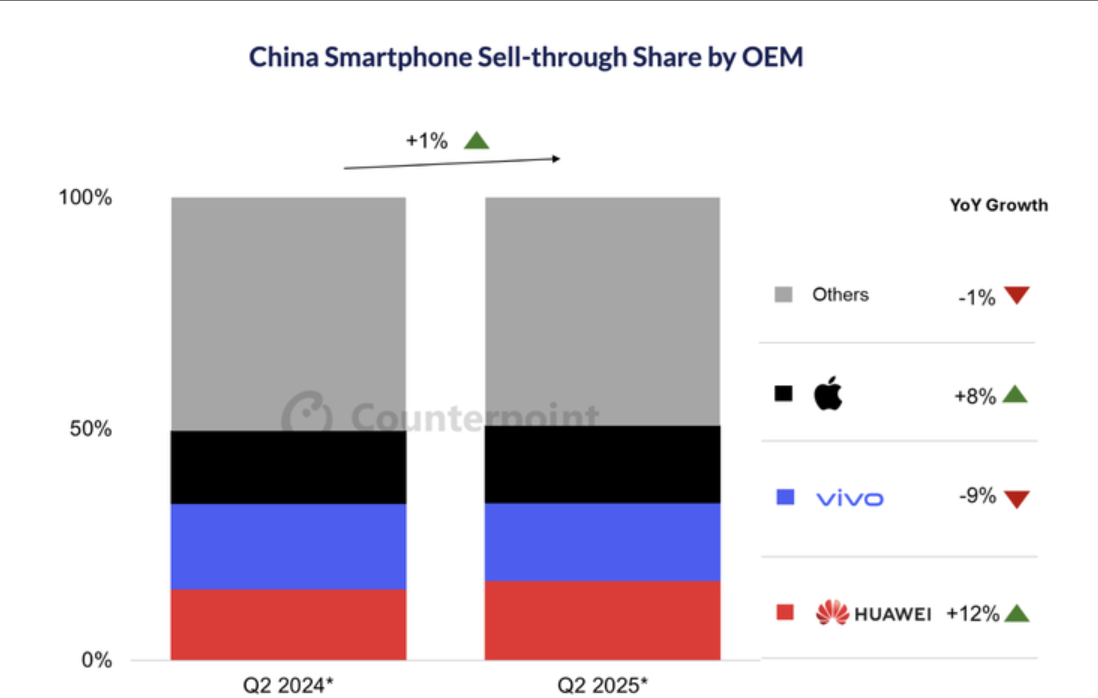

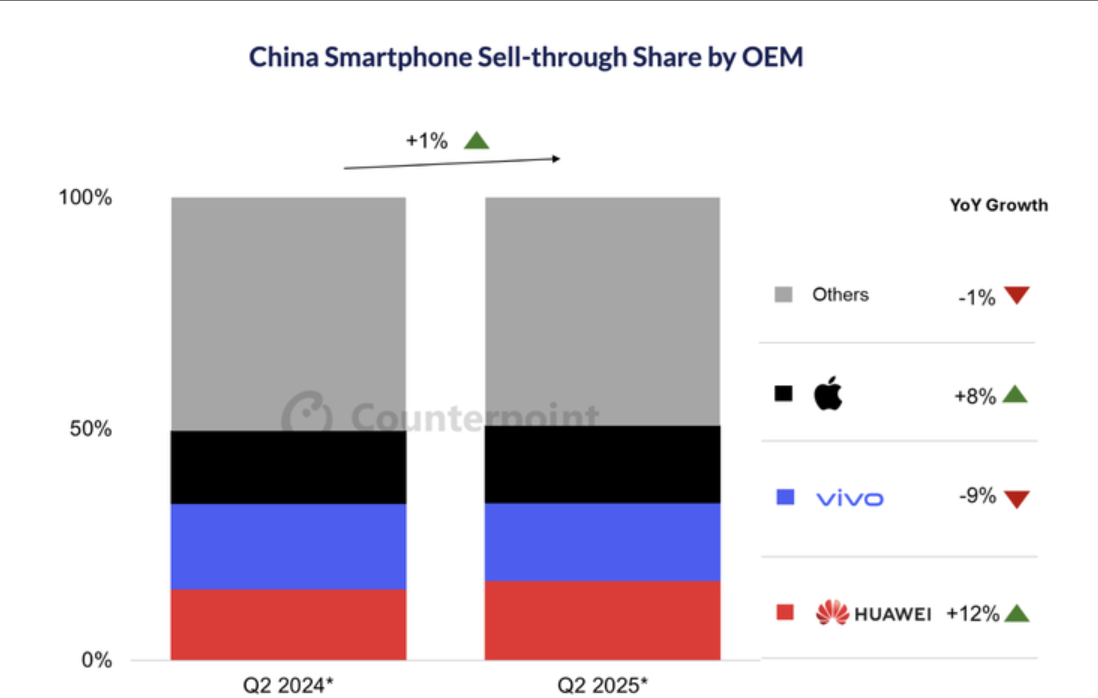

In the second quarter of 2025, iPhone sales in the China market increased by 8% year-on-year.

