Collect! Outlook for Central Bank Super Week at the end of July: Big speculation about interest rate cuts by major central banks around the world

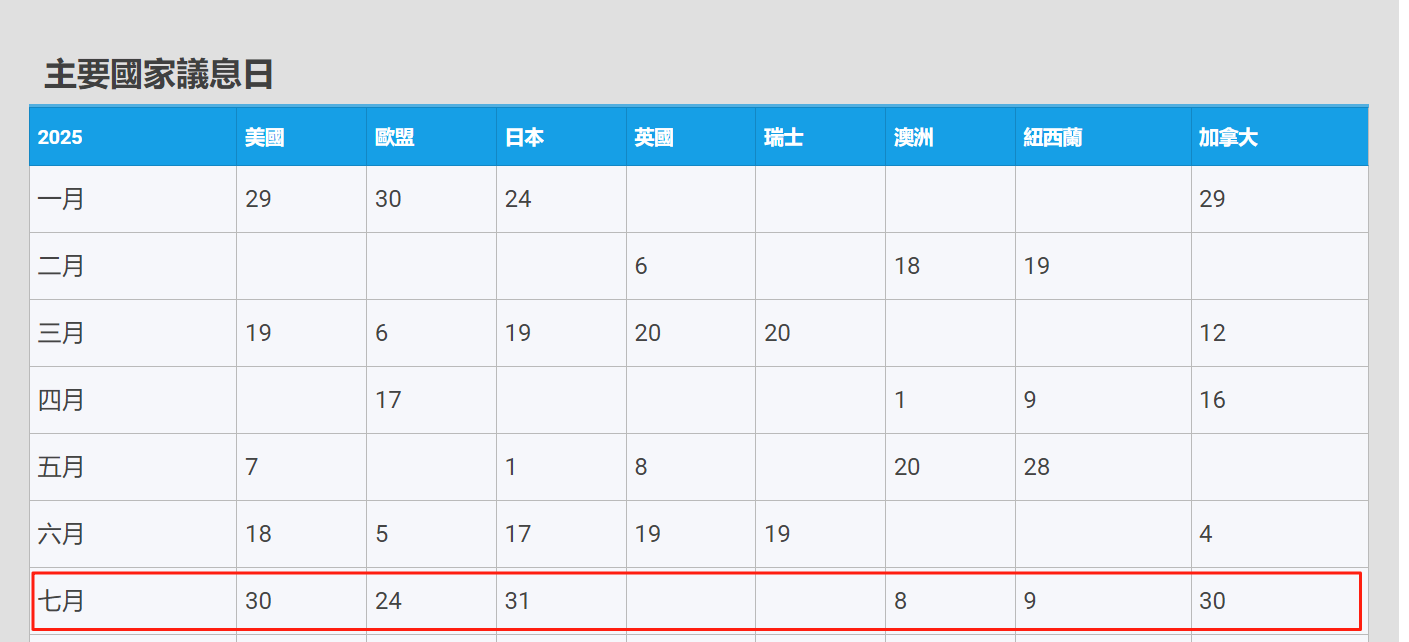

In the next 10 days, major central banks around the world such as the United States, Japan, the European Union, and Canada will announce the latest interest rate decisions.

On July 22, the Central Bank Super Week is coming.In the next 10 days, major central banks around the world such as the United States, Japan, the European Union, and Canada will announce the latest interest rate decisions.

On July 22, the Central Bank Super Week is coming.In the next 10 days, major central banks around the world such as the United States, Japan, the European Union, and Canada will announce the latest interest rate decisions.

Will the EU cut interest rates and brake?Will the United States continue to maintain high interest rates?Will Powell be accused by Trump?Will the Bank of Japan's interest rate increase set off a global capital earthquake?For more information, Hawk Insight brings you an article.

