On June 22, a special fleet of vehicles appeared on the streets of Austin, Texas for the first time-10 to 20 Model Y vehicles with a prominent "Robotaxi" logo printed on their bodies, driving towards city roads without a driver.

Without hype or media promotion, Tesla's self-driving taxi service, which has been preparing for many years, has officially entered the actual stage.

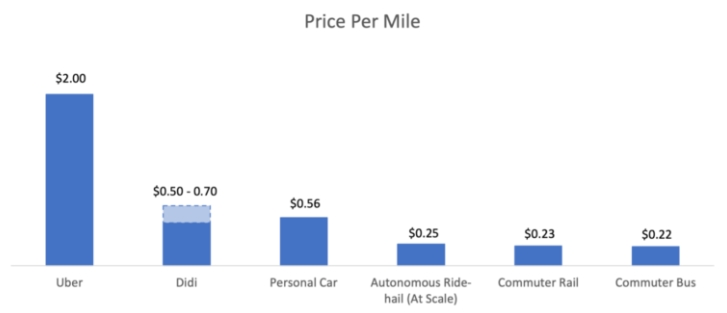

Tesla said that passengers only need to pay a fixed fee of $4.20 to ride the Robotaxi, and the service is currently operating from 6 a.m. to midnight every day.In order to ensure travel safety, the co-pilot position of each Robotaxi is equipped with a safety monitor. Although they do not have traditional driving control equipment, they can intervene necessary on the vehicle through emergency stop buttons and other devices.

Three major reasons for driverless landing

There are three reasons why Tesla can quickly clear the obstacles and take a big step towards true driverless driving across the United States.

First, supervision is relaxed.In April 2025, the U.S. Highway Traffic Safety Administration (NHTSA) announced a relaxation of safety requirements, streamlining the accident reporting process, and expanding the scope of the "Autonomous Vehicle Exemption Program" to clear the system for Tesla's Cybercab model that eliminated steering wheels and pedals. obstacles.

Second, technology accumulation.The core of Tesla's technology moat lies in the dual advantages of disruptive cost control and data accumulation.Goldman Sachs analysts highlighted in their latest report that Tesla has adopted a customized silicon chip solution and abandoned expensive lidar, making the hardware cost of its autonomous driving system only one-seventh that of competitor Waymo.

At the same time, its FSD V12 system uses an end-to-end neural network architecture to continuously optimize the algorithm through the cumulative travel data of more than 3 billion miles of 3 million FSD-equipped vehicles around the world.This "hardware embedding + software subscription" model, combined with modular production capabilities, gives it significant cost advantages when promoted on a large scale.

