As the yen continues to be strong, the market is worried about whether the "black swan incident" in August will happen again.

On November 29, the yen continued to surge after data showed that consumer price data in Tokyo, Japan was stronger than expected.On expectations that the Federal Reserve will continue to cut interest rates next month, the USDJPY quickly fell from above 156 at the opening of around 150 and quickly fell below the key psychological level of 150.Japanese and Korean stock markets plunged after the opening.

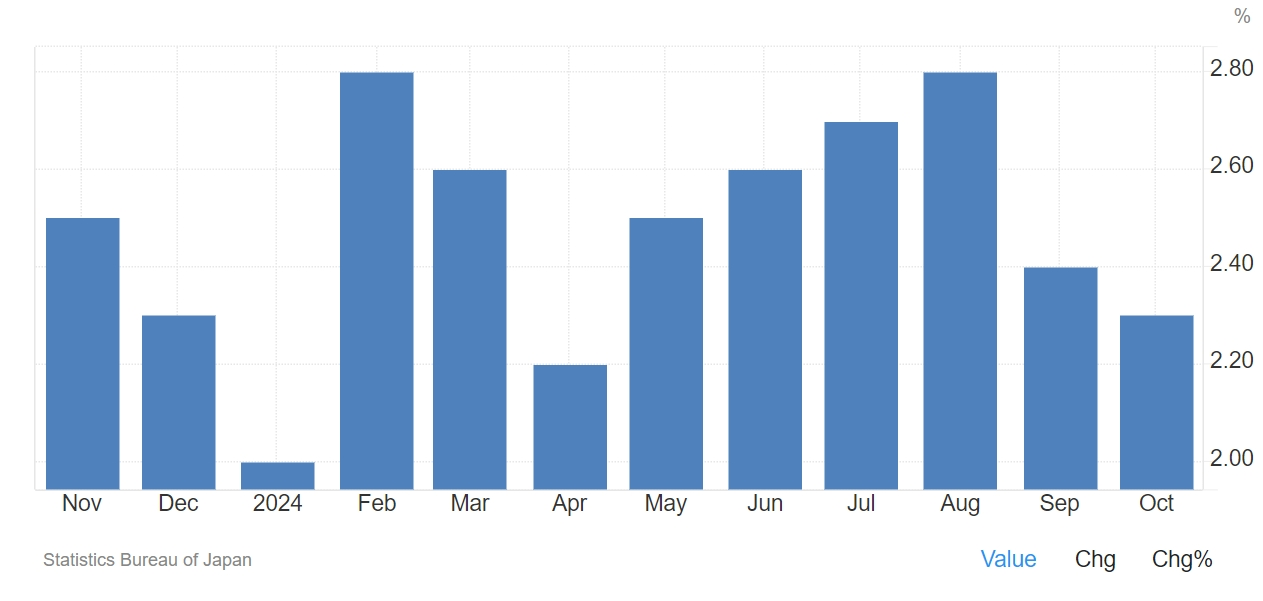

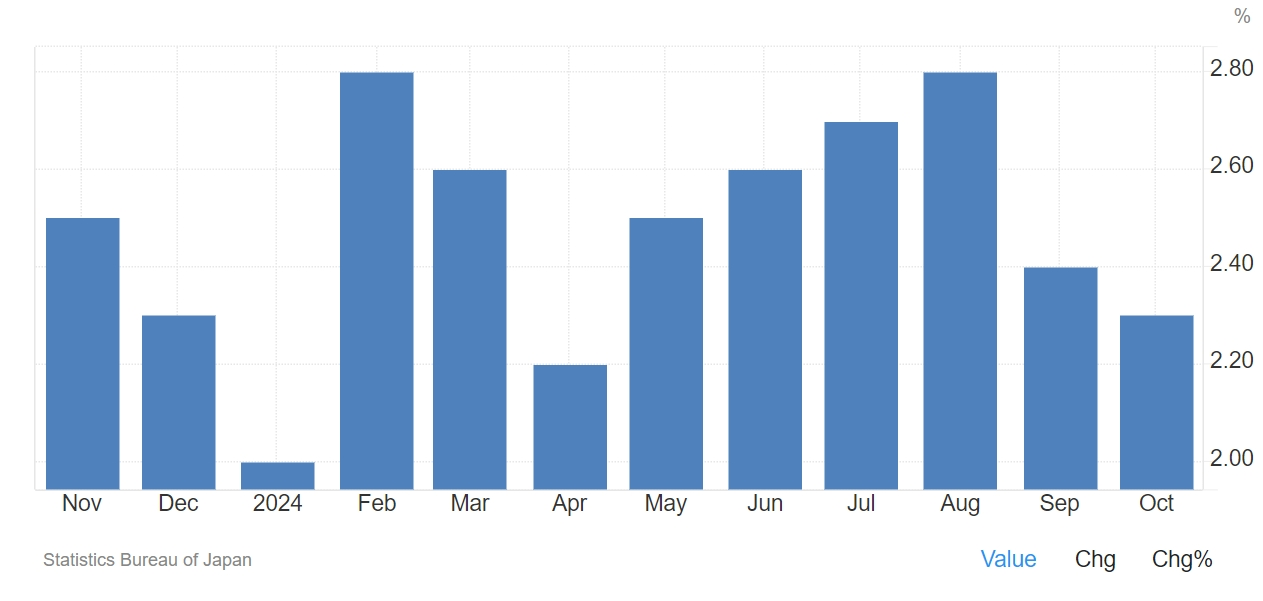

Data showed that due to the Japanese government's reduction in energy subsidies, Tokyo's core CPI rose by 2.2% year-on-year in November, up from 1.8% in the same period last year and higher than market expectations of 2%.In addition, food prices also pushed up the inflation rate, and the overall inflation rate accelerated to 2.6%.

In addition, like Trump, the newly appointed Shigeru Ishiba government also announced a large-scale fiscal stimulus plan last week. The main measures include: providing energy subsidies, raising the threshold for tax-free wages, and distributing cash to low-income households. The total scale is expected to reach 21.9 trillion yen. If private sector investment is included, the overall stimulus scale of the Ishiba government will reach 39 trillion yen.

The continued recovery of inflation, coupled with large-scale fiscal stimulus plans, coupled with safe-haven buying triggered by tariff concerns, has jointly stimulated a strong recovery of the yen-the yen has risen nearly 3% this week.

In the overnight swaps market, the market expects that the Bank of Japan will continue to raise interest rates at its next meeting to exceed 60%.If the Federal Reserve cuts interest rates next month, US and Japanese bond yields will continue to narrow, which is a strong stimulus to the appreciation of the yen.In addition, the US Thanksgiving holiday is approaching and market transactions are weak, which is also one of the conditions for the yen to surge.

Overall, some strategists have said that there is still room for further growth in the yen.

As the yen continues to be strong, the market is worried about whether the "black swan incident" in August will happen again.According to data from Bank of China, Japan's overseas securities investment and yen financing both declined slightly, indicating that the margin of traditional carry transactions has cooled.

