The 16 Pro model broke out during the "618" shopping festival in China.

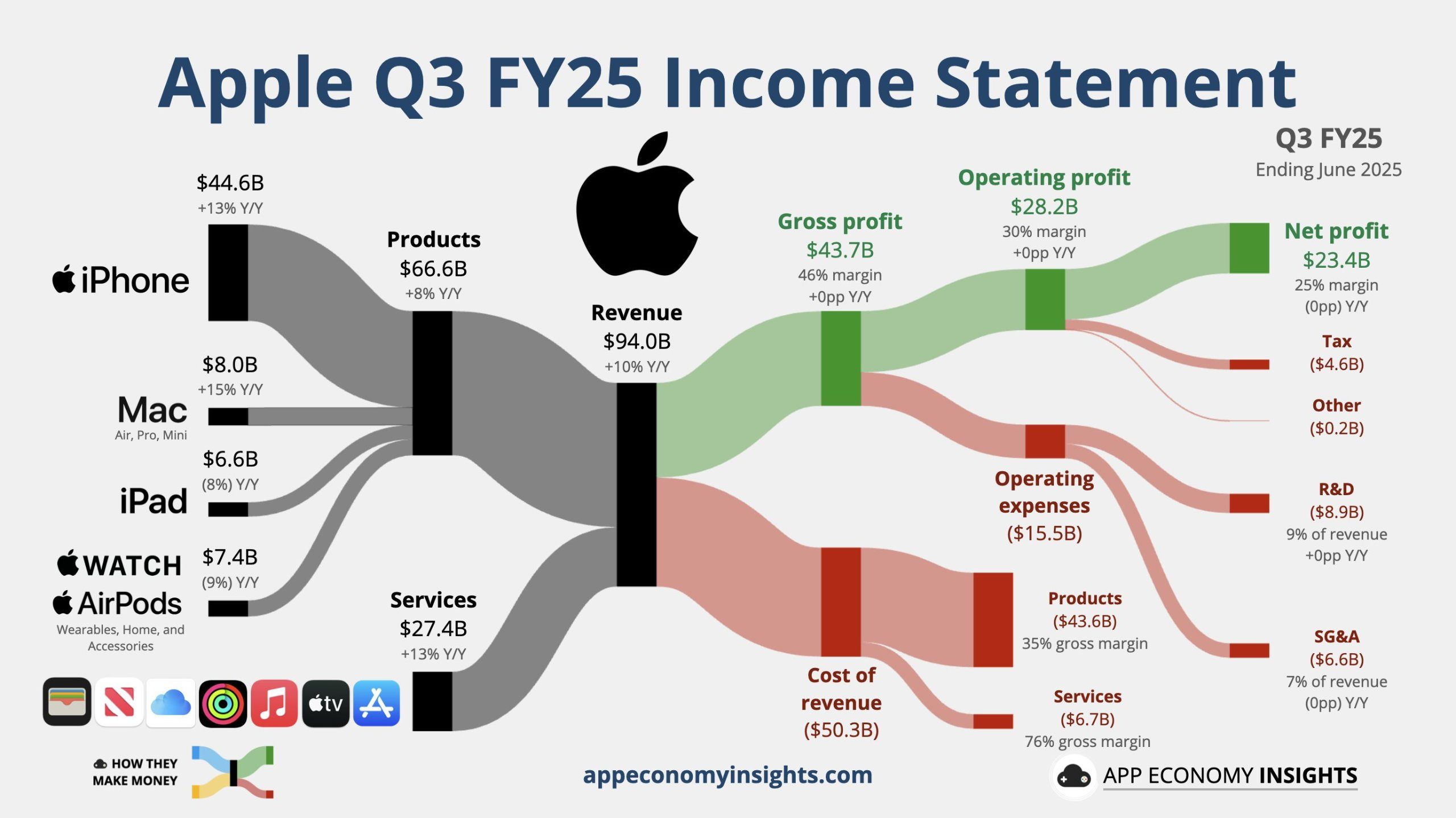

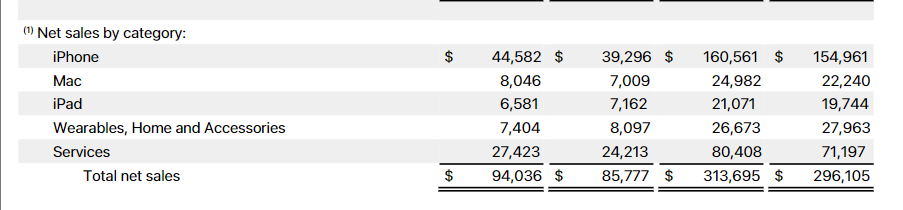

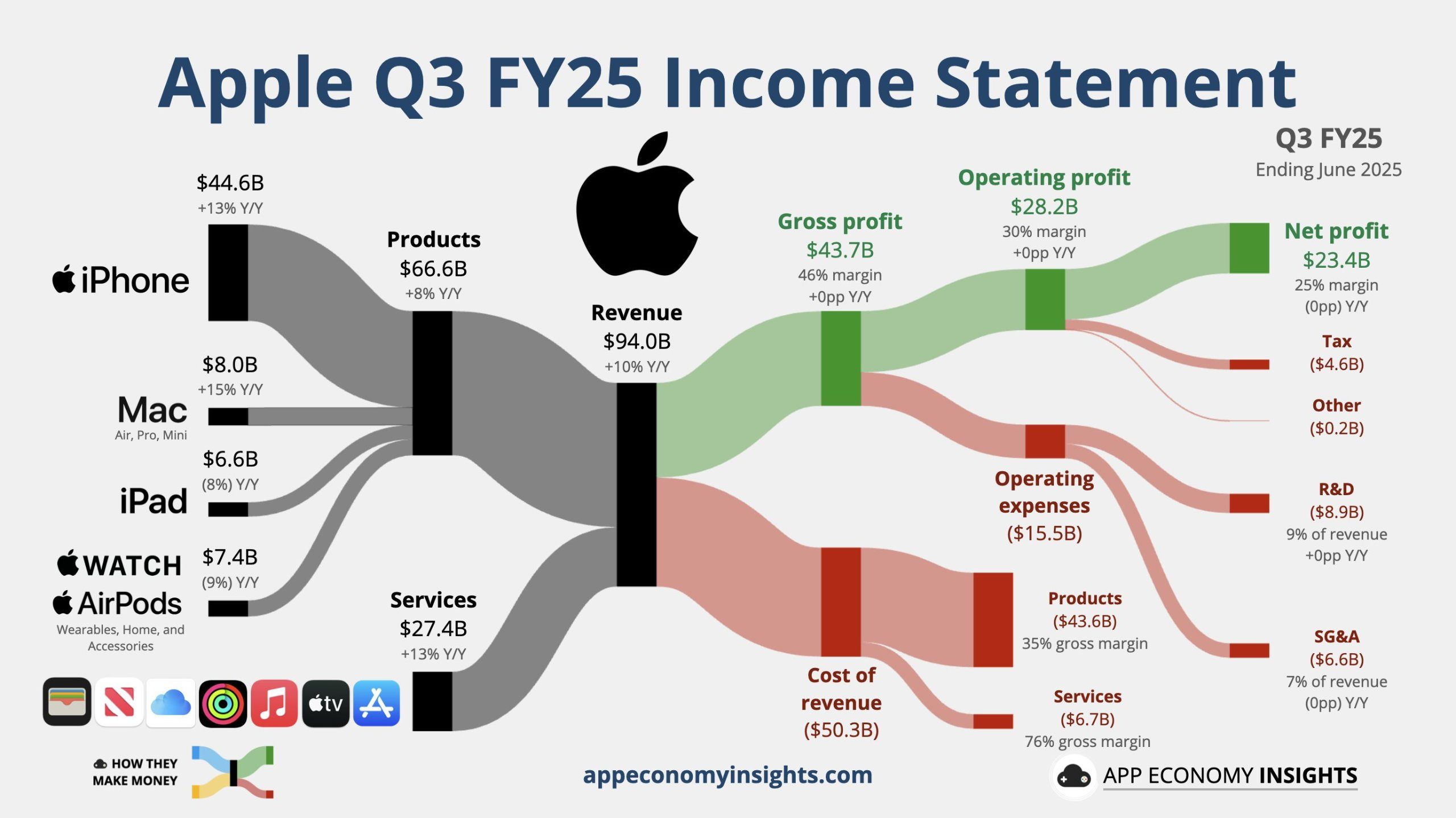

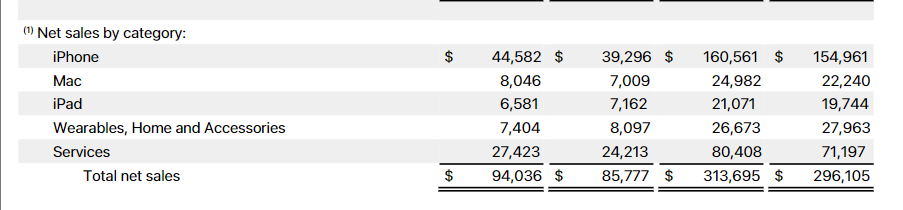

On August 1, Apple announced its third-quarter results for the fiscal year 2025, breaking through the market's conservative expectations with revenue of US$94 billion and a year-on-year growth rate of 10%, setting the strongest growth record since December 2021.iPhone sales in the quarter reached US$44.58 billion, a year-on-year increase of 13.5%, contributing nearly half of the increase in revenue; the services business hit a record high of US$27.42 billion, a year-on-year increase of 13%.

iPhone rebounds strongly

