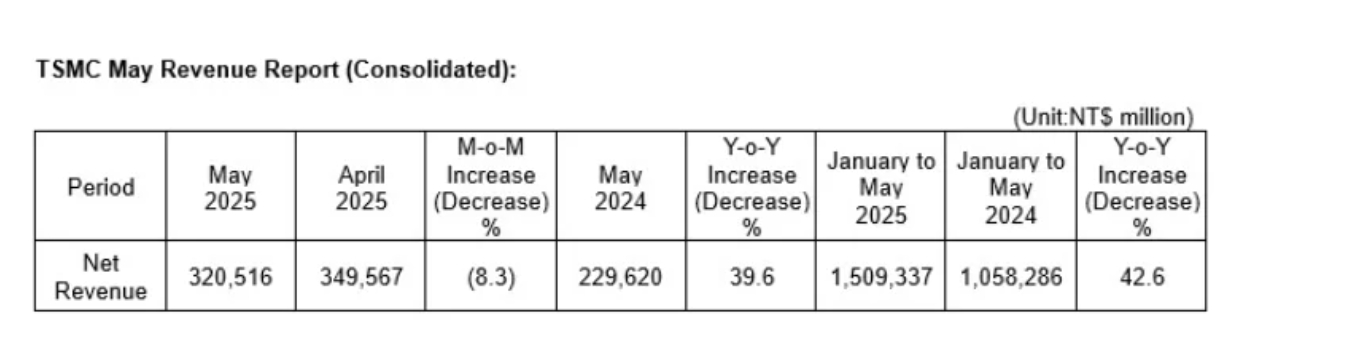

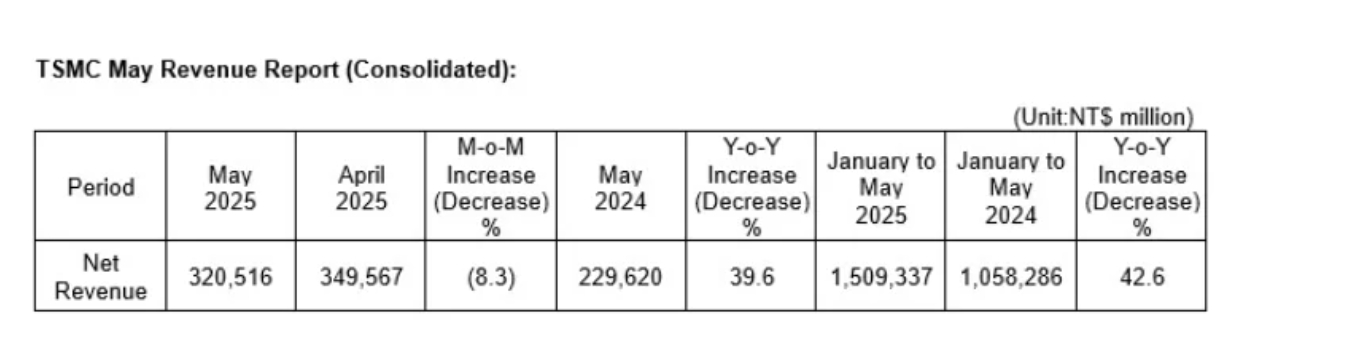

On Tuesday, June 10, global chip foundry giant TSMC announced its May revenue report. Although sales of NT$320.52 billion fell by 8.3% month-on-month, they still increased by 39.6% year-on-year. Cumulative sales in the first five months reached NT$1.51 trillion, a year-on-year increase of 42.6%. Behind this set of figures, global demand for AI computing power is still very strong.

TSMC's profits in 2025 may hit another new high

In the field of wafer foundry, TSMC's dominance has formed a "winner-takes-all" pattern.In the first quarter of 2025, when the overall revenue of the global wafer foundry industry fell by 5.4% quarterly, TSMC took the lead with a market share of 67.6%.Its moat comes from intergenerational rolling: 3 nanometer processes contribute 22% of revenue, 5 nanometer processes account for 36%, and 7 nanometer processes account for 15%. The three together account for 73%, an increase of 6 percentage points from the previous quarter.While competitors are still fighting on the 10-nanometer battlefield, TSMC has launched a charge for the 2-nanometer GAA process and is expected to be mass produced by the end of 2025, with a price of up to US$25,000 per piece.

