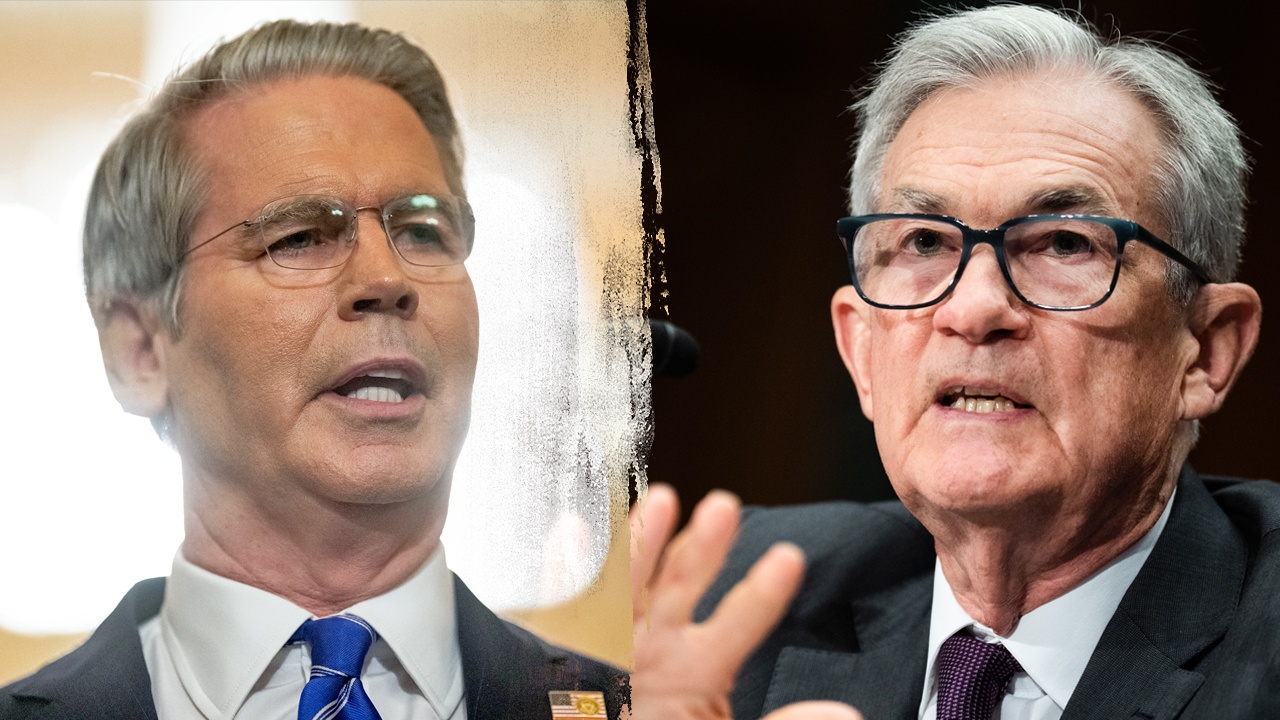

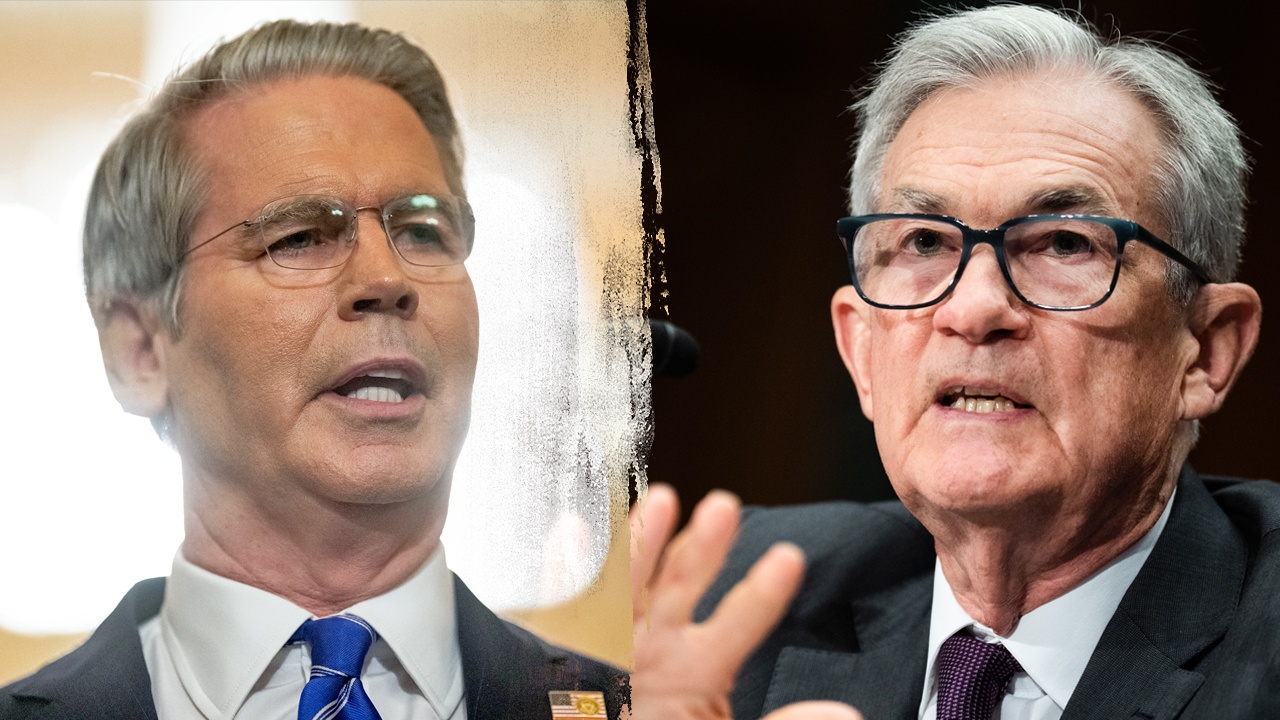

On September 3, it was reported that U.S. Treasury Secretary Scott Bessant will begin a series of interviews with candidates for the next Federal Reserve Chairman this Friday.The process was nearly half a year ahead of the traditional timetable, raising deep concerns in the market about possible political interference in the Fed's independence.