The iPhone remains Apple's most dependent flagship product, with revenue growing by 13.5% this quarter.This growth stems from triple driving forces: First, the iPhone 16 series, especially Pro models, broke out during the "618" shopping festival in China, and the national subsidy directly stimulated consumer demand; Second, consumers buy in advance due to expected price increases caused by tariffs "; Third, the replacement rate of existing users around the world has achieved double-digit growth, and the" old-for-new "base and loyalty are still expanding.What is more noteworthy is that Apple has quietly completed the restructuring of its supply chain-moving some iPhone production to India and its Mac and Apple Watch production lines to Vietnam, with the aim of using geographical diversification to cushion tariff shocks.

In terms of other products, revenue from Mac was US$8.046 billion, an increase of nearly 15% compared with US$7.009 billion in the same period last year, the fastest growth rate in the entire product line.In contrast, revenue from iPad of US$6.58 billion fell 8% year-on-year, and revenue from wearables of US$7.4 billion fell 8.6% year-on-year.

During the quarter, Apple's revenue grew positively in all geographical divisions: Japan led the lead with a growth rate of 13.4%, and other Asia-Pacific regions surged by 20.1%.The one with the greatest turning point is Greater China-after two consecutive quarters of decline, revenue for this quarter was US$15.37 billion, a year-on-year increase of 4.4%.

