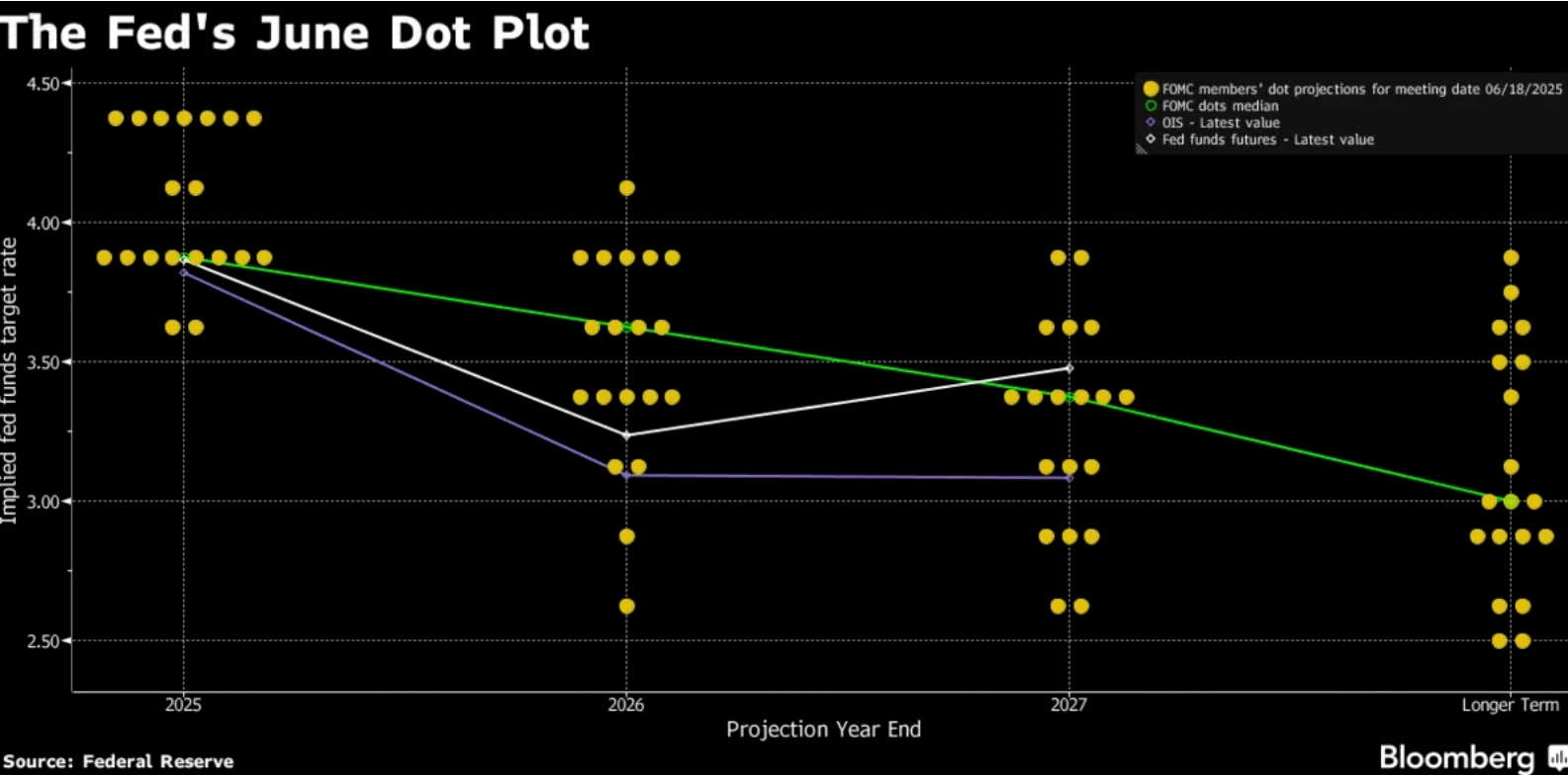

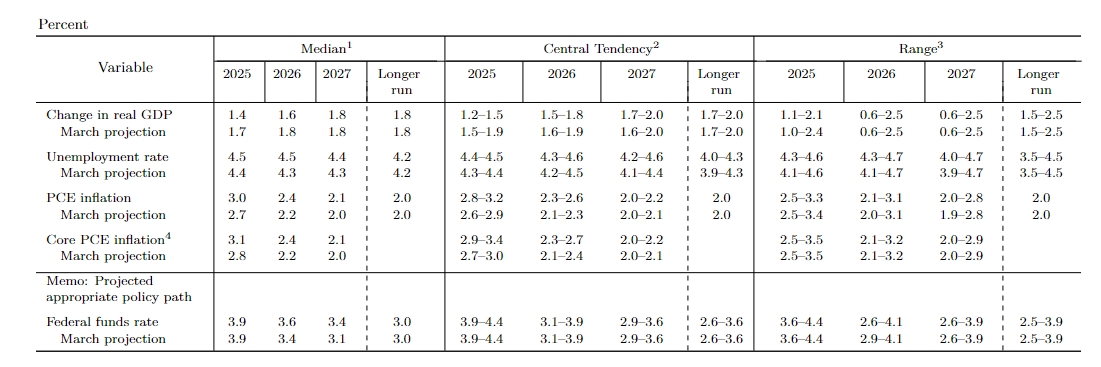

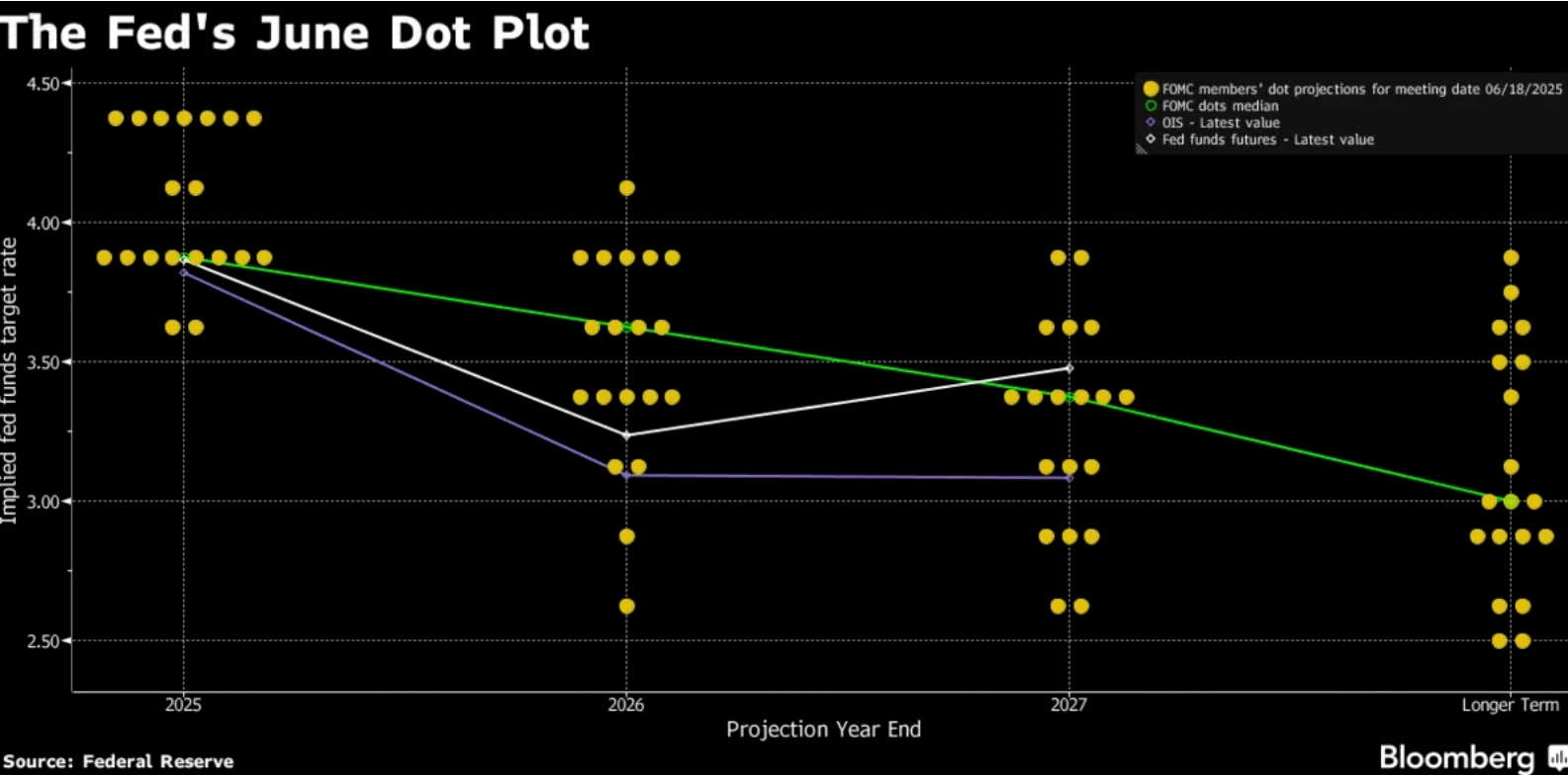

The number of officials advocating no interest rate cuts throughout the year increased from four in March to seven.