Computing anxiety has eased and the OEM profit range has opened. TSMC predicts that the company's profits will hit a new high in 2025.

At last week's shareholders meeting, TSMC Director and President Wei Zhejia said that sales growth in US dollar terms in 2025 is expected to be in the middle of the 20% range, and profits will hit a record high.

Wei Zhejia said that the tariff policy has potential impacts such as uncertainties and risks, but so far,"no changes in customer behavior have been seen," so he maintains his outlook for this year's full-year revenue.

Wei Zhejia emphasized that market demand remains strong and wafer manufacturing is expected to continue to benefit from strong demand for AI and moderate recovery in other end markets.

The demand for AI computing power has become a perpetual motion machine for TSMC's growth.

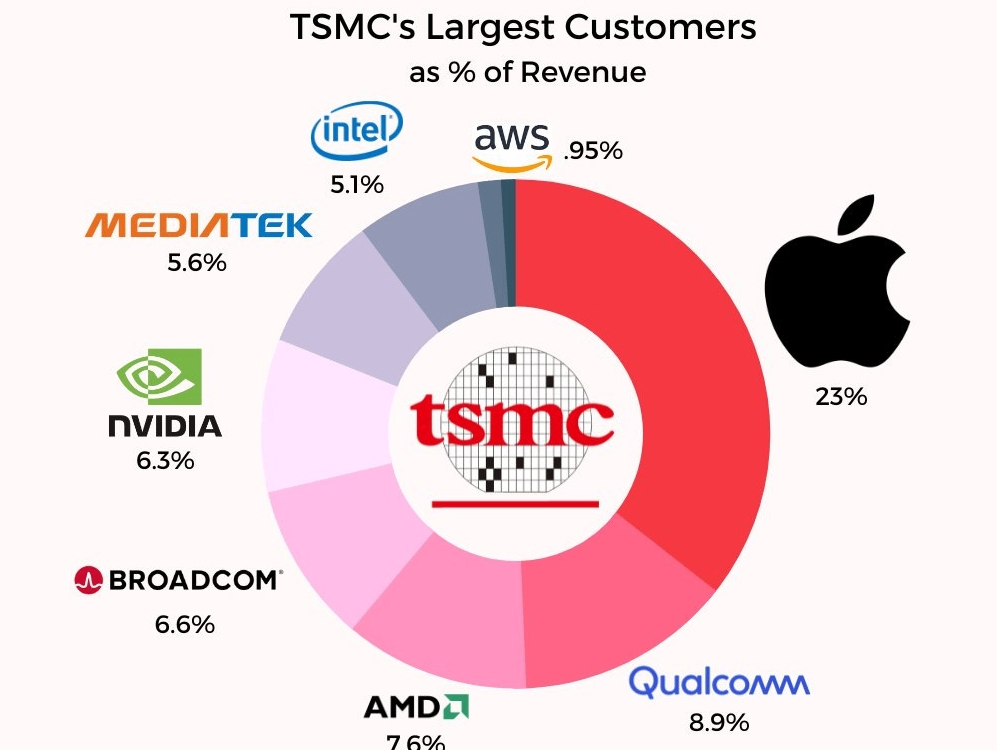

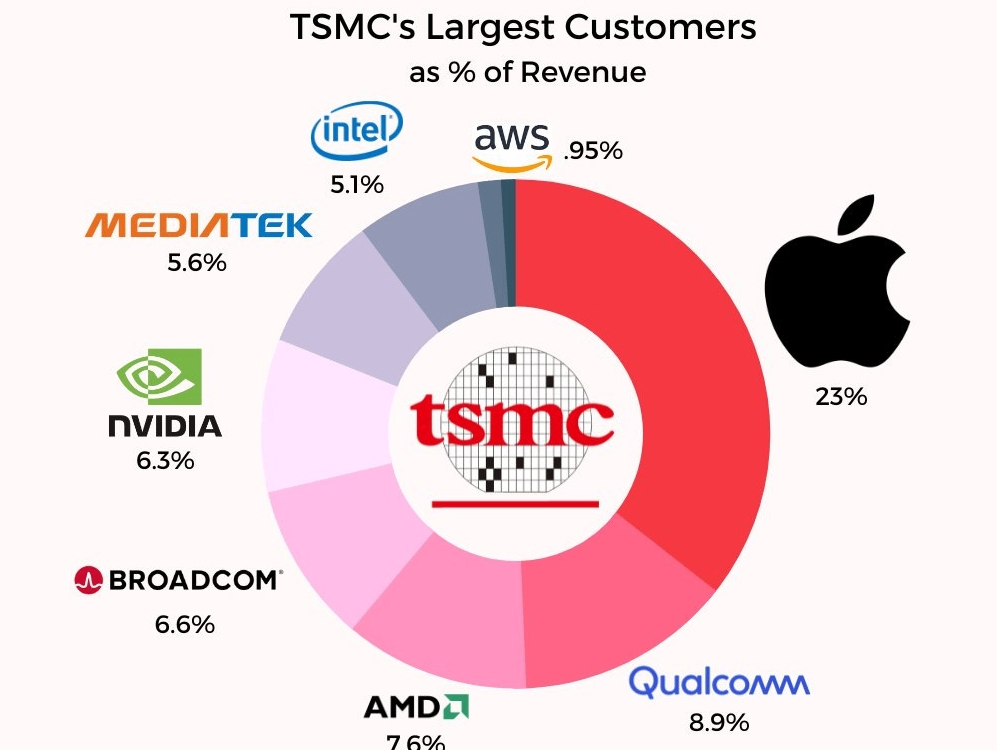

HPC (High Performance Computing)-related revenue surged by more than 70% year-on-year, accounting for nearly 60% of total revenue.NVIDIA's GPUs, AMD's accelerators and the data center expansion of cloud giants such as Microsoft and Amazon have jointly pushed up orders.It is predicted that TSMC's AI accelerator chip sales will double in 2025, with a compound growth rate of 45% from 2024 to 2029.Wei Zhejia even bluntly said: "Only one of all major AI chip manufacturers has not placed an order." The 5/3-nanometer process capacity utilization rate has reached 100%.

