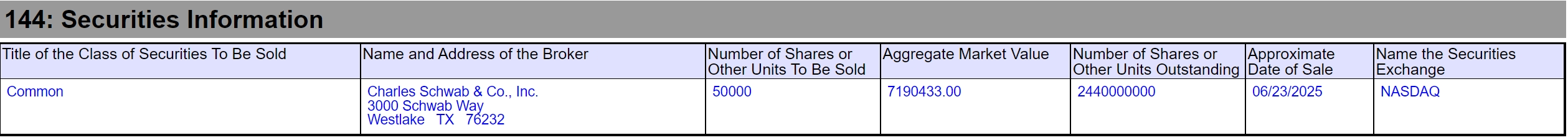

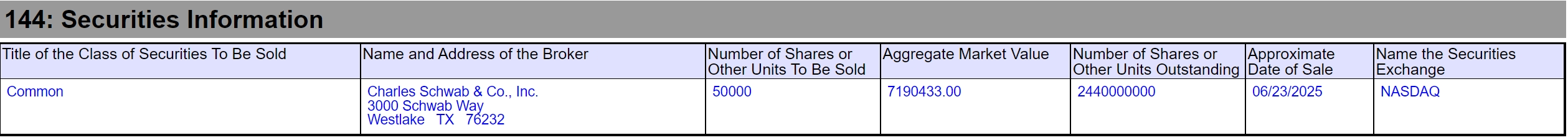

Huang Renxun plans to sell another 50,000 shares in the near future.