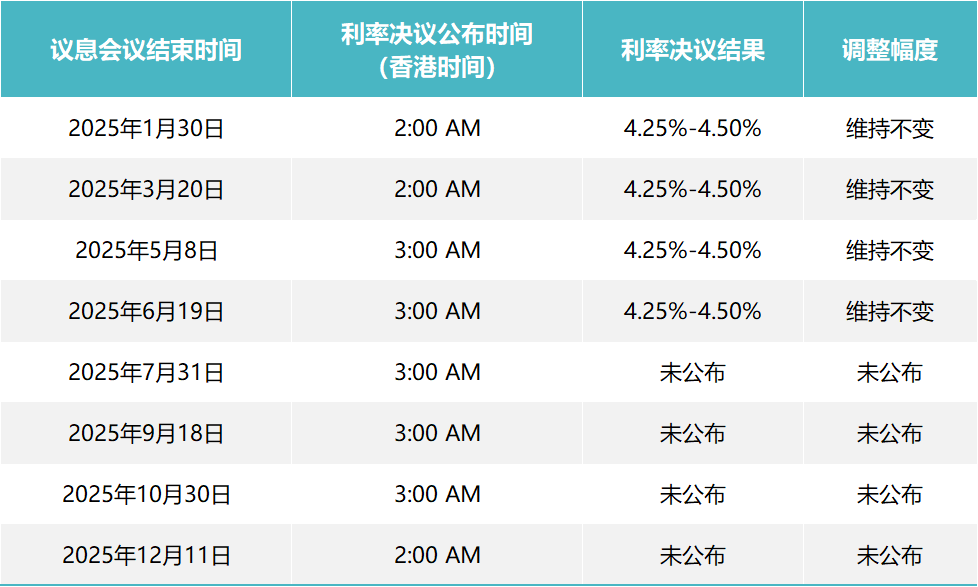

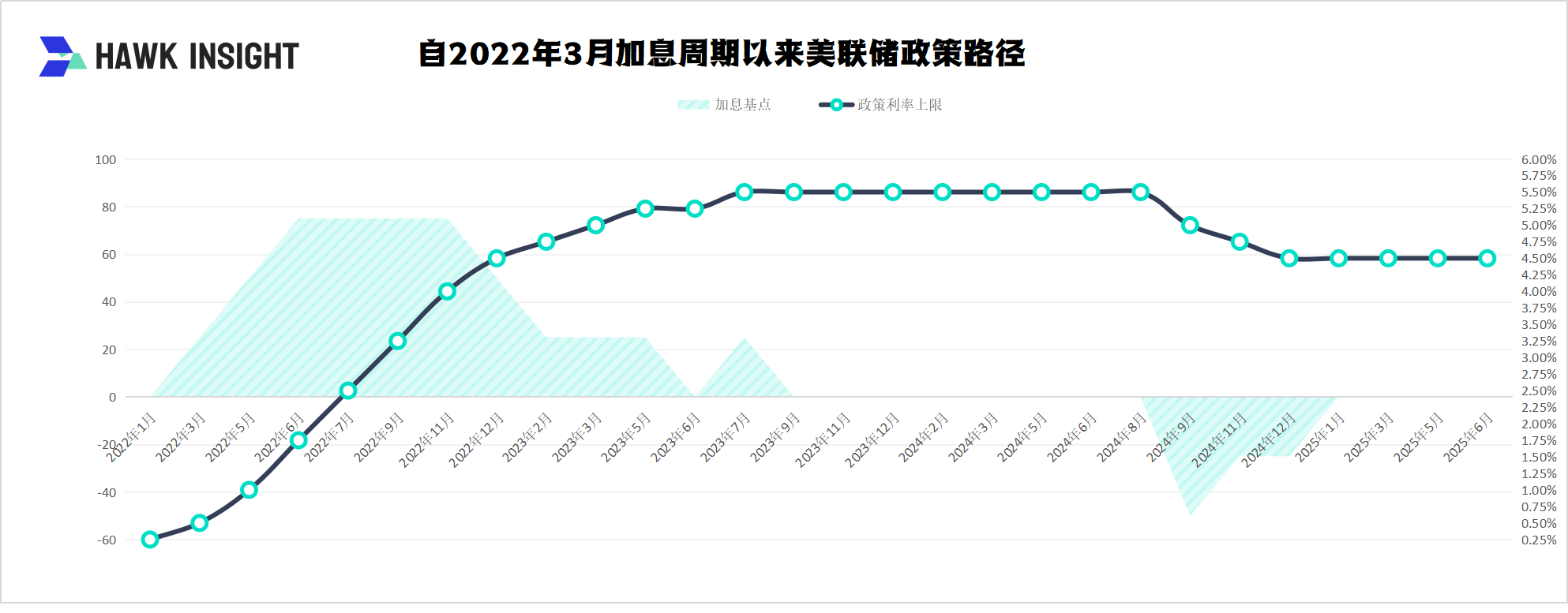

