FOMC Preview: Dovish or Hawkish Rate Cut Ahead?

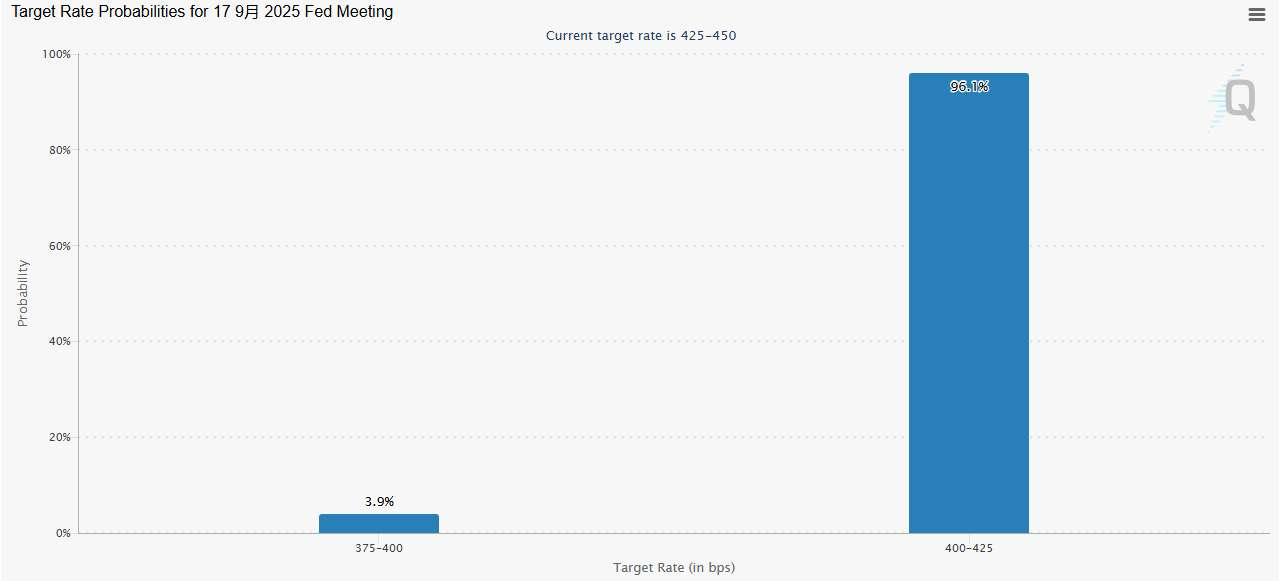

The Federal Reserve’s September rate decision is imminent. According to CME FedWatch, markets assign a 96.1% probability of a 25-basis-point cut and a 3.9% chance of a 50-basis-point cut.With the cut

The Federal Reserve’s September rate decision is imminent. According to CME FedWatch, markets assign a 96.1% probability of a 25-basis-point cut and a 3.9% chance of a 50-basis-point cut.

With the cut essentially locked in, attention now shifts to the voting split, the dot plot, and Powell’s remarks.

Will this be a dovish cut or a hawkish one? The answer will shape the stock market’s reaction.

If the Fed signals a more dovish rate outlook alongside the cut, equities are likely to rise. Conversely, a “hawkish cut” would weigh on stocks. JPMorgan’s trading desk outlined five possible scenarios and their potential impact:

- 47.5% probability: A “dovish” 25bp cut. The Fed frames inflation as temporary, emphasizes labor market weakness, and leaves room for further cuts. The S&P 500 rises 0.5%–1%.

- 40% probability: A “hawkish” 25bp cut. Recent data (small business surveys, Indeed job postings) show hiring picking up. The dot plot and Powell’s tone could lean hawkish, pushing the S&P 500 slightly lower.

- 7.5% probability: A 50bp cut. The outcome hinges on Powell’s framing. If it signals labor market rescue, recession fears spike and stocks plunge. If framed as a “catch-up” move, equities may rally.

The last two scenarios — no change or a 25bp hike — are highly unlikely, but if they occur, equities would suffer steep losses.

How to position in equities?

