U.S. customers such as Apple and Nvidia placed orders at the end of the first quarter.

On April 17, TSMC, the world's leading semiconductor OEM leader, announced its Q1 financial report.Data showed that TSMC's revenue in the first quarter reached NT$839.25 billion (approximately US$26.36 billion), a year-on-year increase of 42%, and net profit surged 60.3% year-on-year to NT$361.6 billion, both exceeding market expectations.

Compound driving force for high performance growth

The unexpected performance of the first quarter's results was essentially the result of the resonance between the intergenerational dividend of technology and geopolitical pressure.

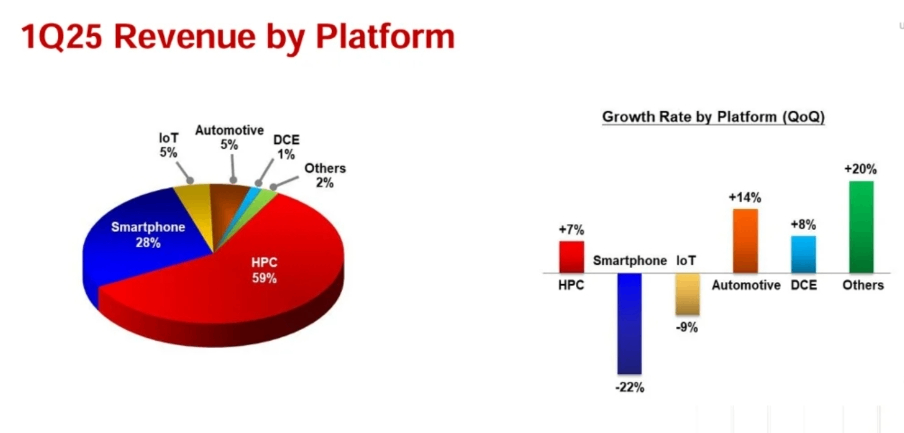

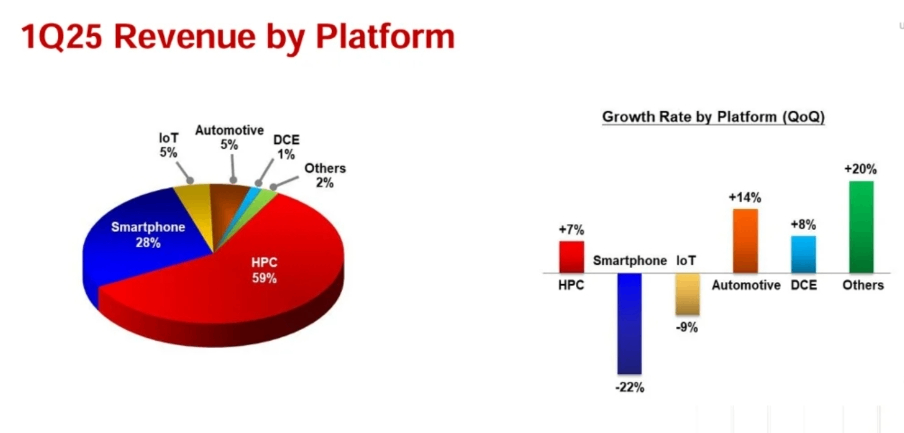

In terms of revenue structure, high-performance computing (HPC) ranks first with 59%, of which AI accelerators have contributed significantly-the earnings call revealed that AI-related revenue has accounted for 15%-17% of total revenue, compared with 2024 The growth has tripled in the same period and is expected to double again in 2025.