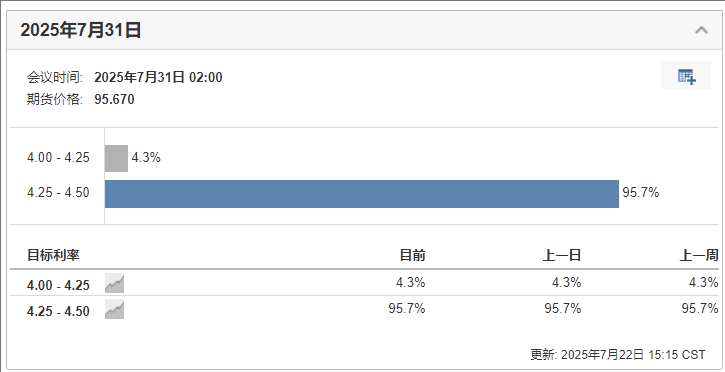

US: Federal Reserve's independence is facing severe test from White House pressure

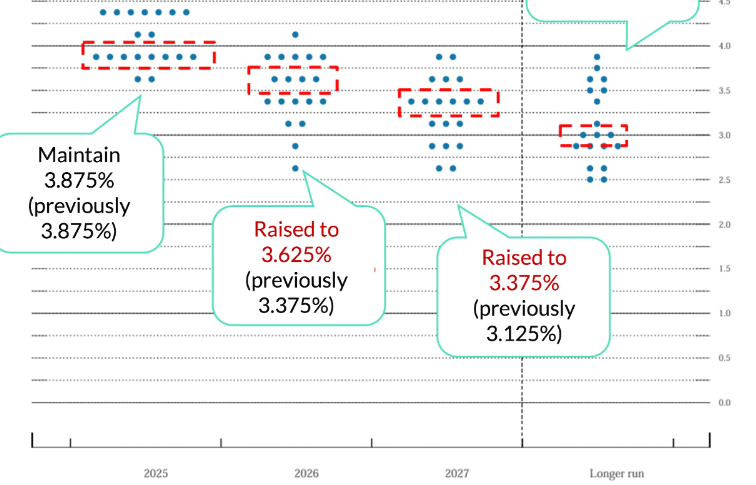

According to notes from previous interest-rate meetings, despite Trump's continued pressure to cut interest rates, there are significant differences in judgment within the Federal Open Market Committee (FOMC) on the impact of tariffs: Directors Christopher Waller and Michelle Bowman believe that the price shock is temporary, implying that there is a possibility of interest rates being cut at the July meeting; and 7 of the 19 policymakers insist that interest rates should remain unchanged in 2025.