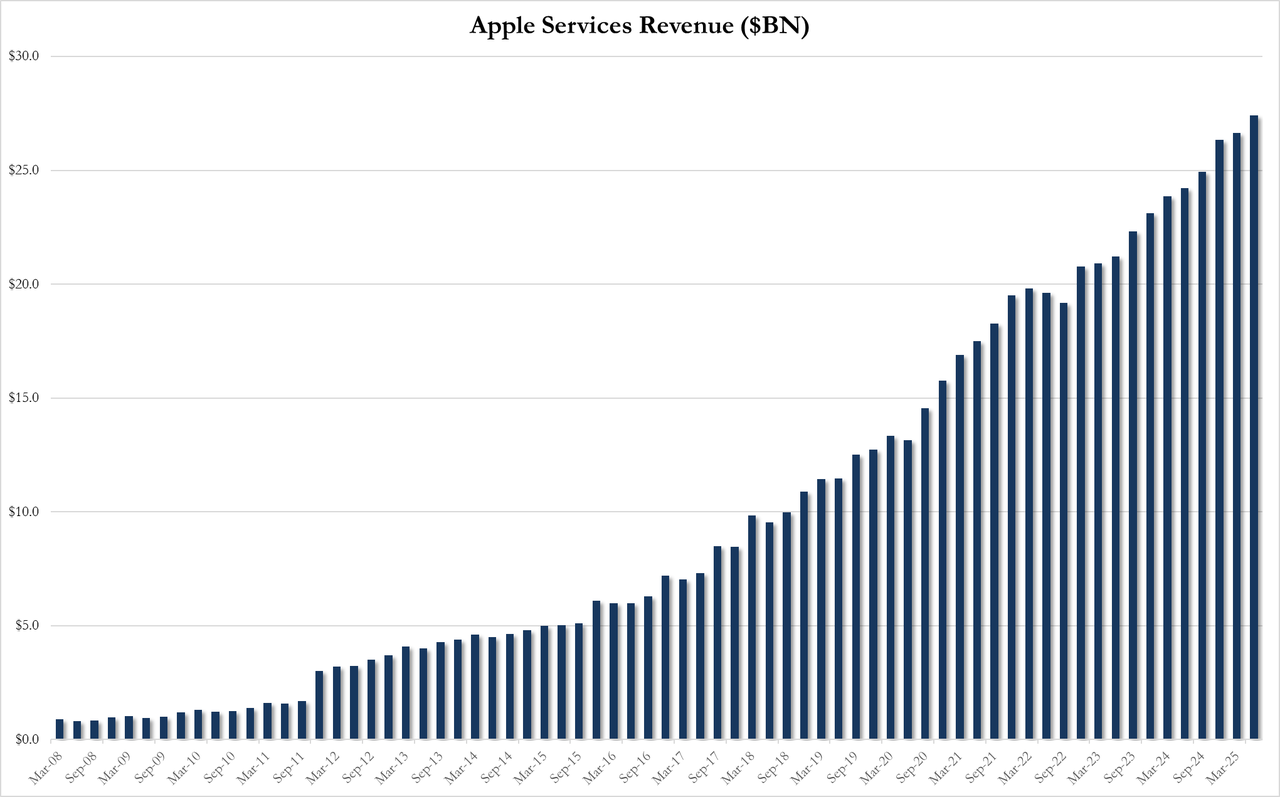

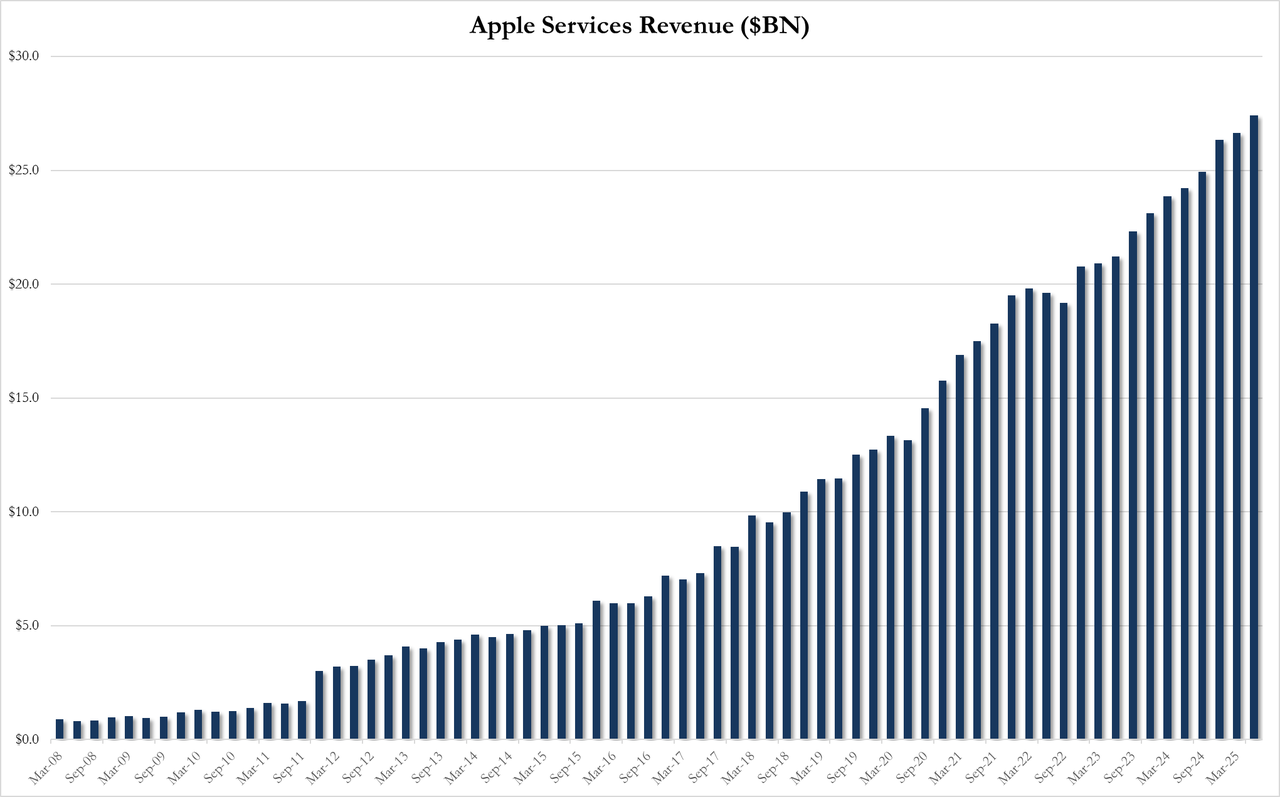

Service Business Acceleration

During the quarter, Apple's services business revenue reached US$27.4 billion, a year-on-year increase of 13%.This revenue not only comes from the natural growth of traditional strengths in the App Store and iCloud subscriptions, but Apple's investment in the content field has also begun to bear fruit: Apple TV+ has received 81 Emmy nominations, and the platform has won a total of 585 industry awards.This performance exceeded analyst expectations.According to data provided by LSEG, analysts had on average expected Apple's third-quarter services revenue to be US$26.8 billion.

Apple CEO Tim Cook said: "We are proud to announce that in the fiscal third quarter, we achieved double-digit growth in iPhones, Macs and services, with growth in every region around the world.At WWDC25, we are excited to launch a new software design that will cover all of our platforms and announce more great Apple Intelligence features.”

Apple faces a "headwind" behind strong performance

The financial report showed that Apple's third-quarter earnings per share were $1.57, higher than analysts 'expectations.

However, Apple's cash reserves quietly signaled caution, with share repurchases reduced by $10 billion to $70.6 billion, and cash and equivalents increased to $36.3 billion.Analysts said Apple's move was to set a margin of safety in response to the tariff storm.

Apple has absorbed $800 million in tariff costs this quarter, but Cook warned that the figure will jump to $1.1 billion in the fourth quarter.In order to maintain its profit line, Apple has adopted a three-pronged strategy: moving production to India and Vietnam to avoid some tariffs; increasing the average selling price (ASP) through a combination of high-end models; and taking advantage of the exchange rate dividends brought by the weakening US dollar (Q3 and Q4 are expected to contribute revenue gains of US$1.18 billion and US$1.37 billion respectively).

Bank of America predicts that Apple's Q4 will hit a 45% low in gross profit margin, but is expected to rebound through a high-end product portfolio such as ultra-thin iPhones.

For Apple's future trend, Wall Street has set divergent price targets of $139 -270.Goldman Sachs adheres to a "buy" rating of $251, saying that Apple has an irreplaceable dynamic balance between service innovation and high-end hardware.