The U.S. national debt is close to US$36 trillion, a significant increase from US$20 trillion when it first took office in 2017.

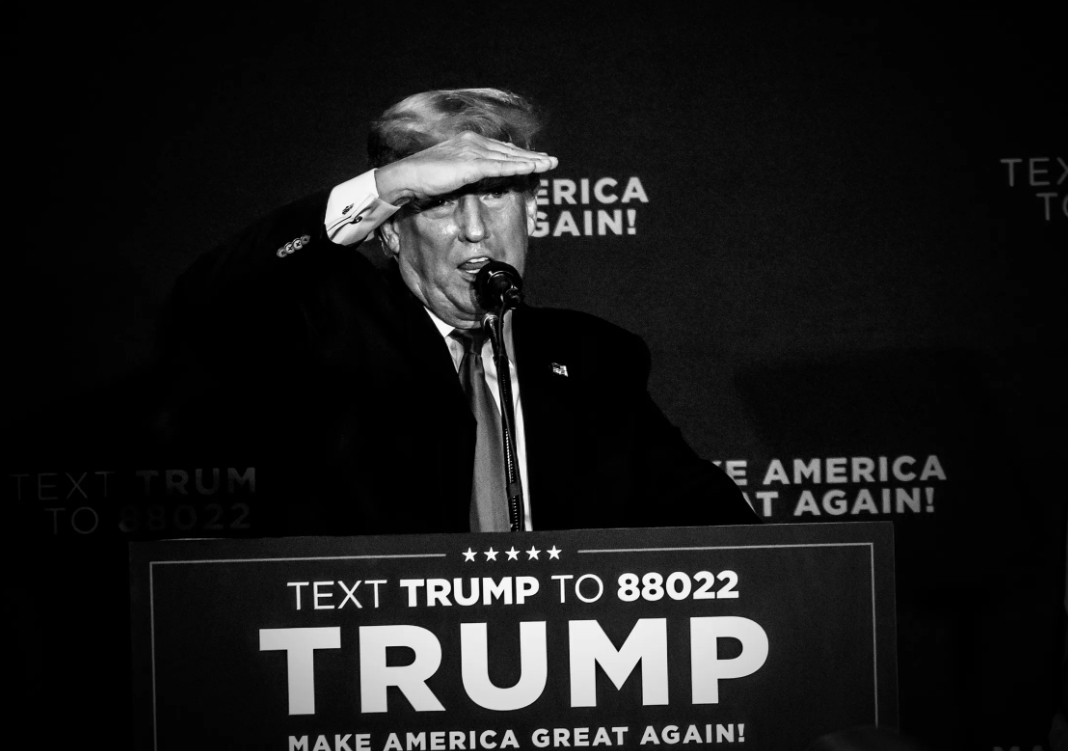

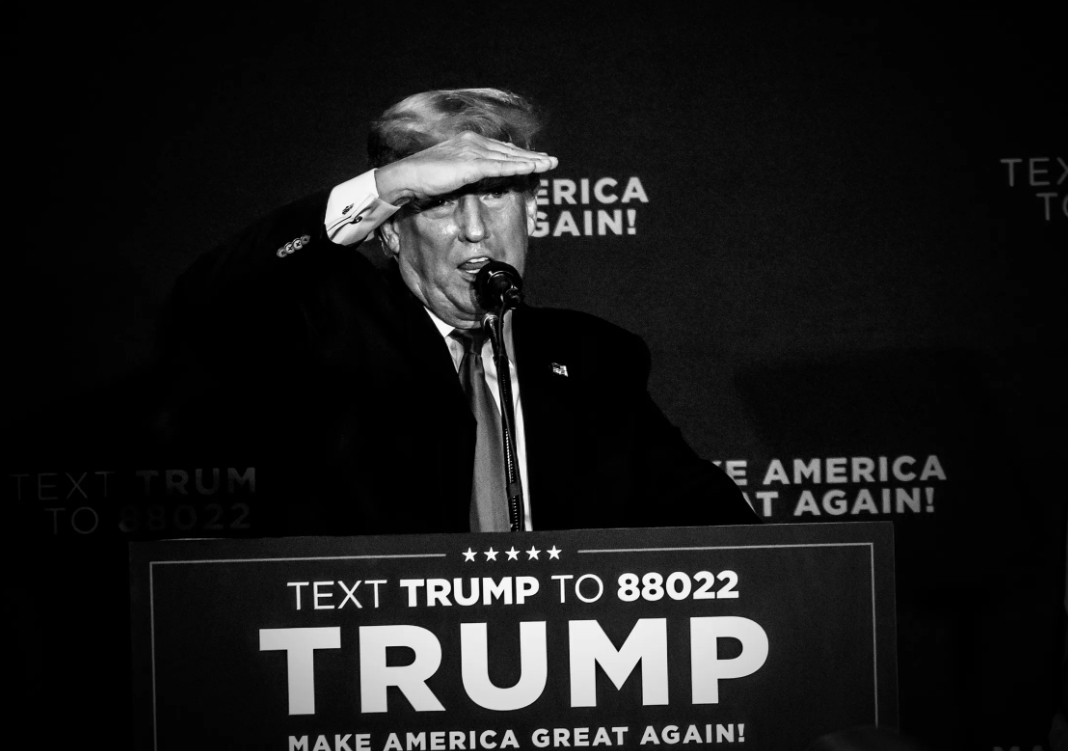

As Donald Trump approaches his second term, the United States faces unprecedented fiscal and debt management challenges.Trump has accumulated rich experience in debt management in the field of real estate development, but the national debt problem he is facing this time is much more complex than ever.According to the latest data, the U.S. national debt is close to US$36 trillion, a significant increase from the US$20 trillion when it first took office in 2017.The proportion of this debt to GDP has also increased from 75% in 2017 to 96% today, and this proportion is expected to continue to rise in the future.

In Trump's business career, debt management has been one of his core strategies.He borrowed heavily to promote project development, and overcame difficulties through debt restructuring and finding new lenders when faced with debt repayment difficulties.However, as the 47th president, he inherited public debt problems that went beyond traditional debt management.The continued growth of national debt not only limits fiscal policy flexibility, but also raises market concerns about the long-term fiscal sustainability of the United States.

Since September 2024, the Federal Reserve has cut short-term interest rates by a full percentage point, but long-term interest rates have bucked the trend and risen.This divergence in interest rate trends has triggered market concerns about the sustainability of U.S. debt.Economist Torsten Sløk, chief economist at private equity firm Apollo, pointed out in his January 7 newsletter that this phenomenon is "extremely rare" and that the market may be sending some kind of signal.Although the bond market has not clearly expressed its concerns, the Treasury's continued debt issuance and potential inflation expectations may be important factors driving long-term interest rates higher.

The debt ceiling issue will become one of Trump's top challenges in his second term.The U.S. Treasury is expected to reach the debt ceiling on January 20, 2025, while Congress needs to raise or suspend the debt ceiling before spring or summer to avoid a debt default.However, the process may be full of political games, and some Republicans may use this opportunity to pressure cuts in government spending.Investment firm BTIG pointed out in a January 6 analysis that while a default may ultimately be avoided, political dynamics on Capitol Hill could lead to one of the most intense debt ceiling crises in recent years.

