US December CPI Data Exceeds Expectations Google Announces Hundreds of Layoffs

Google (GOOGL) announced it will cut hundreds of employees across multiple business areas globally, meaning Google is trying to cut costs further and focus on investing in the company's most important priorities and significant opportunities ahead.。

U.S. stock news before the market.

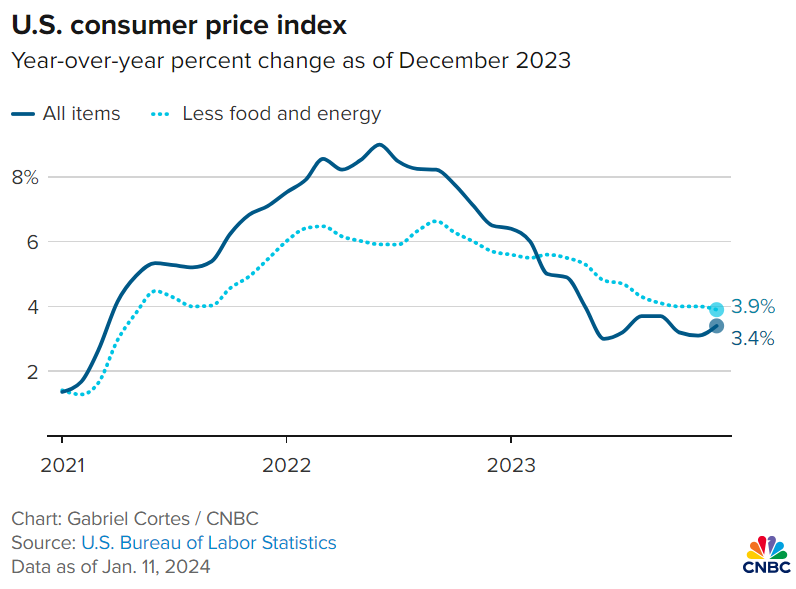

"01" December CPI exceeded expectations

According to the latest report from the U.S. Bureau of Labor Statistics, the CPI increased by + 3 in December..4%, monthly increase + 0.3%, both exceeded expectations (+ 3.2%, + 0.2%), rising housing costs contributed the most to pushing up the CPI, and higher energy prices explained why December inflation was higher than expected and exceeded November's annual increase of + 3.1%; however, even after excluding food and energy, the core CPI increased by + 3 per year..9%, monthly increase + 0.3%, still both exceeded expectations (+ 3.8%, + 0.2%), for the Federal Reserve (Fed), the report does not support expectations of a March rate cut, the dollar index, U.S. bond yields short-term pull up, U.S. stock futures pre-market lower。

"02" Google announced hundreds of layoffs

Google (GOOGL) announced it will cut hundreds of employees across multiple business areas globally, meaning Google is trying to cut costs further and focus on investing in the company's most important priorities and significant opportunities ahead.。According to Google, the layoffs cover the Google Assistant department, devices and services department, involving a number of hardware, software areas of employees, but the specific scale and scope of the layoffs can not be determined, the goal is to pursue the simplification of management, to achieve organizational flattening, in order to improve the efficiency of decision-making.。

