Data from Metropolis Trading shows that recently, Yunyinggu Technology Co., Ltd.(referred to as "Yunyinggu"), the largest AMOLED display driver chip manufacturer in the mainland of China, submitted a listing application to the main board of the Hong Kong Stock Exchange, with CICC and CITIC Securities as their co-sponsors.

This listing of Yunying Valley has two backgrounds.

First, in January 2023, the company signed a listing guidance agreement, which was originally scheduled to list on A-shares, but then due to various reasons, the listing plan was aborted.This IPO on the Hong Kong Stock Exchange is the second time Yunying Valley is preparing for the capital market.

Second, in March 2025, Yunyinggu and Huiding Technology terminated the acquisition transaction because the two parties failed to reach a final agreement on the commercial terms of the consideration.Less than half a year after the transaction was terminated, Yunyinggu submitted this IPO application, representing the company's urgent entry into the capital market.

company profile

Founded in 2012 and headquartered in Shenzhen, Yunying Valley Technology is a display driver chip design company adopting Fabless model (fabless), focusing on two core areas: AMOLED smartphone driver chips and Micro-OLED VR/AR device backplane chips.Founder Gu Jing (Tsinghua University Master, Harvard University Doctor of Engineering) led the team to build a full-stack technology system covering chip design, compensation algorithm and circuit layout, with 76 global authorized patents (including 49 overseas patents).

Its technical barriers are reflected in high pixel density solutions-the world's first 5644 PPI Micro-OLED backplane chip was launched in 2017. In 2024, the global market share in this field will reach 40.7%(second in the world). At the same time, AMOLED driver chip sales exceed 51.4 million pieces, with a global market share of 4.0%(first in the mainland of China and fifth in the world).

The company's customers cover 25% of the world's top smartphone brands and VR equipment manufacturers such as Meta and Pico. The shareholder lineup includes industrial capital such as Sequoia China, Xiaomi Yangtze River Fund, Huawei Hubble, and Qualcomm. In 2024, the post-Series F financing valuation reaches 8.33 billion yuan.