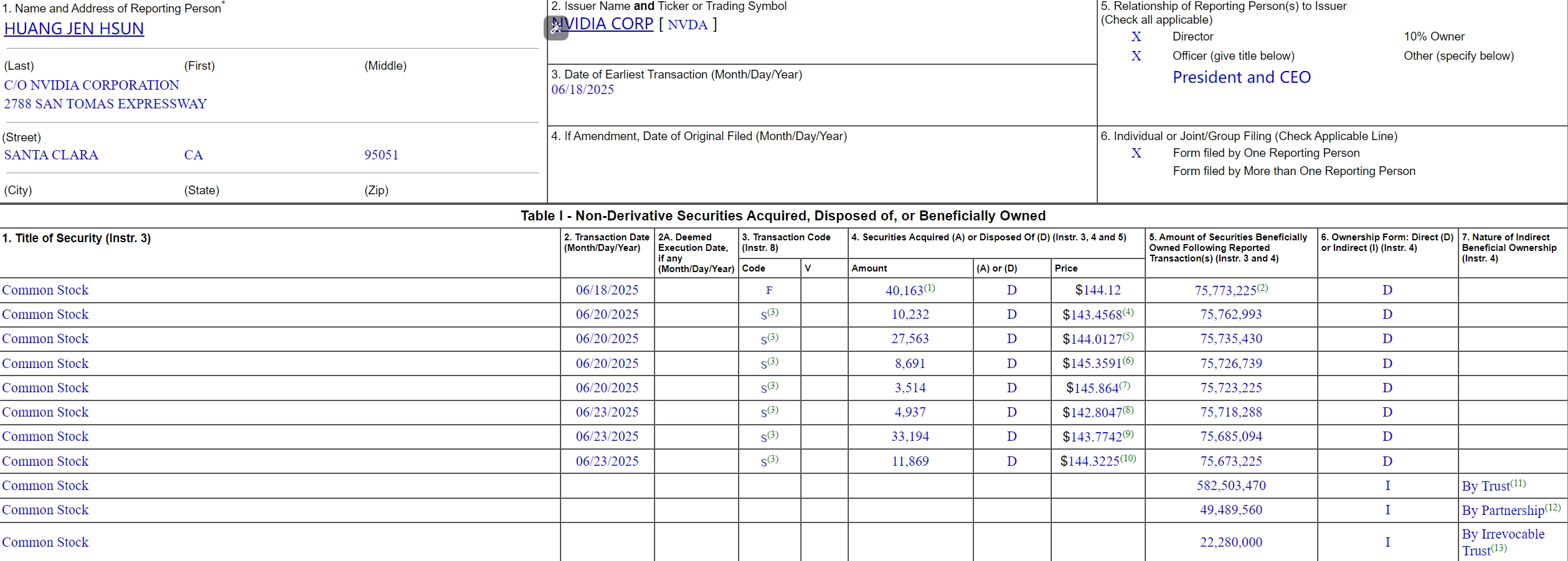

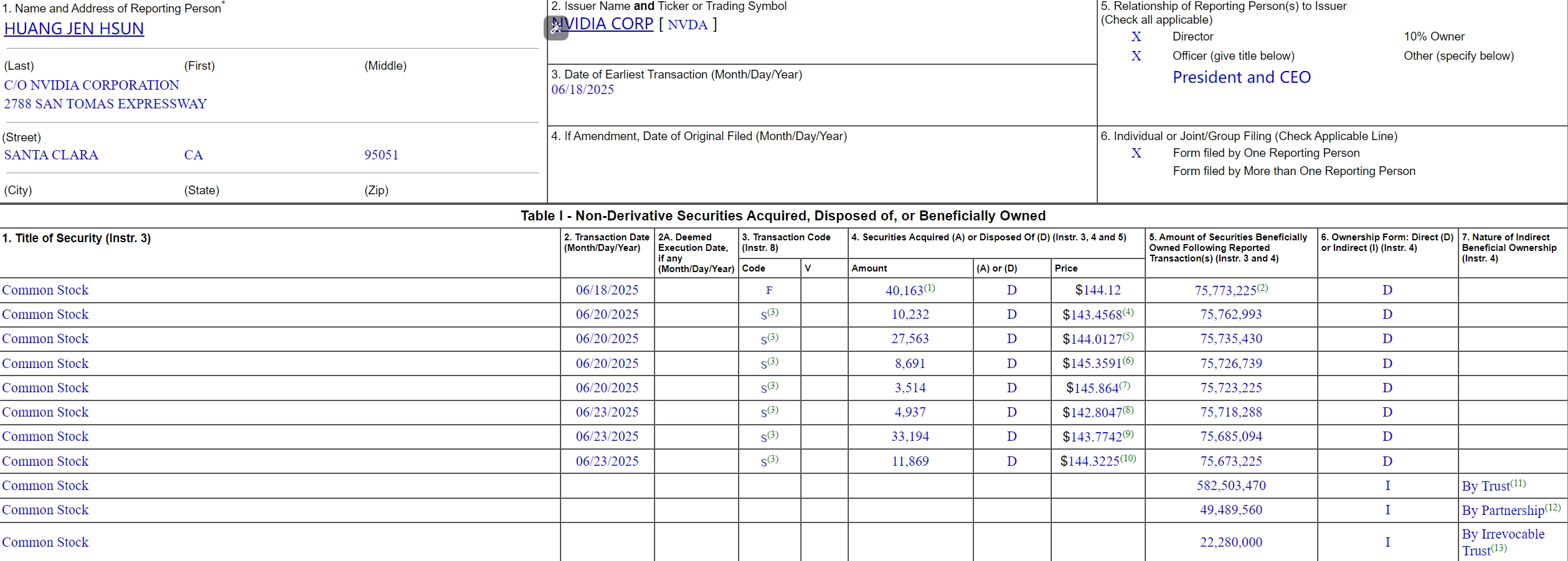

On June 23, according to SEC documents, Huang Renxun sold 100,000 shares of Nvidia stock for a total price of US$14.4 million within two days from June 20 to June 23.

The sell-off was part of Nvidia's March 10b5 -1 trading plan.On March 20, 2025, Nvidia CEO Renxun Huang submitted a document with the U.S. Securities and Exchange Commission to initiate a stock sale plan in accordance with Rule 10b5 -1.Under the plan, he will sell 6 million shares of Nvidia stock by the end of 2025, a deal worth $865 million based on Monday's closing price of $144.17.

According to the SEC filing, the core value of the 10b5 -1 trading plan lies in its procedural legitimacy.This mechanism allows company insiders to automatically execute transactions through pre-set prices, quantities and schedules, completely avoiding suspicion of insider trading.It is worth noting that Huang Renxun's share sale was not an isolated act.Colette Kress, the company's chief financial officer, also launched a similar plan on March 4, planning to sell 500,000 shares by March 2026, valued at approximately US$67.4 million; director Brooke Seawell plans to sell approximately 1.15 million shares by July 2025, worth US$155 million.

