The trigger for this crisis goes far beyond the imbalance between supply and demand at the technical level.

On May 21, the auction of 20-year US Treasury bonds was cold, and the US market suffered three kills.

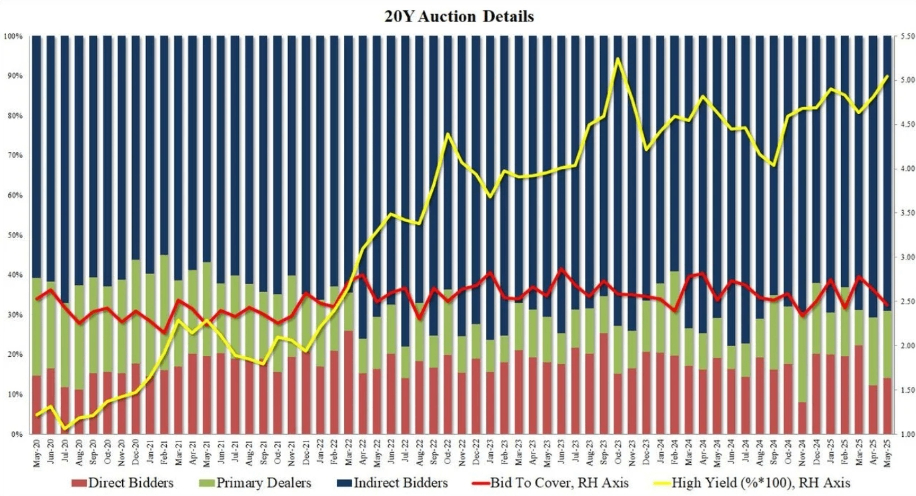

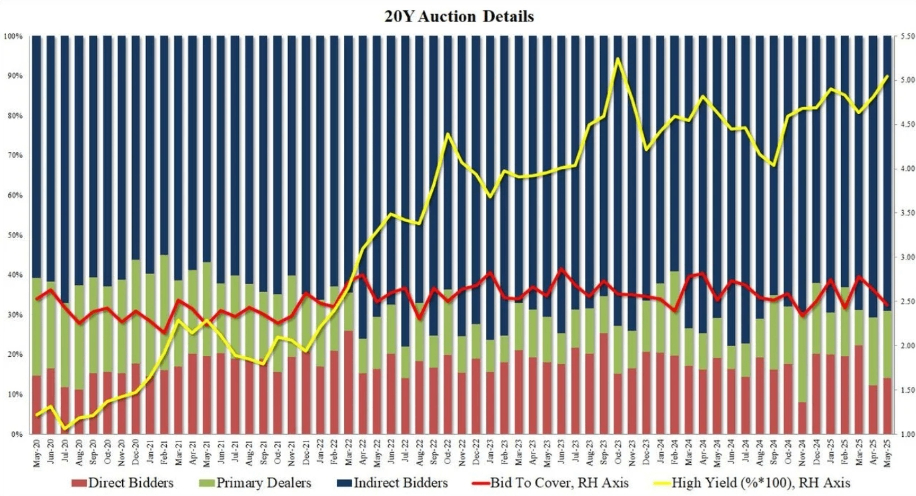

Wednesday's 20-year U.S. bond auction was the first long-term bond auction since Moody's stripped the U.S. of its Aaa rating last week.This financial incident, which Wall Street called a "must-watch TV show", ended with a bleak ending that all participants did not want to face.When auction data released by the U.S. Treasury Department showed that the winning bid rate reached 5.047%, 1.2 basis points higher than the pre-issue rate, market tensions were instantly ignited.

