yuan (RMB, the same below), a year-on-year increase of 1.1%, slightly exceeding market expectations; but the adjusted net profit was only 1 billion yuan, a year-on-year decrease of 20.5%, significantly lower than the market estimate. 1.19 billion yuan.

The company expects revenue in the second quarter to be 32.5 billion yuan to 33.8 billion yuan, and deliveries of 123,000 to 128,000 units, both lower than market expectations.

01 The ideal profit for revenue growth has stalled

On the surface, Ideal Automobile's revenue in the first quarter still maintained growth, but the decline in its profitability is even more alarming.Net profit fell 36.7% year-on-year to 591 million yuan, and adjusted net profit also fell 9.7% year-on-year to 1.3 billion yuan.This situation of "increasing income but not increasing profits" has begun to emerge in 2024-while annual revenue increased by 16.6% to 144.5 billion yuan, net profit fell sharply by 31.9% to 8 billion yuan.

The continued decline in gross profit margins has become a core pain point.The gross profit margin of Q1 vehicles in 2025 will drop to 19.3%, a significant drop from 22.73% in the same period in 2023.This data is approaching the warning line that Li Xiang once proposed that "20% gross profit margin is the minimum health standard for directly operated car companies."

The operating loss reached 584 million yuan, falling into the loss range again after three quarters.Among the cost structure, the surge in sales expenses consumes profits: sales and management expenses for the whole year of 2024 will reach 12.2 billion yuan, a year-on-year increase of 25.17%.

02 The product structure was forced to sink and its ideals were defeated in the high-end battlefield

The core factor for the decline in ideal profitability lies in the decline in average prices caused by the forced sinking of the product structure.The L6 model launched in 2024 will become the main sales force with a starting price of 249,800 yuan, accounting for more than 36% of the annual delivery of 500,500 vehicles.

The success of this "civilian model" is a double-edged sword.Its hot sales directly led to the average price of branded bicycles dropping from 370,000 yuan in 2023 to about 330,000 yuan.In contrast, sales of the L8 and L9, which are positioned at the high-end, fell by 33.4% and 24.5% respectively year-on-year. The cumulative sales of the flagship model L9 this year have almost halved.

The loss of the high-end market is no accident.The market penetration rate of new energy SUVs with more than 300,000 yuan is only 8.7%, and the growth rate has slowed significantly from 120% in 2023 to 45%.When competing products such as the M9 and NIO ES8 competed to deploy the extended-range market, and the price of the Tesla Model Y dropped to 249,900 yuan to directly intercept potential L6 users, the scarcity of ideals in the high-end market was quickly diluted.

03 Counterattack by competitors

The dilemma of ideals in the high-end market just sets off the successful counterattack of competitors in the mainstream market.In April 2025, the new force delivery list showed a landmark change: Zero Run reached the top with 41,000 vehicles, Xiaopeng delivered 35,000 vehicles, and Ideal relegated to third place with 33,900 vehicles.

Xiaopeng's counterattack stems from the strategy of "technology decentralization + cost dilution".The G6 model is equipped with the flagship XNGP intelligent driving system starting at 209,900 yuan, reducing high-cost components such as lidar through large-scale production.In the first quarter, Xiaopeng's revenue surged by 141.45% year-on-year, and gross profit margin increased by 2.87 percentage points to 15.56%.

Zero running relies on vertical integration capabilities to achieve disruptive breakthroughs.Its C11 model sells for only 150,000 yuan, but comes standard with a Qualcomm 8155 chip, L2-level driving assistance and triple screen. The same configuration costs an additional 80,000 yuan on the ideal L6.This cost advantage stems from the self-developed "four-leaf clover" architecture, which streamlines more than 200 ECUs that traditional automobile companies need to purchase into 4 domain controllers, and reduces hardware costs by 30%.

04 Ideal has started "self-rescue mode"

In the face of drastic changes in the market, ideal cars are adjusting their course.The company has quietly lowered its sales target for 2025 from 700,000 units to 640,000 units, of which the target for extended range L series has been reduced from 560,000 units to 520,000 units, and the target for pure electric products has been significantly increased from 50,000 units to 120,000 units.As of April, a total of 126,800 vehicles have been delivered, and the target completion rate is only 19.81%. The pressure is still huge.

Pure electricity layout has become a strategic breakthrough.The first pure electric SUV, the Ideal i8, which will be launched in July, has completed its second application. It is equipped with a dual-motor four-wheel drive system and has a CLTC battery life of up to 720 kilometers; the second pure electric SUV, i6, will be launched in the fourth quarter.In order to support the pure electricity strategy, it is ideal to build more than 2500 supercharging stations before the i8 goes public, and 1900 have been built so far.

The development of overseas markets is accelerating simultaneously.The company has designated 2025 as the "first year of overseas business", and recruitment information shows that it is actively recruiting sales vice presidents in seven countries including Mexico and Saudi Arabia.The German R & D center has settled in Munich to focus on the development of next-generation power semiconductors.In Central Asia and the Middle East, Ideal has established direct after-sales service centers in Kazakhstan, Dubai and other places.

In terms of organizational structure, it is ideal to implement the "war zone system" reform and merge the original 26 war zones into five major regions. The person in charge directly reports to Zou Liangjun, vice president of sales, and learns from Apple's regional management model to improve market response speed.

05 Midfield Dilemma: Long-term Challenges for Ideal Cars

Even if strategic adjustments unfold rapidly, ideals still face multiple structural challenges:

The double-edged sword effect of the right to speak in the supply chain.It is ideal to deeply bind suppliers such as Xinchen Power and Huichuan Technology through a joint venture model. In 2024, the balance of accounts payable and bills will reach 53.6 billion yuan, accounting for 58.88% of the total liabilities for the current period.Although this strength brought in 1.82 billion yuan in interest income, the supplier's gross profit margin continued to be compressed-Xinchen Power's gross profit margin dropped from 11% to 3.29%.This unsustainable model may backfire to the supply chain ecosystem.

Intergenerational risks of technological routes.Ideal is betting heavily in the AI field and launching the research and development of a VLA model that integrates visual, language, and action models. It is planned to be released simultaneously with the i8.Li Xiang believes that "the end-to-end +VLM architecture is like a monkey driving, but it still cannot reach the level of a human driver."However, when Xiaopeng XNGP and Huawei ADS have verified their capabilities on the real road, the ideal intelligent narrative needs to be fulfilled as soon as possible.

Executive compensation disputes reveal hidden governance concerns.In 2024, Li Xiang received more than 600 million yuan in equity incentives, accounting for 7.5% of the annual net profit.During the same period, the total compensation of five non-director executives fell by more than 60% to 48.76 million yuan.This distribution structure may affect team stability.

The transformation of ideal cars is essentially a microcosm of the evolution of the entire new energy vehicle industry from "high-end early adopters" to "mainstream popularization".When Li Xiang announced that "2025 is the first year of overseas markets", the capital market was more concerned about: sweeping the third-and fourth-tier markets with a C11 of 150,000 yuan in zero-running, and Xiaopeng reshaping the 200,000 yuan level with 800V overcharging. Today, with the ideal of a price band above 250,000 yuan, can we find new additions in the wave of civilianization?