Even if "Made in the USA" is strongly promoted, the "localization" of the iPhone is only a migration of the final assembly process.

On May 26, the Trump administration recently put pressure on Apple again to move its iPhone production line back to the United States, otherwise it will face a 25% tariff penalty.What happens when the iPhone is labeled "Made in America"?

According to calculations by Bank of America analyst Wamsi Mohan, if the iPhone production line is completely moved back to the United States, labor costs alone will increase by 25%. Coupled with tariffs, parts import costs and supply chain reconstruction expenditures, the final selling price may increase from the current. US$1199 soared to US$3500, an increase of as much as 190%-this price has far exceeded the psychological threshold of ordinary consumers.

Market research shows that if the price of the iPhone doubles, sales in the U.S. market may plummet by 18%-22%, directly causing Apple to lose annual revenue of US$7 - 8.5 billion.What is more serious is that the shortcomings of the U.S. manufacturing industry lie not only in cost, but also in the fragmentation of its ecosystem-the matching rate of the local electronics supply chain is less than 15%, and core components such as OLED screens and battery modules still need to rely on Asian imports. Rebuilding a complete supply chain takes more than five years and costs more than US$200 billion, equivalent to 1.8 times Apple's 2024 net profit.InvalidParameterValue

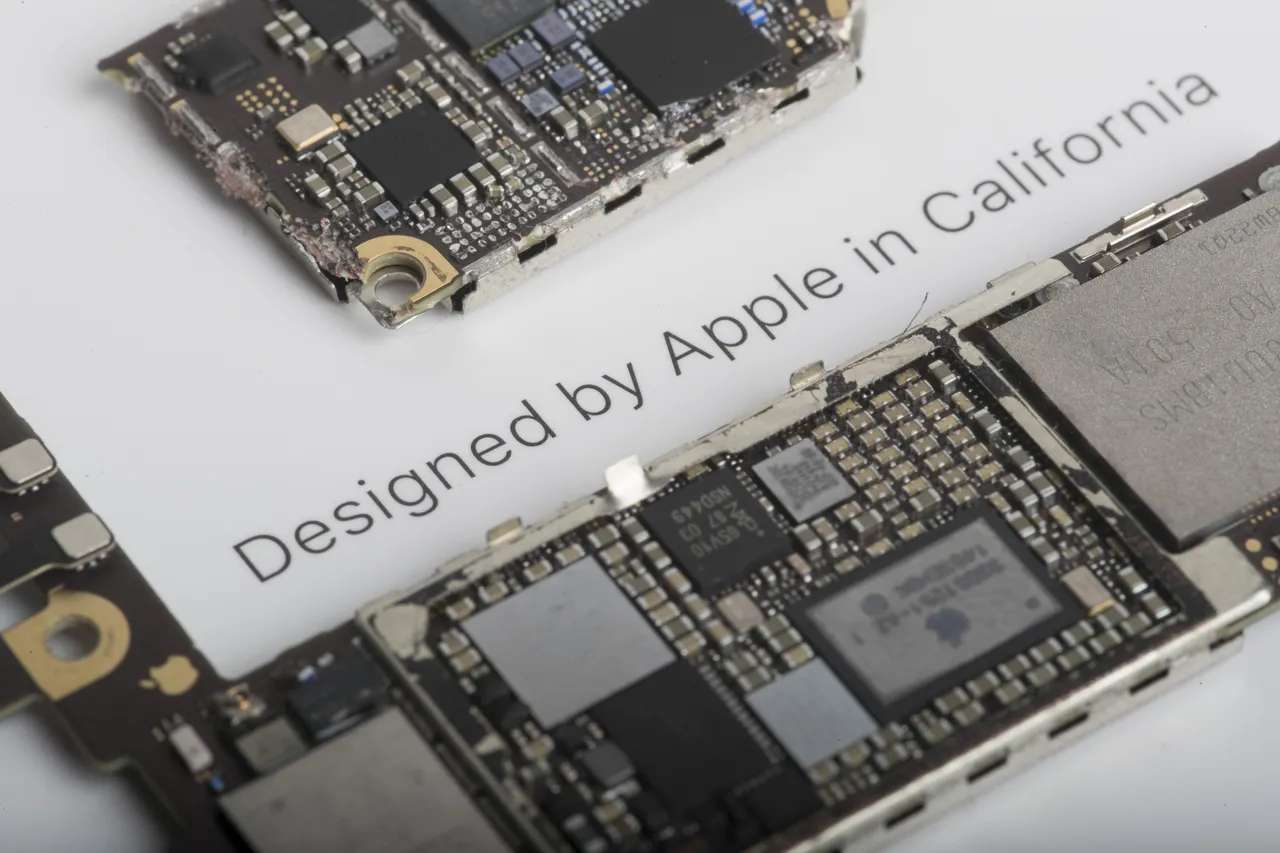

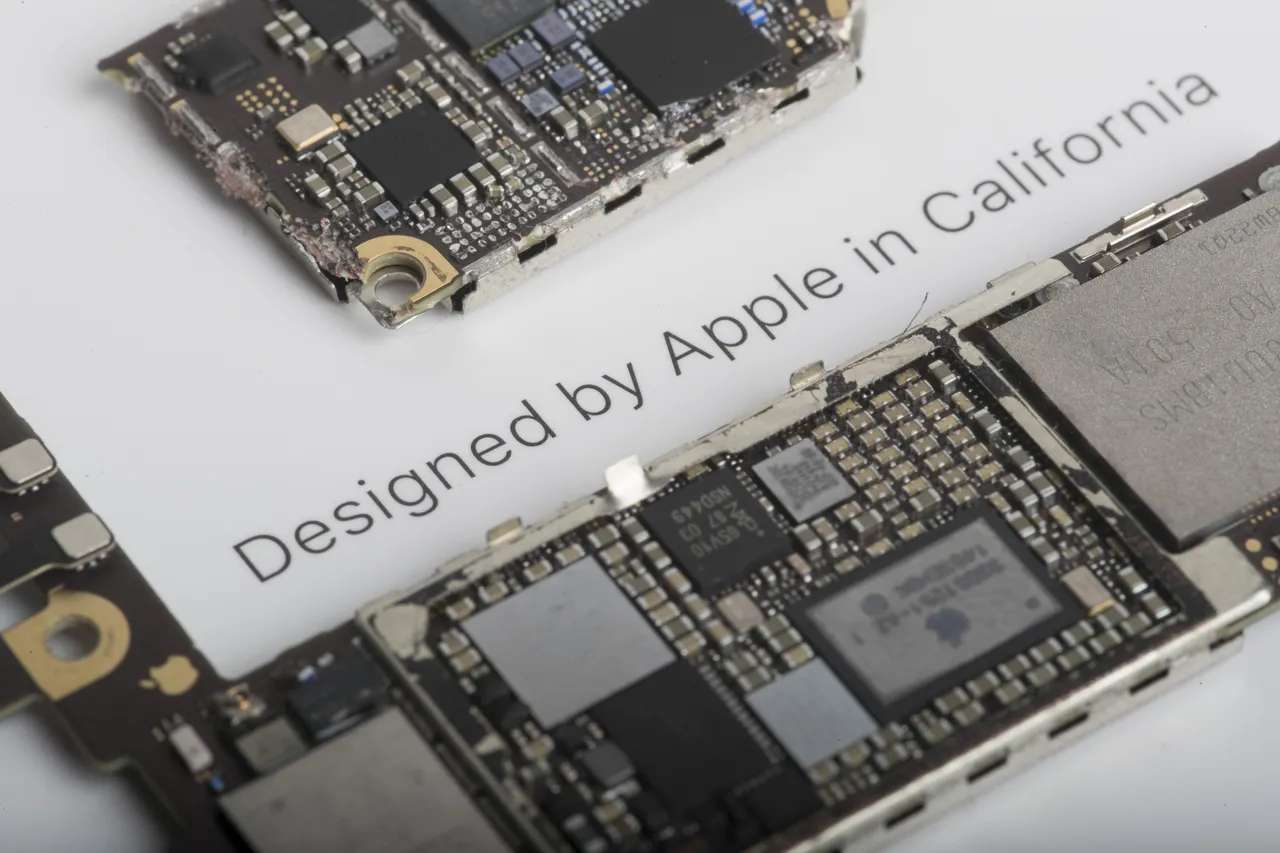

Apple's dilemma reflects the "path dependence" of the global industrial chain-the birth of an iPhone involved 19 countries around the world and more than 200 suppliers, and 90% of its assembly was concentrated in China, forming a "2-hour response" cluster effect.This efficiency advantage stems from the industrial ecology that China has accumulated over decades: from the large-scale reserve of mold engineers (China can easily fill multiple football fields, but the United States cannot even get a room), to the control of key raw materials such as rare earths (the United States relies on China for imports of 70% of rare earths), to the synergy of bonded zone policies and logistics networks.