Faced with surging demand, TSMC's production capacity expansion can be called "radical".The 3-nanometer production line is rushing to a monthly production capacity of 125,000 pieces, a 25% increase from the original target; although the Arizona factory faces the challenge of 30% higher costs than the local market, it still starts 4-nanometer mass production ahead of schedule.Even more eye-catching is its $165 billion U.S. investment plan to add three new wafer fabs and two advanced packaging plants in an attempt to turn "silicon shield" into geopolitical insurance.

The capital market cast a vote of confidence in this.TSMC's share price soared 74% during the year, and its market value exceeded US$930 billion, pointing to the trillion-dollar mark.Goldman Sachs raised its target price by 19%, and Citigroup and Morgan Stanley followed suit. The logic is highly consistent: the expected price increase of 3/5 nanometer chips is compounded by the siphon effect of AI orders.JPMorgan Chase also predicts that AI will contribute 35% to TSMC's revenue by 2028.

AI prosperity leads to ecological reconstruction of the semiconductor industry

Behind the prosperity of TSMC is the unprecedented iteration of computing power demand in the United States.

According to the latest industry tracking data, the global AI chip market in 2025 has more than five times that of 2021. The energy consumption of training a single top-level large model reaches the daily power consumption level of a small town.The explosive growth in demand has caused significant computing power bottlenecks between 2023 and 2024-companies have been waiting for GPU quotas for months, and key areas of cloud computing platforms often encounter warnings of saturation of computing power allocation.