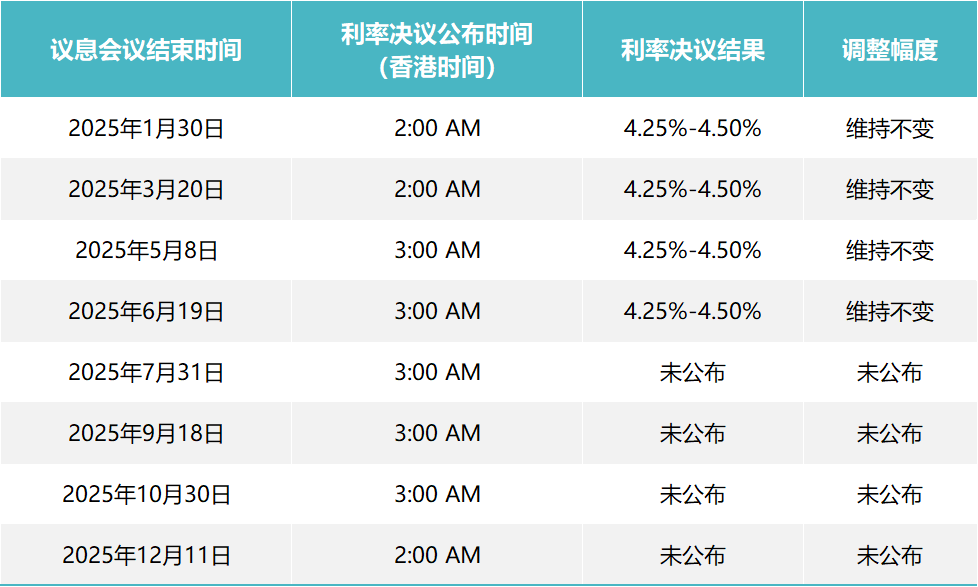

On June 19, the Federal Reserve continued to keep interest rates unchanged.

