Berkshire's operations in the second quarter showed three major characteristics.

On August 14, according to Berkshire Hathaway's latest 13F document submitted to the U.S. Securities and Exchange Commission (SEC), after half a year of wait-and-see, Berkshire resumed its holdings of Apple in the second quarter, while continuing to cut Bank of America's positions and aggressively opened positions in many new targets such as medical insurance giant UnitedHealth, steel manufacturer Nucor, and real estate developer Renner Construction.

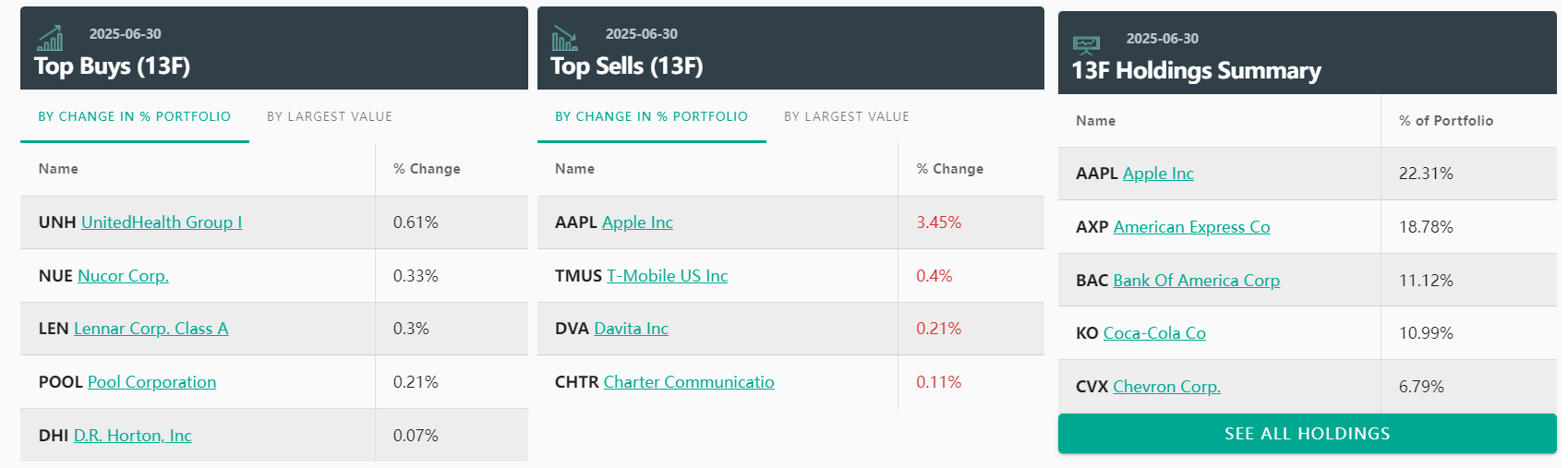

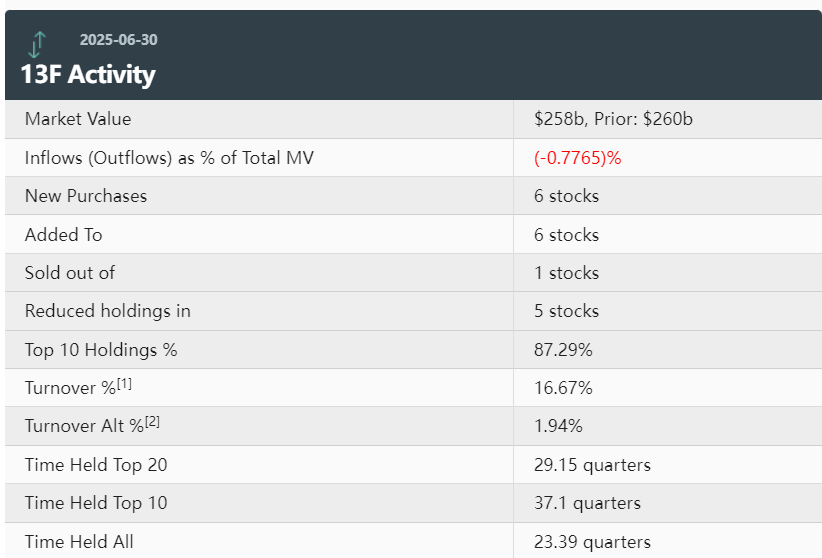

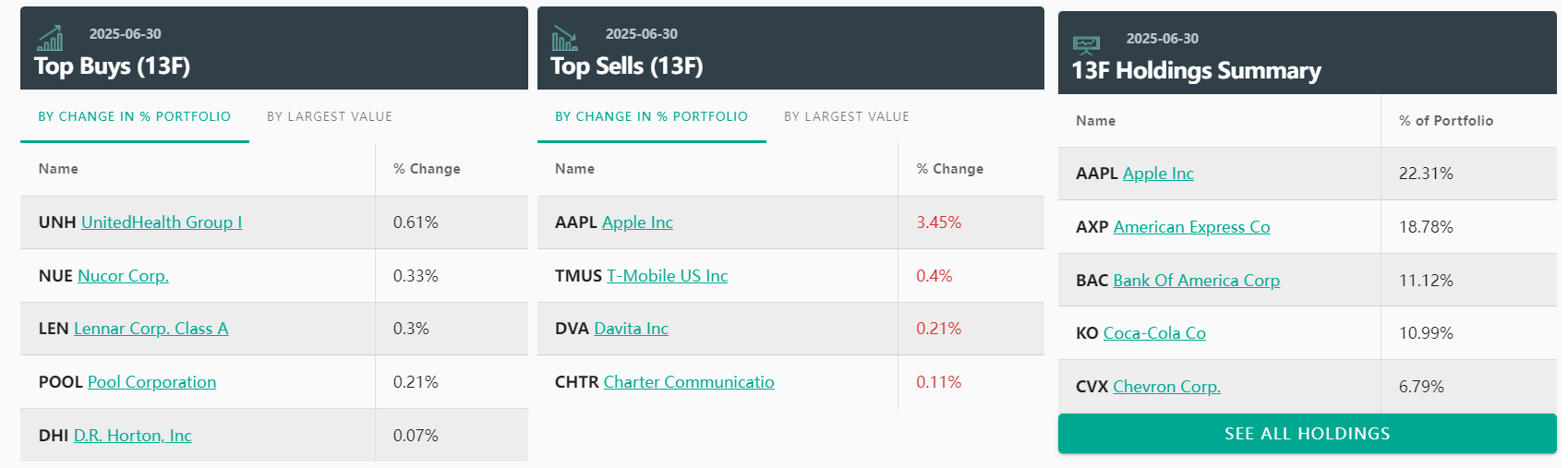

Apple remains the core of the adjustment.In the second quarter, Berkshire sold about 20 million Apple shares, a month-on-month decrease of 6.67%. The market value of its holdings shrank by about US$4.1 billion, and its proportion of total holdings dropped from 25.76% to 22.31%.Although Apple is still Berkshire's number one heavyweight stock, holding approximately 280 million shares as of the end of the quarter, it has cut its positions at high levels for two consecutive years, demonstrating the company's caution in the context of rising valuations of technology stocks.It is worth noting that in the second quarter, Apple was affected by the slowdown in hardware sales and the slower than expected advancement of its AI strategy. Its stock price was under pressure and its market value fell by nearly 10% from its high point. This may be an important reason why Buffett's team accelerated the realization of some of its gains.

Bank of America also continues to be reduced.Berkshire sold approximately 26.31 million shares in the second quarter, with its holdings falling 4.71% month-on-month and its market value decreasing by US$1.24 billion.Although the proportion of positions rebounded slightly to 11.12% due to the adjustment of total asset structure, Berkshire's shareholding in the bank has dropped from 1.03 billion shares to 605 million shares in the past year, a cumulative reduction of more than 40%.Considering the net interest margin pressure faced by Bank of America, slowing loan demand and rising regulatory costs, Berkshire's strategy appears to be to gradually withdraw from concentrated exposure to bank stocks to guard against potential credit risks and earnings fluctuations.