The reconstruction of the industry pattern is not only reflected in the TSMC level, but also resonates with the entire industrial chain.

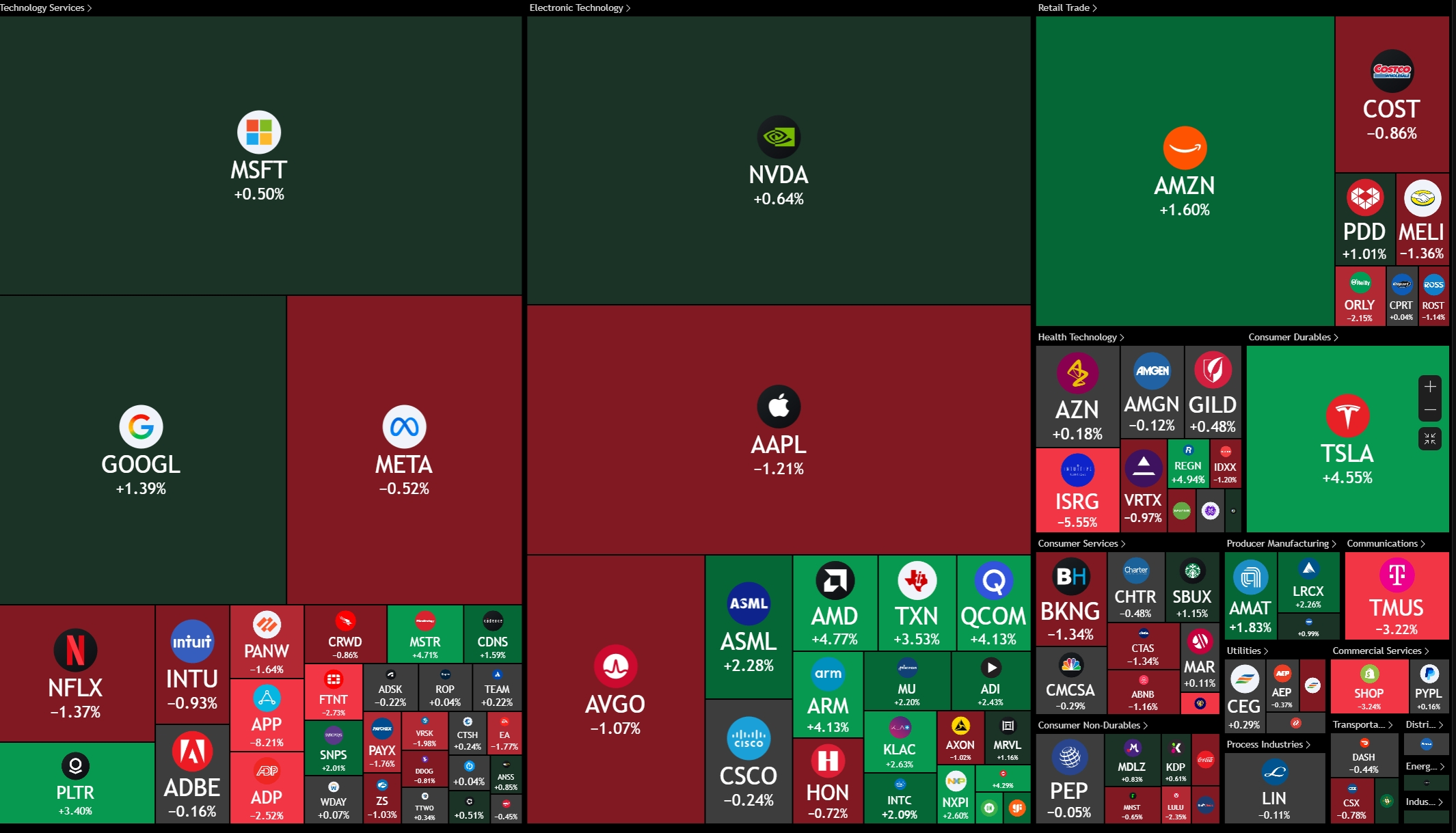

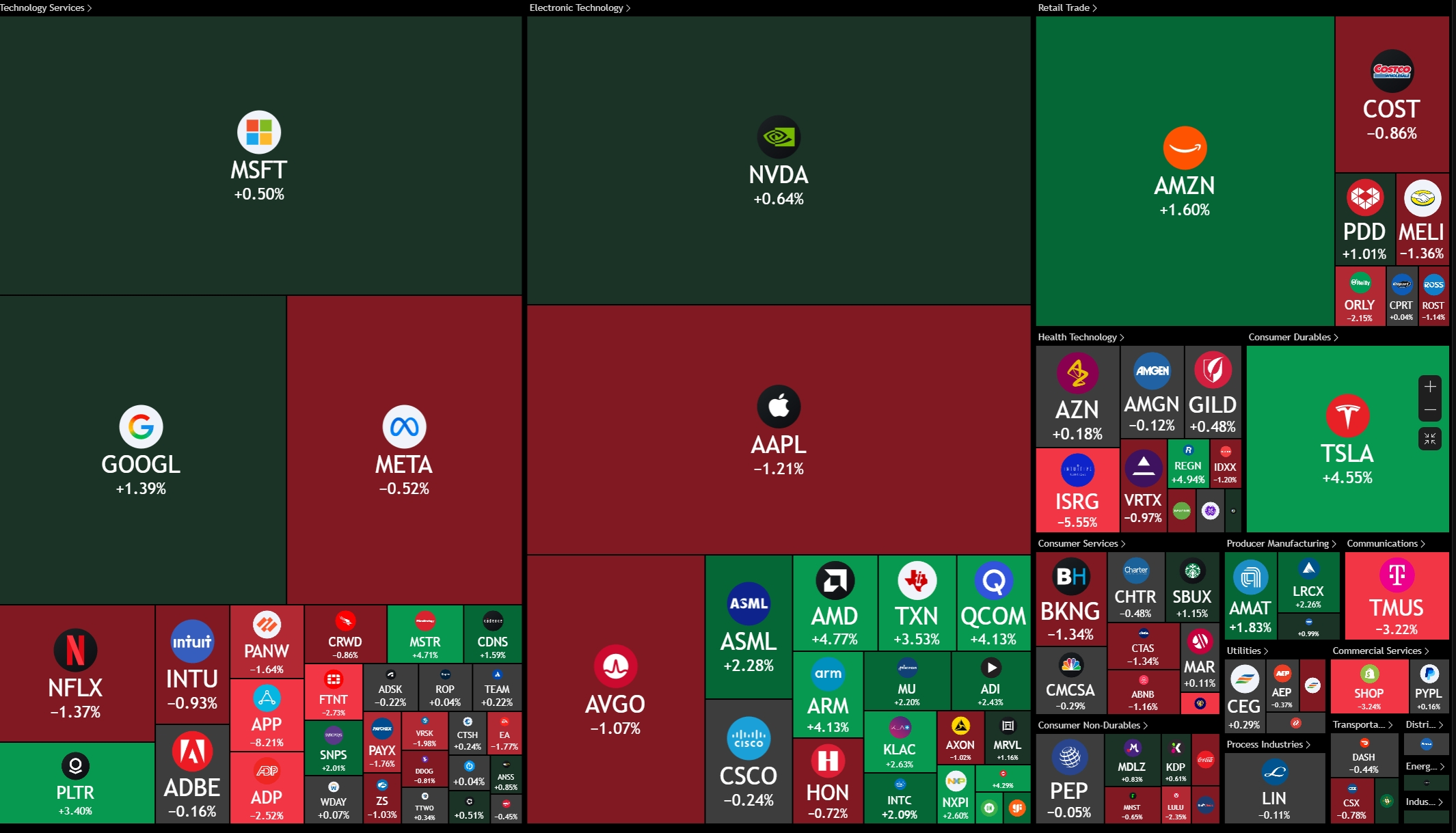

Upstream equipment manufacturer ASML's quarterly shipments of the latest EUV lithography machines increased by 28% year-on-year; silicon wafer suppliers announced two consecutive price increases in 2025, but they were still unable to meet the surge in orders, and the wave of wafer factory expansion swept across Asia and Arizona.Design manufacturers such as Nvidia's next-generation AI GPUs based on TSMC have been locked in full-year production capacity by many technology giants in advance.At the software level, demand for compilers and operator libraries optimized for specific AI hardware has soared, giving rise to a group of software developers whose valuations are rising rapidly.The entire technology industry is undergoing all-round resource tilt and capital reset around the AI computing system.