In early trading of Hong Kong stocks on July 8, Apple concept stocks collectively stepped out of a rising curve.Qiu Ti Technology, Sunyu Optical Technology and AAC Technology all increased by more than 3%, while BYD Electronics simultaneously rose by 2.37%.

Apple sales "reversed"

According to the latest report of research firm Counterpoint Research: In the second quarter of 2025, iPhone sales in the China market increased by 8% year-on-year, ending the two consecutive years of decline since the second quarter of 2023.

The real driver of sales growth is not product innovation, but Apple's aggressive pricing strategy rarely launched in the China market.

In May of this year, Apple adjusted its iPhone pricing system a week ahead of the "618" promotion. Among them, the price of the iPhone 16 Pro 128GB version dropped sharply from 7999 yuan to 5499 yuan through the official price reduction and the "national subsidy" policy, a drop of as much as 31%.This price adjustment made Apple's mobile phone Pro series enter the 5000 yuan price range for the first time in the history of, directly triggering market purchases and even out of stock.At the same time, Apple has cooperated with China's policy to increase the valuation of trade-in, stimulating the demand of wait-and-see users for replacement through dual price leverage.

In addition, the phased easing of geopolitical risks has injected recovery expectations into the supply chain.

In mid-April, the United States announced a memorandum to exempt "reciprocal tariffs" on computers, smartphones and other products, pushing A-share Apple concept stocks such as Yingtong Communications and Ultrasound Electronics to open at daily limits.Subsequently, on May 12, China and the United States reached an important consensus on establishing an economic and trade consultation mechanism, further alleviating market concerns about the escalation of tariff conflicts.

BOC International pointed out in its analysis that in this context, combined with the lifting of the EDA ban by the United States and the conclusion of the U.S. -Vietnam trade agreement, the valuation repair of the consumer electronics sector is sustainable.It is particularly noteworthy that the share prices of most supply chain companies are still lower than the level in early April, and the advance stocking of goods by U.S. customers to avoid potential tariff risks may cause fruit chain companies to exceed expectations in the second quarter.

Some analysts also pointed out that this round of market prices for Apple concept stocks is essentially a long-suppressed valuation repair.

Cinda Securities earlier stated that valuations have entered an attractive range after the tariff policy led to a sharp correction in high-quality consumer electronics stocks.CLSA also emphasized that supply chain companies such as Lixun Precision and AAC Technology have regained investors 'attention due to low valuations.Investors should note that supporting the long-term recovery of the fruit chain requires stronger product logic.

Technology giants break through in midsummer

The phased easing of geopolitical risks and optimism about economic fundamentals have also spread to U.S. stocks.

On April 11, the U.S. Department of Commerce announced an exemption from "reciprocal tariffs" on smartphones, personal computers and other electronic products, unloading the shackles of giants such as Apple and Nvidia that rely on global supply chains; subsequently, the U.S. -Vietnam Trade Agreement was reached and the EDA software ban was lifted, further releasing the momentum of valuation repair in the consumer electronics sector.

Since April, the "Magnificent Seven" index has rebounded strongly, with a single-day gain of 14%. Among them, Apple's share price surged 15.33%, followed by Nvidia's rise of 18.72%.BOC International pointed out that although the share prices of most supply chain companies are still lower than the level in early April, the advance stocking of goods by American customers to avoid potential tariff risks may cause the second quarter financial report of fruit chain companies to exceed expectations, and the current market is still sustainable.

Among them, artificial intelligence is becoming a core variable in reshaping the competitive landscape of consumer electronics.China Galaxy Securities predicts that the penetration rate of AI mobile phones will reach 34% in 2025, and the penetration rate of AI PC will jump from 0.5% in 2024 to 79.7% in 2028. The technological revolution is giving rise to a new round of replacement cycles on the hardware side.Analysts at Goldman Sachs have observed that demand driven by Apple Intelligence has quietly begun. They expect iPhone shipments to increase by 10% year-on-year in the second quarter, and service business revenue to increase by 11%.