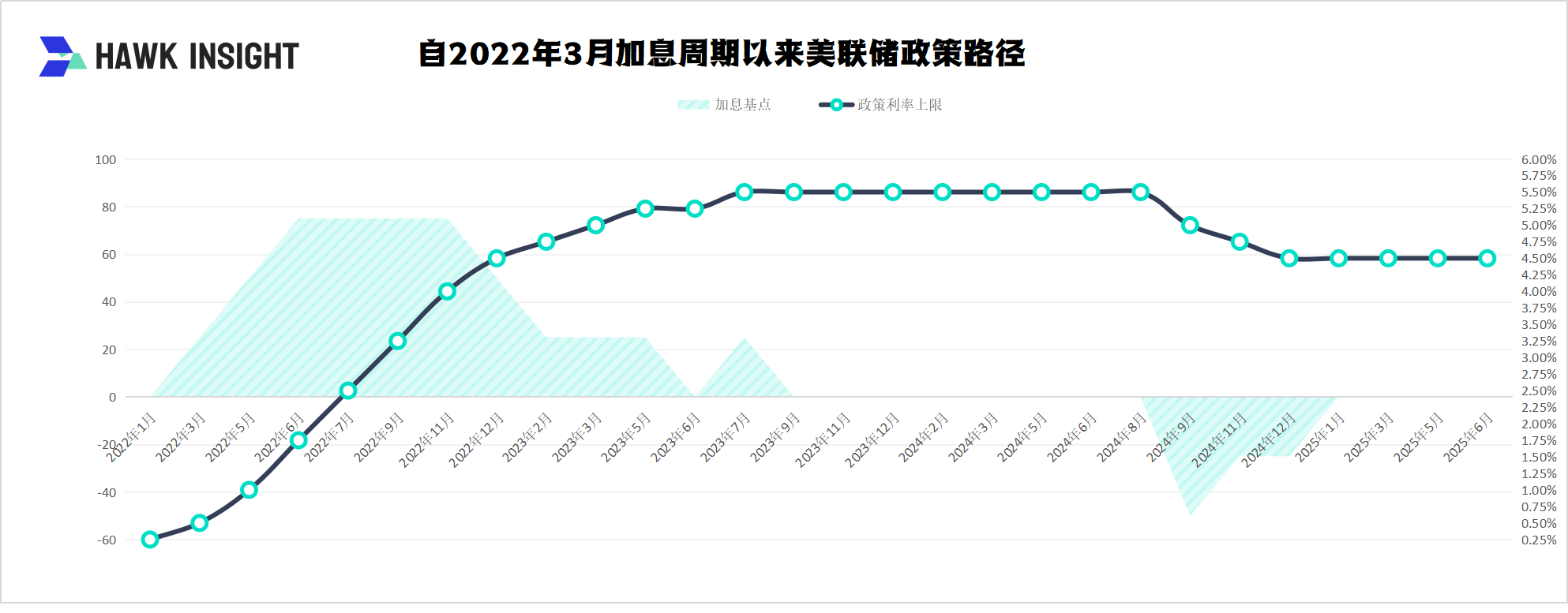

The Federal Reserve anchored the federal funds rate at the 4.25%-4.5% range for the fourth consecutive time at the FOMC meeting in June. This decision was fully in line with market expectations (the futures market forecast probability reached 99.9%).

Following the interest rate decision was also released a dot chart. The median forecast of two interest rate cuts (50 basis points in total) in 2025 was maintained, but the hawks have increased significantly-the number of officials advocating no interest rate cuts throughout the year increased from 4 in March to 7, while the number of officials supporting at least one interest rate cut shrank from 16 to 12.

On the eve of this month's meeting, many officials said they preferred to keep interest rates stable for some time, pending clarity on how Trump's economic policies will affect inflation and the overall economy.

