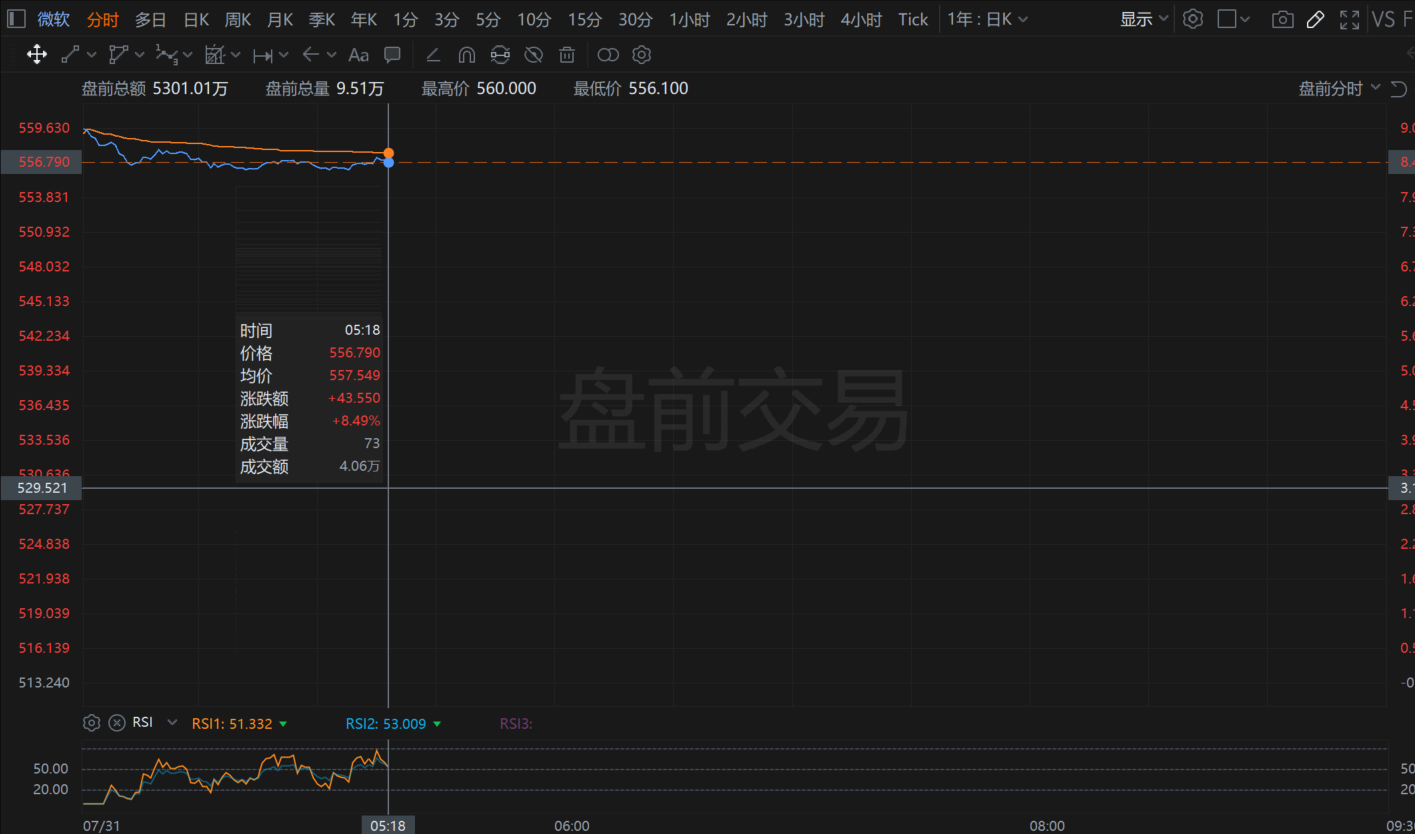

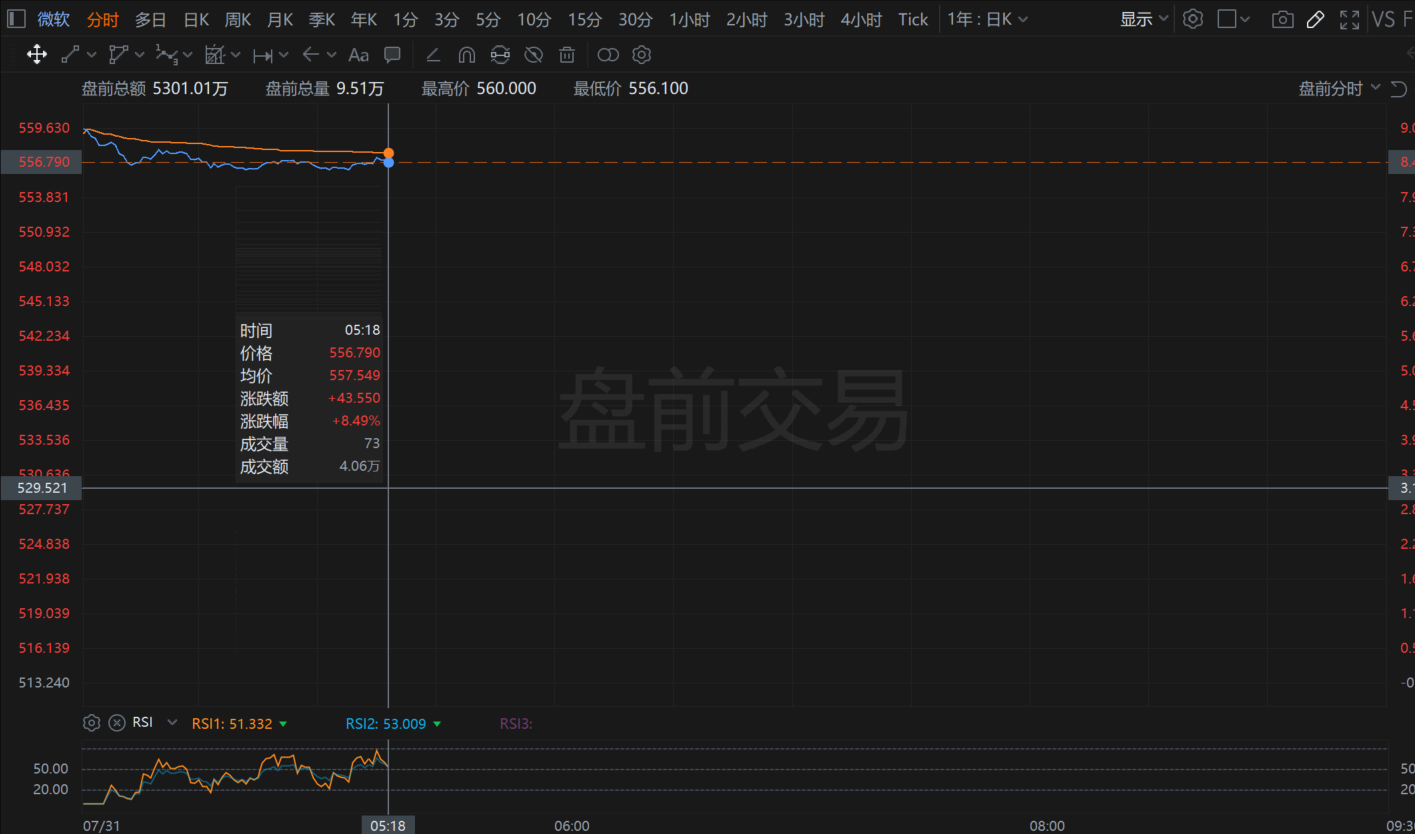

Earnings exceeding expectations boosted market confidence, and Microsoft's share price surged 8%.