In contrast, the yield rate of Indian factories is 5%-8% lower than that of China, while production capacity in Vietnam is slowly climbing due to insufficient labor skills.Even if Apple tries the "China +1" strategy to spread risks, the supply chain matching rate of Southeast Asian countries is less than 30%, and core components still need to be transferred from China, with little cost advantage.InvalidParameterValue

In the face of tariff pressure, Apple's strategy shows pragmatism.Cook did not flatly reject "Made in America" like Jobs did, but traded small-scale local production (such as Mac Pro assembly in Texas) in exchange for tariff exemptions while accelerating supply chain diversification.For example, increasing Lixun Precision's OEM share from 18% to 35%, and using its FOB (FOB) model to transfer tariff risks, it is expected to save US$3.3 - 4.4 billion annually in costs.

In addition, Apple is trying to maintain short-term price stability by hoarding inventory and adjusting its pricing strategy to cushion the impact by urgently mobilizing five cargo aircraft at the end of March to transport 600 tons of iPhones from India to the United States.

However, these measures are only temporary measures.If tariffs become long-term, Apple may be forced to choose between "raising prices to protect profits" or "lowering prices to protect shares". No matter which choice, its average gross profit margin of 45% will be eroded.InvalidParameterValue

The ripple effect of this supply chain restructuring has spread to the macroeconomic level.Morgan Stanley predicts that if the 25% tariff is fully implemented, the U.S. inflation rate may climb to 3%, increasing average household spending by $3800, thereby curbing demand for consumer electronics.For Apple, the bigger worry lies in the weakening of innovation capabilities-a potential profit loss of $33 billion a year (26% of operating