Trump turned his face and reversed, gold hit a new high, the three major futures indexes rebounded, and the TACO transaction was staged again?

Global assets fluctuated.

In the past weekend, a speech by former US President Trump once again ignited the global market."Don't worry, everything will get better," he wrote on his social platform Truth Social, which was widely interpreted by markets as a softening of his stance after threatening to impose tariffs on Friday.Just a few days ago, Trump issued a new round of high-profile tariff threats, which suddenly strained investor sentiment and collectively corrected the world's major stock indexes.However, this latest statement seemed to inject a shot in the arm into the market. In early Asian trading on Monday, the three major stock index futures of U.S. stocks collectively rebounded strongly, gold prices hit a new high, and risk aversion also eased significantly.

The market's response was quick and strong.As of press time, the Nasdaq 100 index's main consecutive gain reached 1.66%, the S & P 500 index futures rose 1.21%, and the Dow Jones index futures also rose 0.83%.At the same time, spot gold broke through US$4000/ounce, setting a record high, reaching a high of US$4060.This extreme price performance reflects that the market is still highly sensitive to global macro uncertainties.The strengthening of the U.S. dollar and the weakening of traditional safe-haven assets such as the yen mark the beginning of a shift from extreme safe-haven to re-embracing risky assets.

incident

This time, the starting point of the incident can be traced back to the evening of October 10-Trump issued a fiery statement on his social platform Truth Social, saying that he would impose further tariffs on China goods.Immediately afterwards, at 5 a.m. Beijing time on October 11, he explicitly threatened to impose a "100% tariff" on China goods. This radical statement instantly triggered violent fluctuations in global asset markets, especially high-risk assets.

The cryptocurrency market is the most sensitive.Mainstream currencies such as Bitcoin and Ethereum fell sharply in the short term, causing a waterfall market, and investors 'risk aversion quickly heated up.In the following U.S. stock trading session, this sentiment spread to traditional assets. The three major U.S. stock indexes fell collectively on Friday (October 11), with the Dow falling 2.7%, the Nasdaq falling 2.5%, and the S & P 500 Index falling 2.7%, the largest one-day decline since April.

In just 24 hours, the market quickly shifted from "normal trading" to "safe haven".The VIX panic index rose simultaneously, and the global capital chain began to show signs of contraction.Behind this is Trump's policy swing of reneging on his word.

"TACO Trading" Reappears

Analyzing the market's reaction, many investors can't help but think of the so-called "TACO deal" that has been staged many times before-that is, Trump's remarks led to a rapid correction of Assets and then a rapid rebound due to a softening of his tone.This "Trump-style trading logic" has become an important feature of U.S. stock market volatility in recent years.From April to October, similar plots have appeared many times, but this time it was just a "script reenactment".

What's more interesting is that the pace of the market crash and rebound this time coincides with the point where the U.S. government may fall into a "shutdown".The federal government has been in an informal shutdown for a week due to unresolved fiscal appropriations.October 15 will be the payday for most federal employees, which may be the first time that hundreds of thousands of government employees are "unpaid". This practical issue is also likely to accelerate the White House's concessions on tariff issues.

From the perspective of the Sino-US game, this market's "suppression first and then promotion" is not illogical.Compared with April, many institutions analyzed that the current level of panic in the market has dropped significantly.CICC pointed out that the current VIX panic index is 21.7, far below the April high of 60, indicating that the market has accumulated experience in dealing with trade frictions and the mood is more stable.Minsheng Securities also emphasized that from the perspective of the Sino-US game, China has not chosen tit-for-tat, but has maintained restraint, while the White House clearly "leaves room" in its tariff policy.