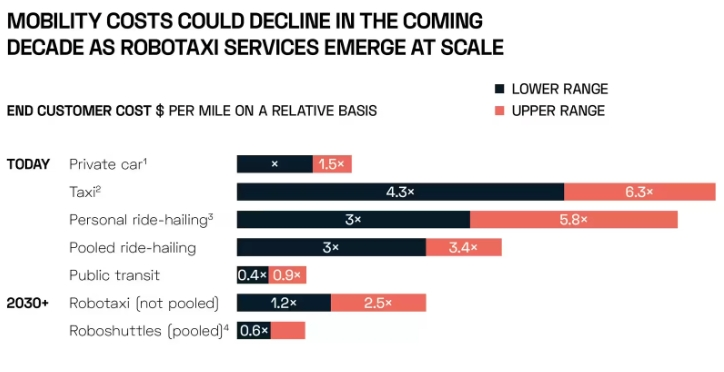

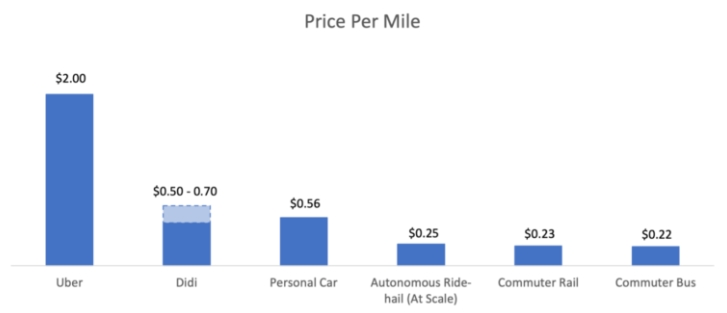

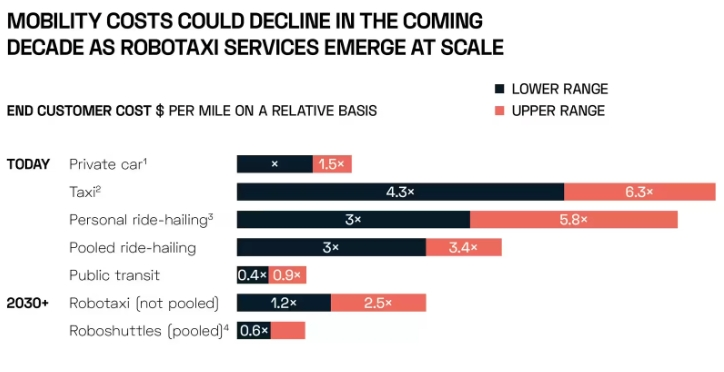

Third, and more importantly, Tesla has built a unique business closed-loop-privately owned autonomous vehicles can connect to the operating network to generate revenue for car owners, transform consumers into ecological participants, and completely restructure the car value chain.Musk aggressively predicted that by 2027, Robotaxi business revenue will exceed vehicle sales.This expectation is based on an operating cost model of 40 cents per mile, which is significantly lower than the current industry average of $1.34.

Robotaxi embarks on autonomous driving to reshape the trillion-dollar travel ecosystem

Flashpoints will not exist in isolation.

From lidar in the sensing layer (Luminar's share price has doubled in a year) to domain controllers in computing platforms (orders for NVIDIA Orin chips have surged), to high-precision maps and vehicle-road collaboration infrastructure, the implementation of Robotaxi is driving the revaluation of the entire industrial chain.TSMC's 5-nanometer process production capacity is accelerating its tilt towards autonomous driving computing chips, and roadside sensing solutions from companies such as Mobileye have also entered the procurement lists of major cities around the world.The Boston Consulting Research Report shows that Robotaxi will increase the proportion of automotive electronics in vehicle costs from the current 35% to 50% by 2030. This change in ratio heralds a historic opportunity for the restructuring of a 100 billion-dollar supply chain.

At the capital level, Robotaxi has become an important coordinate for valuation differentiation.

While traditional car companies are still suffering from the profit pressure brought by the electrification transformation, Tesla's market value center is being re-anchored by the iterative prospects of the FSD system.The Ark Invest research report even believes that the successful Robotaxi business will contribute more than 60% of Tesla's per-share valuation in 2027.The market is beginning to realize that the "Mobility as a Service"(MaaS) model will reshape the automotive industry from a cyclical manufacturing industry to a replicable technology services ecosystem, a process that will drive fundamental parameter adjustments in the industry's overall valuation model.A valuation revolution in traditional manufacturing frameworks has begun.

7 sisters in the US stock market make a comeback

As the S & P 500 index struggled to climb, the "seven sisters" consisting of Microsoft, Apple, Nvidia, Amazon, Alphabet (Google parent company), Meta (Facebook parent company) and Tesla had already exceeded historical peaks.These seven technology giants have contributed nearly 110% of the S & P 500 's increase this year, and their total market value has exceeded the combined value of all listed companies in the world except the United States.

For Tesla, the company's breakthrough path is to double bundle the energy network and the data network. What is ignored by most analysts is that its energy storage business is booming at an annual growth rate of 87%(14.7GWh deployed in 2023), and Megapack battery factory production capacity has been booked until 2026.