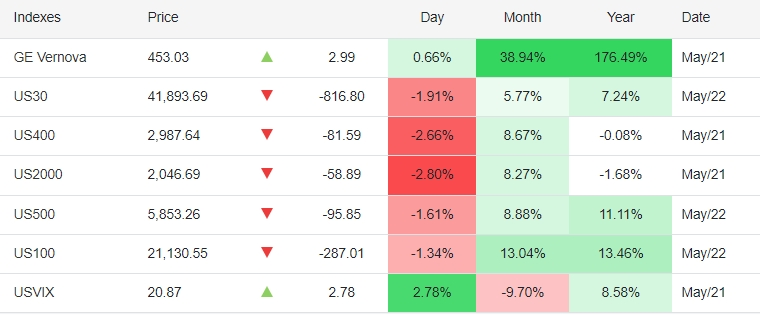

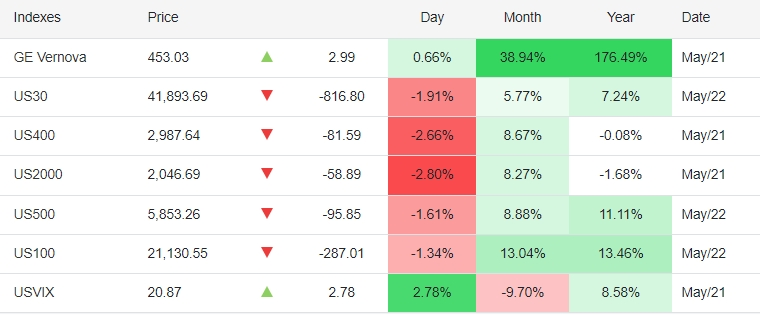

This not only set the largest tail spread in the past six months, but the bid multiple also slipped from a six-month average of 2.57 to 2.46, directly exposing the sharp contraction of international capital's demand for U.S. bonds.The auction was like a domino that was knocked down, triggering a collective plunge of the three major U.S. stock indexes. The Dow Jones index evaporated more than 800 points in a single day, the S & P 500 and Nasdaq both fell more than 1.4%, while the US dollar index fell below the 100 mark to 99.586, forming a rare "triple kill between stocks and bonds" situation.

The trigger for this crisis goes far beyond the imbalance between supply and demand at the technical level.Moody's clearly pointed out in its downgrade report that the proportion of U.S. federal debt to GDP will climb to 134% in 2035, and the tax cut bill pushed by Trump is expected to increase the fiscal deficit by an additional US$3 -5 trillion, which makes U.S. debt The long-term credit foundation has been fundamentally questioned.

George Saravelos, head of foreign exchange research at Deutsche Bank, pointedly pointed out that the anomaly of the simultaneous weakening of the US dollar and US debt is essentially a collective protest by foreign investors against the "US double deficit" financing model-when the market began to demand a higher risk premium to compensate for the cost of holding US debt, the "risk-free" aura of US dollar assets has cracked.This sentiment is confirmed in the derivatives market: Open interest on the Chicago Mercantile Exchange shows that large amounts of money are betting that the yield on 10-year U.S. Treasury bonds will exceed the 5% mark in the next few weeks. This gathering of unilateral short positions is the first time since yields hit 5% at the end of 2023.

It is worth noting that this wave of U.S. debt selling shows obvious term structure characteristics.The yields on the 20-year and 30-year treasury bonds soared to 5.127% and 5.094% respectively, while the 10-year yield also exceeded 4.6%. This "bear steep" trend suggests that the market is repricing long-term inflation risks and debt sustainability.

Jerry Chen, an analyst at Jiasheng Group, pointed out that the current rise in long-term yields is not due to expectations of overheating, but to a concentrated outbreak of contradictions between supply and demand in the U.S. bond market. As foreign central banks and sovereign funds reduce their holdings of U.S. bonds, primary dealers are forced to take on more shares, and this structural change has forced the Ministry of Finance to raise the issue rate to attract buyers.What is even more worrying is that this pressure is forming a negative feedback loop: higher financing costs exacerbate fiscal deficits, and widening deficits further suppress bond demand. This death spiral is accelerating under the catalysis of Trump's tax cuts.

In this U.S. debt storm, the changes in traditional safe-haven assets are equally thought-provoking.While the price of gold exceeded US$3300/ounce, Bitcoin simultaneously hit a record high of US$109,770. This "double hedging" pattern subverts the classic asset allocation theory.

On the surface, the progress made by the GENIUS stablecoin Act in the Senate has injected policy certainty into digital currencies, and the change in attitude of traditional institutions such as JPMorgan Chase has brought about incremental funding expectations.But at a deeper level, Bitcoin's bucking trend actually reflects global capital's distrust of the legal currency system. When the "ultimate collateral" of US debt wavers, decentralized assets are becoming a new tool for hedging sovereign credit risks.

Bridge Aqui Jindalio's warning is particularly harsh at this moment: Moody's downgrade only reveals the tip of the iceberg of the U.S. debt crisis. The real risk is that the U.S. government may pass on costs through monetization of debt, which will cause holders to suffer an implicit default.

The sharp fluctuations in the market have also exposed the dilemma for policymakers.Federal Reserve officials have recently frequently signaled that they are "not in a hurry to cut interest rates" in an attempt to find a balance between controlling inflation and maintaining financial stability.However, when the 10-year U.S. bond yield exceeded the key psychological threshold of 4.5%, U.S. stocks with high valuations immediately showed vulnerability-the S & P 500 forward P & E ratio had reached 21.7 times, far exceeding the historical average of 15.8 times. Rising capital costs are eroding corporate earnings expectations.

Morgan Stanley strategist Michael Wilson warned that if U.S. bond yields continue to rise, long-term assets such as technology stocks will bear the brunt. This pressure has begun to appear amid the general decline in Nasdaq components.The more far-reaching impact is that the function of U.S. debt as an anchor for global asset pricing is weakening. When liquidity cracks appear in this US$53 trillion market, cross-border capital flows and exchange rate fluctuations may enter a new cycle of turmoil.