financial data

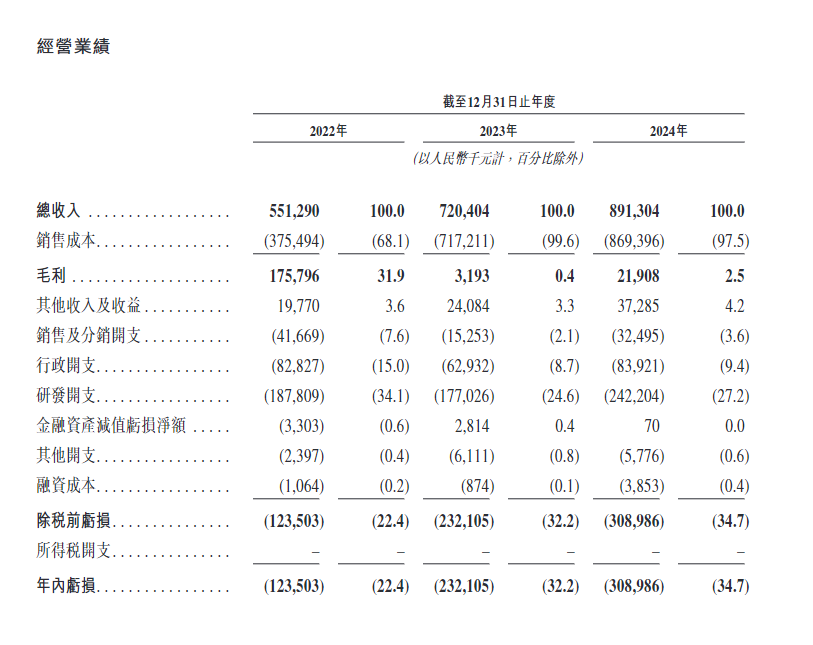

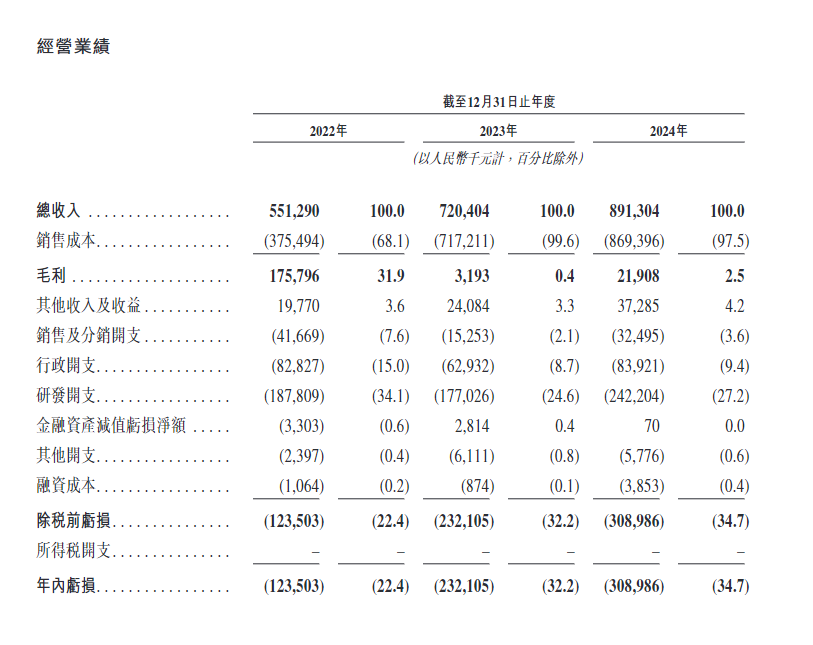

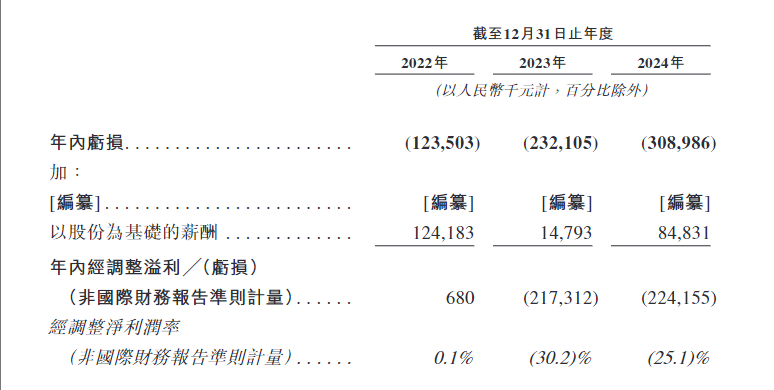

Yunying Valley's financial data presents a typical dilemma of "increasing but not increasing profits".

First, the company's revenue from 2022 to 2024 increased from 551 million yuan to 891 million yuan (CAGR 28.7%), but the gross profit margin of AMOLED chips (accounting for 91.6% of revenue) plummeted from 32.6% to 0.3%. The main reason was that the average selling price dropped by 38%(25.7 yuan →15.9 yuan/chip) in three years, while sales increased by 265% to 51.35 million chips in the same period, forming a vicious cycle of "price for volume".

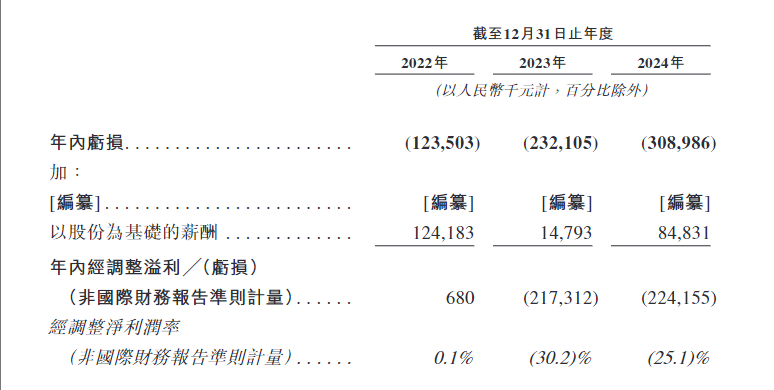

Not only that, the company's losses continue to expand.The net loss increased from 124 million yuan to 309 million yuan, and the loss ratio (loss/revenue) deteriorated from-22.4% to-34.7%.The company is burning too much money on R & D-investment in R & D in 2024 will reach 242 million yuan, accounting for 27.2% of total revenue.Although the investment and research end can support technological iteration, it has not been transformed into profit momentum.