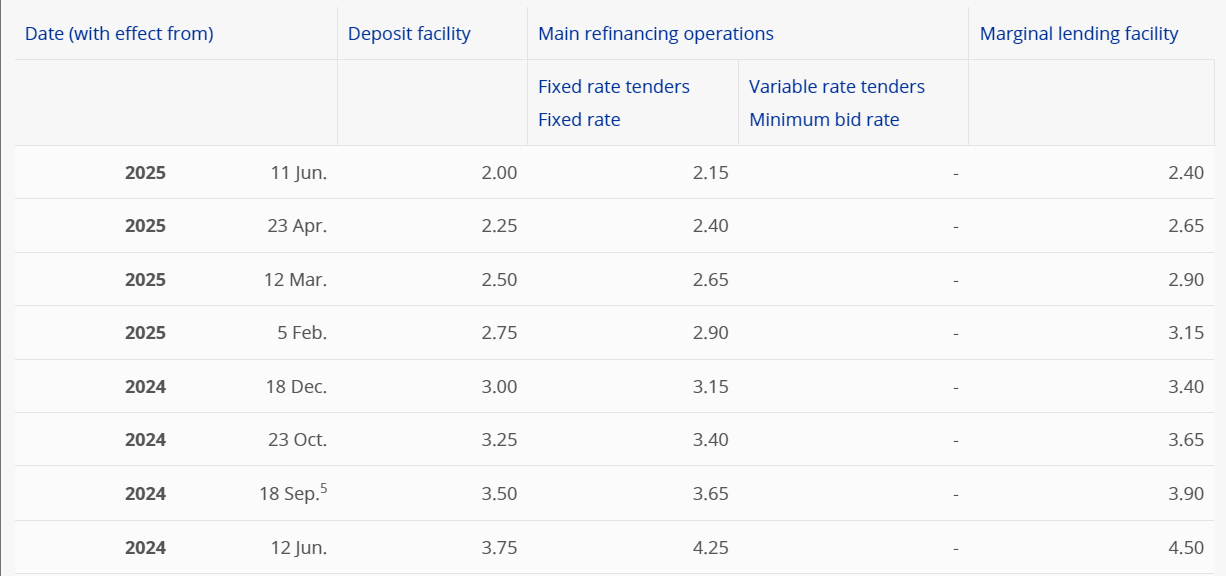

Europe: The tipping point for policy shift

The interest rate market expects that the bank will end its seven-consecutive meeting interest-rate cycle this week, choosing to sit tight for the first time and maintain the benchmark interest rate at 2%.

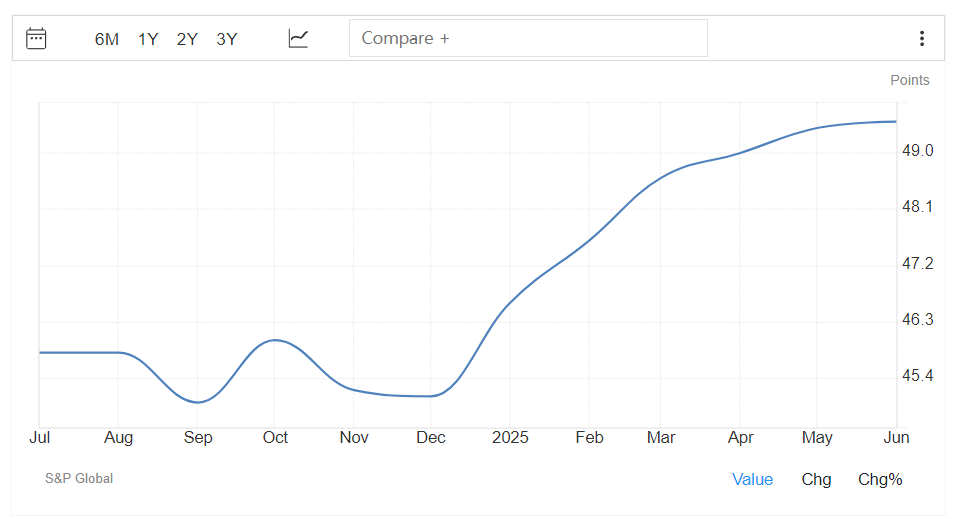

On the surface, this decision is waiting for the final implementation of U.S. tariffs on August 1, but in fact reflects its internal reassessment of economic resilience-the euro zone manufacturing PMI has rebounded for four consecutive months, and June's data hit a new high since August 2022.

On the surface, this decision is waiting for the final implementation of U.S. tariffs on August 1, but in fact reflects its internal reassessment of economic resilience-the euro zone manufacturing PMI has rebounded for four consecutive months, and June's data hit a new high since August 2022.