The debt ceiling crisis may not only cause market turmoil, but may also trigger further downgrades of the U.S. credit rating.Debt ceiling gridlock in 2011 and 2023 led to downgrades of U.S. credit ratings by Standard & Poor's and Fitch, respectively.Although these downgrades have not caused material damage to the U.S. credit condition, markets are becoming more sensitive to risk.

In addition, Trump's policy agenda will also be severely constrained by debt issues.First, the government has reached its borrowing limit, and Congress needs to increase the limit before spring or summer of 2025, otherwise it could trigger a debt default.Second, the debt ceiling standoff may lead to another downgrade of the U.S. credit rating.Third, Trump may face being unable to extend expiring tax cuts or even pass any legislation that could further inflate the national debt.For example, extending the 2017 tax cuts for another ten years would add approximately $5 trillion to the debt.However, any attempt by Congress to cut spending could spark strong opposition from interest groups.

In this context, Trump's proposed "Government Efficiency Commission"(led by Elon Musk) could become an important part of his fiscal policy.The committee aims to conduct comprehensive financial and performance audits of the federal government and make recommendations for reform.However, the connection of Musk's business interests to government contracts raises potential conflicts of interest that could undermine the committee's credibility.

In the long run, the United States faces huge challenges to fiscal sustainability.Mandatory spending items such as social protection and Medicare account for most of the federal budget, and spending on these items is expected to continue to grow.At the same time, interest payments on debt are also climbing rapidly, becoming one of the fastest-growing items in the federal budget.According to projections from the Congressional Budget Office (CBO), the federal budget deficit will reach $20 trillion over the next decade, while public debt as a share of GDP could reach 122% by 2034.

Although Trump inherited a strong economic legacy in his second term, his policy choices could pose a threat to economic stability.For example, the implementation of large-scale tariffs could lead to higher prices of imported goods, harm import-dependent industries, and weaken consumer confidence.In addition, large-scale repatriation of immigrants may trigger labor shortages, further pushing up inflationary pressures.Continuing tax cuts could exacerbate the federal deficit and raise borrowing costs.