Doo Financial Observation| Does Musk throw US$1 billion and Tesla's share price reach an inflection point?

Tesla, rising during the year.

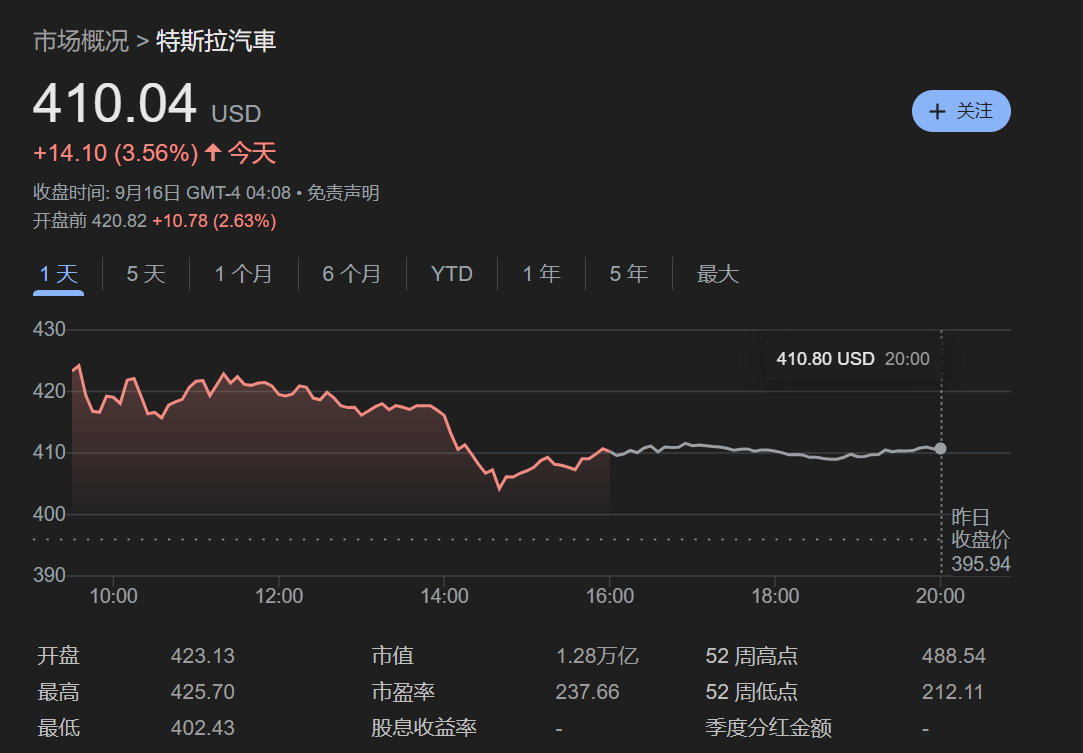

In early trading of U.S. stocks on September 16, U.S. Eastern Time, Tesla's share price rose by more than 6% at one point due to Musk's rare large-scale open market increase, marking that its trend turned from decline to rise during the year.

Model Y L sold well

Trillion-dollar incentives to put Maskra back into the "driving seat"

In recent years, Musk's energy has been highly dispersed among multiple projects. In addition to Tesla, he has also been deeply involved in SpaceX, X (formerly Twitter), Neuralink, xAI and other businesses, sometimes even leaving the market with the impression that "Tesla is just one of his many projects."This kind of "attention drift" has caused investor uneasiness, especially as Tesla is facing intensified global competition, rising profit pressure, and AI transformation still needs to be verified. The market is increasingly hoping that Musk can refocus more energy. Focus on the company's core growth and redemption path.

What's special about this incentive plan is that instead of setting goals based on traditional stock options, company market value or short-term financial performance, it binds the incentive structure to several challenging yet highly aligned KPIs in Tesla's long-term strategic direction: such as realizing a large-scale autonomous taxi network, bulk delivery of Optimus robots, increasing adjusted EBITDA to hundreds of billions of dollars, and achieving breakthroughs in vertical integration of AI and hardware.The setting of each goal means that Musk must personally step down and promote the implementation of the company's core strategy before he can be qualified to honor the corresponding salary.

Musk spends $1 billion to double his bet on "Tesla AI"

In less than a week after the salary plan was proposed, Musk purchased Tesla shares on a large scale through the open market between September 11 and 12, purchasing a total of approximately 2.57 million shares, with a total amount of nearly 1 billion U.S. dollars.

Daniellves, head of global technology research at U.S. investment bank Wedbush, said the latest stock purchase "is a huge signal of confidence for Tesla bulls, indicating that Musk is doubling down on Tesla's artificial intelligence plans."”

So, is the future direction of Tesla's share price really reaching an inflection point?

Despite the recent strong trend, Wall Street is still divided on Tesla's future outlook.Most investment banks and research institutions have become cautious, and stock prices are generally expected to fluctuate around US$300 in the next 12 months, slightly lower than current levels.In the latest MarketBeat consensus, the average target price of 41 analysts for TSLA for the next 12 months is US$303, while the current price is close to US$410, with a 25%-30% correction space.In terms of ratings,"Hold" has become mainstream, showing that the market's confidence in continuing to rise sharply in the short term is still limited.

Of course, there are also optimists such as Wedbush who continue to set a target price above $500, but this view is still in the minority.The core focus of the market has gradually shifted from simple delivery volume and revenue expansion to new businesses with high uncertainties such as the redemption of AI capabilities and the commercialization of humanoid robots.This means that even if Musk personally increases the number, it will not be possible to completely eliminate the risks and fluctuations in the future route.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.