As of the end of 2024, Yunying Valley's book cash is only 105 million yuan, but short-term borrowings alone are as high as 151 million yuan, and the current liability gap reaches 46 million yuan. The risk of insolvency is prominent.Customer concentration (the top five customers accounted for 90.2% of revenue, and the largest customer accounted for 54.1%) and supplier dependence (TSMC accounted for 74.5% of purchases) form a "double strangulation", and profit margins are extremely compressed.

industry prospects

Although Yunying Valley is in a financial dilemma, from the perspective of industry prospects, the focus of the global display panel industry is accelerating towards the mainland of China.

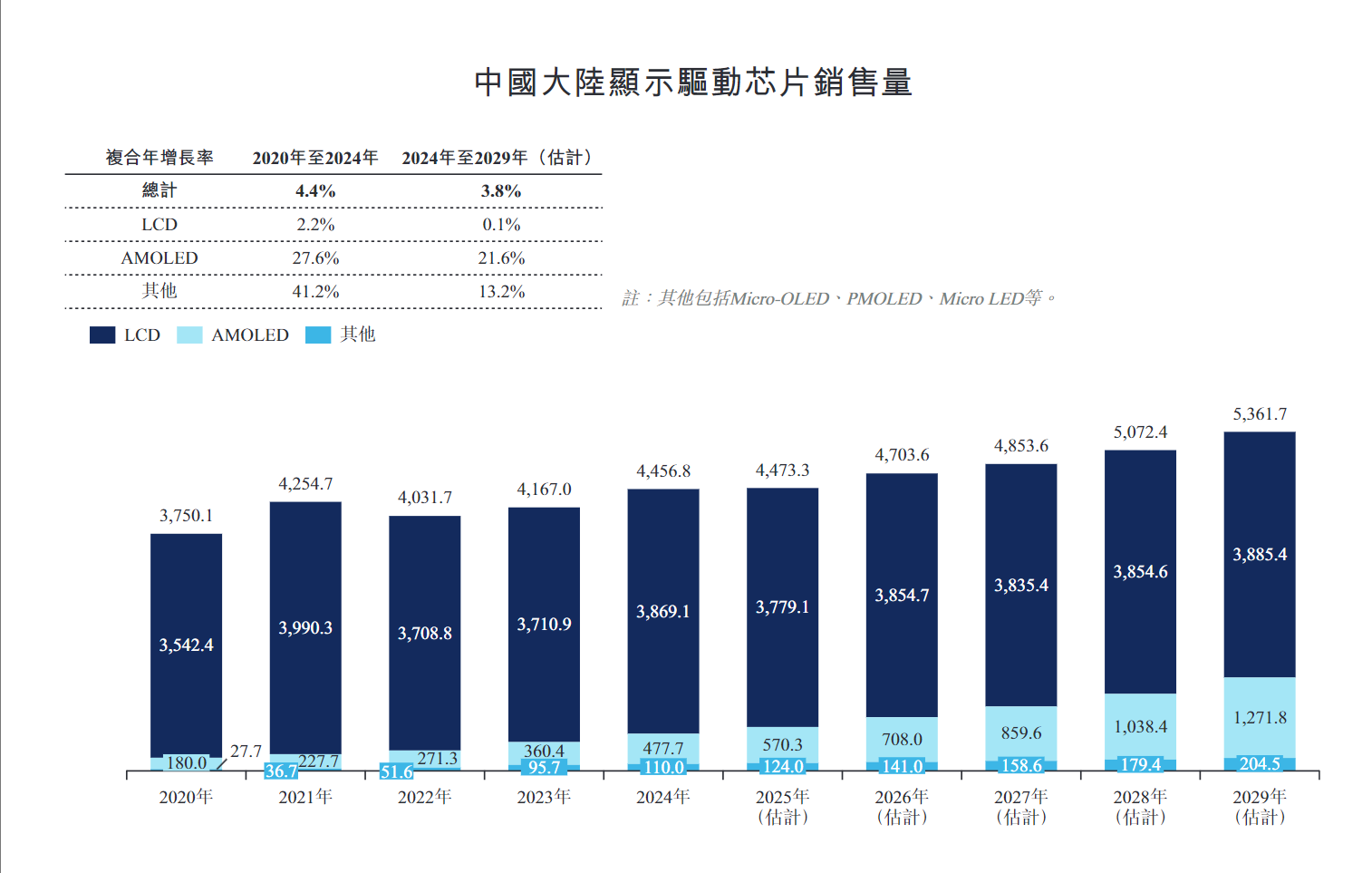

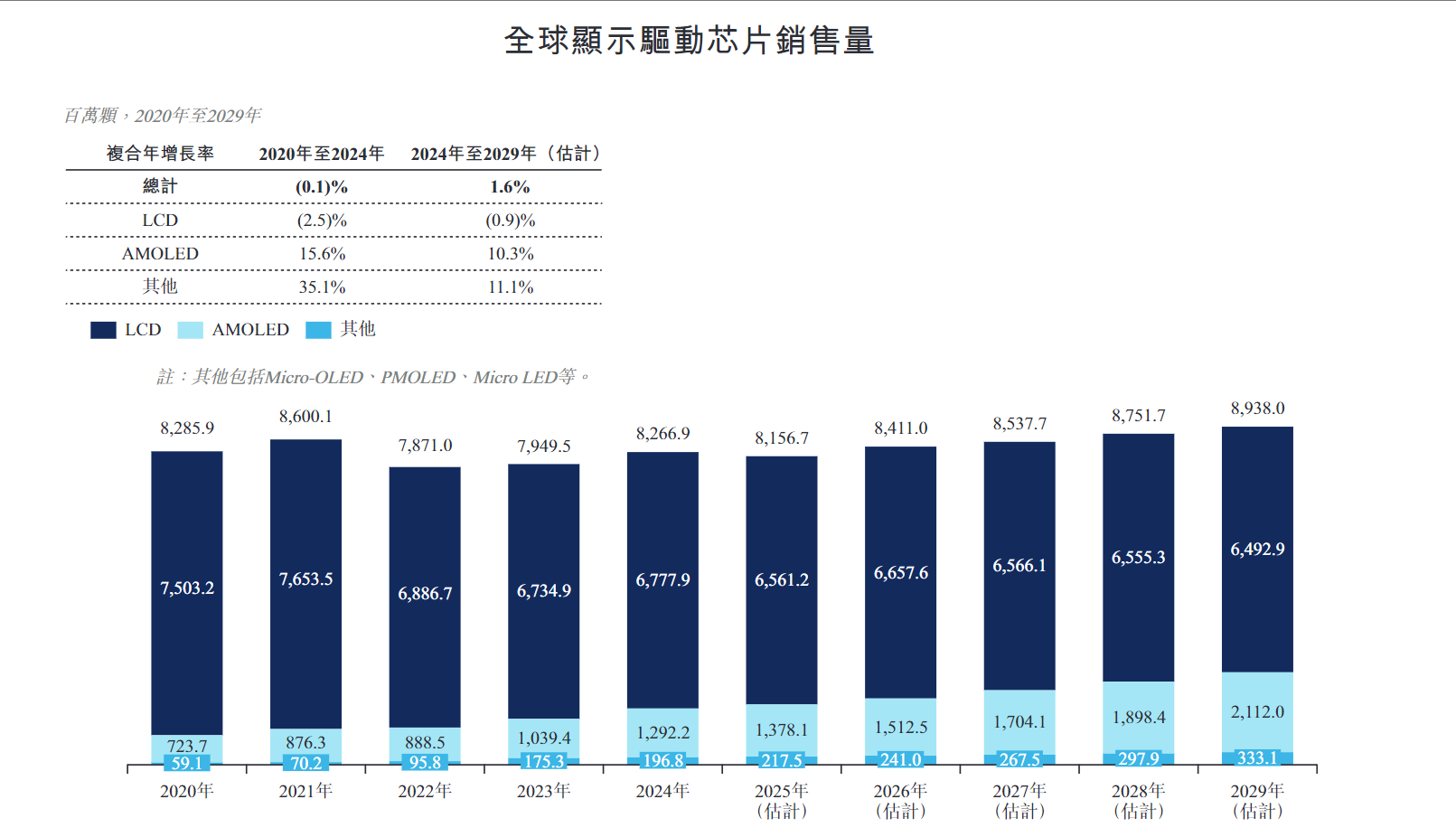

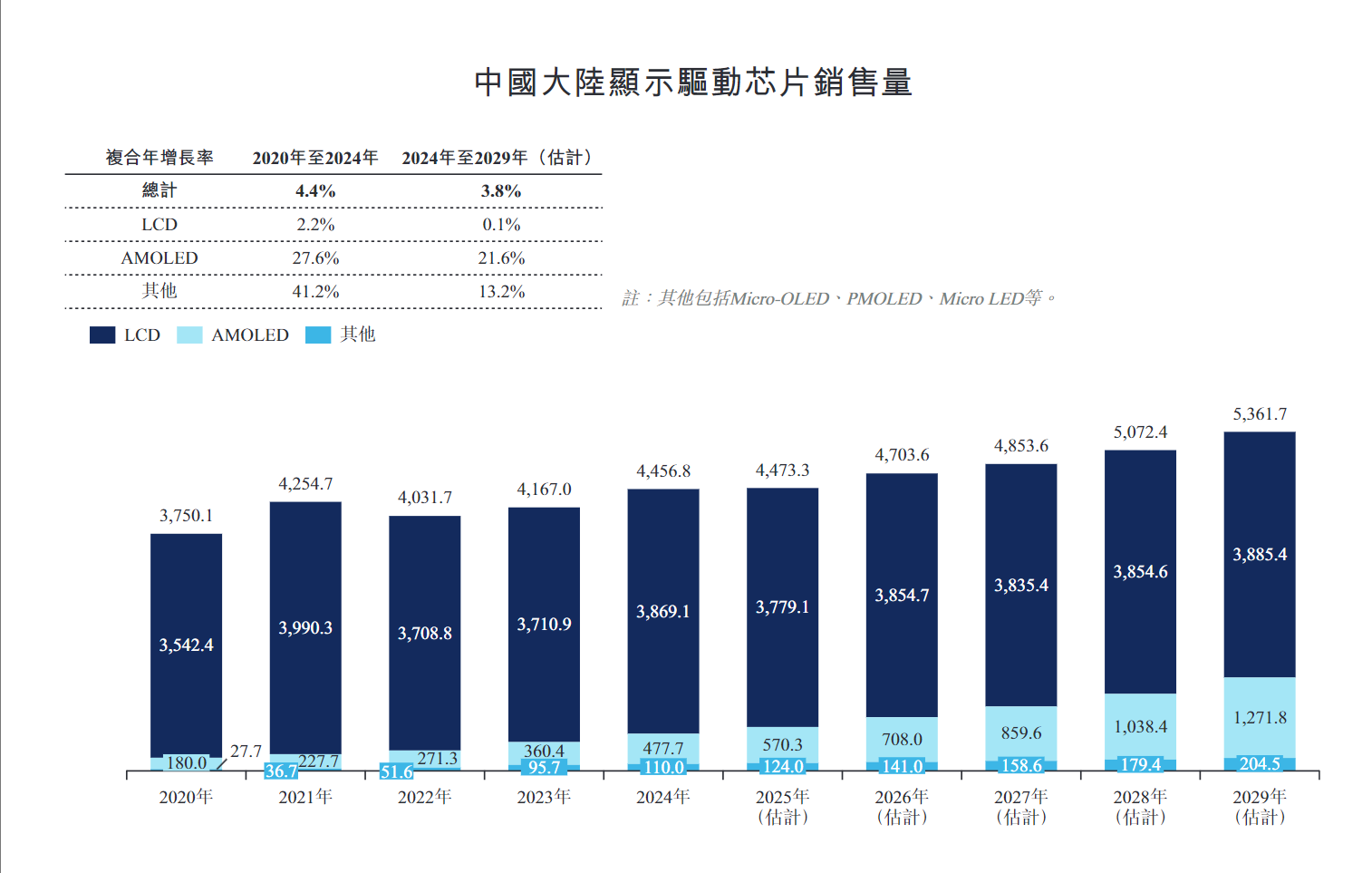