There are currently 11 shortlisted candidates, including Federal Reserve Governors Christopher Waller and Michelle Bowman, White House National Economic Council Director Kevin Hassett and former Federal Reserve Governor Kevin Walsh.The interview process will last until next week, including face-to-face and video conference formats, after which Besent will submit a final list of candidates to President Trump.

There are still nine months before Powell's term ends

The interview process led by Treasury Secretary Basent will officially launch on September 5 and is expected to last throughout the week.The interview format is flexible and diverse, ranging from traditional face-to-face conversations to video conferencing-an approach that ensures that geographically dispersed candidates can participate in the selection process.

The list of candidates includes monetary policy experts, current government officials and Wall Street veterans.The main contenders include current Federal Reserve Governors Waller and Bowman, White House National Economic Council Director Hassett, and former Federal Reserve Governor Walsh.

Other candidates include Dallas Fed Chairman Logan, former Federal Reserve Governor Lindsay, former St. Louis Fed Chairman Brad, and Wall Street financiers such as BlackRock's global fixed income chief investment officer Rick Reid.

The unusual thing about the Fed chairman selection process is its timing.Current Chairman Powell's term of office will not end until May 2026, which is nearly nine months away.In accordance with historical practice, the election of a new chairman usually begins about three months before the expiration of the current term.

The Trump team's practice of significantly advancing the selection process has sparked much speculation.Analysts believe that the White House made an exception to determine Powell's successor in advance, with the obvious intention of weakening Powell's authority and influence within the Federal Reserve-a practice that the market calls the establishment of a "shadow Federal Reserve Chairman."

Tensions between the White House and the Federal Reserve have reached boiling point

Since starting his second term, Trump has continued to pressure the Federal Reserve to cut interest rates, but has never been able to do so.Trump has publicly threatened to fire Federal Reserve Chairman Powell, but ultimately refrained from doing so given the far-reaching and serious consequences of the move.

Isabel Schnabel, a member of the Executive Committee of the European Central Bank, warned in this regard: "Any attempt to weaken the independence of central banks will lead to an increase in medium-and long-term interest rates and disrupt the entire global financial system."In addition, nearly 600 economists jointly issued an open letter warning Trump that the move would undermine the independence of the Federal Reserve. The signatories include several Nobel Prize winners and former Federal Reserve economists.

In addition to threatening the Federal Reserve chairman, the Trump administration is also trying to reshape the composition of the Federal Reserve Board of Governors by sacking current directors.The Trump administration fired Federal Reserve Governor Lisa Cook for "mortgage fraud," the first time in U.S. history that a president has tried to remove a current Federal Reserve governor.

Cook denied the charges and filed a lawsuit.In her document submitted on September 3, she emphasized that relevant property mortgage information had been listed when her appointment was approved in 2022, and the circumstances known at that time cannot be a reason for her dismissal now.Currently, Cook is asking a judge to temporarily prevent Trump from removing him while further litigation is underway.

If Trump successfully removes Cook and places his own people to fill him, the number of directors supporting him will gain an overwhelming advantage.The Federal Reserve Board of Governors has seven members, all of whom are nominated by the President and approved by the Senate.

Potential policy impacts and market reactions

Most of Trump's favored candidates are dovish and support interest rate cuts.Treasury Secretary Bessant said in a recent interview that the Federal Reserve should cut interest rates by 50 basis points this month to stimulate the housing industry.

According to the latest data from CME's "Federal Reserve Observation", the probability of the Fed leaving interest rates unchanged in September is 9.5%, and the probability of cutting interest rates by 25 basis points is 90.5%.The probability of a cumulative 50 basis points interest rate cut in October is also as high as 49.3%.

If Trump controls the majority of the board of directors by removing Cook and nominating a new chairman, it may promote his advocated interest rate cut agenda.Markets are worried that this will lead to a rebound in inflation, fluctuations in bond yields, and increase risks to economic operations.

Historical experience shows that political interference in monetary policy often has serious consequences.In the 1970s, President Nixon pressured the Federal Reserve to cut interest rates, which led to major stagflation. The inflation rate once exceeded 12%, and the economy fell into recession.

A loss to the independence of the Federal Reserve could shake the dollar's monetary hegemony.The reason why the US dollar can become the world's reserve currency largely depends on the credibility of the Federal Reserve.Currently, about 60% of global foreign exchange reserves are denominated in U.S. dollars, 90% of foreign exchange transactions involve U.S. dollars, and half of international trade is settled in U.S. dollars.But this "excessively privileged" status is facing challenges.The US dollar's share of global foreign exchange reserves has dropped from 71% in 1999 to 58% in 2022.

Central banks are also increasing their gold reserves, with China, Russia and Turkey being the largest buyers of gold in the past decade.If the Fed is seen as politically controlled, foreign investors may accelerate the diversification of dollar asset allocation, leading to capital flight, pushing up the cost of US bond issuance, creating a vicious cycle.