In addition, Berkshire completely cleared T-Mobile in the second quarter, selling 3.88 million shares, reducing its 0.4% position in the first quarter to zero.Although this investment is not long, the telecommunications industry has limited profit margins under high capital expenditures and competitive pressure. Coupled with the periodic rebound in stock prices, the exit may be based on a comprehensive consideration of capital efficiency and return.

In sharp contrast to the reduction is Berkshire's layout in new areas.

In the second quarter, UnitedHealth became the largest target for opening positions, with 5.04 million new shares, with a market value of nearly US$1.57 billion, accounting for 0.61% of the total positions, ranking 18th among all the company's positions.Once this move was disclosed, UnitedHealth's share price once rose by more than 9% after hours, reflecting the market's high sensitivity to the "Buffett buy effect."Against the background of accelerating aging trends in the United States and rigid growth in medical insurance expenditures, the medical insurance industry has stable cash flow and anti-cyclical characteristics, which is highly consistent with Berkshire's preferred "predictable profit" characteristics.It is widely believed in the industry that the investment is more likely to be handled by Buffett's two investment deputies, Todd Combs and Ted Weschler, because they have been more active in the medical and health field in recent years.

Steel and real estate have also become Berkshire's new hunting grounds.Nucor Steel acquired 6.61 million shares in the second quarter, with a market value of approximately US$857 million, accounting for 0.33%.As the largest steel producer in the United States, Nucor has a flexible business structure, low debt level, and long-term benefit potential from the trend of infrastructure investment and manufacturing return.Renner Construction added 7.05 million shares, with a market value of nearly US$697 million, accounting for 0.3%.With the Federal Reserve approaching the turning point of interest rates and the housing market expected to recover, sales and profits of leading real estate companies are expected to improve.In addition, Berkshire has also added 1.915 million new shares of Horton Homes with a market value of approximately US$225 million, and 1.17 million shares of Lamar Outdoor Advertising with a market value of approximately US$117 million, showing a two-way balance between the cyclical and defensive sectors.