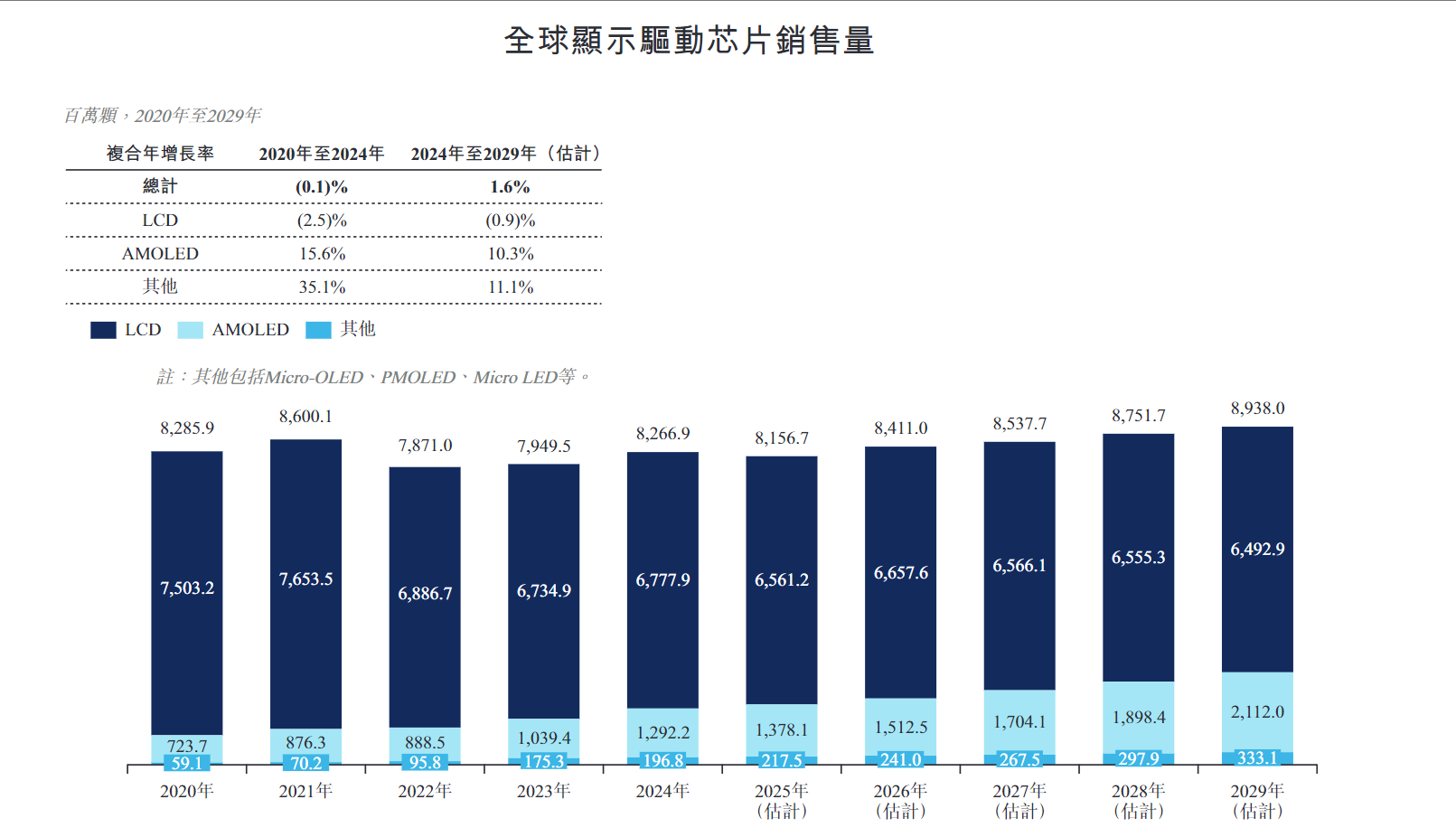

According to public data, the global share of display panel production capacity in the mainland of China has jumped from 50% in 2020 to 70% in 2024. It is expected to exceed the 80% mark by 2029, completely establishing its position as a global manufacturing center. This structural transfer has not only reshaped the pattern of the panel industry chain, but also directly promoted the explosive growth of China's display-driven chip market: Between 2020 and 2024, sales of display driver chips in the mainland of China increased from 3.75 billion to 4.456 billion, and the global market share climbed from 45.3% to 53.9% over the same period. The proportion of AMOLED panel production capacity has reached 55% of the world in 2024 and is expected to exceed 60% in 2029.

