What is more noteworthy is Coca-Cola, a sugarcane sugar formula that will be launched in the United States this fall. This is not only a response to the social opinion of former President Trump, but also a strategic move aimed at high-end market segments.

On July 22, Coca-Cola announced its second quarter 2025 financial report.

Data showed that Coca-Cola's adjusted revenue in the second quarter reached US$12.62 billion, a year-on-year increase of 2.5%, exceeding market expectations of US$12.54 billion; adjusted earnings per share were US$0.87, also higher than the expected US$0.83, a year-on-year increase of 4%; The most astonishing thing was that operating profit surged 63% year-on-year, and operating profit margin jumped to 34.1%, setting a new high in recent years.

Coca-Cola's financial performance this season can be called a "textbook-level profit optimization case."

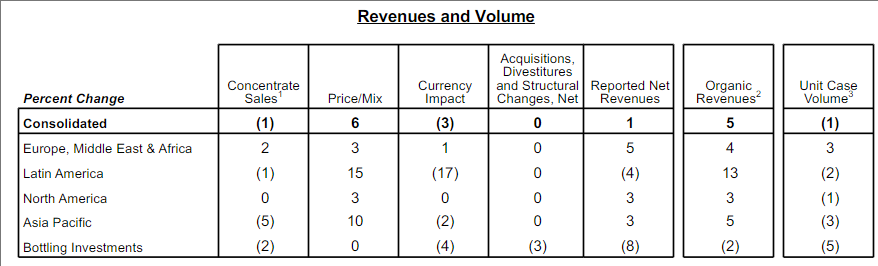

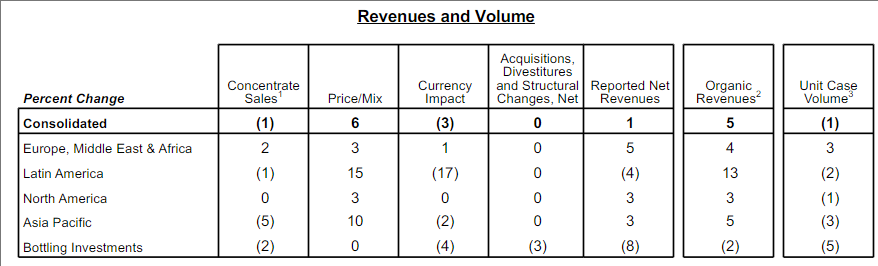

2025 is a small year for global carbonated beverages. Against the background of an actual decline in global sales per unit box of 1%, the company has used precise price strategies and product mix adjustments to push the price/combination indicator to increase by 6%, and finally achieve a 5% organic income growth-this trend is particularly typical in Latin America. Although sales fell by 2%, the price/combination strategy contributed 15 percentage points of growth.

The jump in profit margins is driven by triple engines: organic revenue growth, optimization of marketing investment timing and strict cost control. Even under the drag of exchange rate headwinds (affecting EPS by about 5 percentage points), comparable operating margins have been achieved from 32.8% to 34.7%.This contrast of "volume reduction and profit increase" highlights the company's ability to pass on costs and optimize product structure in an inflationary environment.

The replacement of product portfolios is quietly rewriting Coca-Cola's revenue map.During the quarter, Coca-Cola Zero Sugar maintained double-digit sales growth of 14% for the fourth consecutive quarter, and Diet Coke in North America also achieved four consecutive quarters of growth.Under the wave of health, the strong performance of the protein shake brand in the U.S. market further verified the correctness of the company's strategy of transitioning to high value-added products.What is more noteworthy is Coca-Cola, a sugarcane sugar formula that will be launched in the United States this fall. This is not only a response to the social opinion of former President Trump, but also a strategic move aimed at high-end market segments.By turning sweetener choices into brand narratives, Coca-Cola is reshaping the value chain of sugary drinks.