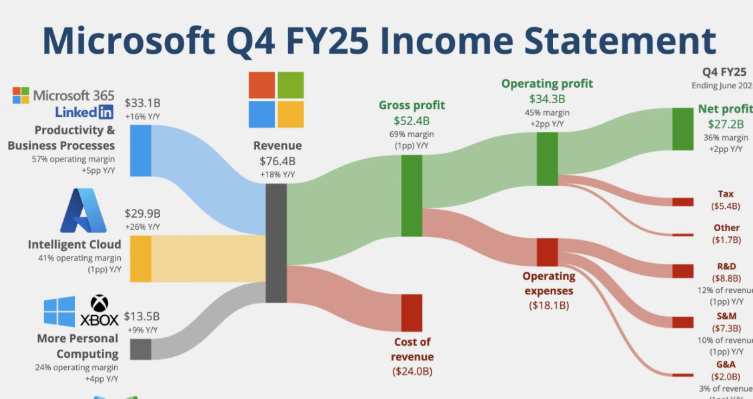

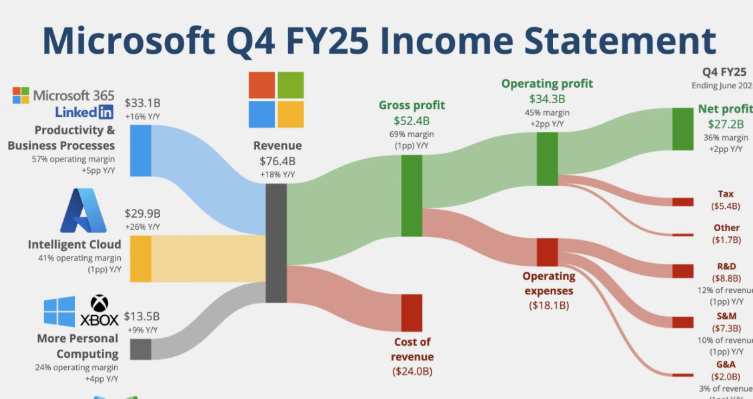

After the U.S. stock market closed on Wednesday, July 30, U.S. Eastern Time, Microsoft released financial data for the fourth quarter of fiscal year 2025 (hereinafter referred to as the second quarter).Data showed that Microsoft's operating income in the second quarter was US$76.44 billion, a year-on-year increase of 18%. Analysts expected US$73.89 billion, a year-on-year increase of 13% in the first quarter; diluted earnings per share (EPS) was US$3.65, a year-on-year increase of 24%. Analysts expected US$3.37, a year-on-year increase of 17.7% in the first quarter; operating profit in the second quarter was US$34.3 billion, a year-on-year increase of 23%, and a year-on-year increase of 16% in the first quarter; Net profit for the second quarter was US$27.2 billion, a year-on-year increase of 24%, and a year-on-year increase of 18% in the first quarter.

Including assets acquired under finance leases, total capital expenditures in the second quarter were US$24.2 billion, a year-on-year increase of 27%, and an increase of nearly 53% in the first quarter; of which, cash expenditures related to real estate and equipment were US$17.1 billion, a year-on-year increase of 23%. In the first quarter, the year-on-year increase was nearly 52%.

Financial results that exceeded expectations boosted market confidence. Microsoft's share price surged 8% after hours, and its market value exceeded US$4.1 trillion.The company predicts that capital expenditure in the next quarter will exceed US$30 billion in an unprecedented manner, with an annualized expenditure scale of US$120 billion.

Excluding exchange rate factors, revenue from Azure and other cloud services increased by 39% in the second quarter, becoming the biggest highlight in the second quarter.

Data shows that the number of tokens processed by the Azure AI Foundry platform has increased more than 7 times year-on-year, reaching 500 trillion yuan, and 80% of Fortune 500 companies have become their customers.What is even more shocking is the speed at which the technology stack matures-Nadella points out that developers have moved beyond the simple API call stage and entered a new era of building "stateful applications."Robust frameworks built by products such as Azure Search, Fabric and Cosmos DB allow companies to quickly deploy complex AI applications just as they did when they were using relational databases.

Good news also came from other business lines. GitHub Copilot users exceeded 20 million, adding 5 million users within three months. 90% of Fortune 100 companies adopted this tool, confirming Nadella's "business scale will exceed the overall level when acquiring GitHub" prediction; The monthly active users of the Copilot product line exceeded 100 million mark, becoming the fastest-adopted commercial product in Microsoft history; Dragon Copilot in the medical field has recorded 13 million doctor-patient sessions, saving the Mercy Health System more than 100,000 clinical time-the in-depth application of these vertical industries is opening up incremental space for the commercialization of Microsoft AI.

Faced with the doubts of the capital market, Microsoft used a set of comparative data to demonstrate its strategic determination: despite the annual capital expenditure of US$80 billion (about half of which was invested in AI infrastructure), the intelligent cloud division still maintained a staggering gross profit margin of 70%.More critical is its capital efficiency-for every dollar invested in AI infrastructure, Azure AI services generate an annualized growth return of 157%.This input-output relationship explains why Hood dares to predict "double-digit revenue and operating profit growth" in fiscal year 2026.

What is worth noting is the subtle shift in capital allocation: Although it was previously forecast to focus on short-life assets such as GPUs, in order to meet surge demand, Microsoft is still leaning resources towards long-life assets such as data centers.This flexibility stems from its vertical integration from chips to cooling systems-the deployment of customized Maia and cobalt chips, and the large-scale application of liquid cooling technology, so that Azure's AI service gross profit margin is expected to reach 65% in 2026, significantly ahead of AWS. 50% and Google Cloud's 40%.

CEO Satya Nadella said the company ended a record fiscal year with a "very strong performance" and that rapid innovation and widespread adoption of AI technology are driving the company to achieve breakthrough growth in multiple business areas.User adoption of AI products such as Microsoft 365 Copilot and GitHub Copilot has reached "unprecedented" levels.

Key factors driving Azure's rapid growth include active migration activities for VMware and SAP, as well as migration needs for Microsoft's server products.Nadella pointed out that "it turns out that we are still far from the finish line-probably in the middle stage at best," suggesting that there is still huge room for growth in the migration business.At the same time, the company continues to explore new models for monetization of AI products.

Microsoft Chief Financial Officer Amy Hood revealed that commercial bookings exceeded US$100 billion for the first time, a year-on-year increase of 37%, and commercial remaining performance obligations increased to US$368 billion.Double-digit revenue and operating income growth are expected to continue in fiscal 2026, and Azure revenue in the first quarter is expected to increase by 37% year-on-year.

Faced with analysts 'concerns about continued growth in capital expenditures, CFO Amy Hood emphasized that the company has a US$368 billion contract backlog and capital expenditures are highly matched to actual needs.She said that tight supply and demand conditions are expected to continue until December this year, and the company is more concerned about gaining market share rather than turning points in capital expenditures.