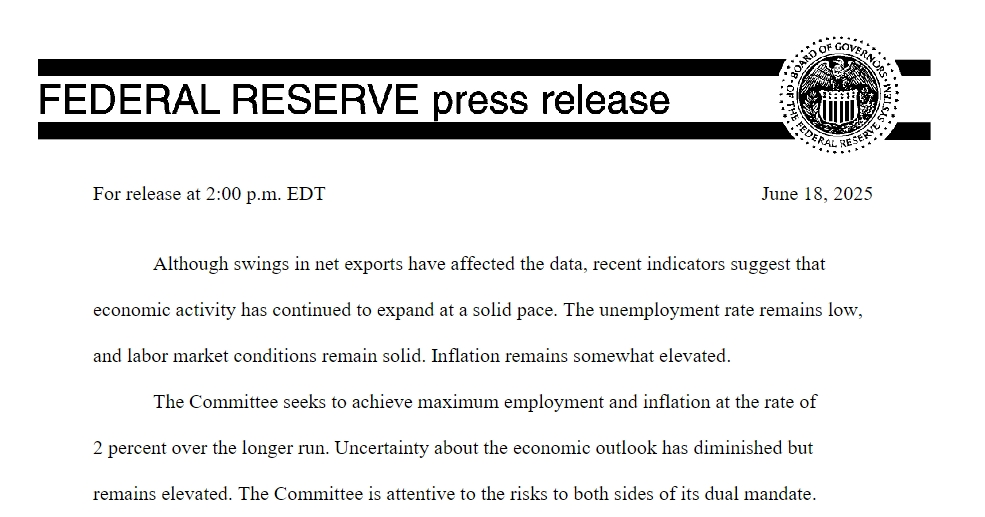

In a post-meeting statement, policymakers abandoned statements made at the previous meeting that unemployment and inflation risks were rising.They also said uncertainty about the economic outlook has eased but remains high.

Federal Reserve officials and economists generally expect that the government's expansion of tariff measures will put pressure on economic activity and put upward pressure on prices.Officials 'interest rate expectations are in line with investors' expectations for a rate cut this year before the announcement.

Asked about officials 'differences over interest rate forecasts, Powell downplayed that.Given the high degree of economic uncertainty, he said: No one has full confidence in these interest rate paths.

U.S. Treasuries closed near flat on the day, with yields above intraday lows, and traders continue to expect two interest rate cuts this year, with the first likely in September.