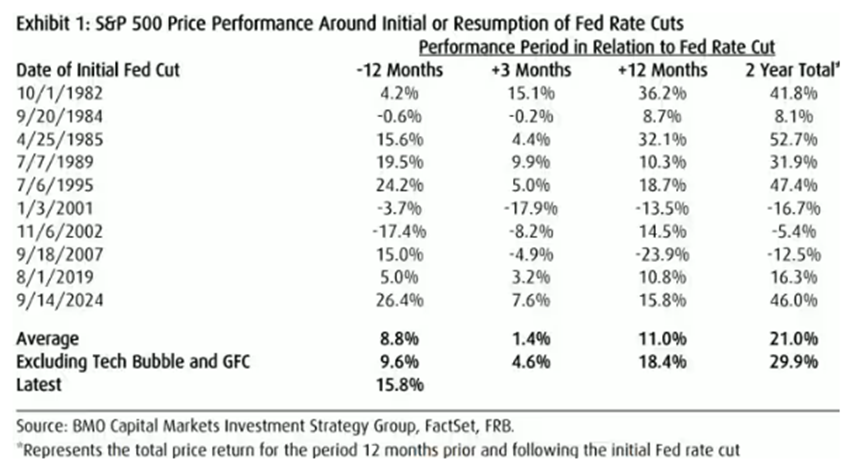

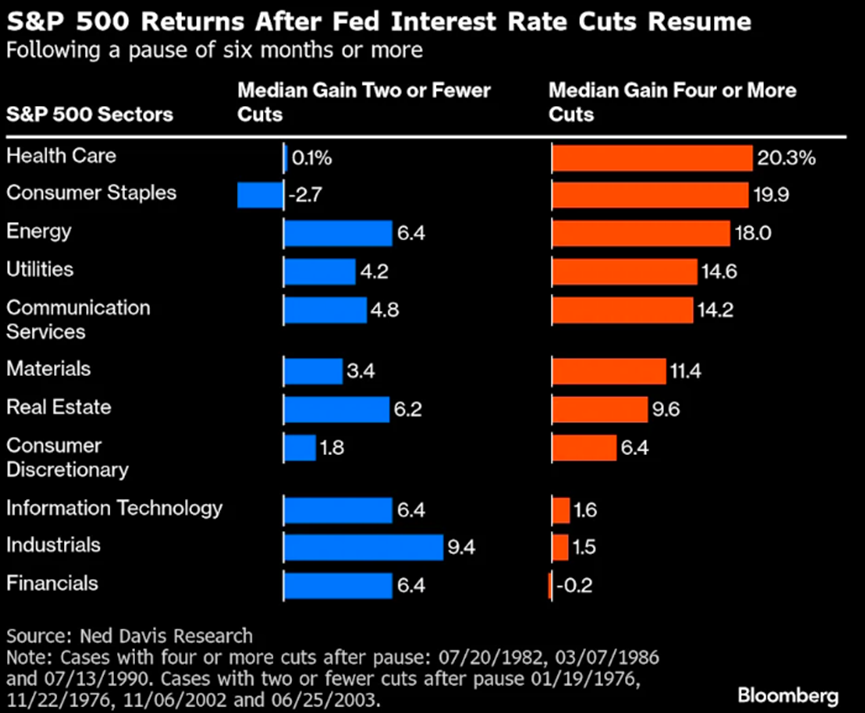

According to Ned Davis Research strategist Rob Anderson, in preventive easing cycles with a relatively strong economy, cyclical sectors like financials and industrials outperform. But in weaker, rescue-driven cycles, defensive sectors like healthcare and consumer staples deliver the highest median returns.

This round is viewed as preventive easing, favoring cyclicals. However, Fed commentary on the labor market will be critical. If labor weakness persists, recession risk rises.

Echoes of 2007?

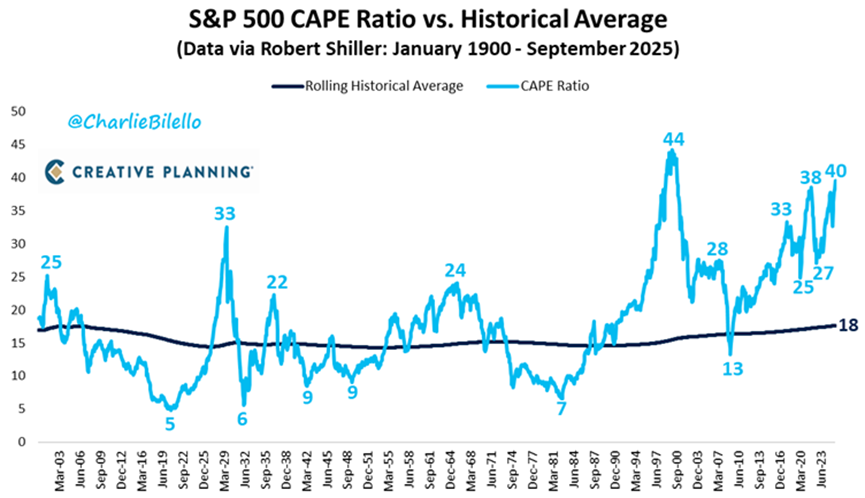

While this cut is widely seen as preventive and theoretically bullish for equities, differences from 1995 and 1998 are notable. Back then, inflation was subdued (2.83% and 1.56%). Today, inflation rebound risks limit the Fed’s path. With valuations at historic highs, markets shouldn’t overestimate the boost from easing.

