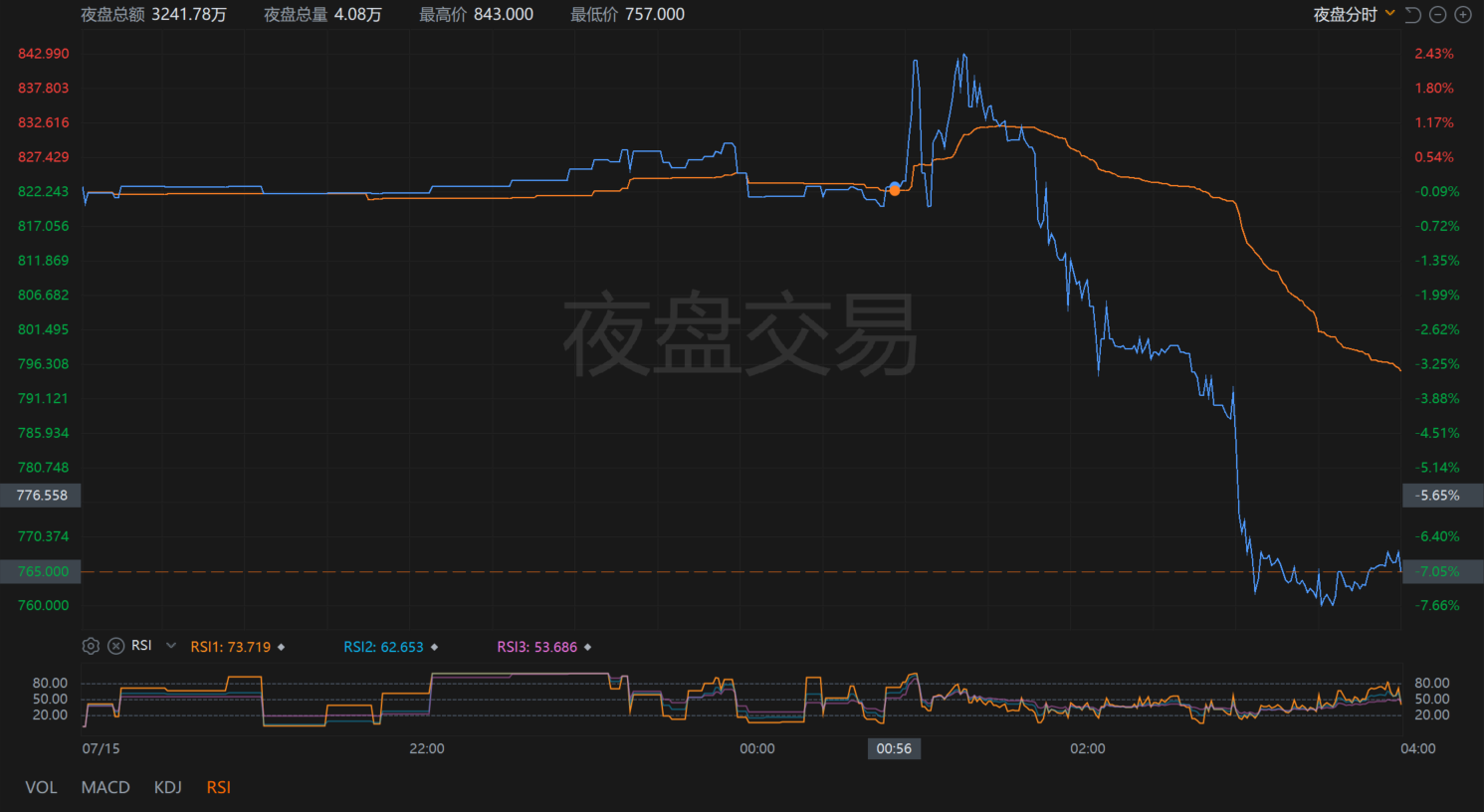

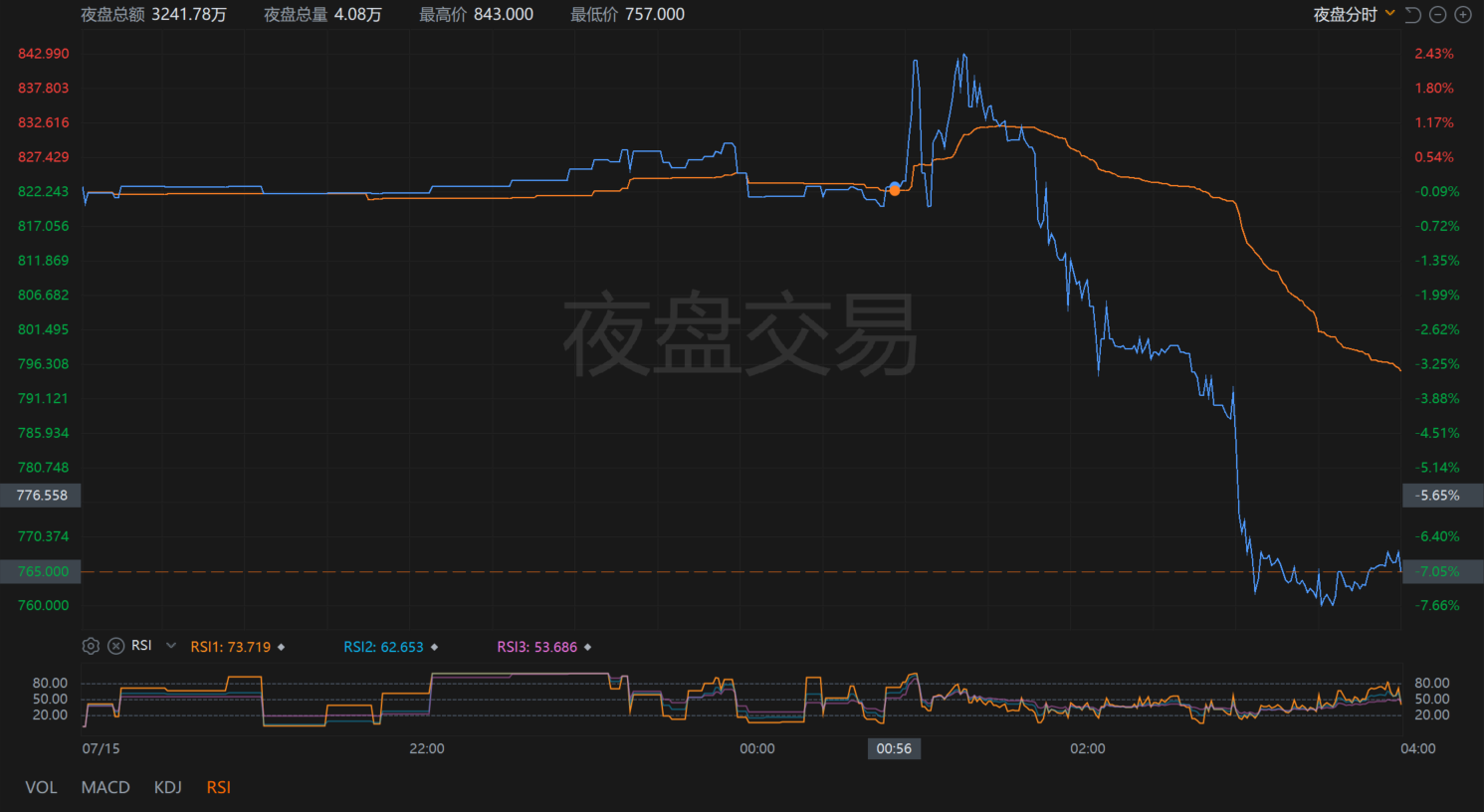

Due to management's growth warning for 2026, the company went downward after a short-term rise in U.S. stocks in the night session, and is now down by more than 8%.

On July 16, Dutch lithography giant ASML delivered a strong report card. However, due to management's growth warning for 2026, the company went downward after a short-term rise in U.S. stocks in the night session, and is now down. More than 8%.

