FOMC Cuts 25bp, Powell Balances Jobs and Inflation

The highly anticipated Federal Reserve rate decision is out: a 25-basis-point cut, fully in line with market expectations.At the press conference, Chair Jerome Powell emphasized rising downside risks

The highly anticipated Federal Reserve rate decision is out: a 25-basis-point cut, fully in line with market expectations.

At the press conference, Chair Jerome Powell emphasized rising downside risks to the labor market, while inflation has increased but without significantly greater risk. This tilted the Fed’s risk balance toward employment.

Once heavily skewed toward inflation, the balance⚖ is now shifting closer to neutral, justifying the rate cut decision.

Voting: no major split

Fears of four dissenting votes did not materialize. Instead, there was only one dissent — from Stephen Miran, Trump’s newly appointed “super dove,” who favored a deeper 50bp cut.

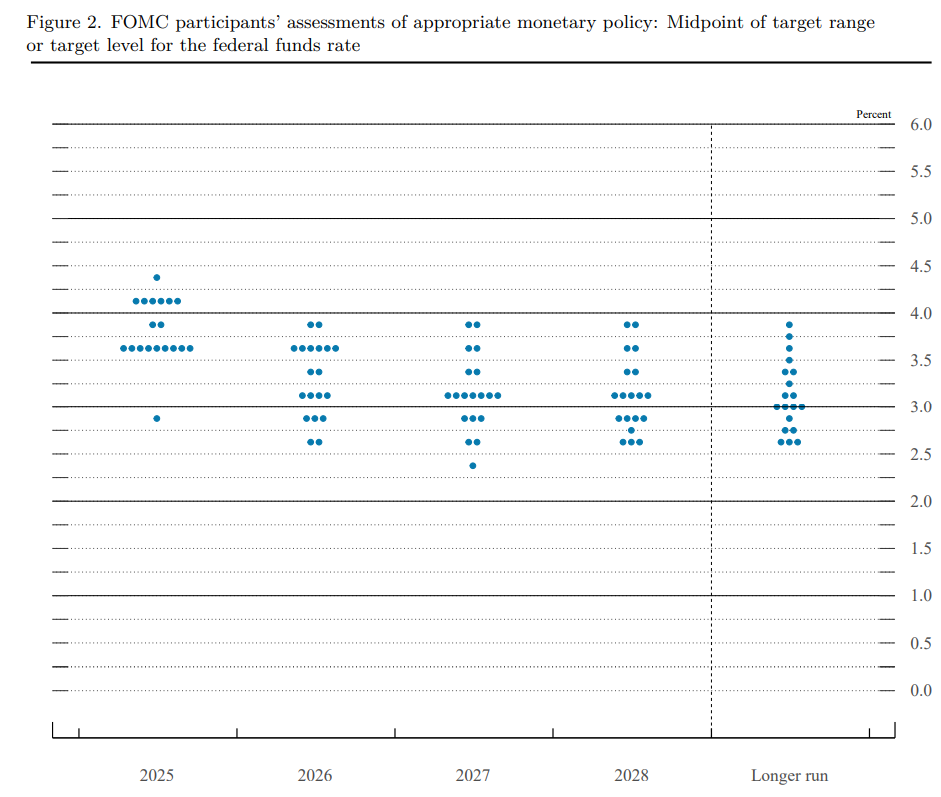

Dot plot: hawkish tilt

The dot plot shows Fed officials expect 75bp of cuts in 2025 and another 25bp in 2026, totaling 100bp. Markets, however, anticipate about 140bp of easing by end-2026, making the Fed’s guidance appear hawkish.

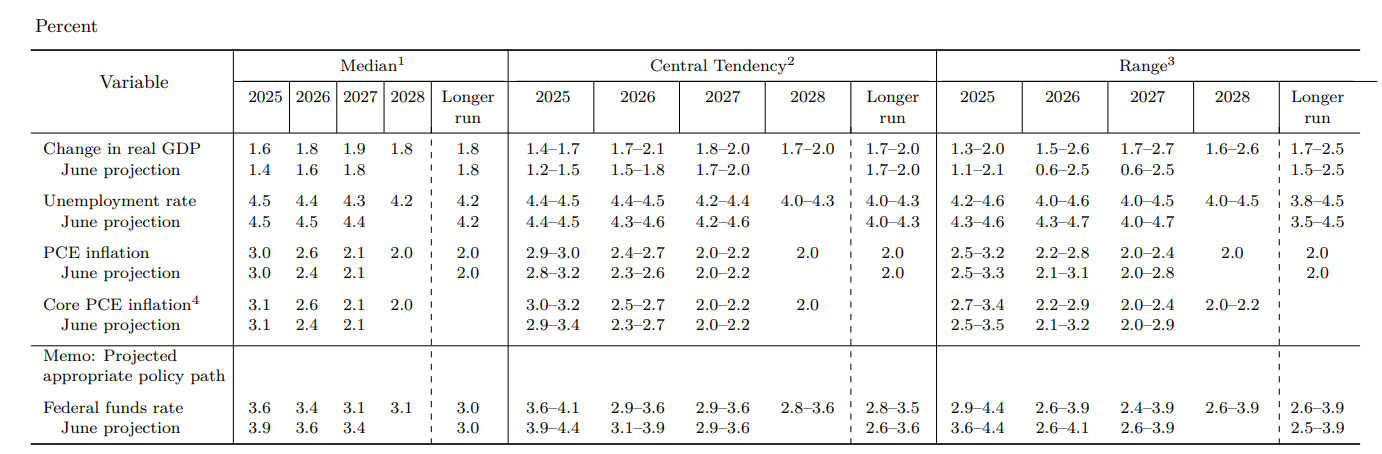

Economic projections: growth and inflation revised up, unemployment down

Compared with June, Fed officials raised forecasts for real GDP and inflation while lowering unemployment projections, confirming U.S. economic resilience.

Powell’s remarks: balancing act, inflation risks contained, focus on labor market

Powell maintained his reputation as a skilled “balancer.” He noted unemployment remains low but has risen slightly, signaling labor market weakness. Meanwhile, inflation remains elevated, with goods inflation rebounding and services inflation continuing to ease.

On economic activity, Powell observed slowing consumption, ongoing housing weakness, but stronger corporate investment in equipment and intangibles. Labor demand is weakening, with job growth falling below the level needed to keep unemployment stable. The Fed now projects unemployment at 4.5% by end-2025, then gradually declining.

Powell highlighted that Trump’s aggressive deportation of undocumented workers has slowed labor supply, but demand has weakened even more — pushing unemployment marginally higher.

On prices, Powell stressed that inflation has fallen sharply from its mid-2022 peak but remains above the 2% target. Inflation risks appear slightly reduced as labor softens and GDP slows. He described tariffs as a “one-off” effect on goods prices but acknowledged inflation could prove more persistent, a risk requiring vigilance.

Why not a 50bp cut now?

Powell clarified that 50bp moves are reserved for moments when policy is “badly misaligned” and needs quick adjustment. That is not the case now. Policy has been on the right track, and it is appropriate to wait and observe how tariffs, inflation, and labor trends evolve.

Last year’s 50bp cut, he recalled, was warranted because policy rates were well above neutral, even if the exact neutral rate was unknown. The Fed moved quickly to avoid falling behind the curve. Today, with rates closer to neutral and labor markets softening but not collapsing, there is no urgency for deeper cuts.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.