Capital markets have keenly captured the fundamental leap in the ecological status of semiconductors in this transformation.

The Philadelphia Semiconductor Index hit record highs in May 2025, with the equipment and foundry sectors leading the gains.TSMC's share price continues to receive support from institutional investors after its surge in Q1 in 2025. Its solid technical barriers and irreplaceable production capacity role have become the core investment logic of capital.

Goldman Sachs pointed out in an in-depth report that the AI industry has entered a stage of "hardware-driven prosperity", and semiconductor manufacturing is the strategic commanding height of this stage.This is not an isolated trend. From the continued funding of the Chip and Science Act on Capitol Hill to the intensive capital injection of Silicon Valley venture capital into AI start-ups, the entire resource allocation for technological innovation clearly points to the building of underlying semiconductor capabilities.

Faced with such historical opportunities, how should we ordinary people invest?

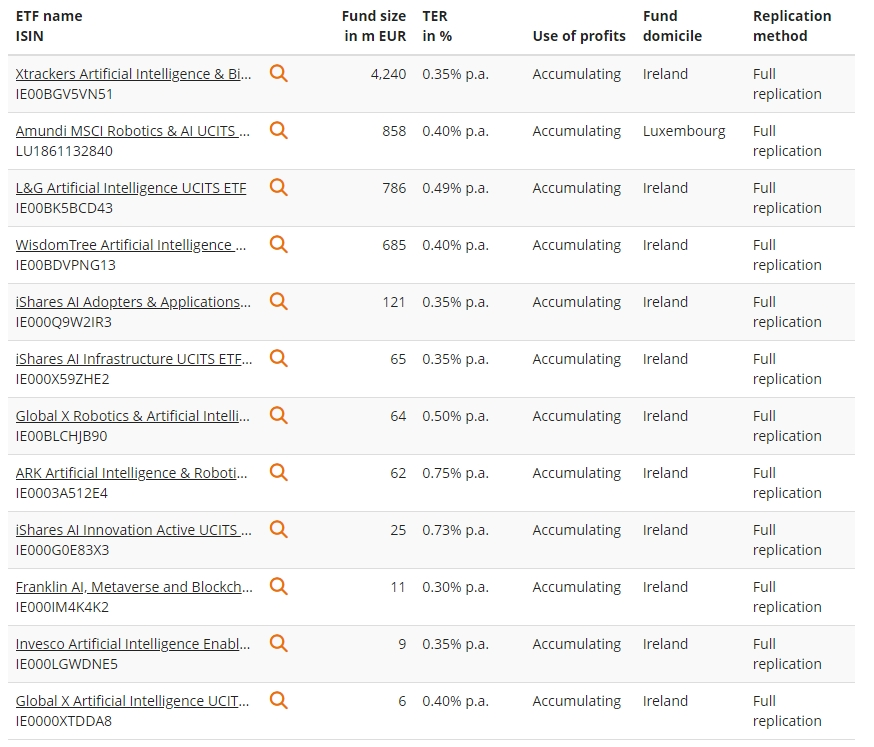

The stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.

Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

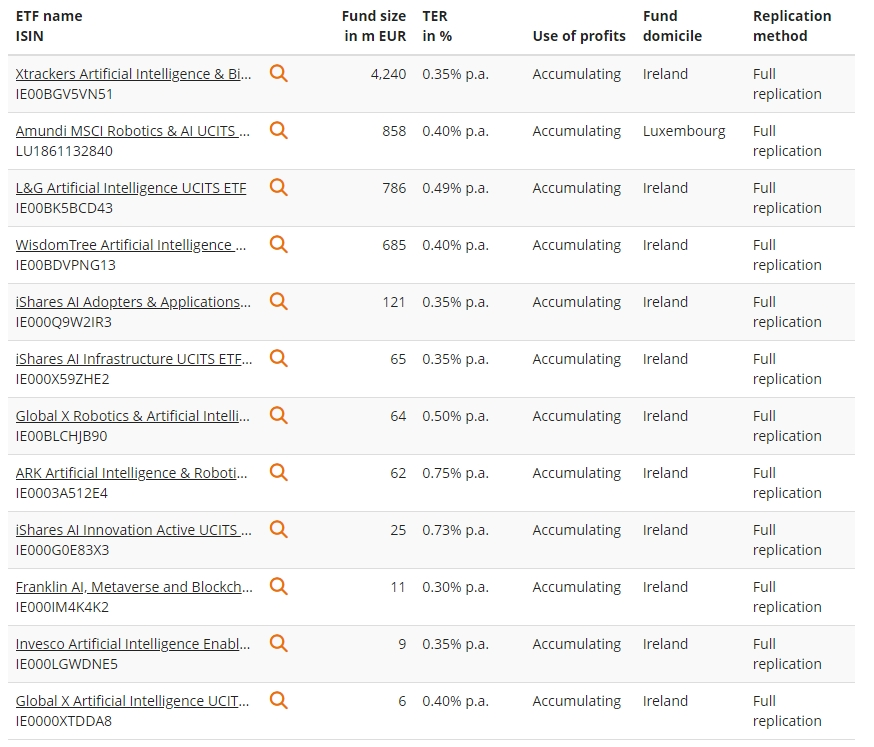

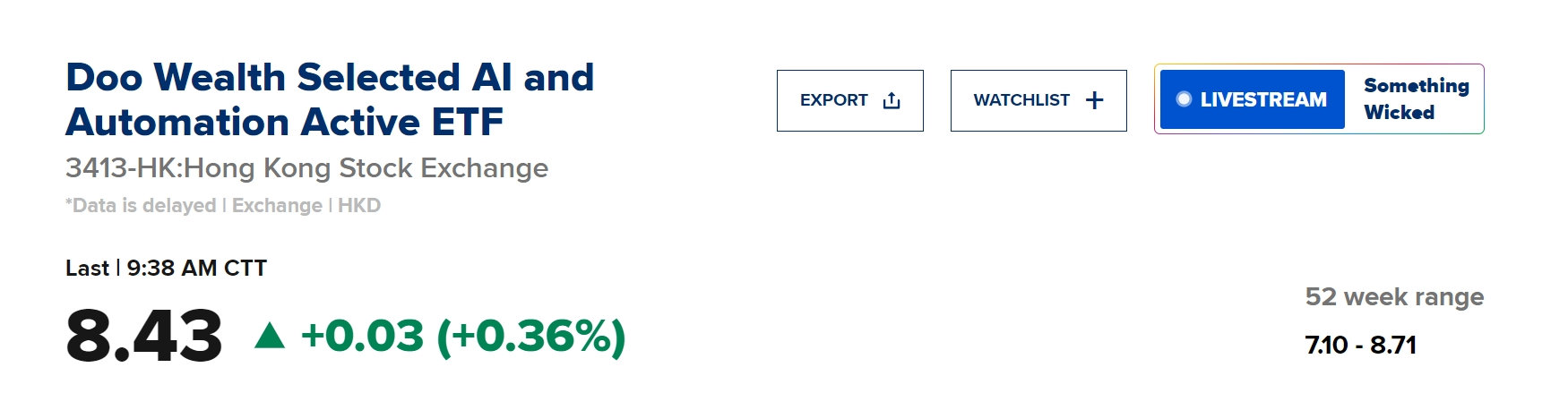

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

I wish everyone a smooth investment ~