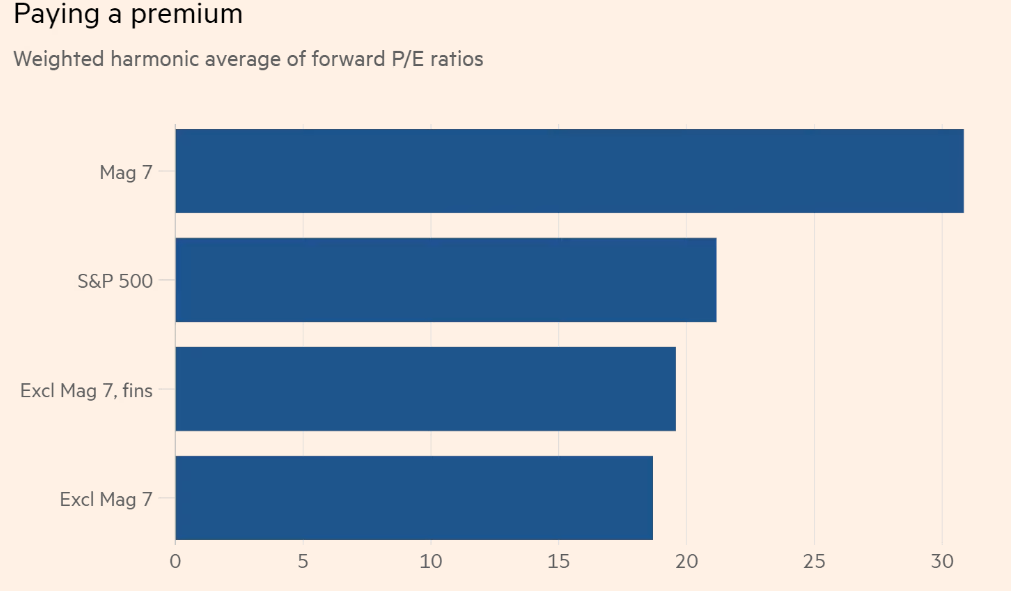

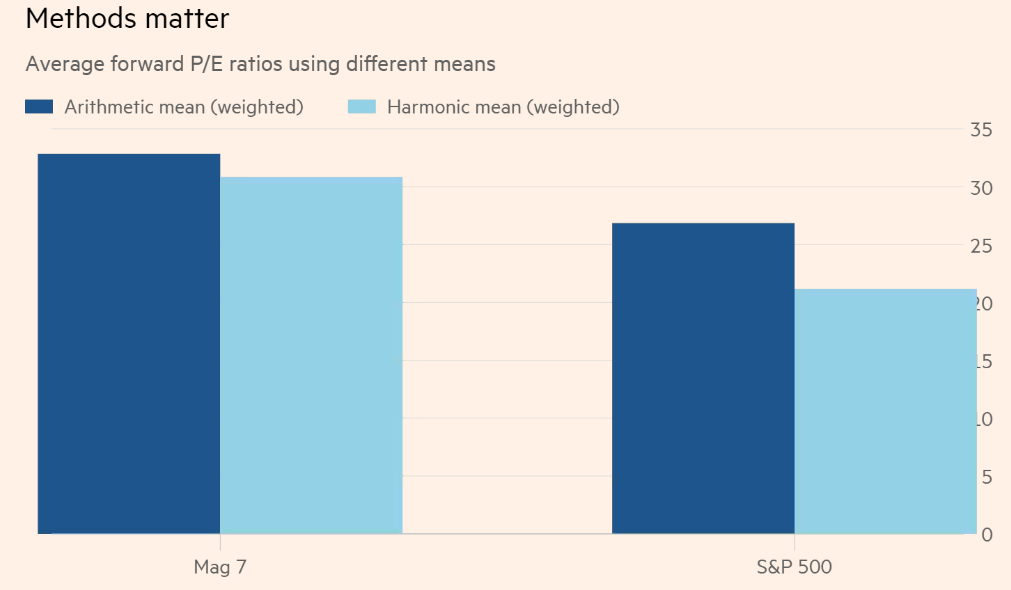

But this does not mean that investors can take it lightly.Both CICC and Guojin Securities have warned about current stock market valuations.Data shows that the valuation of China's technology and consumer leaders has reached 20 times, significantly higher than 18.8 times in April; the current P/E ratio of the "Seven Sisters" of U.S. stocks has also reached 31 times, up from 26.8 times in April.These all indicate that the market's risk premium level has been reduced, and any new negative shocks may trigger more violent fluctuations.

In addition, the current U.S. stock earnings season is about to start.Citigroup, Goldman Sachs, Wells Fargo, JPMorgan Chase, Bank of America and Morgan Stanley will release intensive earnings reports this week, which will undoubtedly provide more variables for market trends.Once these financial giants 'financial reports fall short of expectations, they may trigger a new round of market adjustments.

The market is divided into two camps

From an institutional perspective, there are currently two main camps.

The first category is the "TACO faction", which believes that the market will continue the trading logic since April, and the current sharp decline is a rare opportunity for layout.The team of Liu Chenming of Guangfa Securities pointed out that the threat of a 100% tariff in the United States is difficult to truly implement, and is more like extreme pressure before negotiations. From historical experience, every time Trump makes a tough statement, it is often accompanied by policy softening or a longer time window., on the contrary, it provides the market with buying opportunities.

The second category is the "wait and wait" faction, which is more cautious.Both Guojin Securities and China International Capital Corporation emphasized that the current valuation is on the high side, the market is no longer a "golden pit" period, and the easing of conflicts is not enough to support the stock market to continue to rise.They believe that China and the United States are still in a game period and are far from reaching a clear negotiation outcome.Under valuation pressure, large fluctuations or even double dip may occur in the short term.