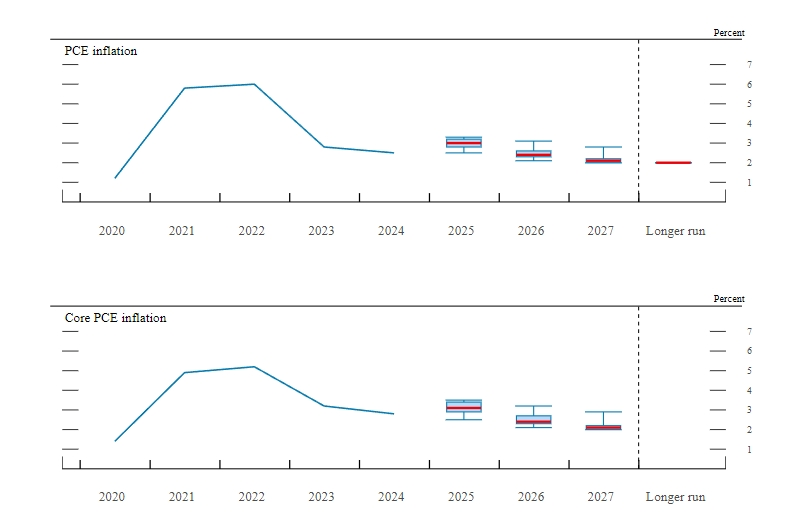

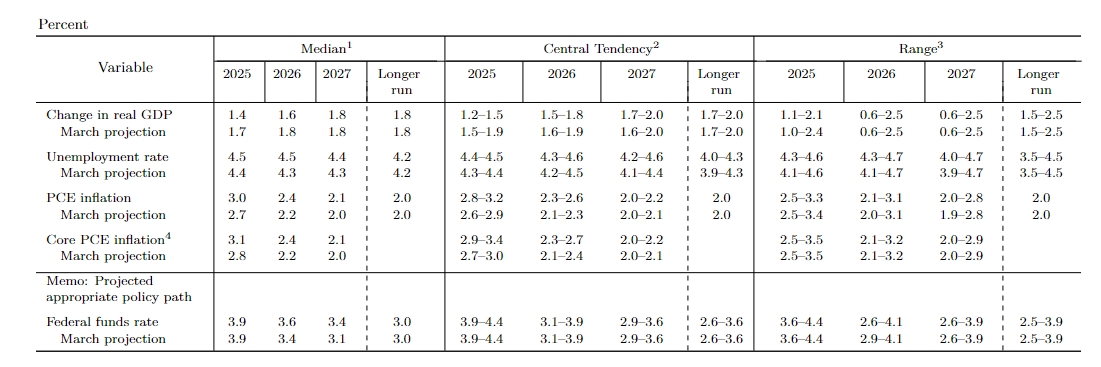

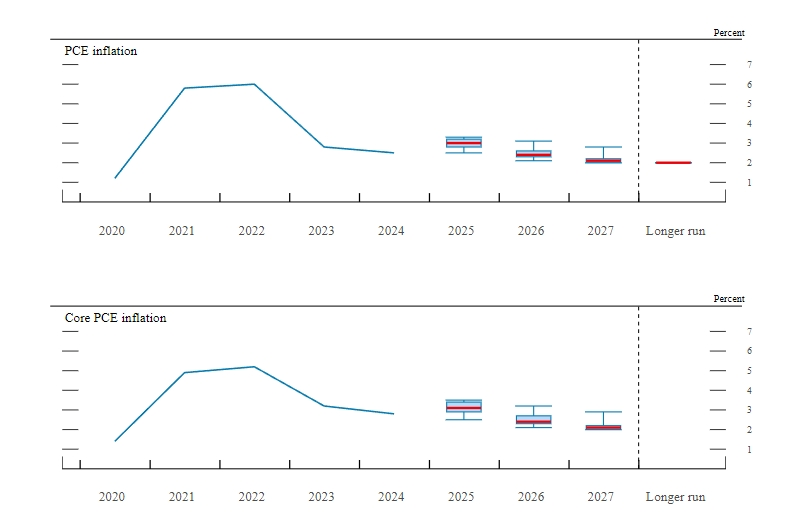

The revision of the Economic Forecast Summary (SEP) further reveals the Fed's deep concerns.

The GDP growth forecast in 2025 will be lowered from 1.7% to 1.4%, and from 1.8% to 1.6% in 2026. At the same time, the unemployment rate is expected to be raised across the board and is expected to rise to 4.5% in 2025.

In 2025, PCE inflation expectations will be significantly raised from 2.7% to 3.0%, while core PCE will increase from 2.8% to 3.1%, significantly higher than the actual PCE growth rate of 2.1% in April.These forecasts reflect the thorny situation facing Fed policymakers.Rising inflationary pressures usually mean that the Federal Reserve should raise interest rates to curb the economy, while slowing economic growth requires interest rates to stimulate the economy.

Trump has repeatedly urged the Federal Reserve to cut interest rates this year, saying that the Federal Reserve under Powell has often been slow to adjust policies.

The game between political pressure and central bank independence culminated at this meeting.Four hours before the resolution was announced, Trump publicly attacked Powell as a "stupid person," accusing his refusal to cut interest rates of causing hundreds of billions of dollars in losses in U.S. financing costs, and declared that "interest rates should be reduced by at least 2.5 percentage points."Such remarks continue his recent escalating pattern of pressure: from a request for a 100 basis point interest rate cut in January to gradually increase it to 250 basis points.

However, the Fed has demonstrated remarkable institutional resilience.Powell indirectly responded to political interference with the idea that "the only goal of the FOMC is economic stability" and emphasized the dual mission of decision-making based entirely on employment and inflation data.This calm stance is also reflected in the 2026 interest rate forecast-despite election-year pressures, the 2026 median interest rate forecast is raised from 3.4% to 3.6%, signaling a determination to anchor long-term inflation.

Currently, although the market regards September as the most likely first window for interest rate cuts (the current pricing probability is about 65%), the expected path is still full of variables.The benchmark scenario points to a full-year interest rate cut of 50-75 basis points, and the trigger conditions must meet the dual requirements of a steady decline in inflation and a moderate increase in unemployment.

Analysts said that if tariffs are implemented and inflation exceeds 3% or wage growth continues to be overheated, the interest rate cut may shrink to 25-50 basis points; otherwise, economic recession signals or liquidity crises may force the Federal Reserve to initiate aggressive easing of 75-100 basis points.