The differentiation of regional markets reveals the uneven resilience of global consumption.Europe, Middle East and Africa (EMEA) became the engine of growth, with single-box sales rising by 3%, driven mainly by sparkling drinks, water and coffee and tea drinks.However, North America and Asia-Pacific markets fell 1% and 3% respectively, while Latin America also fell 2%.Behind this divergence lies a completely different consumption picture: in Europe, Coca-Cola has restarted its "Share a Coke" campaign to cover 38 countries, combining celebrity marketing and digital interactive tools to stimulate demand; while in markets such as Mexico and India, abnormal weather (Mexican hurricanes) and geopolitical conflicts (tensions between India and Pakistan) have become short-term restraining factors.China has become a rare bright spot in the Asia-Pacific region, achieving sales growth despite a cautious consumption environment.According to the financial report, this is due to the resilience of Coca-Cola trademark products from the catering channel.

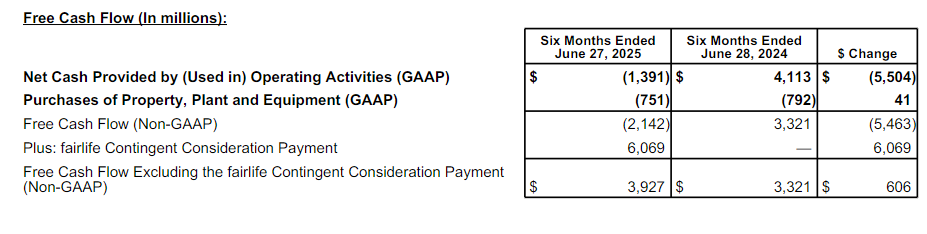

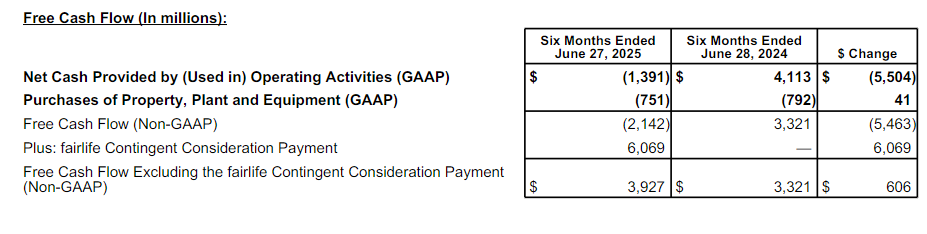

Despite the impressive profits, cash flow data reveals traces of capital movements.Coca-Cola recorded negative US$1.4 billion in operating cash flow in the second quarter, mainly due to the US$6.1 billion contingent consideration paid in the first quarter to acquire dairy brand fairlife.Excluding this expense, free cash flow was actually US$3.9 billion, a year-on-year increase of approximately US$600 million.In terms of capital structure, long-term debt increased to US$45 billion, an increase of US$2.6 billion from the end of 2024.The acquisition of fairlife is showing synergy effects-the brand still maintained double-digit growth in the second quarter, and the production capacity bottleneck is expected to ease as the new plant in New York comes into operation in early 2026.In terms of international expansion, the success of the Santa Clara dairy business in Mexico provides a cross-regional replication model.

At the post-season press conference, Coca-Cola's management continued to be confident and maintained its guidance of 5%-6% annual organic revenue growth.CEO James Quincey stressed in a conference call that he was "confident of achieving positive sales growth in the second half of the year." His confidence came from three aspects: the lower comparative base in the third quarter, the cyclical rebound in the Mexican and Indian markets, and the accumulated profits in the first half of the year provide ammunition for investment in the second half of the year.The company plans to increase marketing investment, such as the "Juntos" event for the centenary celebration of Mexico and the promotion of a new franchise system in the Indian market.However, challenges remain-exchange rate headwinds are expected to drag down full-year EPS growth by about 5 percentage points, and the implementation of the world's lowest tax system has also increased the effective tax rate from 18.6% to 20.8%.