The core reason driving this round of gold price rise mainly comes from uncertainty at the macro level.

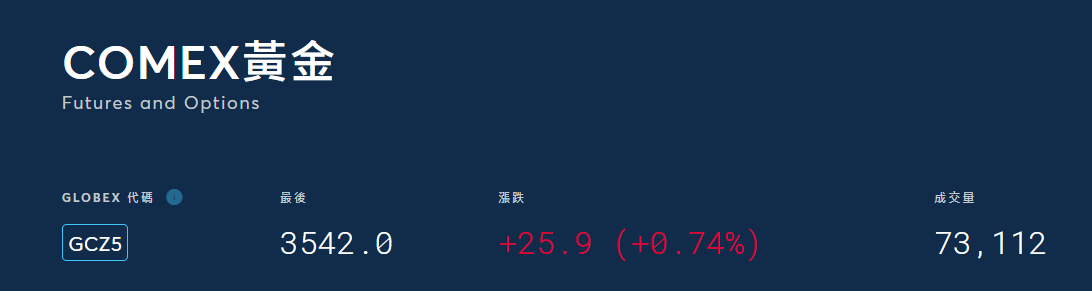

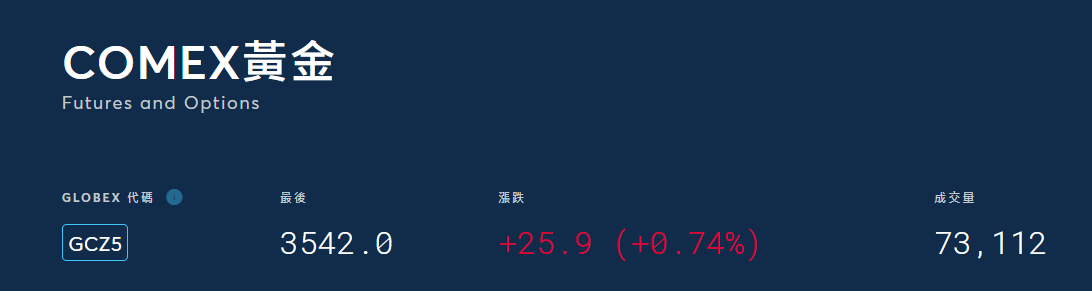

On the morning of September 1, COMEX spot gold once exceeded US$3552/ounce in intraday trading, setting a new high of US$3534 set in early August; at the same time, China's domestic gold futures strengthened simultaneously, and the main Shanghai gold contract exceeded the 800 yuan/gram mark in intraday trading.Spot silver prices broke through the key threshold of US$40/ounce for the first time since 2011, with a cumulative increase of more than 40% during the year.Currently, London silver is currently quoted at US$40.574/ounce, an increase of 2.22%.

The rapid rise in gold prices not only triggered a chain reaction in the capital market, but also quickly transmitted to the consumer end. The prices of China gold jewelry brands such as Chow Tai Fook, Laomiao Gold and Laofengxiang rose across the board. The rise range of a single gram within a week generally reached 15 to 18 yuan, and the cost of purchasing gold for consumers increased significantly.

Analysts said that the core reason for driving this round of gold price rise mainly comes from uncertainty at the macro level.

On August 22, at the world-renowned Central Bank's annual meeting in Jackson Hole, Federal Reserve Chairman Powell issued a rare signal of being relatively "dovish".He said that even though there are certain upside risks to the current inflation level, the Fed is still open to the path of future interest rate cuts.This statement quickly ignited the market's expectations for loose monetary policy, causing the US dollar index to weaken and pushing funds back to safe-haven assets such as gold.

In addition, there are also many turbulence factors within the Federal Reserve in the near future-the dismissal of Federal Reserve Governor Cook by Trump due to political factors has triggered increased market concerns about the independence of the Federal Reserve, further weakening investors 'confidence in US dollar assets and providing additional momentum for the gold price.

From a broader global macro perspective, gold's strong performance is also affected by a series of external variables.

The first is the resurgence of inflation expectations.Although the Federal Reserve has raised interest rates several times in an attempt to suppress inflation, U.S. CPI data has repeatedly been higher than expected since 2025, indicating that core inflation is sticky.At the same time, the continued rise in crude oil prices and the rebound in global commodity prices are also supporting the overall price level.This inflationary pressure provides solid value support for gold.Second, geopolitical risks have not diminished.The situation in the Middle East remains tense, the Ukraine crisis remains unresolved, and the US-China game is intensifying in many fields.Against the background of the increasingly turbulent global political and economic landscape, the risk-averse nature of gold has been re-emphasized by the market.

In terms of capital flow, according to the latest data from the World Gold Council, global gold ETFs achieved net capital inflows for the fourth consecutive month in August 2025, indicating that institutional investors are also reconfiguring gold assets to hedge market fluctuations.In addition, central banks in major economies including Switzerland, Germany, and Japan are also increasing their holdings of gold reserves to strengthen credit endorsements of their currencies, which further exacerbates supply and demand tensions in the gold market and pushes up prices.

Not only that, the needs of consumers cannot be ignored.

As the world's two largest gold consumers, China and India have a direct impact on global gold prices.According to media reports, in the second quarter of 2025, domestic gold jewelry consumption in China increased by more than 15% year-on-year. Especially among young consumers,"gold financial management" has gradually become a hot trend.Coupled with the expectation of RMB depreciation, China households are enthusiastic about purchasing gold, and domestic gold jewelry retail terminal prices in China continue to rise.For example, data on September 1 showed that the price of gold ornaments in Chow Tai Fook rose to 1027 yuan/gram, an increase of 18 yuan from the previous week, while brands such as Laomiao Gold, Laofengxiang, and Saturday Fook also generally raised it to more than 1000 yuan/gram.This increase in retail prices not only reflects the rapid transmission of fluctuations in international gold prices, but also shows that the domestic consumer market is still highly sensitive and receptive to gold.

From a technical perspective, the current price of gold has strongly exceeded several key resistance levels.Analysts said that after the COMEX gold price breaks above US$3500, the next resistance level will point to US$3600. If this level is stabilized, the US$4000 mark will not be unreachable in the medium to long term.Bank of America pointed out in its latest report that it is expected that by the first half of 2026, the price of gold may reach US$4000/ounce.Analysts at the bank emphasized: "Potential interest rate cuts are creating a breeding ground for the depreciation of the dollar, which is the catalyst for the rise in gold prices.In a high-inflation environment, if the Fed chooses to cut interest rates, a mismatch between policies and fundamentals will be formed, and the attractiveness of gold as a store of value will further increase.”

However, some analysts are also cautious about the current continued rise in gold prices.They believe that if inflation suddenly falls or the geopolitical situation relaxes, gold prices may face short-term correction pressure.In addition, there is still a high degree of uncertainty whether the Federal Reserve will actually implement interest rate cuts in the future.Once the policy turns to the return of "hawks", the dollar may strengthen again, thus restraining the trend of gold prices.Therefore, in the short term, investors need to pay close attention to key economic indicators such as Fed officials 'speeches, non-agricultural data, CPI and PCE to determine whether market expectations will reverse.