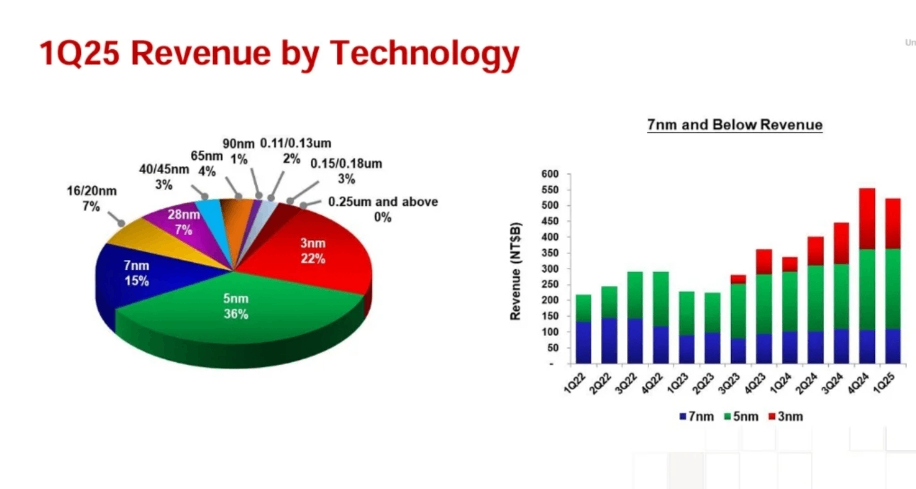

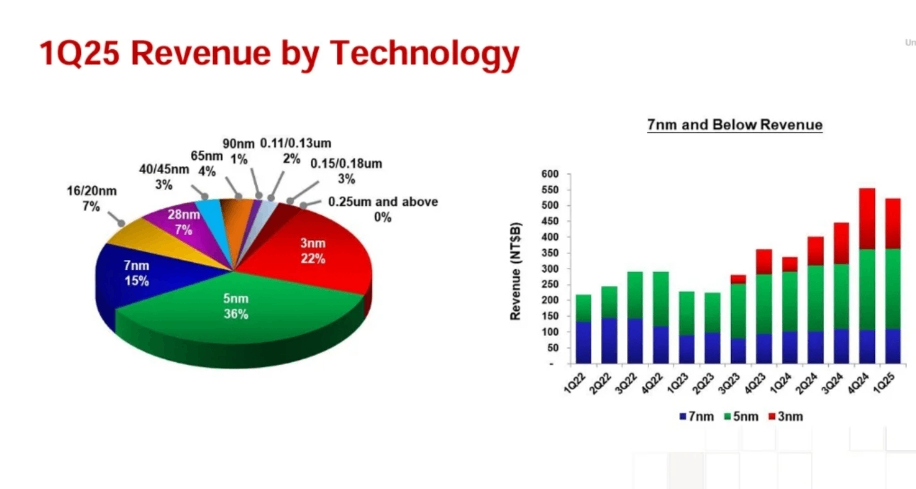

This growth momentum is inseparable from TSMC's absolute dominance in advanced processes: 3nm process revenue accounts for 22%, 5nm accounts for 36%, and 7nm and below processes together contribute 73% of wafer revenue. The pricing power of building technical barriers was demonstrated in the gross profit margin of 58.8%.

However, another hidden thrust comes from the "tariff defensive hoarding" in the supply chain.

The 32% import tariff originally scheduled to be implemented by the Trump administration on April 2 forced U.S. customers such as Apple and Nvidia to place orders at the end of the first quarter.According to supply chain estimates, orders for chips related to smartphones and notebooks alone increased by 7%-8% month-on-month, directly pushing up inventory turnover days to historical highs.