These distributed energy nodes will become the charging hub and edge computing sites of the Robotaxi service network in the future.A more sophisticated design is virtual power plant (VPP) integration-Tesla has built a real-time data pool for power dispatch by including 500,000 home Powerwall users in a demand response plan (California has approved it to operate as an e-vendor).

The Bain Consulting report pointed out that this vehicle-energy-cloud collaborative system can reduce investment in charging infrastructure by 40%, while providing spatio-temporal prediction data of grid load for autonomous driving.While other technology giants compete for AI hegemony in the cloud, Tesla is turning the flow of energy in the physical world into data advantage.

In the face of competition, the other "sisters" did not give in.

Microsoft Azure's AI service revenue increased by 52% year-on-year in the first quarter of 2024, pushing the smart cloud division's revenue to exceed US$30 billion for the first time.More critical is the qualitative change in capital efficiency-a Morgan Stanley research report pointed out that the embedding of AI functions has increased Azure's operating profit margin by 5 percentage points, which stems from the high pricing elasticity of AI services (a premium of 20-30% compared to ordinary cloud services) and low marginal cost characteristics.

Although Amazon AWS does not disclose AI revenue separately, analysts generally estimate that the scale of its AI reasoning services has reached 1.8 times that of traditional EC2 instances.As cloud services shift from "digital real estate" to "intelligent hubs", the infrastructure of technology giants is transforming into a profit amplifier in the digital economy era.

Nvidia single-handedly restructured the chip industry valuation system, and its market value exceeded a key node of US$3 trillion during the year.But what is easy to overlook is the synergy effect of the supply chain-72% of TSMC's process capacity below 5 nanometers is used to produce AI chips (Cowen's institutional data), while SK Hynix HBM3E memory is almost fully booked by Nvidia.

Faced with such historical opportunities, how should we ordinary people invest?

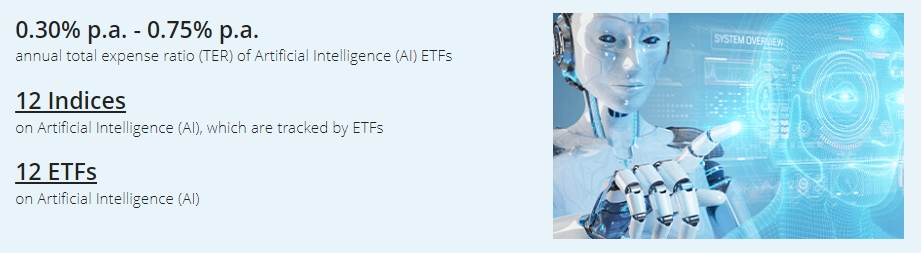

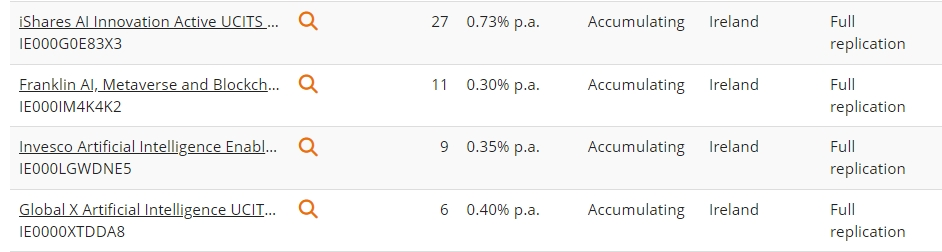

The stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.

Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

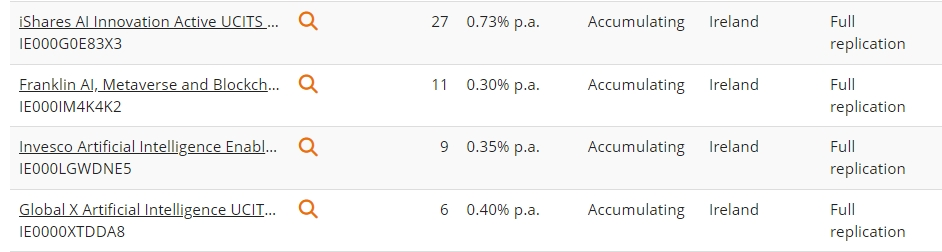

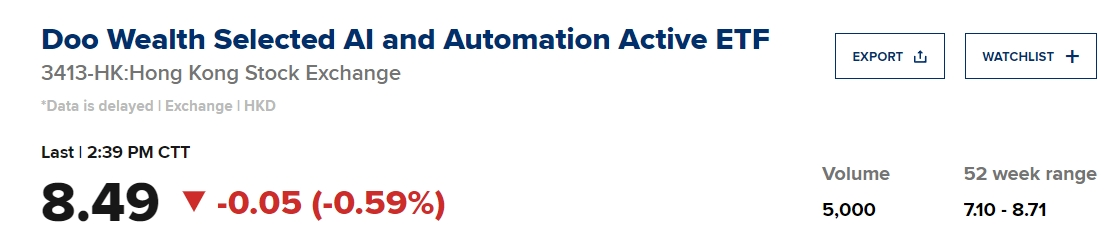

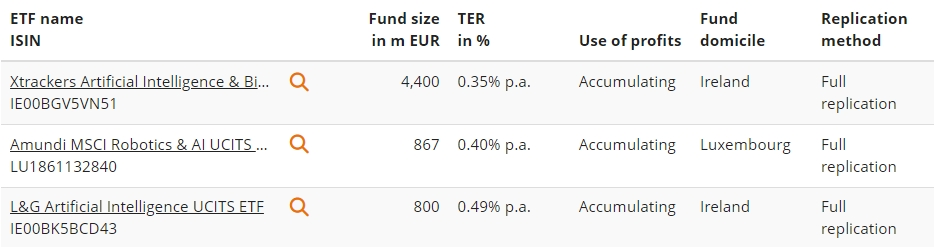

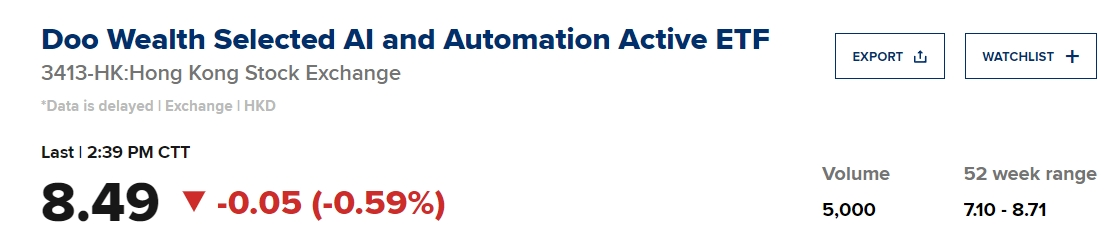

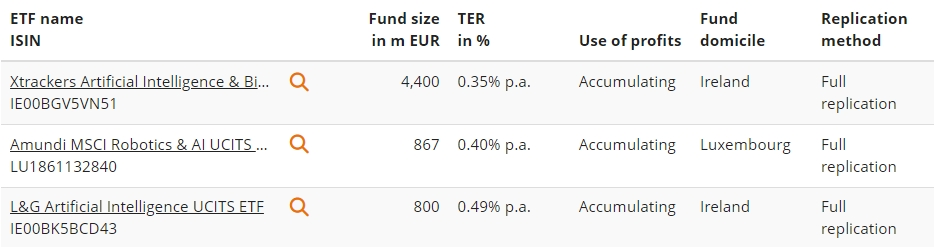

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

I wish everyone a smooth investment ~