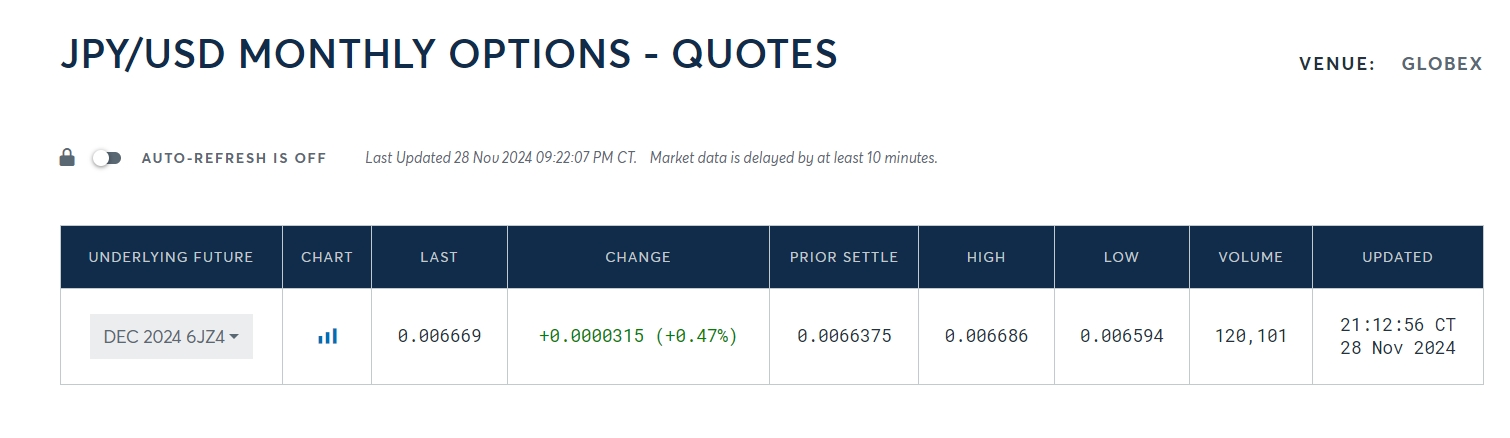

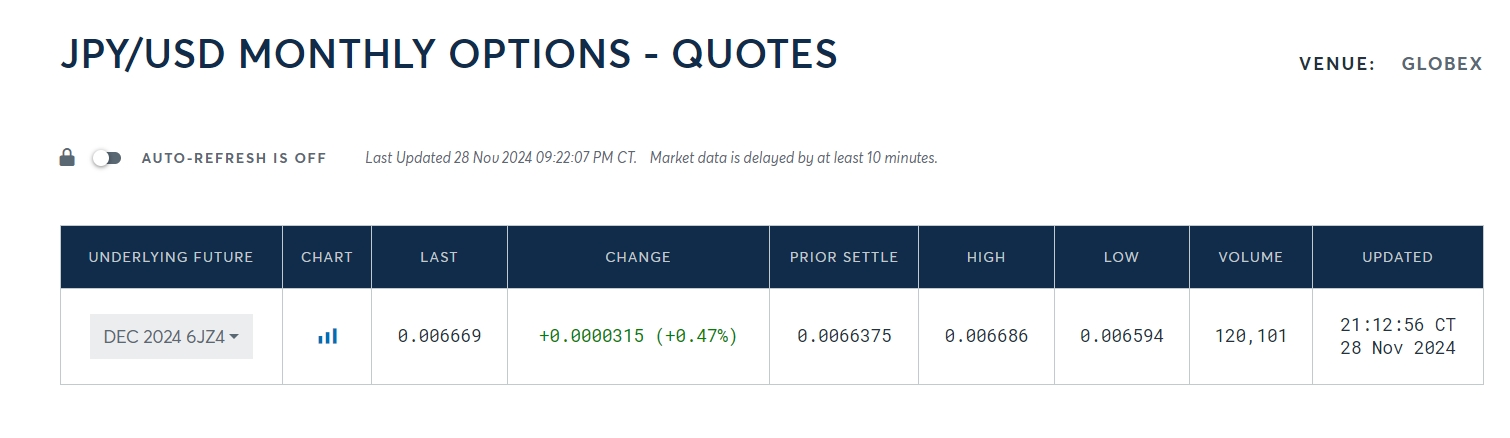

In addition, short positions in derivatives related to the yen against the U.S. dollar are also accumulating, indicating that there is still downward pressure on the yen. CME exchange data shows that in the week ending November 19, futures and options positions of the yen against the U.S. dollar were net short positions. 5,795 positions were net short positions, which fell rapidly from the peak of 16,166 positions in mid-September to a critical value and then turned short.

Regarding the continued explosion of the yen and its impact, Rodrigo Catril, strategist at National Australia Bank Limited's Sydney branch, said,"Carry traders don't like uncertainty.As a result, the reasons for the sell-off are uncertainty about tariffs and the growing possibility of Trump making sudden policy statements on social media.”

Jane Foley, head of foreign exchange strategy at Rabobank in London, also wrote in a research note,"Markets have been encouraged that the Bank of Japan may raise interest rates in December, and the latter may not want to disappoint.”

Kyle Rodda, senior market analyst at Capital.Com, said,"This kind of trade will keep you awake at night.Markets will be very tense in the days leading up to the weekend, and if you take on this carry trade risk, there will be little breathing space in the face of the current volatility.”