This collective action is structured and suggests that the executive team may be engaged in routine financial planning rather than bearish on the company's prospects.Historical experience supports this judgment: after Huang Renxun completed his previous share sale in 2024, Nvidia's share price rose by 2.18%, which the market interpreted as a technical reduction rather than a confidence crisis.

It is reported that according to another document filed on Monday, Huang Renxun plans to sell another 50,000 shares in the near future.

This is the second consecutive year that Huang Renxun has implemented such a large-scale reduction-between June and September 2024, he also sold 6 million shares and cashed in US$713 million, with an average transaction price of US$118.83.This plan disclosure coincides with the sharp fluctuations in Nvidia's share price: the company's market value hit a record high of US$153.13 on January 7, 2025, and fell to US$115.59 at the GTC meeting on March 18, evaporating more than a trillion dollars in market value.However, with the large-scale shipment of Blackwell chips and the clarity of the roadmap for the next generation of AI chips, the stock price has returned to its upward trend, hitting a record high of $1280 ($128 after stock split adjustment) in May.

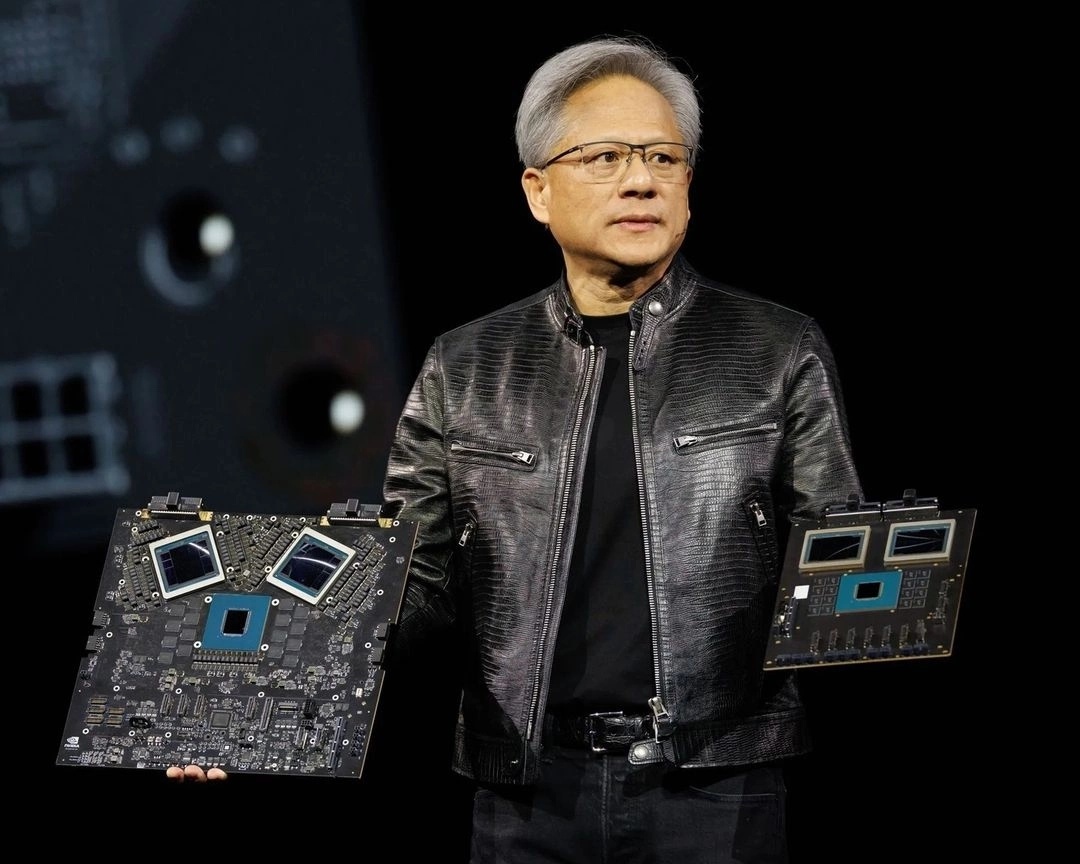

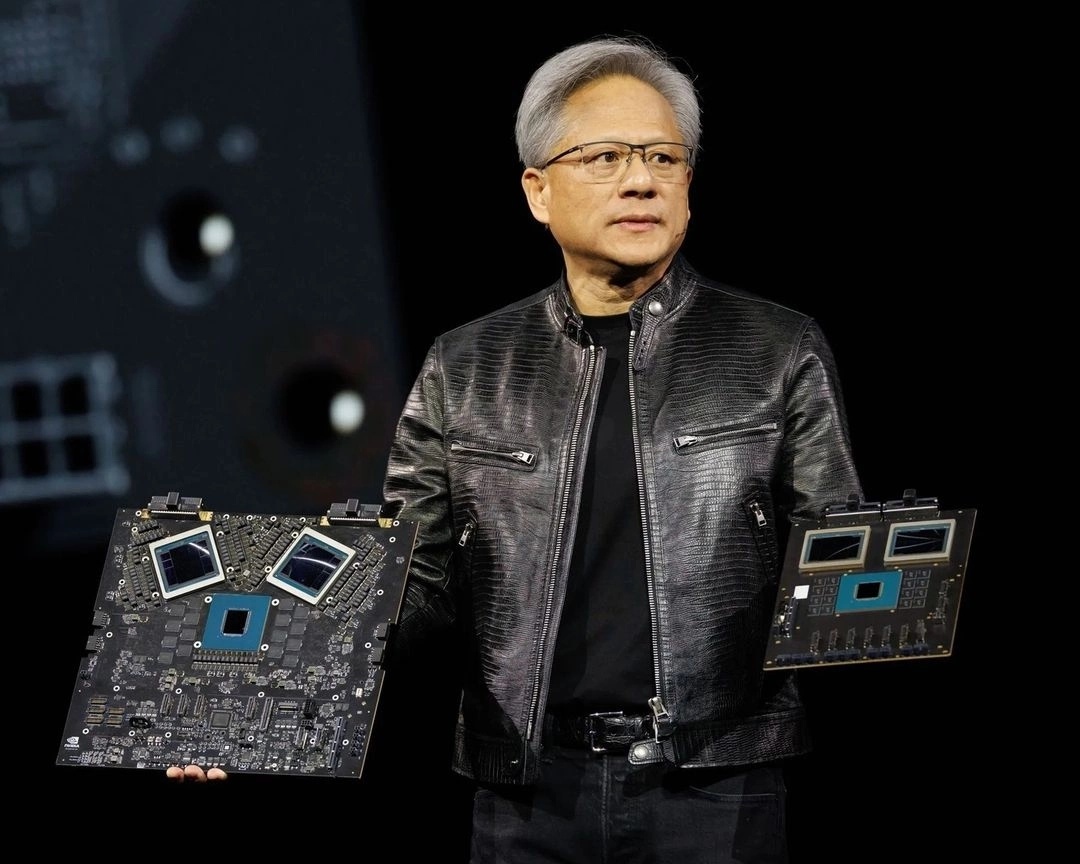

From a fundamental perspective, Nvidia's growth engine remains strong.In fiscal year 2025 (as of January 26, 2025), the company's revenue reached US$130.5 billion, a year-on-year increase of 114%, of which the data center business contributed US$115.2 billion, a year-on-year increase of 142%.More importantly, Huang Renxun announced at the GTC conference that the Grace Blackwell solution has been fully put into production and will ship 3.6 million Blackwell GPUs to the four major cloud platforms in 2025.

These numbers support the company's revenue guidance of $43 billion for the first quarter of fiscal 2026, a 69% increase from the same period last year.The market demand for Blackwell architecture chips has formed an "overwhelming" trend-the AI inference performance of its GB200 NVL72 system is 30 times faster than the previous generation H100 GPU, and the next-generation Vera Rubin chip will be launched in the second half of 2026. The memory bandwidth will be 2.4 times that of Grace.