The market's positive response to Musk's apology is essentially a pricing for policy risk mitigation.

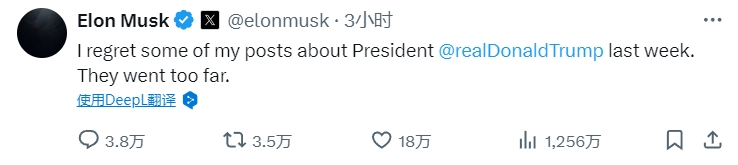

On June 11, Musk apologized on social media X.

He posted a post saying that I regretted the post I posted last week about President Trump, which went too far.

After sending a "good signal", Tesla's share price jumped 2.6% in pre-market hours-a storm of market value evaporation triggered by political rhetoric finally ushered in a breathing signal.The open conflict, which began with policy differences and escalated into personal attacks, wiped Tesla's market value by more than $150 billion in just one week.

At the beginning of the week, Musk and Trump exchanged off-air messages on social media.

Musk criticized the bill for ignoring its supporting policies, and even declared in the fierce debate that "Trump could not win the 2024 election without my support" and even threw out the accusation of "ingratitude."

But what really touched the red line was his suggestion that the current U.S. president was linked to the Epstein scandal-an attack that was seen as a "nuclear option" in political circles immediately drew a "regrettable" qualitative assessment from White House Press Secretary Carolyn Levitt and an angry counterattack from Trump himself for "great disrespect for the presidency."

Trump told the media coldly on Air Force One,"I gave him many opportunities long before this happened."

This collapse of trust has an immediate deterrent to the market: as Tesla's core stakeholder, the U.S. government holds not only SpaceX's defense orders and Tesla's electric vehicle tax credits, but also tariffs and policy levers that govern its global supply chain.

Back twelve months ago, the relationship between the two was still at the peak of its honeymoon.

In his victory speech, Trump praised Musk as a "super genius" and thanked him for the election boost he brought through a $118 million Political Action Committee donation and key state platforms; Musk served as Trump's ad hoc "Government Efficiency" The head of the Department uses policy influence to strive for a loose regulatory environment for Tesla.

Wade Bush analyst Dan Ives predicted at the time that such an alliance would benefit Tesla in a deregulated environment, with an optimistic target market value pointing to $2 trillion.

However, the shelf life of political friendships was clearly shorter than market expectations-when Musk publicly opposed the core Republican bill, the Trump team immediately hinted that subsidies to his companies might be cut, instantly reversing the optimistic narrative of the capital market.

The market's positive response to Musk's apology is essentially a pricing for policy risk mitigation.

Although Tesla's pre-market gain of 2.6% could not immediately recover $150 billion in lost ground, it clearly showed that investors regard the restoration of political relations as a prerequisite for restoring market value.This sensitivity stems from Tesla's deep embedding of government actions: everything from lithium refining project approvals at Texas plants to regulatory adaptations for fully autonomous driving (FSD) to tariff barriers to China's electric vehicle competitors requires endorsement by the White House or Congress.

Trump's previous threat to impose tariffs on China's electric vehicles has objectively built a protective wall for Tesla-but only if the company's helm is not included in the list of political opponents.

A deeper capital concern lies in Musk's politicization turn.

When the Tema broke down, Musk launched a poll to form the "American Party" and unexpectedly received the support of 80% of the participants-this is a good thing for Musk personally and means that his "political influence" is still there; But it is a bad thing for investors, who see the risk of corporate energy being diverted by political aspirations.There are precedents for similar situations: in 2023, the distraction caused by Musk's acquisition of Twitter was once seen by Wade Bush analysts as the inducement of Tesla's value loss of $15 per share.

Nowadays, at the critical stage of the implementation of Tesla's FSD technology and the commissioning of the Texas lithium refinery, if the founder is deeply involved in the creation of a political party, it may once again cause "execution anxiety."After all, no institutional investor would expect a trillion-dollar technology giant whose CEO would spend his energy on the trivial operations of political organizations.