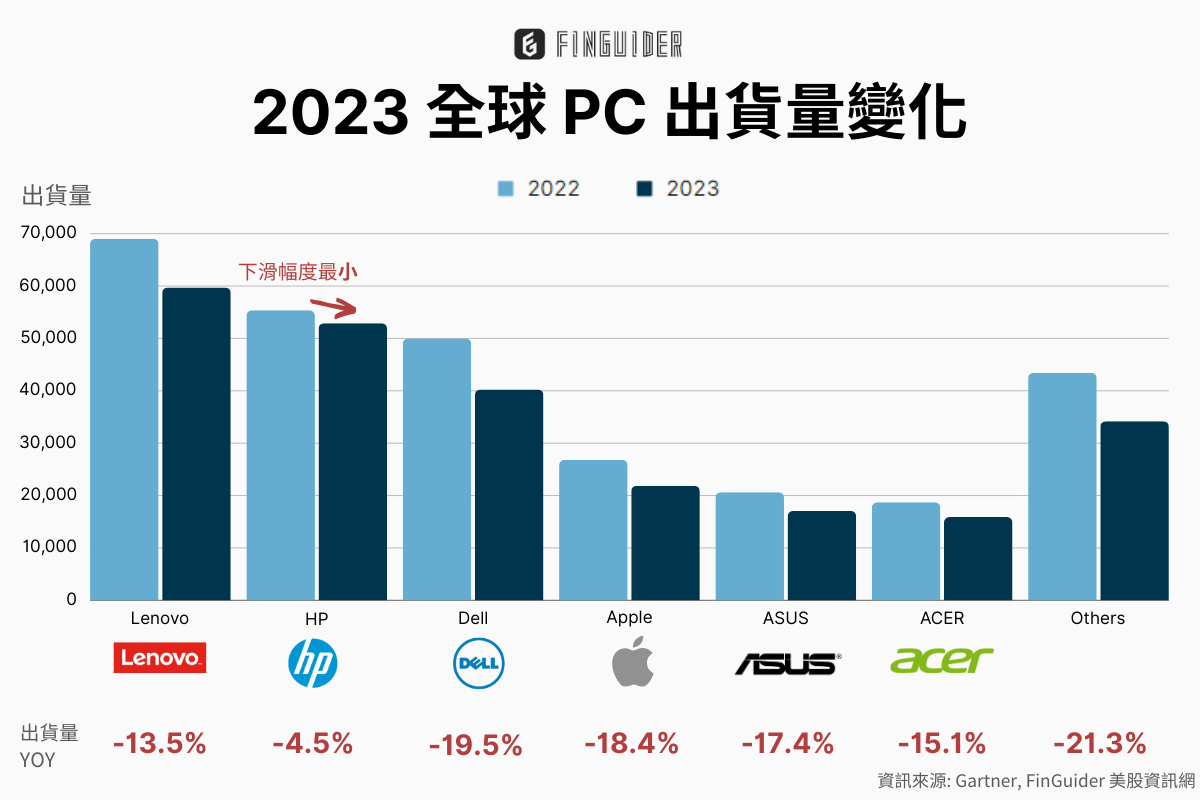

"03" Global PC market out of the doldrums at the end of 2023

Research firm Gartner's latest survey shows that global PC shipments in 2023 were 2.4.2 billion units, compared to the 2022 recession -14.8%, not only for two consecutive years of double-digit recession, but also for the first time since 2006 PC shipments fell to 2.Under 500 million units, but Q4 global PC shipments of 63.37 million units, a quarterly decrease of -1.6%, annual increase + 0.3%, meaning growth for the first time after eight consecutive quarters of declining shipments。

"04" Bitcoin spot ETF ignites investor confidence

As the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin Spot ETF, incentivizing Coinbase (COIN), Robinhood (HOOD) pre-market synchronized surge。Tom Lee, founder of investment firm Fundstrat, said that the approval of the Bitcoin Spot ETF will drive a surge in demand, with estimates that Bitcoin could jump to $100,000 to $150,000 in the next 12 months, and it's worth noting that Lee is not the only analyst with high expectations for Bitcoin, with Standard Chartered also noting that Bitcoin is expected to soar to $200,000 by the end of 2025.。

"05" Barclays continues to look down on Apple's prospects

Barclays said Apple's (AAPL) App Store is on track to grow revenue by + 10% a year in the most recent quarter, but growth in the App Store could slow to mid-single digits as the base period gets higher in coming quarters。Analyst Tim Long pointed out that Apple will face a more difficult environment in many ways this year, in addition to the slowdown in software revenue growth, hardware revenue in the coming quarter may also be weaker than the market expected, mainly due to the impact of sluggish iPhone sales in China, the weak general economic environment in Europe and the United States, and the rebound in Android camp sales.。

"06" Microsoft to strengthen the protection of EU data sovereignty

Microsoft (MSFT) said it has upgraded its cloud infrastructure so that customers in the EU can better store and process personal data within the EU.。Global technology companies have been facing pressure from EU regulators to provide so-called "sovereign independence" cloud services, strict protection of data security within the EU, Amazon (AMZN) cloud computing department (AWS) in October last year has launched a separate cloud service for Europe。

《 More 》

* Reuters reported that shipping giant Maersk (Maersk) announced a detour by rail due to the ongoing drought in the Panama Canal, and the CEO of Maersk revealed that it is not yet clear when the Red Sea route will resume, which is expected to have a considerable impact on global economic growth.

* U.S. natural gas production giant Chesapeake (CHK) announced the acquisition of Southwest Energy Company (SWN) in a $7.4 billion all-stock deal, forming the nation's largest natural gas producer with an estimated enterprise value of about $24 billion.

* After the spot Bitcoin ETF was approved by the SEC, although Musk reiterated that he would not spend much time on Bitcoin, he was open to using Bitcoin on the X platform

* JPMorgan Asset Management said that as the U.S. economy slows, the Fed's final rate cut may exceed the signal shown in the current interest rate dot plot, and the market expects that a 6-yard rate cut may be appropriate, which is expected to push the yield curve steeper, so it is bullish on short-term bonds.

* NIO (NIO) announced strategic partnerships with several Chinese automotive supply chains, including collaborating on the construction of shared energy storage systems, as well as cooperation in charging and battery swapping.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.