Sources say that Nvidia's new GPU may be named 6000D or B40.

On May 26, it was reported that Nvidia adjusted its China market strategy again.Starting from June, Nvidia plans to launch a new special version of GPUs based on the Blackwell architecture for China, with a pricing range of US$6500 to US$8000, which is more than 30% lower than previous H20 models.

Sources say that Nvidia's new GPU may be named 6000D or B40.

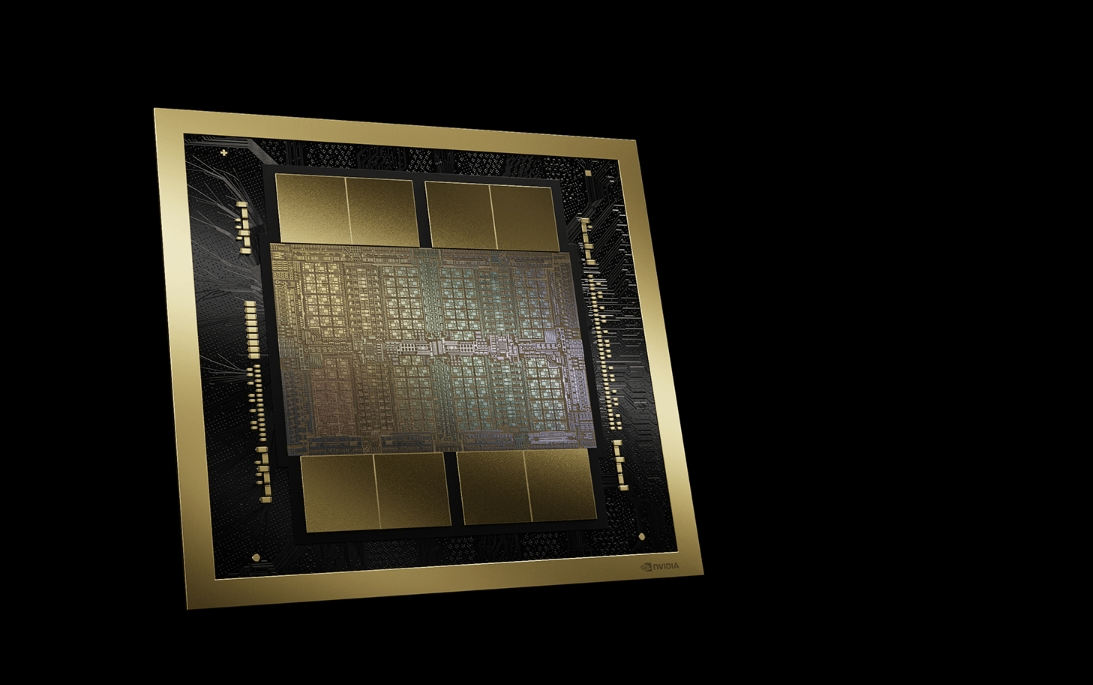

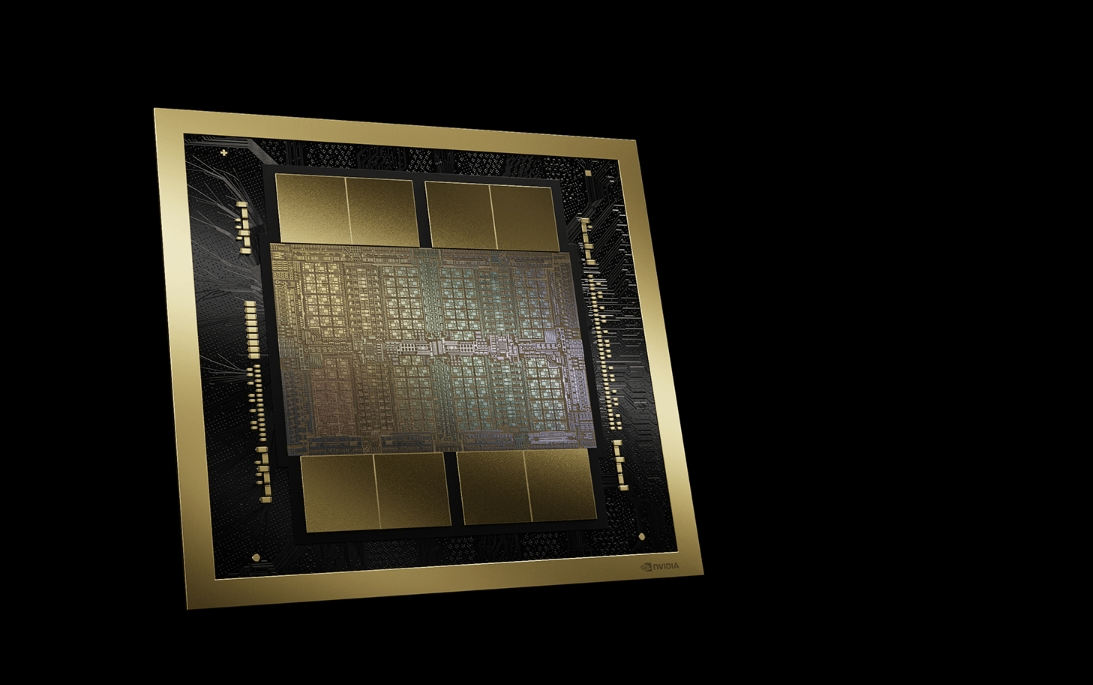

In terms of technical parameters, although the new chip continues the tradition of "performance castration" of NVIDIA's special products, there has been a significant shift in strategy.Unlike the H20 that adopts the Hopper architecture and relies on TSMC's CoWoS advanced packaging, this new product shifts to the RTX Pro6000D architecture and uses traditional GDDR7 memory to deliberately avoid CoWoS technology, which is subject to production bottlenecks.

The choice of this technology path is quite profound-CoWoS is the core technology for high-density integration of AI chips. Currently, more than 90% of the world's production capacity is in the hands of TSMC. However, US export controls have blocked the import of CoWoS equipment in the mainland of China, and domestic substitution is still in its early stages.By simplifying the packaging process, Nvidia not only avoids supply chain risks, but also creates a time window for quickly seizing the market.This "de-high-end" route is in sharp contrast to the company's previous strategy of maintaining high-end positioning on products such as RTX5880Ada, reflecting its fundamental shift in its judgment of priorities in the China market.

Huang Renxun recently admitted that Nvidia's share of China's data center market has dropped sharply from 95% before 2022 to 50%. H20 inventory write-offs have reached US$5.5 billion, and potential sales losses are approximately US$15 billion.This cliff-like decline is not only due to the hardware restrictions of the U.S. export ban, but more importantly, the reduced dependence of China customers on CUDA ecology.Although the single-card computing power performance of domestic GPUs generally exceeds that of H20, NVIDIA still has an advantage in large-scale computing power cluster deployments thanks to its CUDA software ecosystem and NVLink multi-card interconnection technology.However, as Huawei Shengteng, Mu Xi and other manufacturers accelerate the construction of their own software stacks, this technological moat is gradually being eroded.Nvidia chose to cut prices significantly at this time, but it was actually a strategic choice to exchange short-term profits for ecological duration.