This explosive growth of end-side AI not only reshapes the consumer experience-for example, Apple plans to optimize Siri through device-side data analysis and create a "HER"-style "personal AI assistant"-but also promotes the value differentiation of the industrial chain.

Reflected in the capital market, institutions have begun to adjust their firepower allocation.CITIC Securities clearly recommends grasping the "AI main line" in the second half of the year and focusing on laying out the AI Agent and computing power industry chain, covering management software, medical IT, servers and other sectors; at the same time, taking into account structural opportunities such as robots and low-altitude economy.

Soochow Securities Research reported that in this round of index breakthroughs, finance is the booster of upward breakthroughs. Judging from this week's market conditions, its role may be coming to an end.After financial stocks lead the index to set the stage, the growth sector is expected to "take the stage", especially in the pan-tech direction with advantages in current chips and positions.At present, the stock price position and congestion of some industry trend varieties are still at historically low levels. In particular, the proportion of transactions in the AI sector is still at the historical ranking of 23% since 2023. The artificial intelligence and computing power industry chains are in the direction of technological growth. Links have configuration value.

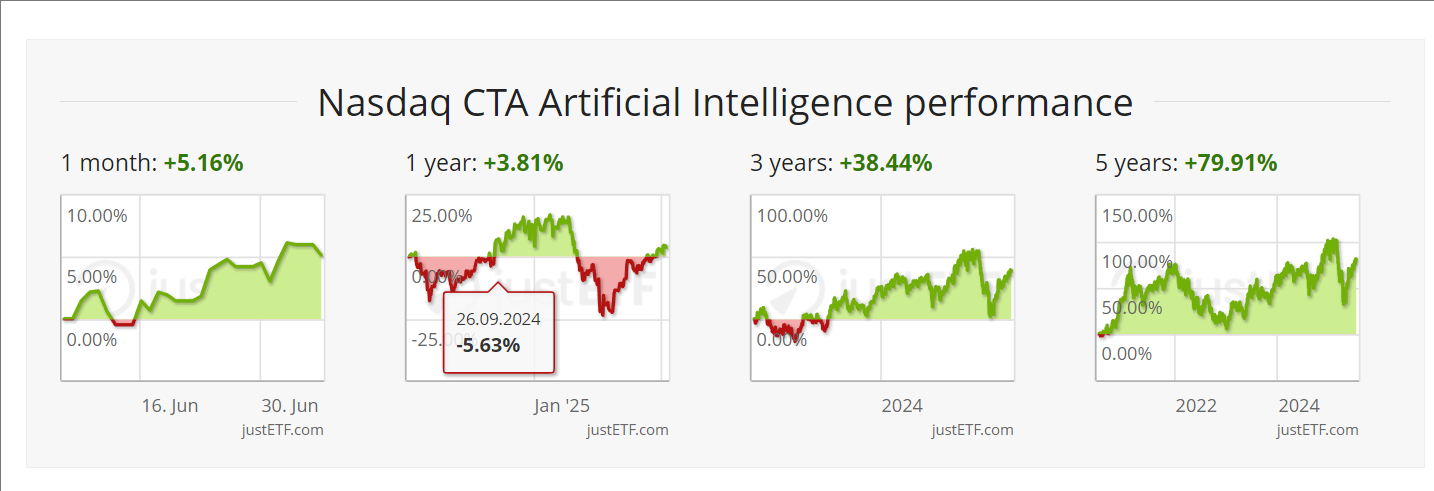

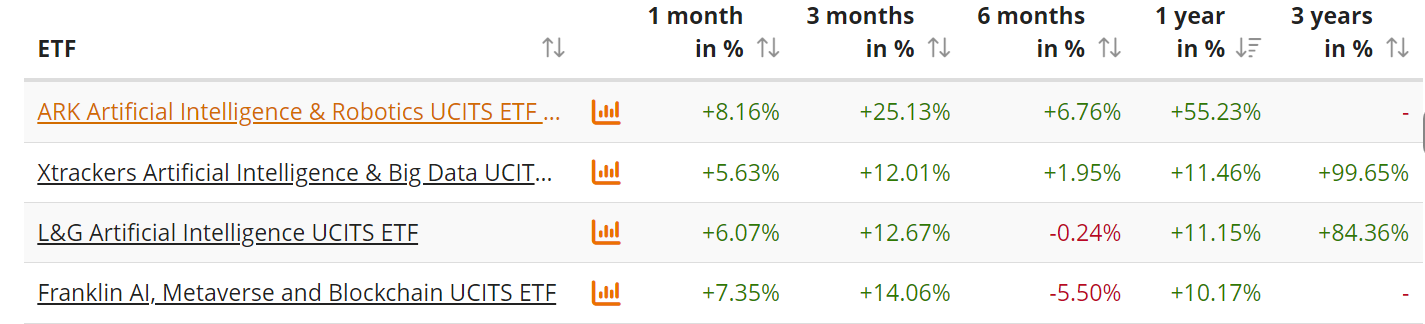

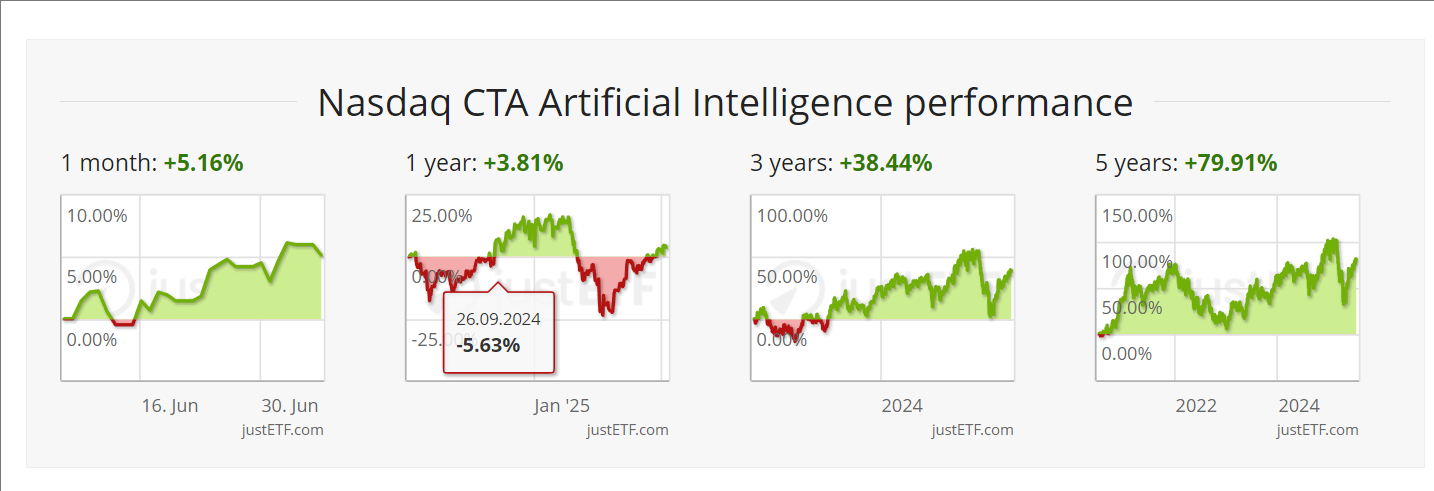

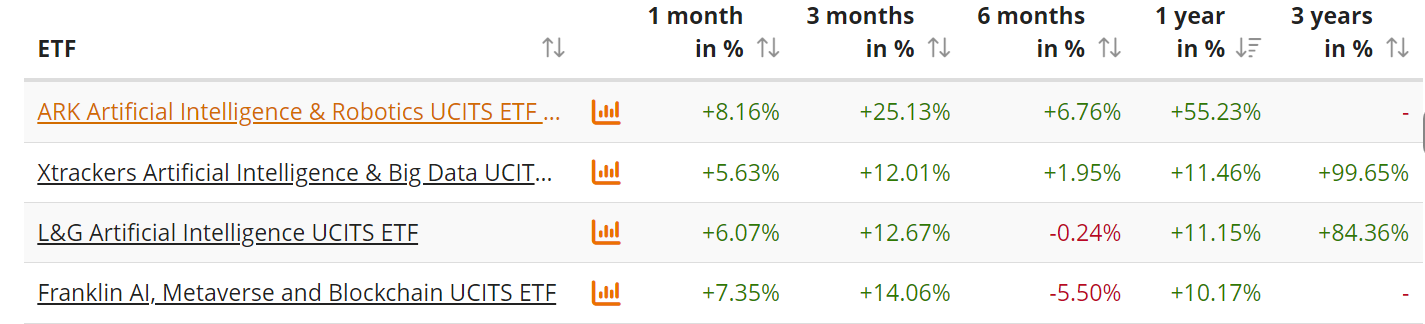

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Starting from the second half of 2025, generative AI will penetrate into vertical fields such as medical, finance, and industry in the rigid demand of reducing costs and increasing efficiency, opening a true "enterprise consumption stage."This evolution of software and hardware collaboration has upgraded AI investment logic from a simple arms race for computing power to a revaluation of the value of the industry-wide efficiency revolution.