profit) may force the company to cut R & D investment and shake its technological leadership.The capital market has already voted with its feet: Apple's share price plunged 23% on the 4th after the news was announced. The market value of fruit chain companies such as Lixun Precision and Goer Co., Ltd. was once halved until the tariff suspension policy was introduced.InvalidParameterValue

Trump's vision of "manufacturing reflux" essentially reduces complex economic issues to political slogans.The hollowing out of U.S. manufacturing has not been achieved in a cold day: there is a gap of 500,000 industrial workers, the hourly wage is six times that of China workers, and there is widespread resistance to high-intensity assembly line work (for example, Foxconn's Wisconsin plant ultimately created only 1454 jobs, far below the promised 13,000).

What's even more ironic is that even if "Made in the United States" is strongly promoted, the "localization" of the iPhone is only a relocation of the final assembly process. 90% of its parts and components still rely on the global supply chain, and the tariff costs are ultimately borne by American consumers.This paradox reveals a cruel reality: in the face of efficiency and cost-driven industrial chain logic, political intervention often has little effect.InvalidParameterValue

Cook once said: "Globalization is not an option, it is a reality."When Trump's tariff stick attempts to rewrite this reality, Apple's dilemma just confirms the resilience of the global industrial chain-China's manufacturing industry has been upgraded from a OEM to a solution provider, directly reaching the global market through TEMU, SHEIN and other platforms, weakening the bargaining power of traditional channels.

The end of this game may have long been doomed: in today's irreversible industrial division of labor, the price of forcibly tearing the supply chain will eventually be borne by the initiator himself.For Apple, how to find a balance between political risk and business logic will be more challenging than the release of any new product.