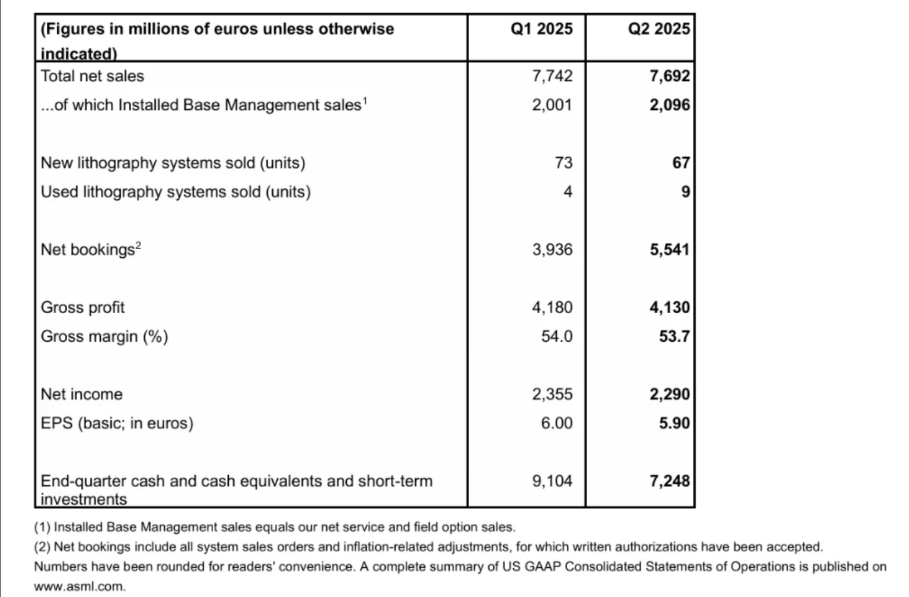

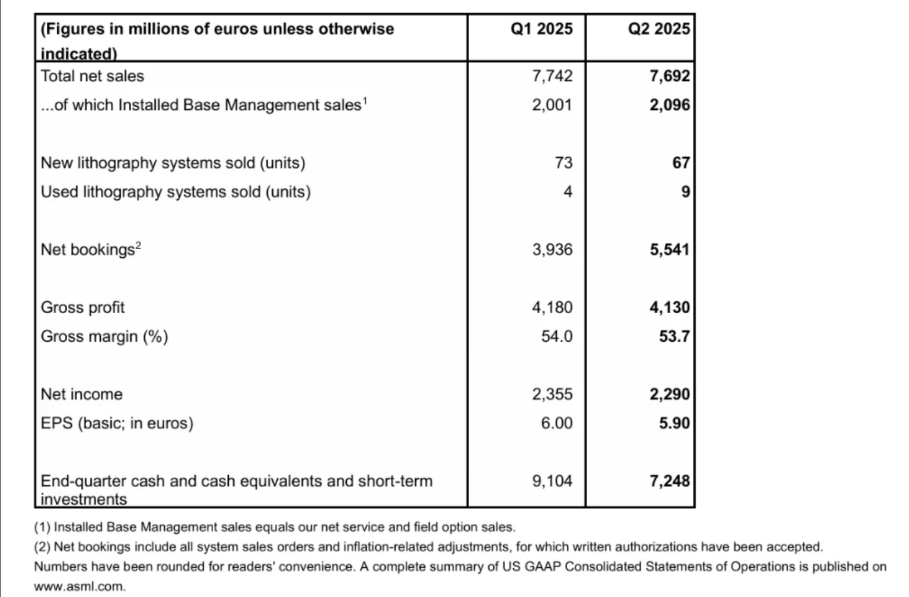

Specifically, Asmail achieved net sales of 7.7 billion euros in the second quarter, which not only hit the previous guidance limit, but also exceeded market expectations of 7.54 billion euros; net profit reached 2.3 billion euros, also crushing market expectations of 2.01 billion euros.What is particularly noteworthy is that the gross profit margin reached 53.7%, which is significantly higher than the company's guidance range of 50%-53%.

The core engines driving performance come from two directions: First, orders exploded, and net bookings soared to 5.5 billion euros in the second quarter, a 41% month-on-month increase from 3.9 billion euros in the first quarter, far exceeding market expectations of 4.45 billion euros; Second, a key breakthrough in technological iteration was made-the first High NA EUV lithography machine EXE: 5200B was delivered. The equipment uses a 0.55 numerical aperture optical system and has a wafer processing capacity of ≥175 wafers per hour. The dual mask exposure design significantly improves chip manufacturing efficiency-this marks a substantial step in semiconductor manufacturing towards 2 nanometer and more advanced processes.

It is worth noting that the amount of new orders of 5.5 billion euros has rebounded significantly from the 3.9 billion euros in the first quarter, which has alleviated market concerns about the downturn in the semiconductor cycle and weak demand to a certain extent.Among them, orders for EUV equipment were 2.3 billion euros, indicating that customers 'demand for advanced processes remained strong.ASML's cash and short-term investments fell to 7.2 billion euros from 9.1 billion euros at the end of the first quarter, mainly due to the implementation of a 1.4 billion euro share repurchase program.

In terms of products, the proportion of Asmai logic chip equipment orders surged from 60% in the first quarter to 84%, while memory chips shrank from 40% to 16%.The amount of new orders of 5.5 billion euros has rebounded significantly from the 3.9 billion euros in the first quarter, which has alleviated market concerns about the downward trend of the semiconductor cycle and weak demand to a certain extent. It also supports the current explosive growth in AI chip demand. --The big model arms race has forced logic chip makers such as TSMC and Intel to expand production crazily, while the storage market is still in the early stages of recovery.

Dai Houjie, the company's CFO, said more clearly: "In 2025, the EUV lithography business is expected to grow by 30% year-on-year, and artificial intelligence is the main driving force."The company expects that High NA equipment revenue will continue to increase in the second half of the year, further consolidating technical barriers.

It is worth noting that although the performance exceeded expectations, the management's outlook for 2026 showed uncertainty for the first time. CEO Fu Keli admitted in the financial report: "Although preparations are being made for growth in 2026, it is impossible to confirm whether it can be achieved."This cautious statement points to two major hidden dangers: the continued fermentation of geopolitical risks, especially the repeated games of major economies over export controls of chip equipment to China; and the possibility that global economic fluctuations may weaken chip capital expenditures.

According to the analysis, in the short term, the cost reduction caused by tariff policy adjustments and the increase in revenue from after-sales upgrade services (the growth rate exceeded 20% in the first half of the year) will jointly push up profit margins, but these factors are unsustainable.First, when AI chip customers such as Nvidia and AMD complete this round of production capacity expansion, it is doubtful whether the demand for EUV equipment can remain high.Second, storage giants such as Samsung and SK Hynix are still digesting inventories, and their capital expenditure recovery is not enough to continue the growth of logic chips.

For guidance for the next quarter, the company expects total net sales in the third quarter to be between 7.4 billion euros and 7.9 billion euros, with gross margins between 50% and 52%.Research and development costs are expected to be approximately € 1.2 billion, and sales, general services and administration (SG&A) costs are expected to be approximately € 310 million.

For the full year of 2025, the company expects total net sales to increase by 15%, with a gross profit margin of approximately 52%.