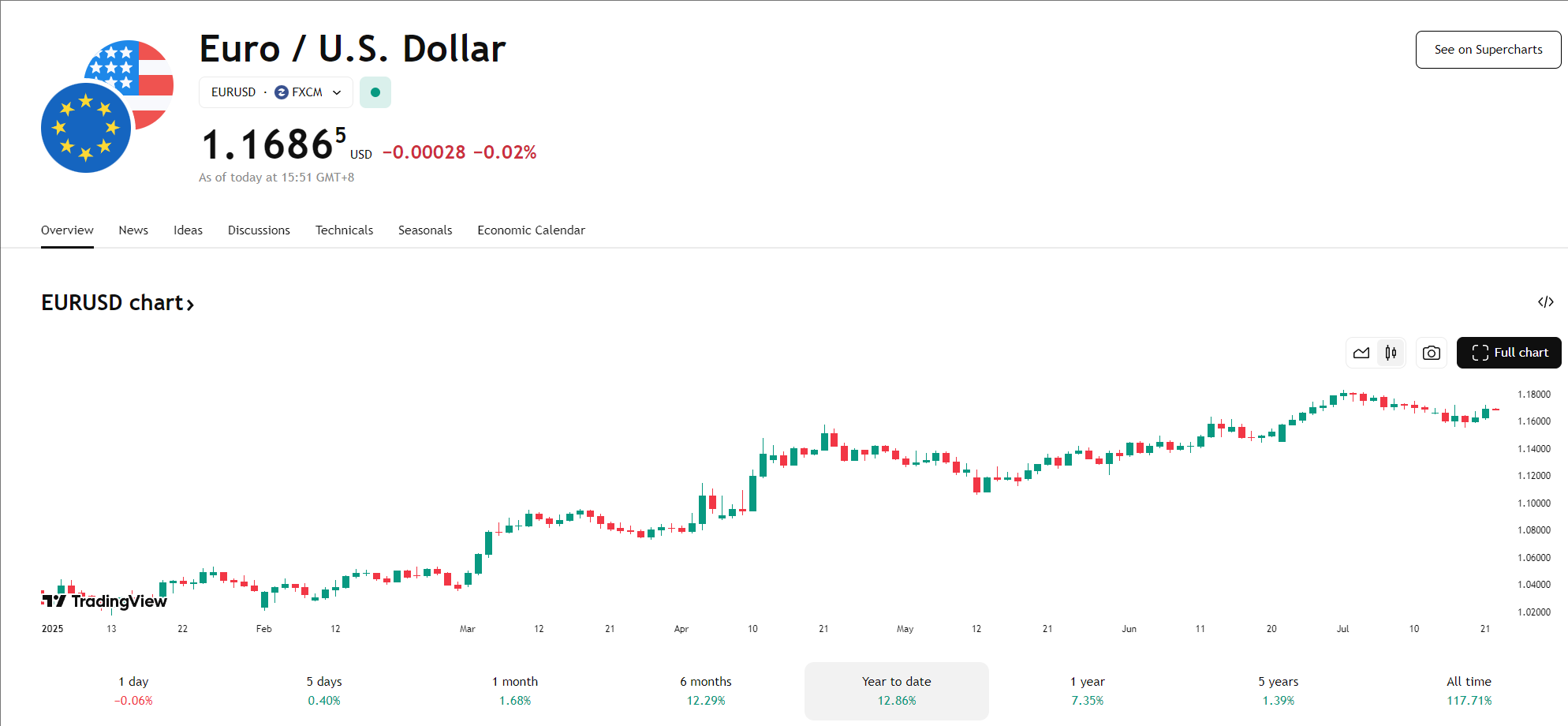

However, the strengthening of the euro is becoming a new worry. European Central Bank Deputy President De Guindos warned that if the euro continues to appreciate, it will make policy formulation "more complicated": a strong currency not only suppresses inflation by lowering import prices, but also weakens European export competitiveness.

Japan: Political paralysis & high inflation, the Bank of Japan may suspend interest rates

After Japanese Prime Minister Shigeru Ishiba's recent election setback, Bank of Japan officials believe that there is no need to change the current policy stance of gradually raising interest rates.People familiar with the matter said that although central bank officials will closely monitor the government's subsequent fiscal policy direction, they still believe that as long as the economic outlook is in line with expectations, it is appropriate to continue to raise the Bank of Japan's benchmark interest rate.

Sources pointed out that the policy committee may decide to maintain the benchmark interest rate at 0.5% at next week's meeting.At the same time, as trade talks between Tokyo and Washington are still ongoing, officials hope to carefully assess the possible impact of the agreement on inflation trends and the future economy before raising interest rates further.

Although the election results will not change the Bank of Japan's policy trajectory in the short term, some officials believe that if the government implements large-scale fiscal easing, it still needs to be aware of whether it will push up inflation risks.Due to the recent surge in rice and other food prices, inflation has grown faster than originally expected, and the central bank's internal vigilance against upside risks to inflation is gradually increasing.

Other countries: Canada may continue to cut interest rates, Brazil maintains the status quo

Emerging markets and resource-based economies are showing a divergence in the wave of interest rate cuts.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.