On the other hand, the restructuring of supply chains is reshaping the competitive landscape of the industry.TSMC's continued tight production capacity for CoWoS has forced Nvidia to spill packaging orders to secondary suppliers such as Silicon Precision. In August 2024, it outsourced the CoW front-end process for the first time.Although this capacity decentralization strategy alleviates short-term pressure, it aggravates the risk of technology leakage.

At the same time, the mainland of China packaging manufacturers are accelerating the deployment of 2.5D/3D advanced packaging. Companies such as Changjiang Technology and Tongfu Microelectronics already have basic technology reserves. Huatian Technology has made breakthroughs in the field of FOPLP (Fan-out Panel Level Packaging).This parallel evolution of the industrial chain has made Nvidia have to struggle to balance technical confidentiality and cost control.The abandonment of CoWoS by new products to traditional packaging can be interpreted as getting rid of their dependence on TSMC's production capacity, and can also be regarded as a strategic temptation to show kindness to the the mainland of China supply chain.

Geopolitical uncertainty continues to complicate business decision-making.The latest U.S. AI chip ban places China in the third level, almost completely banning high-end GPU imports, forcing Nvidia to conduct a more thorough product castration.However, the joint opposition from technology giants such as Microsoft and Amazon has exposed deep differences between American industry and policy levels-over-regulation is pushing allies into the arms of China and accelerating the process of local substitution.

This contradiction has triggered a ripple reaction in the capital market: although Nvidia shipped more than 1 million H20 chips to China in 2024, with revenue reaching US$12 billion, investors are more worried about its long-term access to China's US$50 billion data center market.

According to estimates by U.S. investment bank Jefferies, new U.S. export rules for chips limit memory bandwidth to 1.7-1.8tb per second, compared with H20 's speed of 4tb per second.It is predicted that new GPUs using GDDR7 memory technology will achieve speeds of approximately 1.7tb per second, which is well within export control limits.