Among the top ten heavy positions, the only one that gained an increase in holdings was Chevron. In the second quarter, Berkshire added 3.45 million shares, increasing the market value of its holdings by US$495 million.However, due to the fall in international oil prices in the second quarter, its holdings fell from 7.69% to 6.79%.As of the end of the second quarter, Berkshire's top ten heavy positions remained stable, followed by Apple, American Express, Bank of America, Coca-Cola, Chevron, Moody's, Occidental Petroleum, Kraft Heinz, Anda Insurance and Devitt.

It is worth noting that when Berkshire disclosed its positions in the first quarter in May this year, it applied to keep some positions confidential, triggering market speculation.It is speculated that the "mystery position" may be an industrial company with a total amount of nearly US$5 billion. The emergence of new targets such as Nucor Steel in the second quarter makes this speculation more reasonable.

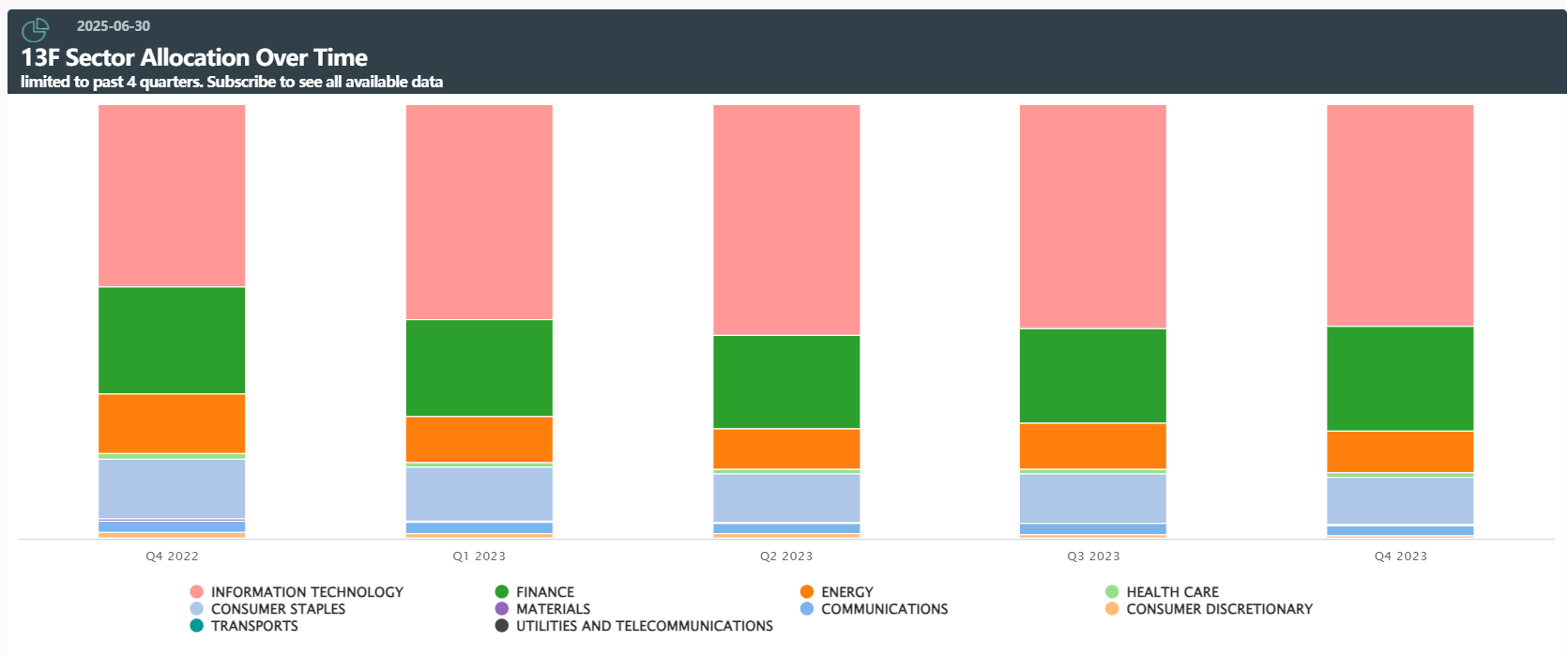

From the perspective of investment logic, Berkshire's operations in the second quarter showed three major characteristics: First, by reducing its holdings of highly concentrated positions such as Apple and Bank of America, it reduced the risk of a single industry and company and locked in part of its book profits; Second, we will deploy sectors such as medical, steel, and real estate against the trend and bet on industry leaders with stable cash flow or cyclical reversal potential; Third, we will retain certain cash and liquidity to reserve operating space for possible macro policy shifts and market fluctuations.