In the dual wave of industrial migration and technology upgrades, display driver chips serve as the core hub connecting processors and display panels, and undertake the key function of transforming digital signals into precise optical output. Their performance directly determines the color reproduction and energy consumption of the screen. Control and response speed.

With its ultra-high contrast, flexible foldable advantages and low power consumption brought by its self-luminous characteristics, AMOLED technology is rapidly replacing traditional TFT-LCD screens and becoming the mainstream choice for consumer electronics display technology.Frost and Sullivan research shows that the penetration rate of smartphone AMOLED panels has reached 60.1% in 2024 and is expected to increase to 69.9% in 2029, driving the annual sales of small and size AMOLED panels to exceed 900 million pieces.

What is more noteworthy is that as the production process matures and costs fall, AMOLED is reaching an inflection point in the field of large size applications. In 2024, the penetration rate of AMOLED for large size panels such as tablets, notebooks and vehicle central control will only be 4.7%, but it is expected to jump to 10.4% by 2029, forming a new growth engine.The expansion of the terminal market is directly transmitted to the upstream chip link. The global demand for AMOLED display driver chips will increase from 1.3 billion in 2024 to 2.1 billion in 2029, with an average annual growth rate of 10.3%. Among them, the mainland of China enterprises will increase their market share from 2% at the beginning of 2023 to 8% in 2024 by virtue of localized service response speed and cost advantages, achieving fourfold growth within two years.

In this wave of domestic substitution, Yunyinggu Technology has become a very representative observation sample.

As the first AMOLED driver chip design company in the mainland of China to pass brand customer certification, it will occupy 4% of the global market share with shipments of 51.4 million chips in 2024, ranking first in the mainland of China and fifth in the world. At the same time, it ranks first among the world's independent manufacturers in the field of Micro-OLED display backpanels with a market share of 40.7%.At the technical level, the company has mastered core patents such as LTPO dynamic refresh, Real-RGB algorithm and RAM-less architecture. Its R & D investment has accounted for more than 25% for three consecutive years, and has obtained a total of 76 global patent authorizations.

listing prospects

Yunying Valley's journey to Hong Kong stocks is actually a microcosm of the collective dilemma of China's hard technology unicorns.

When capital shifts from "domestic alternative narrative" to "profit redemption assessment", whether the valuation of 8.3 billion yuan can stand firm depends on the evolution of three key variables: First, the commercial progress of AMOLED TDDI chips, which can reduce the module thickness 30% and reduce power consumption by 15%, but customer certification needs to be completed in 2025; Second, the development effect of the in-vehicle display market. The gross profit margin of chips in this field exceeds 35%, but requires vehicle specification certification; Third, the patience threshold of state-owned shareholders, the financial return requirements of Guangdong Semiconductor Fund and other institutions are in natural conflict with the long-term characteristics of the industry.

The relatively loose liquidity of Hong Kong stocks in 2025 may help them "gain a firm foothold" in the capital market.

According to forecasts by Ernst & Young, Deloitte, PricewaterhouseCoopers and KPMG, the amount of new shares raised in Hong Kong will reach HK$160 billion to HK$250 billion in 2025, and it is expected to regain the first place in the world in terms of IPO fundraising.Chen Yiting, chief executive of the Hong Kong Stock Exchange, said in an interview that in the past ten years, the cumulative financing amount of Hong Kong's new share market has exceeded US$300 billion, ranking first in the world.In the first five months of 2025, the average daily transaction volume of the Hong Kong securities market was HK$242.3 billion, more than doubling year-on-year.

Opportunities and challenges coexist. What kind of answers can Yunyinggu deliver?We will wait and see.