At the industry configuration level, agencies also gave divergent suggestions.Minsheng Securities suggests focusing on defensive dividend sectors in the short term, such as utilities, telecommunications and consumer necessities, but it is still optimistic about sectors with national strategic support such as rare earths, domestic substitutions, and military industry in the medium and long term.Guangfa was even more radical, proposing that once technology stocks fell back to near the 20-day moving average, they should focus on domestic technology mainlines such as AI chips and semiconductor equipment, believing that this is an excellent opportunity for high-quality assets to get on board amid "irrational fluctuations."

The CICC team suggested that investors who have reduced their positions can continue to wait and see and wait for a more favorable opportunity to enter; those who have not yet reduced their positions need to appropriately adjust their positions according to the degree of market panic, emphasizing that "defense is better than offense."His view is based on the fact that the current market valuation is at a high level. Although the conflict has been suspended, the overall room for rebound is limited.

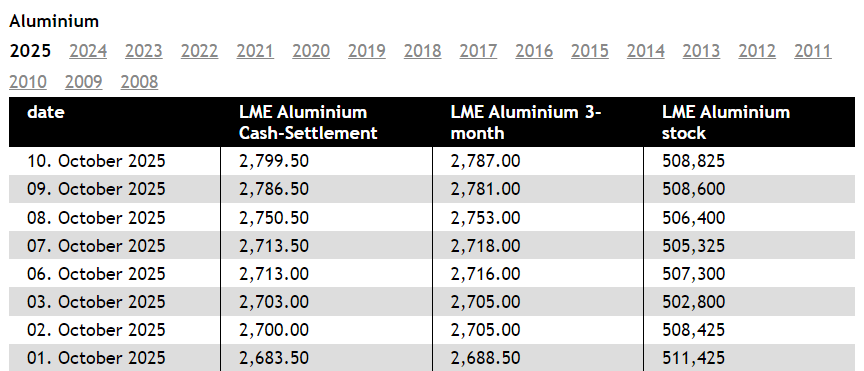

"Aluminum" gradually enters institutional vision under the rampant trend of precious metals

In terms of structural configuration, in addition to the frequently mentioned gold, technology and defense sectors, more and more institutions are turning their attention to the "invisible opportunity in industrial metals"-aluminum.Although the performance of aluminum prices fell relatively behind that of gold, copper and other varieties during the year, alternative demand for aluminum is accelerating against the background of a sharp rise in copper prices and a close to historical highs.

Historical data shows that when the price ratio of copper and aluminum reaches 3.5 to 4 times, it often stimulates significant substitution of copper by aluminum in many fields.At present, this ratio is approaching 3.9, which means that aluminum demand is growing or entering an accelerating channel.According to reports from BHP Billiton and Wood Mackenzie, aluminum is becoming a core metal material in many rapidly growing industries such as energy transformation, automotive electrification, data center infrastructure, and solar energy.

Especially in the electric vehicle industry, the light weight and high-strength characteristics of aluminum not only help reduce the weight of the vehicle and improve endurance performance, but also constitute a strong substitute for copper in terms of cost.According to CRU data, an average electric vehicle requires 150 pounds more aluminum than a traditional car. In North America, best-selling models such as the Ford F-150 began to fully use aluminum bodies as early as a decade ago.

In addition, the application of aluminum in AI data centers is also rising, widely used in cooling systems, heat dissipation components and machine room structural frameworks, becoming an important structural raw material after steel.In the solar energy field, aluminum is gradually replacing copper in the transmission system at a lower price and lighter weight.

On the supply side, the aluminum market is facing systemic bottlenecks.On the one hand, electrolytic aluminum production is highly dependent on electricity, and global power resources are being consumed in large quantities by power-consuming industries such as AI, chips, and data centers.Alcoa has publicly stated that its smelters are competing for power contracts with technology giants such as Amazon and Microsoft, and technology companies are willing to pay electricity prices far higher than the aluminum industry can afford.

On the other hand, China, as the world's largest aluminum producer, has clearly set an upper limit of 45 million tons of electrolytic aluminum production capacity under the influence of the "dual carbon policy" and is unlikely to expand production again.Other potential countries, including Indonesia, are unable to make up for the global production capacity gap in the short term due to environmental financing problems and backward infrastructure.

Market consulting firms SFA, Citibank and Wood Mackenzie all predict that the global primary aluminum surplus will shrink rapidly before 2026, and there will be a long-term gap between 2027 and 2028. The gap may last for five years, and the maximum scale may reach annual consumption. 2%.

Therefore, at a time when gold has reached historical highs and high valuations in the technology sector are under pressure, aluminum may be in a period of strategic opportunities in a valuation depression.With the restructuring of the global energy structure, the acceleration of electrification trends and the continuous rise of copper prices, the role of aluminum as a "new cycle metal" has become increasingly prominent and is being mentioned by more and more institutions.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.