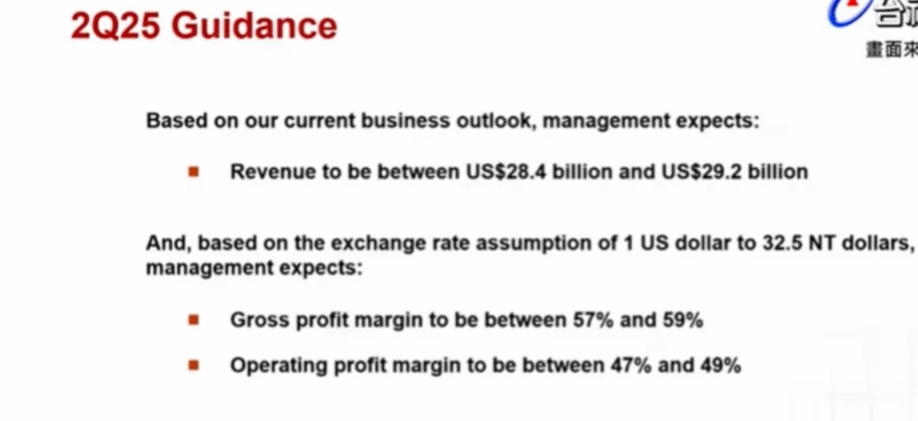

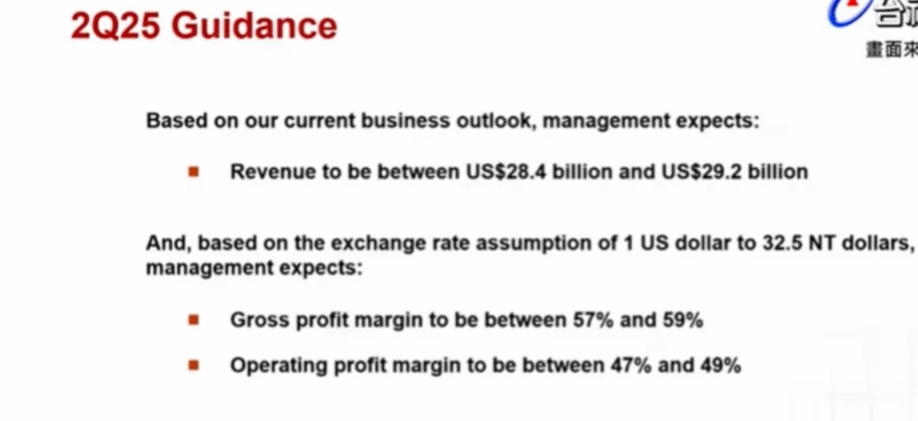

Although this irrational prosperity boosted performance in the short term, it overdrew subsequent demand. Although the revenue guidance for the second quarter of US$28.4 - 29.2 billion was higher than market expectations, the month-on-month growth rate was already showing signs of fatigue, suggesting that the hoarding effect subsided. Real demand is facing a test.

Offensive and defensive logic of capital expenditure

Faced with geographical risks, TSMC's response strategy is characterized by "technological radicalization" and "production capacity dispersion".

Of the US$38 - 42 billion capital expenditure plan confirmed by the French Commission, 70% will be invested in the research and development of advanced processes of 2nm and below. The expansion plan of Kaohsiung and Nanke factories will be accelerated. It is expected that 2nm production capacity will cover the eighth phase of the factory by the end of 2025.This kind of near-"arms race" investment stems from a deep bet on the iteration of AI computing power: JPMorgan Chase estimates that TSMC's share of the data center AI accelerator market is close to 100%, and the 2nm process is expected to produce single-chip transistors after mass production. Increase the density by another 50%, further consolidating its irreplaceability.

At the same time, overseas production capacity layout has become a must-have option to spread risks.

The total investment in Arizona's three wafer fabs has increased to US$165 billion. The first 4nm factory is about to be mass-produced. AMD and Nvidia have announced that some high-end chips will be transferred to U.S. factories.Although this kind of "localized production" can avoid the impact of tariffs, it faces the side effect of soaring costs-the labor cost of U.S. factories is three times that of Taiwan, and the supply chain supporting facilities are not yet complete.

Goldman Sachs estimates that overseas expansion may reduce TSMC's gross profit margin by 0.8-1.2 percentage points in 2025, which forms a subtle tension with management's commitment to "53% long-term gross profit margin."

Valuation reconstruction under geographical changes

The real anxiety of the market is that the semiconductor industry is shifting from being dominated by the technology cycle to being dominated by the political cycle.The "Schrödinger" threat of Trump's tariff policy-suspended for 90 days but not lifted-is like a sword of Damocles.

If the 32% tariff is finally implemented, TSMC may be forced to adjust its pricing strategy: Morgan Stanley's model shows that every 1% tariff transmitted to customers will reduce its revenue by 0.3%-0.5%.The more far-reaching impact lies in the restructuring of the global supply chain. Samsung and Intel are taking the opportunity to lobby U.S. companies to transfer orders. Although their 3nm yield is still 15-20 percentage points behind TSMC, the political premium may distort business logic.

In this context, TSMC's valuation system is facing restructuring.

Although the current 25 times PE is lower than the five-year average, the geo-risk premium has not yet been fully priced.Deutsche Bank pointed out that if the tariffs are fully implemented, the forward EPS may be revised down by 8% to 12%, which is in sharp contrast to JPMorgan Chase's optimistic forecast of "revenue of 220 billion US dollars in 2029".Investors are voting with their feet-although U.S. stocks rose 4% after the earnings report, the cumulative decline was still 20% during the year, reflecting the market's rebalancing of "technological moat" and "political fragility."

Invisible smoke: The next battlefield is encapsulated

When the industry focuses on the process miniaturization competition, TSMC has quietly opened up a second battlefield.CoWoS advanced packaging technology revenue has jumped from 8% in 2024 to 10%, and non-AI applications are about to increase.This ability to integrate logic chips, memory chips and interconnection technology three-dimensionally allows TSMC to occupy a pivotal position in the trend of AI chip customization.

According to the supply chain, NVIDIA Blackwell chips have shifted from CoWoS-S to a more complex CoWoS-L architecture, increasing the package value of a single chip by 30%. TSMC's CoWoS production capacity in 2025 will reach 599,000 pieces, an increase of 45% compared with 2024.Breakthroughs in packaging technology may reshape the value distribution pattern of the semiconductor industry.