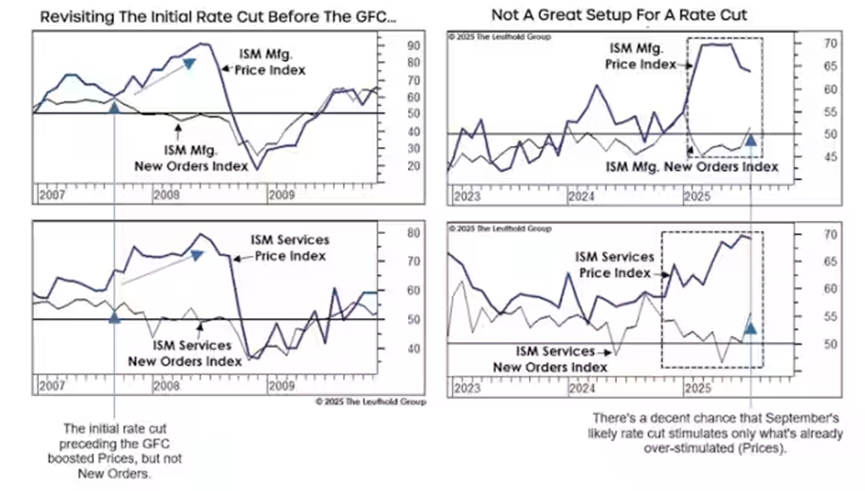

Doug Ramsey, CIO at Leuthold Group, sees parallels with September 2007. Then, the Fed cut rates amid housing and labor weakness while inflation overshot expectations. Cuts failed to revive orders but fueled an inflation rebound. If history rhymes, stagflation risk looms.

Leuthold forecasts CPI to reaccelerate to 3.5% by end-2025, warning such a rebound could hit equities hard.

BTIG strategist Jonathan Krinsky also warns of a potential “buy the rumor, sell the fact” selloff after the Fed move.

A deeply divided FOMC?

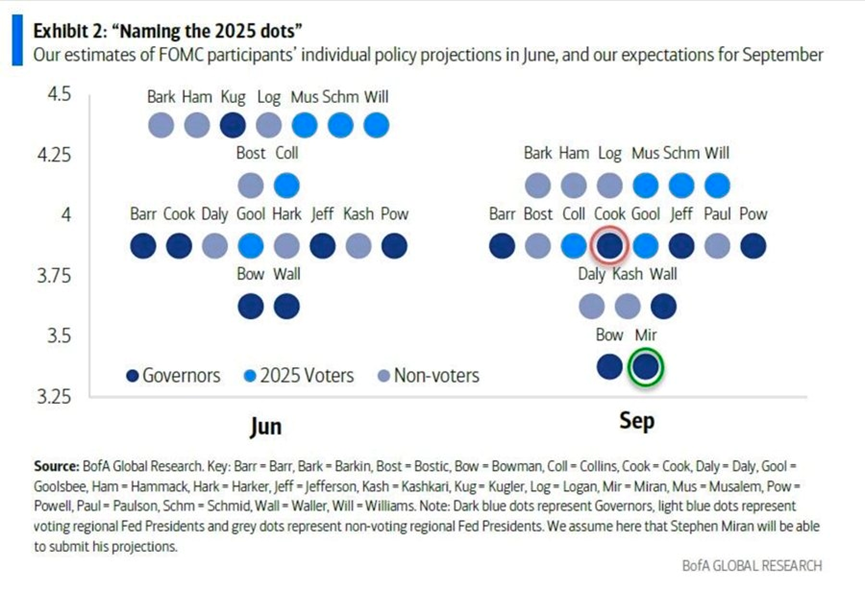

This meeting could feature up to four dissenting votes — an unusually high level of division.

The Senate just confirmed Stephen Miran, aligned with Trump, who is expected to vote for a 50bp cut. Governors Bowman and Waller both supported deeper cuts in July and may again push for larger moves. Meanwhile, Fed Governor Lisa Cook, shielded from Trump dismissal by court ruling, may vote against cuts or even for a hike to demonstrate independence.

If accurate, one-third of FOMC members could dissent — the most divided Fed meeting in decades.

Statement and dot plot: key takeaways

The Fed may adjust language to acknowledge weaker momentum in jobs and growth. It may frame tariff-driven inflation as “one-off” but stress sticky services inflation. While dovish overall, the Fed will stress flexibility.

The 2025 median rate is expected to drop to 4.125% (from 4.375%), suggesting a dovish tilt, though some members may forecast even lower rates. The 2026 median likely stays at 3.375%, but a few could raise to 3.625% to reflect inflation concerns. Short-term dovishness and long-term hawkishness may coexist.

Powell’s press conference will be pivotal:

1. If he maintains balance, markets will parse data for clues.

2. If hawkish, expectations for future cuts fall, stocks retreat.

3. If surprisingly dovish, markets may price an aggressive cutting cycle, sending the dollar tumbling.

What Wall Street thinks

Consensus expects a 25bp cut, citing weakening jobs as the decisive factor. But dot plot forecasts diverge: JPMorgan and Citi see three cuts this year, while Morgan Stanley expects just two.

Labor weakness has overtaken sticky inflation as the top concern. The Fed is expected to maintain a “data-dependent, meeting-by-meeting” approach in its communication.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.